HONG KONG, Oct 31, 2025 - (ACN Newswire) - The global energy transition presents an irreversible trend in the world today. Amidst this historic process, the energy storage industry is particularly critical in the construction of new power systems. Its exponential growth trajectory unequivocally declares it to be a 'Golden Track' brimming with long-term potential. From an investment perspective, when selecting companies in the energy storage sector, leading players with high growth visibility and strong certainty are clearly the most worthwhile targets for current focus and monitoring. ZhiTong Finance believes that Xiamen Hithium Energy Storage Technology Co., Ltd. (hereafter referred to as 'Hithium Energy Storage'), which recently filed its Application Proof for listing with the Hong Kong Stock Exchange (HKEX), is a prime example.

Founded in 2019, Hithium Energy Storage has achieved an extraordinary market position in just over five years. This is naturally reflected in its financial statements, where core financial data continues to trace a steep upward curve. For instance, building on a high base from last year, Hithium Energy Storage's revenue reached RMB 6.971 billion in the first six months of this year, representing a massive year-on-year increase of 224.6%. Gross profit rapidly expanded from less than RMB 100 million in the same period last year to RMB 916 million, marking a robust year-on-year surge of 1073.4%. The net profit metric also underwent a simultaneous 'qualitative change,' successfully turning profitable in the first half of the year with a profit of RMB 223 million.

