Posti Group Corporation Interim Report January-September 2025

This release includes forward-looking statements dependent on future events. Such statements are based on the management's beliefs, expectations and assumptions based on currently available information, and thus include known and unknown risks, uncertainties and other factors. Posti's actual results of operations, financial performance and financial position may significantly deviate from those described in the forward-looking statements.

Unless otherwise stated, the figures in brackets refer to the corresponding period in the previous year.

July-September

Financial highlights

- Net sales decreased by 3.9% to EUR 343.8 (357.9) million.

- Adjusted EBITDA decreased to EUR 48.3 (50.9) million, or 14.0% (14.2%) of net sales.

- EBITDA decreased to EUR 43.2 (49.8) million, or 12.6% (13.9%) of net sales.

- Adjusted operating result (adjusted EBIT) decreased to EUR 17.1 (19.3) million, representing 5.0% (5.4%) of net sales.

- Operating result (EBIT) decreased to EUR 12.0 (18.2) million, representing 3.5% (5.1%) of net sales, which was negatively impacted by the special items of EUR 5.1 (1.1) million including listing costs of EUR 1.7 million.

January-September

Financial highlights

- Net sales decreased by 5.4% to EUR 1,057.2 (1,117.8) million.

- Adjusted EBITDA decreased to EUR 134.3 (153.5) million, or 12.7% (13.7%) of net sales.

- EBITDA decreased to EUR 123.4 (143.8) million, or 11.7% (12.9%) of net sales.

- Adjusted operating result (adjusted EBIT) decreased to EUR 39.3 (58.4) million, representing 3.7% (5.2%) of net sales.

- Operating result (EBIT) decreased to EUR 27.5 (48.7) million, representing 2.6% (4.4%) of net sales, which was negatively impacted by the special items of EUR 11.8 (9.7) million including listing costs of EUR 3.4 million.

- Net debt to adjusted EBITDA was 2.6x (1.2x).

Operational highlights in Q3

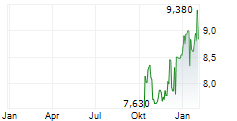

- On September 19, 2025, Posti announced an intention to list to the official list of Nasdaq Helsinki. Trading on Posti Group's shares commenced on Nasdaq Helsinki after the end of the reporting period on October 14, 2025.

- In Postal Services operational efficiency improvements in delivery models and resource optimization increased the segment's profitability. The adjusted EBITDA of Postal Services was 16.4% (12.4%) of net sales. Addressed letter volumes declined by 18% (11%).

- Growth in Finland's consumer recommerce market boosted parcel volumes in the eCommerce and Delivery Services segment, while B2B parcel volume remained soft. Total parcel volumes in Finland and the Baltic countries increased by 8% (3%).

- In the Fulfillment and Logistics Services segment warehouse consolidations and operational efficiency activities have started to improve profitability.

- The combined external net sales of eCommerce and Delivery Services and Fulfillment and Logistics Services continued to increase and accounted for 66.1% (63.6%) of the Group's net sales. The share of Posti's business operations outside Finland increased to 9.8% (9.1%) of net sales.

Guidance for 2025 (unchanged)

Posti is expecting its net sales to be within the range of EUR 1,440-1,500 million, adjusted EBITDA to be within the range of EUR 192-205 million and adjusted EBIT to be within the range of EUR 65-77 million in 2025.

Background for guidance for 2025

The key assumptions underlying the guidance are associated with the development of the Company's business volumes, customer prices, inflation, operational performance, and general economic conditions and logistics market drivers.

The Group's business is characterized by seasonality. The net sales, adjusted EBITDA and adjusted EBIT in the segments are not accrued evenly over the year. In consumer parcels and Postal Services, the first and fourth quarters are typically strong, while the second and third quarters are weaker. The postal volume decline is expected to continue.

