NEW YORK, Nov. 7, 2025 /PRNewswire/ -- HTCO (NASDAQ: HTCO) today announced that it has entered into a financing agreement for an investment of up to US $20 million by an accredited investor, a move designed to accelerate the Company's strategic development of investment in its AI platform to improve operational efficiency and support related digital transformation initiatives.

Under the terms of the agreement, the financing will be implemented in multiple tranches, with the first tranche of US $3 million having been successfully funded. Notably, the Company emphasized that this facility does not include any warrants, ensuring alignment with the Company's disciplined capital structure strategy.

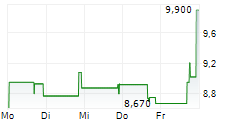

Pursuant to the agreement, the investor has committed to a "daily trading volume limit not exceeding 15 percent of total daily trading volume" for any subsequent share transactions related to this financing. This provision is intended to maintain market stability and safeguard the interests of existing and new shareholders.

The listing and trading of the shares issued in connection with the initial US $3 million financing are subject to the Company filing a F-1 registration statement with the U.S. Securities and Exchange Commission that must become effective within a 120-day period.

The Company further noted that it has not yet determined whether it will require additional financing beyond the initial US $3 million. Any decisions regarding subsequent closings will be based on the Company's ongoing capital planning, operational needs and prevailing market conditions.

Chris Nixon Cox, Company Chairman, stated, "This strategic financing reflects strong market confidence in HTCO's long-term vision for marine digital transformation and the Company's ability to continue to advance technological innovation and optimize capital efficiency-all to drive sustainable value creation for our shareholders."

About High-Trend International Group

High-Trend International Group is a global ocean technology company with core businesses in international shipping and marine carbon neutrality.

Forward-Looking Statements

This news contains "forward-looking statements" as defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These forward-looking statements can be identified by terms such as "may," "might," "could," "will," "aims," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar expressions.

These forward-looking statements are based on the Company's current assumptions, expectations and beliefs, but they are accompanied by substantial risks and uncertainties. These risks and uncertainties may cause the Company's actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements. It should be noted that these statements do not constitute guarantees of future performance and are subject to a series of risks. Readers should not place undue reliance on these forward-looking statements, as there is no assurance that the plans, initiatives or expectations underlying these statements will be realized.

A detailed discussion of factors that could lead to such differences and other risks affecting the Company's business is included in the filings that the Company submits to the U.S. Securities and Exchange Commission (the "Commission") from time to time, including the Company's most recent report on Form 20-F, particularly under the heading "Risk Factors."

SOURCE High-Trend International Group