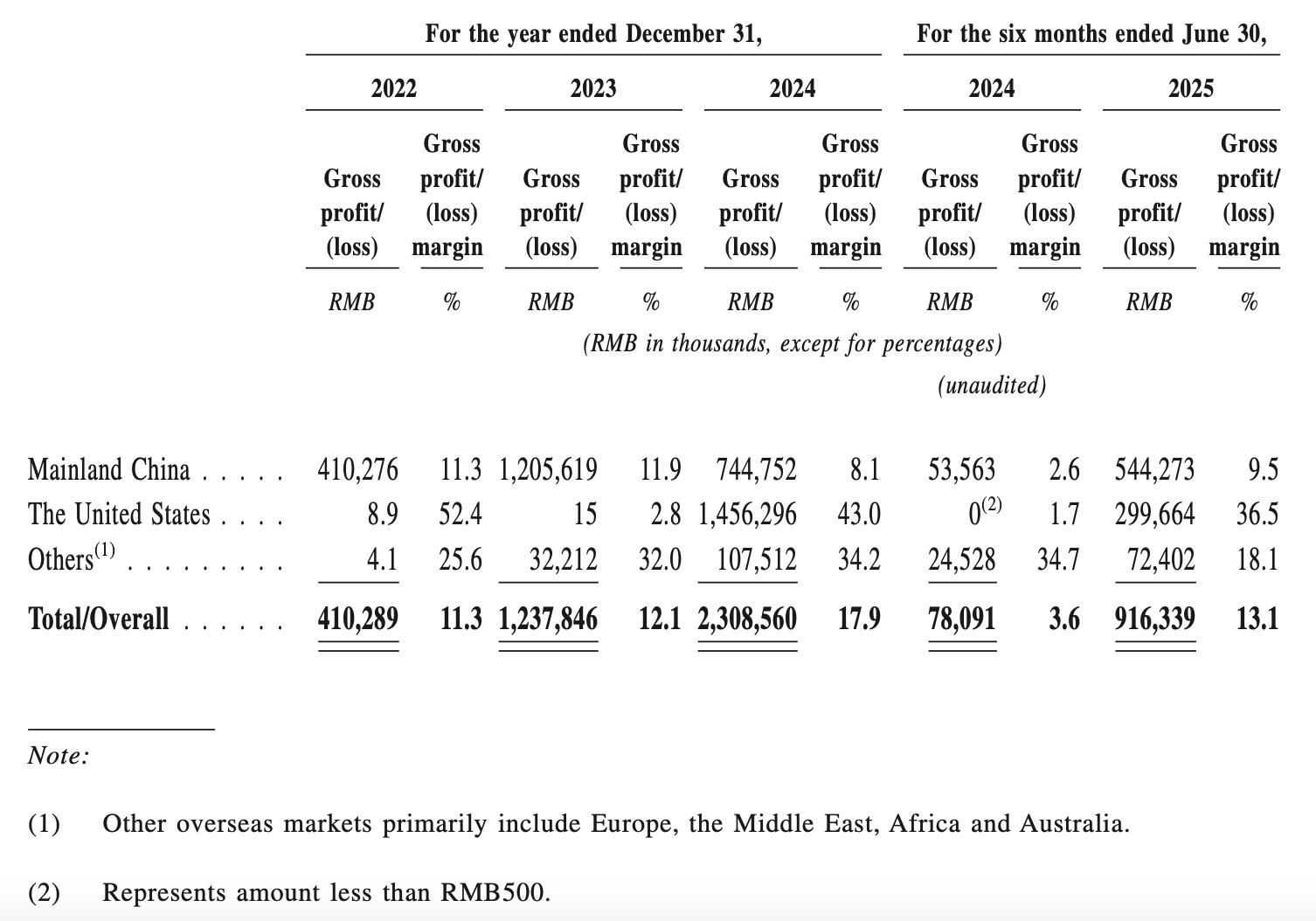

Even more noteworthy, Hithium Energy Storage's latest performance trend has released a strong value signal: its more profitable international business is powerfully 'taking the baton' to become the new 'locomotive' contributing incremental performance. In the first half of this year, the proportion of Hithium Energy Storage's international revenue surged to 17.5%, a 'qualitative leap' compared to 3.3% in the same period last year. While the revenue weight increased significantly, the profit potential of the international business was also initially unlocked. It is estimated that Hithium Energy Storage's international business achieved a gross margin of 30.5% in the first half, a figure significantly higher than the 9.5% gross margin of its Chinese mainland business during the same period. The rapid scaling of Hithium Energy Storage's international business is largely due to its early and acute recognition of the importance of overseas markets, evidenced by its proactive establishment of a production base in Texas, USA, making it the first Chinese company to set up energy storage system production capacity in the United States. With the rapid expansion of its international business, it is reasonable to expect Hithium Energy Storage's revenue scale and profitability metrics to continue growing rapidly.

Cultivating Global Competitiveness Around Core Strategies

The corporate history of Hithium Energy Storage can, in a way, be viewed as a classic example of the global offensive launched by Chinese manufacturing. Over the past few years, Hithium Energy Storage's business volume has continuously climbed new steps. According to the company's prospectus, the compound annual growth rate of Hithium Energy Storage's ESS battery shipments reached 167% from 2022 to 2024. In the first six months of this year, Hithium Energy Storage's ESS battery shipments reached 30 GWh, with a year-on-year growth rate of 252.9%. Despite the high base, there is no sign of a 'regression to the mean' in its shipment growth rate; instead, it has further accelerated.

The secret behind the consistently rapid increase in Hithium Energy Storage's product shipments is likely embedded within the company's three core strategies. Focusing on energy storage is one of the company's core strategies. Placing Hithium Energy Storage within the industry perspective, this is clearly an 'atypical' new energy technology company. The key feature of this 'atypical' nature is that since its inception, the company has consistently focused solely on the energy storage sector, unlike other leading companies in the industry that disperse their focus across the upstream and downstream of the industrial chain. It is likely due to this singular focus that Hithium Energy Storage is able to better understand the fundamental logic and core challenges of the industry. The continued realization of high growth expectations this year is undoubtedly closely linked to the company's unwavering focus on the energy storage domain, based on a deep understanding of the market.

In an era where technological innovation is playing a decisive role in the global competitiveness of the manufacturing industry, any manufacturing enterprise aiming to break out must establish a leading edge in technology and product capabilities. By adhering to the core strategy of building competitive barriers through R&D and innovation, Hithium Energy Storage has consistently matched the vast and rapidly growing market demand with high-quality supply over the years. Data shows that Hithium Energy Storage's cumulative expenditure on R&D exceeded RMB 1.5 billion from 2022 to the first half of 2025. To date, the company has assembled an R&D team of over 1,030 professionals, with over 30% holding a master's degree or higher. This continuously growing R&D expense and powerful R&D talent pool provide the foundational support for Hithium Energy Storage to intensively launch innovative products.

