Significant Balance Sheet Improvement - Debt Free, Receives $9.5 Million in Non-Dilutive Cash

VLN® and Partner VLN® Launches Underway, Rapidly Expanding Store Counts and Availability

MOCKSVILLE, N.C., Nov. 04, 2025 (GLOBE NEWSWIRE) -- 22nd Century Group, Inc. (Nasdaq: XXII), the only tobacco products company that has for 27 years led and continues to lead the fight against the harms of smoking driven by nicotine addiction, today announced results for the third quarter-ended September 30, 2025, and provided an update on recent business highlights.

"The third quarter represents the launch point for a full pivot to a branded products strategy that will drive our future. Multiple brands of our VLN® products are now available for purchase, our store count is increasing every month, and we are securing new distribution agreements to expand our reach.

"As the leader in the Tobacco Harm Reduction Movement, we believe that all tobacco companies should complement their full nicotine products with a set of low nicotine products within their brand families. Our technology roadmap makes this possible, with short time to market and at any scale required, through both Partner VLN® and licensing capabilities, allowing every tobacco company to become fully aligned with the FDA's Low Nicotine Mandate instead of resisting. By doing so, tobacco companies can for the first time truly deliver on their claims of supporting tobacco harm reduction efforts. As important, smoking consumers can access a new way to change in their smoking habit with a form factor that they are accustomed to, the combustible cigarette, but without the highly addictive nicotine that drives addiction," said Larry Firestone, CEO of 22nd Century Group.

"Additionally, we are now in the best financial position of the past two years and have begun the growth phase of our company. With the $9.5 million settlement of our prior insurance claims from the Grass Valley facility fire in 2022 and a debt free balance sheet, we now have a well-funded cash position on which to build the market, both directly and in partnership with our growing list of brand partners adopting VLN® based products. We have recently announced further expansion of both state authorizations and store counts across our VLN® based products, with stocking orders underway now to support our continued expansion."

"We are also exploring other ways to bring VLN® based products to the forefront of the industry and make low nicotine a fundamental part of the fabric of the tobacco industry."

Third Quarter 2025 Financial Results (compared to Second Quarter 2025, except as noted)

All figures reported below reflect continuing operations, excluding discontinued operations related to the sale and exit of the Company's hemp/cannabis business in late 2023, except as noted.

| ? | Net revenues decreased slightly to $4.0 million from $4.1 million. |

| ? | Gross profit (loss) was $(1.1) million, compared to $(0.6) million. |

| ? | Operating expenses were $2.2 million, decreased from $2.3 million. |

| ? | Operating loss increased to $3.2 million, compared to $3.0 million. |

| ? | Consolidated net income increased to $5.5 million, compared to net loss of $3.4 million, reflecting the $9.5 million insurance settlement in discontinued operations. |

| ? | Adjusted EBITDA loss was $2.9 million, compared to a loss of $2.6 million. |

| ? | Ended the third quarter 2025 with cash of $4.8 million. |

Recent Business Highlights

| ? | Strong balance sheet improvement, ending third quarter 2025 with no outstanding debt and an additional $9.5 million in cash received in November 2025 from the insurance settlement. |

| ? | Expanded market access to both VLN® and Partner VLN® brand launches, new natural style cigarette products and increased state authorizations as part of the relaunch of the Company's branded products. State authorizations now include: |

| ? | 22nd Century VLN® - 45 States | |

| ? | Smoker Friendly VLN® - 38 States | |

| ? | Pinnacle® VLN® - 38 States | |

| ? | Smoker Friendly - 46 States | |

| ?? | Pinnacle® - 43 States |

| ? | Delivered first shipments of Pinnacle® VLN® products to top-5 convenience store chain stores across 12 states; began store rollout to approximately 1,000 initial stores as part of a staged launch initiative. |

| ? | Continued to advance negotiations with new customers to expand VLN® distribution and launch additional VLN® partner brands, further diversifying the reduced nicotine content product category. |

| ? | Implemented margin expansion, cost savings and efficiency initiatives of our manufacturing operations to align from the historically low margin CMO volume to our higher margin branded products, including VLN® and Partner VLN®. |

| ? | Advanced plans for 100mm format VLN® cigarettes, plus international combustible products tailored to consumer preferences in those markets, as well as additional filtered cigar products. |