The economic recovery in our home markets has been slow, and the operating environment is expected to remain challenging; Consumer confidence is expected to remain below the long-term average throughout 2025. No major changes are expected in the key logistics market drivers towards the end of the year. Posti will continue to develop its service offering and operational performance to maintain competitiveness of its services. Factors beyond Posti's control that have been considered as a background to the guidance relate to expected global economic and Posti's home markets economic development.

Mid-term financial targets

The Board of Directors of Posti Group has set the following mid-term financial targets in connection with the listing.

- Average organic net sales growth (3-5-year period) of at least 2 percent at Group level and at least 5 percent outside Postal Services compared to 2025

- Average adjusted operating result (adjusted EBIT) growth (3-5-year period) over 5 percent compared to 2025

- Net debt/adjusted EBITDA less than 2.5x

Posti Group's target is to pay continuously increasing ordinary dividends, and a payout ratio of at least 60 percent of net income based on Posti Group's Board of Directors approved dividend policy.

| Key Figures of Posti Group | |||||

| 7-9 | 7-9 | 1-9 | 1-9 | 1-12 | |

| 2025 | 2024 | 2025 | 2024 | 2024 | |

| Financial development and profitability | |||||

| Net sales, EUR million | 343.8 | 357.9 | 1,057.2 | 1,117.8 | 1,521.4 |

| Change in net sales, % | -3.9 % | -3.9 % | -5.4 % | -3.3 % | -4.1 % |

| Adjusted EBITDA, EUR million | 48.3 | 50.9 | 134.3 | 153.5 | 207.6 |

| Adjusted EBITDA margin, % | 14.0% | 14.2% | 12.7% | 13.7% | 13.6% |

| EBITDA, EUR million | 43.2 | 49.8 | 123.4 | 143.8 | 196.6 |

| EBITDA margin, % | 12.6% | 13.9% | 11.7% | 12.9% | 12.9% |

| Adjusted operating result (adjusted EBIT), EUR million | 17.1 | 19.3 | 39.3 | 58.4 | 80.1 |

| Adjusted operating result (adjusted EBIT) margin, % | 5.0% | 5.4% | 3.7% | 5.2% | 5.3% |

| Operating result (EBIT), EUR million | 12.0 | 18.2 | 27.5 | 48.7 | 68.0 |

| Operating result margin (EBIT), % | 3.5% | 5.1% | 2.6% | 4.4% | 4.5% |

| Result for the period, EUR million | 5.3 | 11.9 | 8.8 | 31.5 | 43.8 |

| Financial position | |||||

| Equity ratio, % | 24.0% | 38.2% | 25.2% | ||

| Return on capital employed (12 months), % | 6.5% | 11.9% | 11.2% | ||

| Net debt, EUR million | 496.9 | 258.3 | 257.5 | ||

| Net debt / adjusted EBITDA | 2.6x | 1.2x | 1.2x | ||

| Other key figures | |||||

| Operative free cash flow, EUR million | -64.6 | -5.8 | -2.9 | ||

| Investments, EUR million | 100.1 | 134.4 | 183.5 | ||

| Personnel, end of period | 13,757 | 15,038 | 14,764 | ||

| Personnel on average, FTE | 11,770 | 13,075 | 11,914 | 13,201 | 13,095 |

| Earnings per share, basic, EUR | 0.13 | 0.30 | 0.22 | 0.79 | 1.10 |

| Earnings per share, diluted, EUR | 0.13 | 0.30 | 0.22 | 0.79 | 1.10 |

| Dividend per share, EUR | 0.83 | ||||

| Dividend, EUR million | 33.0 |

Calculation, use and reconciliations of Key Figures are presented in the Appendices.

Antti Jääskeläinen, President and CEO

The third quarter of 2025 marked a historic milestone for Posti Group Corporation with the announcement of our listing on the official list of Nasdaq Helsinki, with trading officially commencing on October 14th. This interim report is our first as a listed company. I am pleased to report that we have achieved 5% adjusted EBIT margin in the third quarter - an improvement compared to the earlier part of the year. Throughout the year, we have implemented several measures to mitigate the impact of a challenging market environment. As a result, our operational efficiency has continued to strengthen, leading to improved performance in the third quarter.