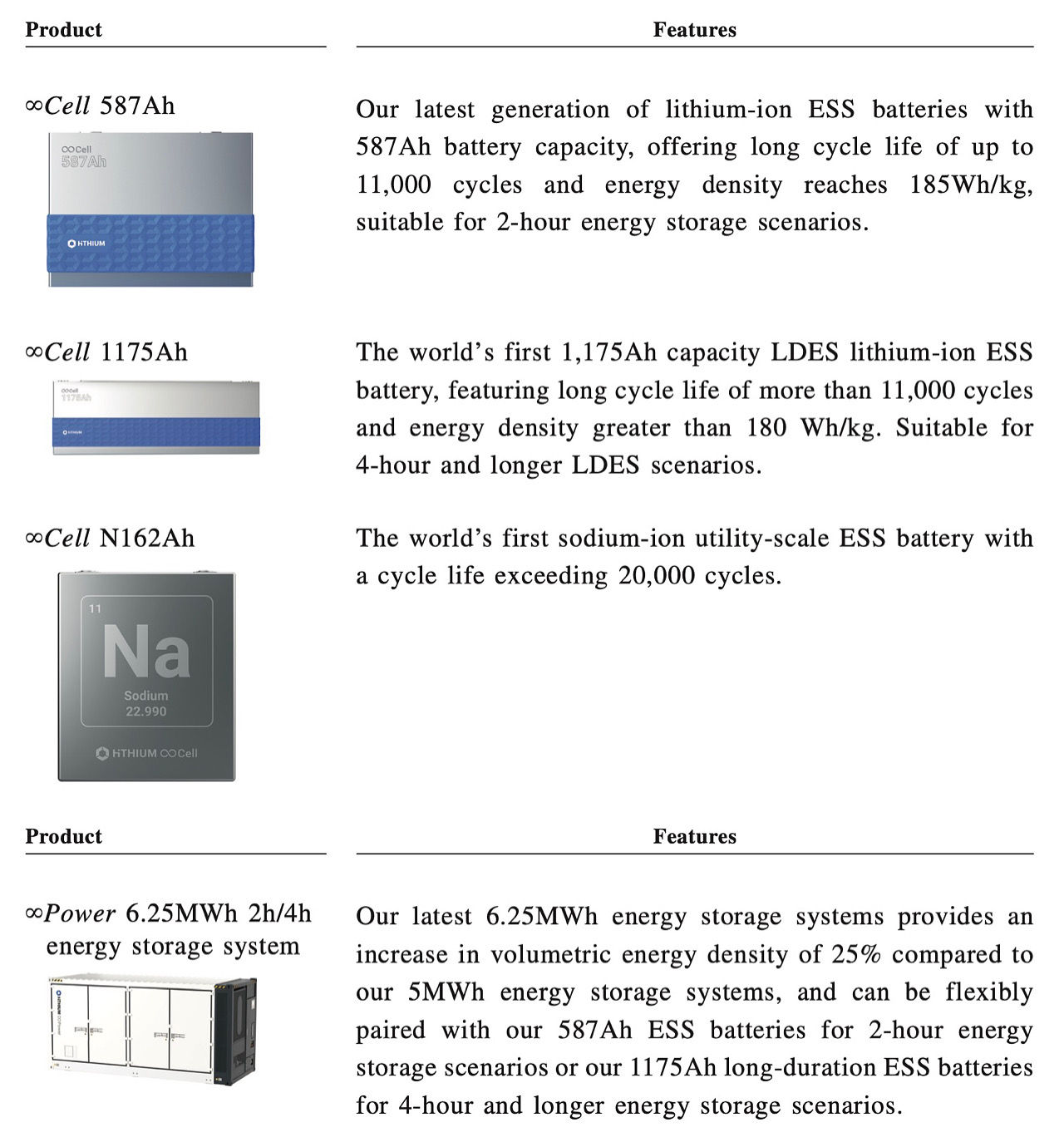

In terms of energy storage battery products, Hithium Energy Storage currently mainly offers 280Ah and 314Ah cells and has unveiled the ∞Cell 587Ah and ∞Cell 1175Ah ESS batteries. Furthermore, it has introduced the sodium-ion ESS battery with a cycle life exceeding 20,000 cycles. Protected by its strong core scientific and technological capabilities, the company has entered a vigorous new product cycle.