Third Quarter 2025 Product Line Net Revenues

| ? | Cigarette net revenues were $2.5 million, from $2.7 million in the third quarter of 2025, reflecting an increase in certain customer pricing incentives, offset by increased CMO volumes. Additional expansion of new natural style cigarette products launched in 2025 will continue to accelerate revenue and margin growth in this category. |

| ? | Filtered cigar net revenues were stable at $1.3 million, reflecting ongoing volume from remaining CMO customers. |

| ? | Cigarillo distribution net revenues were negligible and reflect the time necessary for initial stocking orders to be sold through our distributors before additional reorders are fulfilled in later 2025. |

| ? | VLN® cigarette net revenues were $0.2 million, reflecting initial stocking order activity of partner VLN® products, offset by customer returns and product exchanges to the new VLN® branding. Additional partner brand agreements are in progress as part of a relaunch of its VLN® reduced nicotine content products. |

Balance Sheet

| ? | The Company reported zero long-term debt at quarter end, having extinguished the remaining $3.9 million of its senior secured debt in full. |

| ? | Cash and equivalents were $4.8 million at quarter end. |

| ? | Subsequent to the quarter end, the Company received $9.5 million in insurance proceeds due from the previously announced settlement of its Grass Valley Fire claim. |

Conference Call

22nd Century will host a live webcast today at 8:00 a.m. E.T. to discuss its third quarter 2025 financial results and business highlights. The live and archived webcast will be accessible in the Events section on 22nd Century's Investor Relations website at https://ir.xxiicentury.com/events.

Summary Financial Results

(dollars in thousands, except per share data)

| Three Months Ended | ||||||||||||||||

| September 30, | Change | |||||||||||||||

| 2025 | 2024 | $ | % | |||||||||||||

| Revenues, net | $ | 4,011 | $ | 5,946 | (1,935 | ) | (32.5 | ) | ||||||||

| Gross loss | $ | (1,059 | ) | $ | (588 | ) | (471 | ) | 80.1 | |||||||

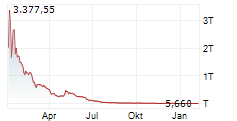

| Operating loss | $ | (3,212 | ) | $ | (3,377 | ) | 165 | (4.9 | ) | |||||||

| Net loss from continuing operations | $ | (3,763 | ) | $ | (3,585 | ) | (178 | ) | 5.0 | |||||||

| Basic and diluted loss per common share from continuing operations | $ | (1.06 | ) | $ | (848.84 | ) | 847.78 | (99.9 | ) | |||||||

| Adjusted EBITDA (a) | $ | (2,885 | ) | $ | (3,178 | ) | 293 | 9.2 | ||||||||

| Nine Months Ended | ||||||||||||||||

| September 30, | Change | |||||||||||||||

| 2025 | 2024 | $ | % | |||||||||||||

| Revenues, net | $ | 14,050 | $ | 20,361 | (6,311 | ) | (31.0 | ) | ||||||||

| Gross loss | $ | (2,303 | ) | $ | (1,147 | ) | (1,156 | ) | 100.8 | |||||||

| Operating loss | $ | (8,763 | ) | $ | (9,858 | ) | 1,095 | (11.1 | ) | |||||||

| Net loss from continuing operations | $ | (10,333 | ) | $ | (11,248 | ) | 915 | (8.1 | ) | |||||||

| Basic and diluted loss per common share from continuing operations | $ | (7.94 | ) | $ | (4,297.69 | ) | 4,289.75 | (99.8 | ) | |||||||

| Adjusted EBITDA (a) | $ | (7,845 | ) | $ | (9,247 | ) | 1,402 | 15.2 | ||||||||

(a) Adjusted EBITDA is a non-GAAP financial measure. Please see "Notes Regarding Non-GAAP Financial Information" for additional information regarding our use of non-GAAP financial measures. Refer to Tables A at the end of this release for reconciliations of adjusted amounts to the closest corresponding GAAP financial measures.