During the third quarter, our net sales declined by 3.9% to EUR 343.8 (357.9) million. The decline was mainly attributable to reduced net sales in Postal Services, following the discontinuation of unaddressed marketing services. Our parcel volumes grew by 8%. Our adjusted EBITDA decreased to EUR 48.3 (50.9) million, and adjusted EBIT decreased to the expected level of EUR 17.1 (19.3) million. The adjusted EBITDA decrease was driven by the decline in net sales but was partly offset by increased operational efficiency. This resulted in adjusted EBITDA and EBIT margins increasing for consecutive quarters.

At the segment level, increased consumer parcel volumes contributed to higher net sales in eCommerce and Delivery Services' in the third quarter, despite softer B2B parcel volumes and freight service's net sales. Ongoing volume growth and operational efficiency activities have improved adjusted EBITDA margin for consecutive quarters, supporting the segment's long-term value creation potential. In Fulfillment and Logistics Services, the market continued to be challenging, which impacted the segment's net sales and adjusted EBITDA. At the same time, the segment's profitability started to improve, thanks to our actions in warehouse consolidation, resource optimization and cost discipline. Despite a decline in net sales and volume, Postal Services achieved an increase in adjusted EBITDA during the third quarter. This performance underscores the segment's operational efficiency and the team's ability to adapt and deliver results.

During the third quarter, our operating environment was shaped by low consumer confidence, as well as weak business environment. Logistics demand remained soft, and warehouse overcapacity continued - particularly in Sweden. Despite these headwinds, we continued to expand our parcel locker network, invest in our green fleet and strengthen operations across our segments. These efforts underscore our commitment to long-term efficiency and sustainable growth. Commercial development remains central to our success, and over the past year we have progressed with new sales organization and higher sales efficiency. Looking ahead, we are confident that our strategic investments and agile operations have positioned us well for the future.

I am proud that in the latest assessment by EcoVadis, world's leading provider of business sustainability ratings, Posti continued to be recognized as a top-tier performer in sustainability. This is a strong affirmation of our ongoing commitment to responsible and sustainable business practices. Once again, we also joined Finland's official delegation at the UN General Assembly Week in New York, contributing to global dialogue on sustainable development.

As we have now entered the final quarter of the year, our focus remains on delivering a successful peak season to our customers, driving innovation, and continuing to deliver excellent operational efficiency. I want to thank all the new shareholders for their trust in us. I was particularly pleased that over 1,100 Posti employees wanted to become new shareholders. Together we are writing a new chapter to Posti's story.

Webcast for analysts and media

An English-language webcast for analysts, media and institutional investors will begin at 11:00 a.m. EET on

October 29.Link for the webcast will be available on https://www.posti.com/en/investors. In the webcast Posti Group's President and CEO Antti Jääskeläinen and CFO Timo Karppinen will go through Posti's Q3 2025 financial results.

A recording of the webcast will be available on https://www.posti.com/en/investors later on the same day.

APPENDICES

Posti Group Corporation Interim Report January-September 2025 Tables in full (PDF)

FURTHER INFORMATION

Antti Jääskeläinen, President and CEO

Timo Karppinen, CFO

Tel. +358 20 452 3366 (MediaDesk)

DISTRIBUTION

Key media

www.posti.com/en/investors

IMAGES AND LOGOS

https://www.posti.com/en/corporate/media

Posti is one of the leading delivery and fulfillment companies in Finland, Sweden, and the Baltics. We make our customers' everyday lives smoother with a wide range of services, which include parcels, freight, and postal services as well as warehouse, fulfillment, and logistics services. Our goal is to transport completely fossil-free throughout the value chain by 2030 and zero our own emissions by 2040. Our net sales in 2024 amounted to EUR 1,521.4 million and we have approximately 15,000 employees. Posti Group's shares are listed on the Nasdaq Helsinki official list in Finland. www.posti.com.