For energy storage system products, Hithium Energy Storage provides all-round energy storage systems with leading capabilities that can be applied in power stations, grids, data centers, commercial and industrial, and residential scenarios. Current delivered products include the 5MWh liquid-cooling energy storage system. Last month, at RE+ 2025'the largest and most influential international solar and energy storage exhibition globally, held in Las Vegas, USA'Hithium Energy Storage unveiled energy storage solutions for AI Data Centers (AIDC), such as the ∞Power 6.25MWh 8h lithium-ion long-duration energy storage system.

Its core R&D innovation strength has also provided crucial assistance for Hithium Energy Storage to achieve scaled production and extreme efficiency. It is reported that Hithium Energy Storage has continuously overcome technological bottlenecks and successfully iterated four generations of smart factories within the last three years, leading to a continuous decline in unit manufacturing costs over the past three years. Currently, the company's fifth-generation factory is also under construction and is expected to commence operation next year. Combined with the explosive growth in Hithium Energy Storage's shipment data, it is fair to say that 'Hithium Smart Manufacturing' has become a reality. Furthermore, the prospectus reveals that the ∞Cell 587Ah, ∞Cell 1175Ah, and ∞Cell N162Ah ESS battery cell products, as well as the ∞Power 6.25 MWh 2h/4h ESS system product, are all expected to achieve mass production in the second half of the year, which will lead to a continued significant increase in Hithium Energy Storage's shipments in the latter half of the year.

How to Evaluate the Investment Value of an 'Evolving' Energy Storage Leader?

Looking across the global capital markets, star technology stocks in mainstream markets have generally been favored by capital this year. The clear dominance of the growth style is underpinned by emerging industries, including new energy, which are gradually becoming critical drivers stimulating current economic growth, thereby guiding market consensus and capital flows.

Given Hithium Energy Storage's strong growth DNA, its consistent delivery on growth expectations over the past few years, and its high growth visibility for the future, it is anticipated that the company will become a highly sought-after 'hot commodity' in the new stock market after its listing on the HKEX.

Reviewing its historical performance, Hithium Energy Storage achieved a compound annual growth rate of 89% in revenue from 2022 to 2024. The gross profit margin significantly jumped from 11.3% in 2022 to 17.9% in 2024. Concurrently, the net profit metric achieved a historic turnaround in 2024, reaching RMB 288 million. Over the same period, the company's metric of total assets minus current liabilities also grew annually, increasing from RMB 718 million in 2022 to RMB 1.701 billion in 2024, indicating a continuously optimizing balance sheet. Building upon the high-performance base of 2024, Hithium Energy Storage's core financial data continued its rapid advance in the first half of this year, strongly fulfilling growth expectations.