Summary Product Line Results

(in thousands)

| Three Months Ended | ||||||||||||||||||||||||

| September 30, | ||||||||||||||||||||||||

| 2025 | 2024 | Change | ||||||||||||||||||||||

| $ | Cartons | $ | Cartons | $ | Cartons | |||||||||||||||||||

| Contract Manufacturing | ||||||||||||||||||||||||

| Cigarettes | 2,520 | 345 | 4,078 | 156 | (1,558 | ) | 189 | |||||||||||||||||

| Filtered Cigars | 1,282 | 168 | 1,664 | 253 | (382 | ) | (85 | ) | ||||||||||||||||

| Cigarillos | - | - | 204 | 30 | (204 | ) | (30 | ) | ||||||||||||||||

| Total Contract Manufacturing | 3,802 | 513 | 5,946 | 439 | (2,144 | ) | 74 | |||||||||||||||||

| VLN® | 209 | 4 | - | - | 209 | 4 | ||||||||||||||||||

| Total Product Line Revenues | 4,011 | 517 | 5,946 | 439 | (1,935 | ) | 78 | |||||||||||||||||

| Nine Months Ended | ||||||||||||||||||||||||

| September 30, | ||||||||||||||||||||||||

| 2025 | 2024 | Change | ||||||||||||||||||||||

| $ | Cartons | $ | Cartons | $ | Cartons | |||||||||||||||||||

| Contract Manufacturing | ||||||||||||||||||||||||

| Cigarettes | 10,249 | 1,370 | 10,942 | 416 | (693 | ) | 954 | |||||||||||||||||

| Filtered Cigars | 3,704 | 498 | 8,593 | 1,249 | (4,889 | ) | (751 | ) | ||||||||||||||||

| Cigarillos | 88 | 14 | 756 | 120 | (668 | ) | (106 | ) | ||||||||||||||||

| Total Contract Manufacturing | 14,041 | 1,882 | 20,291 | 1,785 | (6,250 | ) | 97 | |||||||||||||||||

| VLN® | 9 | 1 | 70 | 1 | (61 | ) | 0 | |||||||||||||||||

| Total Product Line Revenues | 14,050 | 1,883 | 20,361 | 1,786 | (6,311 | ) | 97 | |||||||||||||||||

About 22nd Century Group, Inc.

22nd Century Group is pioneering the tobacco harm reduction movement by enabling smokers to take control of their nicotine consumption.

Our Technology is Tobacco

Our proprietary non-GMO reduced nicotine tobacco plants were developed using our patented technologies that regulate alkaloid biosynthesis activities resulting in a tobacco plant that contains 95% less nicotine than traditional tobacco plants. Our extensive patent portfolio has been developed to ensure that our high-quality tobacco can be grown commercially at scale. We continue to develop our intellectual property to ensure our ongoing leadership in the tobacco harm reduction movement.

Our Products

We created our flagship product, the VLN® cigarette using our low nicotine tobacco, to give traditional cigarette smokers an authentic and familiar alternative in the form of a combustible cigarette that helps them take control of their nicotine consumption. VLN® cigarettes have 95% less nicotine compared to traditional cigarettes and have been proven to allow consumers to greatly reduce their nicotine consumption.

VLN® and Helps You Smoke Less® are registered trademarks of 22nd Century Limited LLC.

Learn more at xxiicentury.com, on X (formerly Twitter), on LinkedIn, and on YouTube.

Learn more about VLN® at tryvln.com.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, all of the statements, expectations, and assumptions contained in this press release are forward-looking statements, including but not limited to our full year business outlook. Forward-looking statements typically contain terms such as "anticipate," "believe," "consider," "continue," "could," "estimate," "expect," "explore," "foresee," "goal," "guidance," "intend," "likely," "may," "plan," "potential," "predict," "preliminary," "probable," "project," "promising," "seek," "should," "will," "would," and similar expressions. Forward-looking statements include, but are not limited to, statements regarding (i) our cost reduction initiatives, (ii) our expectations regarding regulatory enforcement, including our ability to receive an exemption from new regulations, and (iii) our financial and operating performance. Actual results might differ materially from those explicit or implicit in forward-looking statements. Important factors that could cause actual results to differ materially are set forth in "Risk Factors" in the Company's Annual Report on Form 10-K filed on March 20, 2025 and Quarterly Reports on Form 10-Q on May 13, 2025, August 14, 2025, and November 4, 2025. All information provided in this release is as of the date hereof, and the Company assumes no obligation to and does not intend to update these forward-looking statements, except as required by law.

