The third quarter, July - September 2025

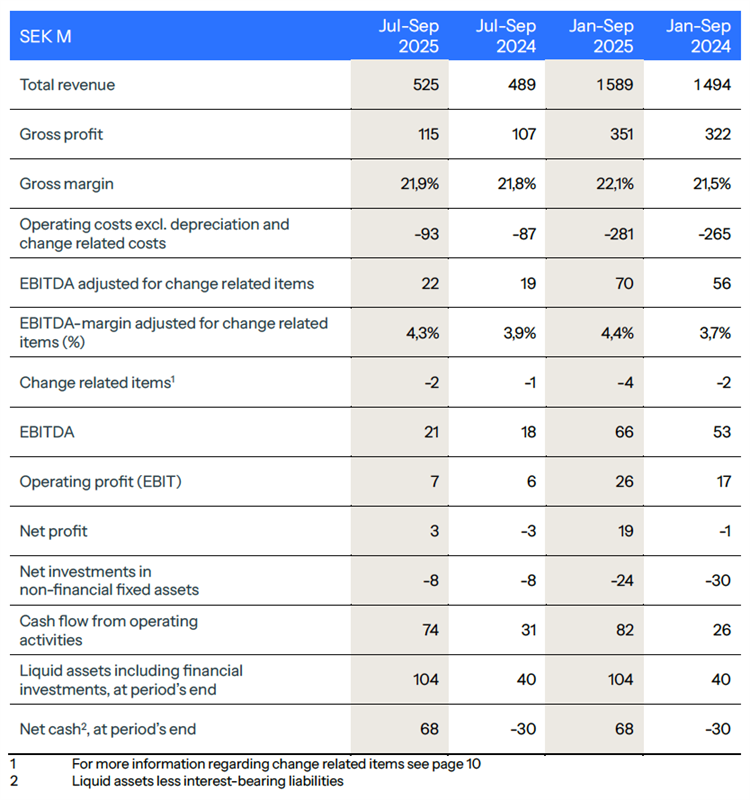

- Total revenue amounted to SEK 525 M (489), an increase of 7% or 10% adjusted for changes in exchange rates compared to the same period last year.

- Gross profit was SEK 115 M (107), an increase of 9% or 11% adjusted for changes in exchange rates. Gross margin was 21.9% (21.8).

- Operating costs excluding depreciation were SEK 94 M (88), an increase of 7% or 9% adjusted for changes in exchange rates. Operating cost, excluding depreciation and change related items, were SEK 93 M (87).

- EBITDA amounted to SEK 21 M (18). Adjusted for change related items, EBITDA was SEK 22 M (19).

- Investments in immaterial assets, mainly related to product development, were SEK 8 M (8).

- Cash flow from operating activities was SEK 74 M (31). The change in working capital was SEK 58 (16) M, where the timing of payments from customers had an exceptionally large positive impact this quarter.

- Earnings per share, before and after dilution were SEK 0.05 (-0.06).

The interim period January - September 2025

- Total revenue amounted to SEK 1 589 M (1 494), which is an increase compared to the same period last year by 6% or 8% adjusted for changes in exchange rates.

- Gross profit was SEK 351 M (322) an increase of 9% or 12% adjusted for changes in exchange rates. Gross margin excluding change related items was 22.1% (21.5).

- Operating costs excluding depreciation were SEK 285 M (268), an increase of 6% or 8% adjusted for changes in exchange rates. Operating costs, excluding depreciation and change related items, were SEK 281 M (265).

- EBITDA amounted to SEK 66 M (53). Adjusted for change related items, EBITDA was SEK 70 M (56).

- Investments in intangible assets, mainly related to product development, were SEK 24 M (28).

- Cash flow from operating activities was SEK 82 M (26). Changes in working capital was SEK 23 (-24) M.

- Earnings per share, before and after dilution were SEK 0.31 (-0.02).

CEO Matthias Stadelmeyer's comments

Tradedoubler continued to deliver solid operational results in the third quarter of 2025, once again demonstrating the resilience of our business model and the strength of our diversified offering. Revenue grew by 7% to SEK 525 M, or 10% when adjusted for currency effects. Gross profit increased by 9% or 11% currency adjusted to SEK 115 M and adjusted EBITDA improved to SEK 22 M (19).

While revenue and gross profit developed in line with our expectations, EBITDA came in slightly lower, mainly due to one-time client-related effects and continued investments in Metapic as well as in building our new team setup in the United States.

Cash flow from operating activities reached an exceptionally strong SEK 74 M (31), to a large extent this is driven by large customer payments received at the end of the quarter. Corresponding publisher payments will be made in October. This performance highlights the healthy fundamentals of our business and our continued focus on cash generation.

Operational and Strategic Developments

Our diversified portfolio and strong regional performance continue to drive results. We are pleased to have won About You, Bosch and L'Oréal across several European markets as new major clients during the quarter - both representing significant and long-term opportunities for our business.

At the same time, one larger client has decided to stop its campaigns with us, which will have an impact on our results in the first half of 2026, in Q3 the client generated SEK 2 M in GP. While individual client dynamics are part of our business reality, our broad and growing partner base positions us well for continued resilience and sustainable growth.

Embracing an AI-Driven Future

The digital marketing landscape is undergoing a fundamental shift: AI will disrupt how traffic is generated, traded and optimized. We are fully aware of the magnitude of this change and have made a conscious decision not to simply add short-term AI features, but to rebuild our platform from the ground up to meet the demands of an AI-driven market.

Our vision is clear:

"To be the most automated and intelligent platform, built to work seamlessly with AI agents in an AI-driven market."

This transformation is the foundation of our long-term competitiveness and profitability. Our purpose is to become an AI-powered company operating in an AI-enabled market - increasing efficiency and profitability while leveraging new developments in traffic acquisition and trading.

To achieve this, we have rebuilt how we store and manage data, creating a central data lake that serves as the backbone of an AI-ready infrastructure. This allows us to automate processes, build AI-driven features and prepare for new forms of interaction with AI systems and agents.

Equally important, we are empowering all our teams to integrate AI into their daily work, ensuring that the adoption of AI becomes part of our culture and daily operations, not just our technology.

Our work focuses on three core pillars:

- Automation-First Platform: Embedding automation and intelligence across our platform and internal processes to drive scalability, efficiency and performance.

- AI-Ready Data Infrastructure: Building a structured, privacy-compliant data foundation designed to integrate seamlessly with AI agents and ecosystems.

- AI-Friendly Interfaces (UI & APIs): Creating interfaces and connections that ensure our partners and publishers are visible and discoverable in AI-driven commerce.

Outlook

Our strong financial position, solid profitability and continued investment discipline give us confidence in our long-term direction. Our strategic trajectory remains clear: to strengthen our market position through innovation, automation and partnership excellence.

We thank our employees, clients, publishers and shareholders for their continued trust and collaboration. Together, we are building the next generation of performance marketing.

Contact information

Matthias Stadelmeyer, President and CEO, telephone +46 8 405 08 00

Viktor Wågström, CFO, telephone +46 8 405 08 00

E-mail: ir@tradedoubler.com

Other information

This information is information that Tradedoubler AB is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 08.00 CET on 31 October 2025. Numerical data in brackets refers to the corresponding periods in 2024 unless otherwise stated. Rounding off differences may arise.