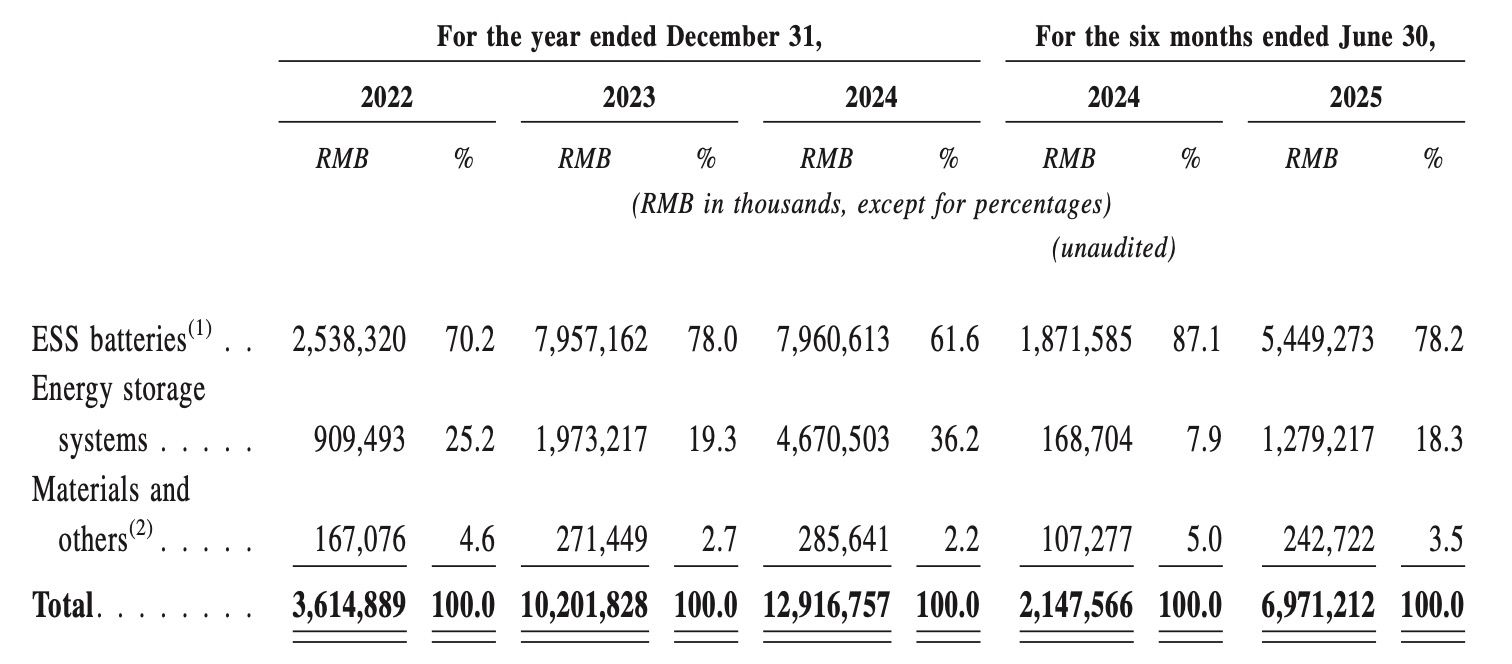

A detailed analysis shows that Hithium Energy Storage's proactive adjustment of its business structure and market strategy is also a key reason for the leap in its financial data. In terms of business structure, the company continues to promote the development of businesses with higher added value. According to data from the prospectus, the revenue from energy storage systems accounted for 18.3% of total revenue in the first half of this year, a significant increase from 7.9% in the same period last year. From a profitability perspective, the gross margin for the ESS System business was 29.7% in the first half, notably higher than the 9.7% gross margin for the ESS Battery business. The rising weight of high-margin business clearly had a positive impact on increasing the company's profits.

Regarding its market strategy, as stated at the beginning of the article, Hithium Energy Storage has achieved global operations covering the entire value chain, guided by its globalization strategy. In 2024, the company's international revenue ratio historically rose to 28.6%. In the first half of this year, Hithium Energy Storage's revenue scale and revenue contribution ratio in Europe, the Middle East, Africa, Australia, and other countries and regions in Asia all significantly increased. All evidence indicates that Hithium Energy Storage's strategic move to establish advanced production capacity in the United States played an extremely critical role in the further scaling of the company's overall performance in the first half of this year. Currently, the company's strategy of building a diversified global market is accelerating in its effectiveness, and its reliance on any single regional market is significantly reduced.

ZhiTong Finance believes that Hithium Energy Storage's track record has already proven it to be a company with deep growth DNA. Furthermore, considering the broad prospects of the energy storage sector and the company's long-term strategy of increasing its presence in international markets, the company's growth sustainability and visibility are excellent. Therefore, Hithium Energy Storage can be considered a high-potential stock in the energy storage field with significant long-term investment value. A company that aligns with market preference and investor expectations, upon its successful listing on the HKEX, is highly likely to be sought after by various capital sources.

Copyright 2025 ACN Newswire . All rights reserved.

|

|

|

|

Founded in 2019, Hithium Energy Storage has achieved an extraordinary market position in just over five years. This is naturally reflected in its financial statements, where core financial data continues to trace a steep upward curve. For instance, building on a high base from last year, Hithium Energy Storage's revenue reached RMB 6.971 billion in the first six months of this year, representing a massive year-on-year increase of 224.6%. Gross profit rapidly expanded from less than RMB 100 million in the same period last year to RMB 916 million, marking a robust year-on-year surge of 1073.4%. The net profit metric also underwent a simultaneous 'qualitative change,' successfully turning profitable in the first half of the year with a profit of RMB 223 million.