Notes regarding Non-GAAP Financial Information

In addition to the Company's reported results in accordance with generally accepted accounting principles in the United States of America ("GAAP"), the Company provides EBITDA and Adjusted EBITDA.

In order to calculate EBITDA, the Company adjusts net (loss) income by adding back interest expense (income), provision (benefit) for income taxes, and depreciation and amortization expense. Adjusted EBITDA consists of EBITDA adjusted by the Company for certain non-cash and/or non-operating expenses, including adding back equity-based employee compensation expense, restructuring and restructuring-related charges such as impairment, acquisition and transaction costs, and other unusual or infrequently occurring items, if applicable, such as inventory reserves and adjustments, gains or losses on disposal of property, plant and equipment, and gains or losses on investments.

The Company believes that the presentation of EBITDA and Adjusted EBITDA are important financial measures that supplement discussion and analysis of its financial condition and results of operations and enhances an understanding of its operating performance. While management considers EBITDA and Adjusted EBITDA to be important, these financial performance measures should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP, such as operating (loss) income, net (loss) income and cash flows from operations. Adjusted EBITDA is susceptible to varying calculations and the Company's measurement of Adjusted EBITDA may not be comparable to those of other companies.

Investor Relations & Media Contact

Matt Kreps

Investor Relations

22nd Century Group

investorrelations@xxiicentury.com

214-597-8200

22nd CENTURY GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(amounts in thousands, except share and per-share data)

| September 30, 2025 | December 31, 2024 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 4,846 | $ | 4,422 | ||||

| Accounts receivable, net | 2,993 | 1,698 | ||||||

| Inventories | 2,906 | 2,015 | ||||||

| Insurance recoveries | 9,500 | 768 | ||||||

| GVB promissory note, net | - | 500 | ||||||

| Prepaid expenses and other current assets | 2,678 | 1,068 | ||||||

| Current assets of discontinued operations held for sale | - | 1,051 | ||||||

| Total current assets | 22,923 | 11,522 | ||||||

| Property, plant and equipment, net | 2,452 | 2,773 | ||||||

| Operating lease right-of-use assets, net | 767 | 1,639 | ||||||

| Intangible assets, net | 6,210 | 5,724 | ||||||

| Other assets | 15 | 15 | ||||||

| Total assets | $ | 32,367 | $ | 21,673 | ||||

| LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS' EQUITY | ||||||||

| Current liabilities: | ||||||||

| Notes and loans payable - current | $ | 368 | $ | 254 | ||||

| Current portion of long-term debt | - | 1,500 | ||||||

| Operating lease obligations | 163 | 261 | ||||||

| Accounts payable | 2,598 | 2,401 | ||||||

| Accrued expenses | 2,234 | 1,021 | ||||||

| Accrued litigation | - | 768 | ||||||

| Accrued payroll | 140 | 318 | ||||||

| Accrued excise taxes and fees | 3,399 | 2,038 | ||||||

| Deferred income | 79 | 20 | ||||||

| Other current liabilities | 1,231 | 100 | ||||||

| Current liabilities of discontinued operations held for sale | 333 | 1,281 | ||||||

| Total current liabilities | 10,545 | 9,962 | ||||||

| Long-term liabilities: | ||||||||

| Operating lease obligations | 644 | 1,437 | ||||||

| Long-term debt | - | 5,165 | ||||||

| Other long-term liabilities | 74 | 1,097 | ||||||

| Total liabilities | 11,263 | 17,661 | ||||||

| Mezzanine equity: | ||||||||

| Series A convertible preferred shares, $0.00001 par value; 9,650 shares issued and outstanding at September 30, 2025 and 0 at December 31, 2024, respectively | 2,734 | - | ||||||

| Total mezzanine equity | 2,734 | - | ||||||

| Shareholders' equity: | ||||||||

| Common stock, $.00001 par value, 500,000,000 shares authorized, 6,987,290 shares issued and outstanding at September 30, 2025 and 31,727 at December 31, 2024, respectively | ||||||||

| Common stock, par value | - | - | ||||||

| Capital in excess of par value | 414,487 | 397,883 | ||||||

| Accumulated deficit | (396,117 | ) | (393,871 | ) | ||||

| Total shareholders' equity | 18,370 | 4,012 | ||||||

| Total liabilities, mezzanine equity and shareholders' equity | $ | 32,367 | $ | 21,673 | ||||

22nd CENTURY GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

(amounts in thousands, except share and per-share data)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Revenues, net | $ | 4,011 | $ | 5,946 | $ | 14,050 | $ | 20,361 | ||||||||

| Cost of goods sold | 2,557 | 3,102 | 8,304 | 11,184 | ||||||||||||

| Excise taxes and fees on products | 2,513 | 3,432 | 8,049 | 10,324 | ||||||||||||

| Gross loss | (1,059 | ) | (588 | ) | (2,303 | ) | (1,147 | ) | ||||||||

| Operating expenses: | ||||||||||||||||

| Sales, general and administrative | 1,849 | 2,547 | 5,766 | 7,814 | ||||||||||||

| Research and development | 193 | 240 | 583 | 915 | ||||||||||||

| Other operating expense (income), net | 111 | 2 | 111 | (18 | ) | |||||||||||

| Total operating expenses | 2,153 | 2,789 | 6,460 | 8,711 | ||||||||||||

| Operating loss from continuing operations | (3,212 | ) | (3,377 | ) | (8,763 | ) | (9,858 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Other income (expense), net | (33 | ) | 100 | (207 | ) | 439 | ||||||||||

| Interest income, net | 16 | 3 | 46 | 26 | ||||||||||||

| Interest expense | (534 | ) | (311 | ) | (1,443 | ) | (1,828 | ) | ||||||||

| Total other income (expense), net | (551 | ) | (208 | ) | (1,604 | ) | (1,363 | ) | ||||||||

| Loss from continuing operations before income taxes | (3,763 | ) | (3,585 | ) | (10,367 | ) | (11,221 | ) | ||||||||

| (Benefit) provision for income taxes | - | - | (34 | ) | 27 | |||||||||||

| Net loss from continuing operations | $ | (3,763 | ) | $ | (3,585 | ) | $ | (10,333 | ) | $ | (11,248 | ) | ||||

| Discontinued operations: | ||||||||||||||||

| Income (loss) from discontinued operations before income taxes | $ | 9,252 | $ | (172 | ) | $ | 8,087 | $ | 640 | |||||||

| Provision for income taxes | - | - | - | - | ||||||||||||

| Income (loss) from discontinued operations | $ | 9,252 | $ | (172 | ) | $ | 8,087 | $ | 640 | |||||||

| Net income (loss) | $ | 5,489 | $ | (3,757 | ) | $ | (2,246 | ) | $ | (10,608 | ) | |||||

| Comprehensive income (loss) | $ | 5,489 | $ | (3,757 | ) | $ | (2,246 | ) | $ | (10,608 | ) | |||||

| Net income (loss) | $ | 5,489 | $ | (3,757 | ) | $ | (2,246 | ) | $ | (10,608 | ) | |||||

| Deemed dividends | - | (3,677 | ) | - | (7,711 | ) | ||||||||||

| Net income (loss) available to common shareholders | $ | 5,489 | $ | (7,434 | ) | $ | (2,246 | ) | $ | (18,319 | ) | |||||

| Basic income (loss) per share: | ||||||||||||||||

| Basic loss per common share from continuing operations | $ | (1.06 | ) | $ | (848.84 | ) | $ | (7.94 | ) | $ | (4,297.69 | ) | ||||

| Basic income (loss) per common share from discontinued operations | $ | 2.61 | $ | (40.77 | ) | $ | 6.21 | $ | 244.44 | |||||||

| Basic loss per common share from deemed dividends | $ | - | $ | (870.65 | ) | $ | - | $ | (2,946.25 | ) | ||||||

| Basic income (loss) per common share | $ | 1.55 | $ | (1,760.26 | ) | $ | (1.73 | ) | $ | (6,999.50 | ) | |||||

| Diluted income (loss) per share: | ||||||||||||||||

| Diluted loss per common share from continuing operations | $ | (1.06 | ) | $ | (848.84 | ) | $ | (7.94 | ) | $ | (4,297.69 | ) | ||||

| Diluted income (loss) per common share from discontinued operations | $ | 0.78 | $ | (40.77 | ) | $ | 1.99 | $ | 137.00 | |||||||