Even more noteworthy, Hithium Energy Storage's latest performance trend has released a strong value signal: its more profitable international business is powerfully 'taking the baton' to become the new 'locomotive' contributing incremental performance. In the first half of this year, the proportion of Hithium Energy Storage's international revenue surged to 17.5%, a 'qualitative leap' compared to 3.3% in the same period last year. While the revenue weight increased significantly, the profit potential of the international business was also initially unlocked. It is estimated that Hithium Energy Storage's international business achieved a gross margin of 30.5% in the first half, a figure significantly higher than the 9.5% gross margin of its Chinese mainland business during the same period. The rapid scaling of Hithium Energy Storage's international business is largely due to its early and acute recognition of the importance of overseas markets, evidenced by its proactive establishment of a production base in Texas, USA, making it the first Chinese company to set up energy storage system production capacity in the United States. With the rapid expansion of its international business, it is reasonable to expect Hithium Energy Storage's revenue scale and profitability metrics to continue growing rapidly.

Cultivating Global Competitiveness Around Core Strategies

The corporate history of Hithium Energy Storage can, in a way, be viewed as a classic example of the global offensive launched by Chinese manufacturing. Over the past few years, Hithium Energy Storage's business volume has continuously climbed new steps. According to the company's prospectus, the compound annual growth rate of Hithium Energy Storage's ESS battery shipments reached 167% from 2022 to 2024. In the first six months of this year, Hithium Energy Storage's ESS battery shipments reached 30 GWh, with a year-on-year growth rate of 252.9%. Despite the high base, there is no sign of a 'regression to the mean' in its shipment growth rate; instead, it has further accelerated.

The secret behind the consistently rapid increase in Hithium Energy Storage's product shipments is likely embedded within the company's three core strategies. Focusing on energy storage is one of the company's core strategies. Placing Hithium Energy Storage within the industry perspective, this is clearly an 'atypical' new energy technology company. The key feature of this 'atypical' nature is that since its inception, the company has consistently focused solely on the energy storage sector, unlike other leading companies in the industry that disperse their focus across the upstream and downstream of the industrial chain. It is likely due to this singular focus that Hithium Energy Storage is able to better understand the fundamental logic and core challenges of the industry. The continued realization of high growth expectations this year is undoubtedly closely linked to the company's unwavering focus on the energy storage domain, based on a deep understanding of the market.

In an era where technological innovation is playing a decisive role in the global competitiveness of the manufacturing industry, any manufacturing enterprise aiming to break out must establish a leading edge in technology and product capabilities. By adhering to the core strategy of building competitive barriers through R&D and innovation, Hithium Energy Storage has consistently matched the vast and rapidly growing market demand with high-quality supply over the years. Data shows that Hithium Energy Storage's cumulative expenditure on R&D exceeded RMB 1.5 billion from 2022 to the first half of 2025. To date, the company has assembled an R&D team of over 1,030 professionals, with over 30% holding a master's degree or higher. This continuously growing R&D expense and powerful R&D talent pool provide the foundational support for Hithium Energy Storage to intensively launch innovative products.

In terms of energy storage battery products, Hithium Energy Storage currently mainly offers 280Ah and 314Ah cells and has unveiled the ∞Cell 587Ah and ∞Cell 1175Ah ESS batteries. Furthermore, it has introduced the sodium-ion ESS battery with a cycle life exceeding 20,000 cycles. Protected by its strong core scientific and technological capabilities, the company has entered a vigorous new product cycle.

For energy storage system products, Hithium Energy Storage provides all-round energy storage systems with leading capabilities that can be applied in power stations, grids, data centers, commercial and industrial, and residential scenarios. Current delivered products include the 5MWh liquid-cooling energy storage system. Last month, at RE+ 2025'the largest and most influential international solar and energy storage exhibition globally, held in Las Vegas, USA'Hithium Energy Storage unveiled energy storage solutions for AI Data Centers (AIDC), such as the ∞Power 6.25MWh 8h lithium-ion long-duration energy storage system.