| Diluted loss per common share from deemed dividends | $ | - | $ | (870.65 | ) | $ | - | $ | (2,946.25 | ) | ||||||

| Diluted income (loss) per common share | $ | (0.28 | ) | $ | (1,760.26 | ) | $ | (5.95 | ) | $ | (7,106.94 | ) | ||||

| Weighted average shares outstanding: | ||||||||||||||||

| Basic | 3,541,337 | 4,223 | 1,301,656 | 2,617 | ||||||||||||

| Diluted | 11,888,488 | 7,182 | 4,070,266 | 4,670 | ||||||||||||

Table A - Reconciliations of Non-GAAP Measures

(dollars in thousands, except share and per-share data)

Below is a table containing information relating to the Company's Net loss, EBITDA and Adjusted EBITDA for the three and nine months ended September 30, 2025 and 2024, including a reconciliation of these Non-GAAP measures for such periods.

| Quarter Ended | ||||||||||||

| September 30, | ||||||||||||

| Amounts in thousands ($000's) | ||||||||||||

| except share and per share data | ||||||||||||

| (UNAUDITED) | ||||||||||||

| $ Change | ||||||||||||

| 2025 | 2024 | fav / (unfav)1 | ||||||||||

| Net loss from continuing operations | $ | (3,763 | ) | $ | (3,585 | ) | $ | (178 | ) | |||

| Interest (income)/expense, net | 518 | 308 | 210 | |||||||||

| Provision (benefit) for income taxes | - | - | - | |||||||||

| Amortization and depreciation | 234 | 249 | (15 | ) | ||||||||

| EBITDA | $ | (3,011 | ) | $ | (3,028 | ) | $ | 17 | ||||

| Adjustments: | ||||||||||||

| Restructuring and impairment | - | (23 | ) | 23 | ||||||||

| Inventory write-down | - | - | - | |||||||||

| Change in fair value of derivative liabilities | - | (23 | ) | 23 | ||||||||

| Change in fair value of warrant liabilities | 33 | (100 | ) | 133 | ||||||||

| Equity-based employee compensation expense | 93 | (4 | ) | 97 | ||||||||

| Adjusted EBITDA | $ | (2,885 | ) | $ | (3,178 | ) | $ | 293 | ||||

| Adjusted EBITDA loss per common share | $ | (0.81 | ) | $ | (752.58 | ) | $ | 751.77 | ||||

| Weighted average common shares outstanding - basic and diluted | 3,541,337 | 4,223 | ||||||||||

| Year Ended | ||||||||||||

| September 30, | ||||||||||||

| Amounts in thousands ($000's) | ||||||||||||

| except share and per share data | ||||||||||||

| (UNAUDITED) | ||||||||||||

| $ Change | ||||||||||||

| 2025 | 2024 | fav / (unfav)1 | ||||||||||

| Net loss from continuing operations | $ | (10,333 | ) | $ | (11,248 | ) | $ | 916 | ||||

| Interest (income)/expense, net | 1,397 | 1,802 | (405 | ) | ||||||||

| Provision (benefit) for income taxes | (34 | ) | 27 | (61 | ) | |||||||

| Amortization and depreciation | 693 | 762 | (69 | ) | ||||||||

| EBITDA | $ | (8,277 | ) | $ | (8,657 | ) | $ | 380 | ||||

| Adjustments: | ||||||||||||

| Restructuring and impairment | - | (348 | ) | 348 | ||||||||

| Inventory write-down | - | 431 | (431 | ) | ||||||||

| Change in fair value of derivative liabilities | - | (482 | ) | 482 | ||||||||

| Change in fair value of warrant liabilities | 207 | (424 | ) | 631 | ||||||||

| Equity-based employee compensation expense | 225 | 233 | (8 | ) | ||||||||

| Adjusted EBITDA | $ | (7,845 | ) | $ | (9,247 | ) | $ | 1,402 | ||||

| Adjusted EBITDA loss per common share | $ | (6.03 | ) | $ | (3,533.20 | ) | $ | 3,527.17 | ||||

| Weighted average common shares outstanding - basic and diluted | 1,301,656 | 2,617 | ||||||||||

1Fav = Favorable variance, which increases EBITDA and Adjusted EBITDA; Unfav = unfavorable variance, which reduces EBITDA and Adjusted EBITDA