Its core R&D innovation strength has also provided crucial assistance for Hithium Energy Storage to achieve scaled production and extreme efficiency. It is reported that Hithium Energy Storage has continuously overcome technological bottlenecks and successfully iterated four generations of smart factories within the last three years, leading to a continuous decline in unit manufacturing costs over the past three years. Currently, the company's fifth-generation factory is also under construction and is expected to commence operation next year. Combined with the explosive growth in Hithium Energy Storage's shipment data, it is fair to say that 'Hithium Smart Manufacturing' has become a reality. Furthermore, the prospectus reveals that the ∞Cell 587Ah, ∞Cell 1175Ah, and ∞Cell N162Ah ESS battery cell products, as well as the ∞Power 6.25 MWh 2h/4h ESS system product, are all expected to achieve mass production in the second half of the year, which will lead to a continued significant increase in Hithium Energy Storage's shipments in the latter half of the year.

How to Evaluate the Investment Value of an 'Evolving' Energy Storage Leader?

Looking across the global capital markets, star technology stocks in mainstream markets have generally been favored by capital this year. The clear dominance of the growth style is underpinned by emerging industries, including new energy, which are gradually becoming critical drivers stimulating current economic growth, thereby guiding market consensus and capital flows.

Given Hithium Energy Storage's strong growth DNA, its consistent delivery on growth expectations over the past few years, and its high growth visibility for the future, it is anticipated that the company will become a highly sought-after 'hot commodity' in the new stock market after its listing on the HKEX.

Reviewing its historical performance, Hithium Energy Storage achieved a compound annual growth rate of 89% in revenue from 2022 to 2024. The gross profit margin significantly jumped from 11.3% in 2022 to 17.9% in 2024. Concurrently, the net profit metric achieved a historic turnaround in 2024, reaching RMB 288 million. Over the same period, the company's metric of total assets minus current liabilities also grew annually, increasing from RMB 718 million in 2022 to RMB 1.701 billion in 2024, indicating a continuously optimizing balance sheet. Building upon the high-performance base of 2024, Hithium Energy Storage's core financial data continued its rapid advance in the first half of this year, strongly fulfilling growth expectations.

A detailed analysis shows that Hithium Energy Storage's proactive adjustment of its business structure and market strategy is also a key reason for the leap in its financial data. In terms of business structure, the company continues to promote the development of businesses with higher added value. According to data from the prospectus, the revenue from energy storage systems accounted for 18.3% of total revenue in the first half of this year, a significant increase from 7.9% in the same period last year. From a profitability perspective, the gross margin for the ESS System business was 29.7% in the first half, notably higher than the 9.7% gross margin for the ESS Battery business. The rising weight of high-margin business clearly had a positive impact on increasing the company's profits.

Regarding its market strategy, as stated at the beginning of the article, Hithium Energy Storage has achieved global operations covering the entire value chain, guided by its globalization strategy. In 2024, the company's international revenue ratio historically rose to 28.6%. In the first half of this year, Hithium Energy Storage's revenue scale and revenue contribution ratio in Europe, the Middle East, Africa, Australia, and other countries and regions in Asia all significantly increased. All evidence indicates that Hithium Energy Storage's strategic move to establish advanced production capacity in the United States played an extremely critical role in the further scaling of the company's overall performance in the first half of this year. Currently, the company's strategy of building a diversified global market is accelerating in its effectiveness, and its reliance on any single regional market is significantly reduced.

ZhiTong Finance believes that Hithium Energy Storage's track record has already proven it to be a company with deep growth DNA. Furthermore, considering the broad prospects of the energy storage sector and the company's long-term strategy of increasing its presence in international markets, the company's growth sustainability and visibility are excellent. Therefore, Hithium Energy Storage can be considered a high-potential stock in the energy storage field with significant long-term investment value. A company that aligns with market preference and investor expectations, upon its successful listing on the HKEX, is highly likely to be sought after by various capital sources.

Copyright 2025 ACN Newswire . All rights reserved.

© 2025 JCN Newswire