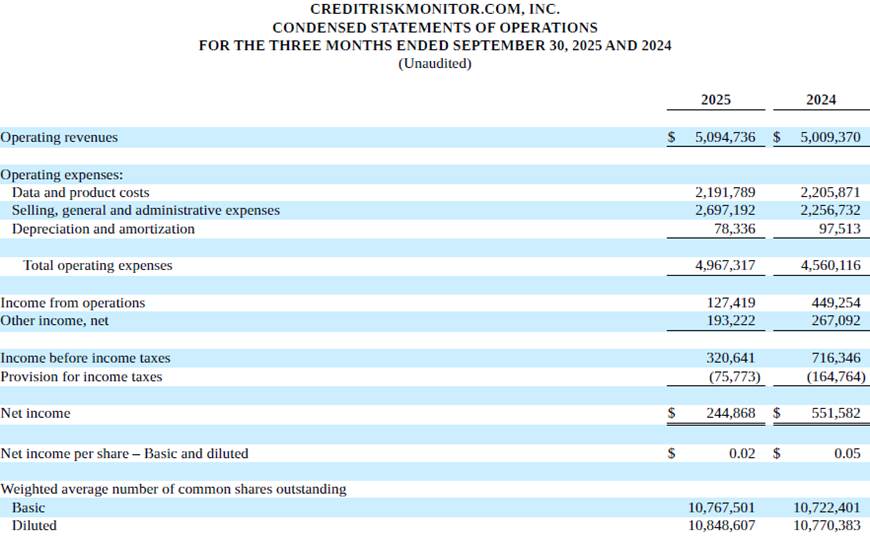

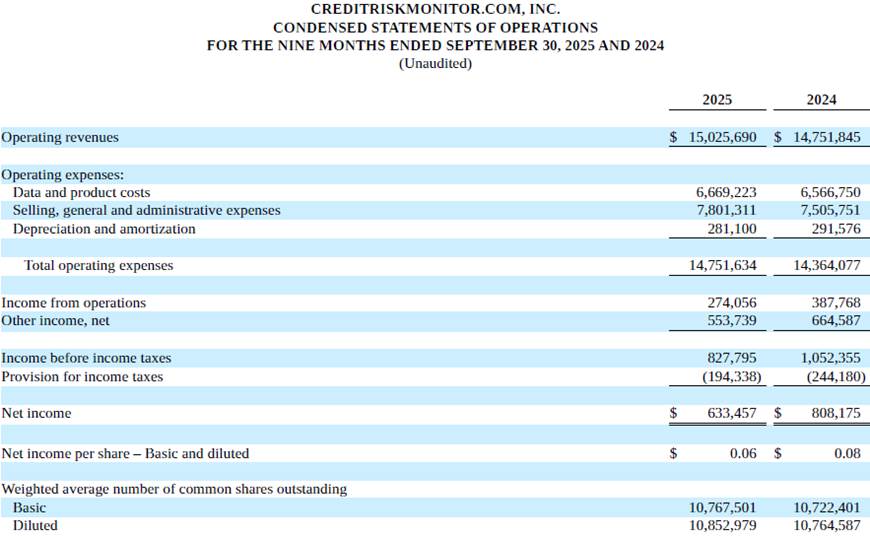

TARRYTOWN, NY / ACCESS Newswire / November 10, 2025 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reported operating revenues of $5.1 million, an increase of approximately $85 thousand or 2%, for the third quarter of fiscal 2025 compared to the same period of fiscal 2024. The Company reported pre-tax income of approximately $321 thousand, a decrease of approximately $396 thousand or 55%, for the third quarter of fiscal 2025 compared to the same period of fiscal 2024. The decrease in pre-tax profitability was primarily driven by an increase in expenses related to employee salaries, employee benefits, commissions, and professional services. The Company reported net income of approximately $245 thousand, a decrease of approximately $307 thousand or 56%, for the second quarter of fiscal 2025 compared to the same period of fiscal 2024.

"The third quarter was all about adaptation as we launched our revamped Client Services model and new Customer Relationship Management (CRM) platform," said Mike Flum, CEO of CreditRiskMonitor. "Our teams have shown tremendous grit navigating the inevitable hiccups that accompany large organizational shifts, and I'm proud of the progress we've made. While there's still work ahead, we're already seeing stronger communication, tighter integration, and greater accountability across our CRM processes.

Splitting our Account Manager role into specialized Client Success and Inside Sales functions has sharpened our focus on customer satisfaction and product-use case fit. Coupled with ongoing product enhancements, these changes should position us for higher gross and net retention. Human-centered service remains a cornerstone of our business, but we're also laying the foundation for copilot, conversational AI, and agent-based interfaces that will drive more efficient self-service interactions and enhance customer experience. The scalability of these tools, paired with similar back-office optimizations, will further support profitability as we modernize and streamline our operations.

On the product front, customer feedback on our new Financial Analyst Strength Test (FAST) Rating and Risk Level features-launched in mid-October-has been overwhelmingly positive. The FAST Rating extends our scored coverage by 3.5 million businesses, particularly smaller international private companies with limited financial data, using a model trained on data evaluated by our team of expert financial analysts. The Risk Level framework consolidates all of our financial risk analytics into a simple Low, Medium, or High Risk classification, giving clients an intuitive way to assess and compare over 10 million public and private companies using the most accurate financial risk analytic available.

Also in October, we hosted our inaugural Product Advisory Council meeting, where clients provided valuable guidance and feedback on our product roadmap and vision for CreditRiskMonitor® 2.0.

On the macroeconomic front, recent major private bankruptcies in the automotive industry at Tricolor Auto Group, LLC and First Brands Group, LLC highlight growing risks in private credit, particularly around off-balance sheet financing and receivables factoring. In both cases, our private company PAYCE® Score identified high risk more than a year prior to their filings. We're also seeing the emergence of the 'cloaking effect' in private companies, driven by the ubiquity of private credit. The cloaking effect, initially identified by Dun & Bradstreet (D&B), refers to a phenomenon where companies maintain timely vendor payments right up until bankruptcy. Because many businesses assess customer creditworthiness using historical payment behavior signals, maintaining prompt payments can mask financial distress and preserve access to trade credit when other sources of working capital are expensive. Historically, this effect was mostly confined to public companies with greater access to debt via capital markets, but the explosion of private credit has extended this same dynamic to private firms. In this environment, predictive analytics like the PAYCE® Score, which cut through surface-level payment signals, are invaluable in helping our clients avoid bad debt write-offs and supply chain disruption."

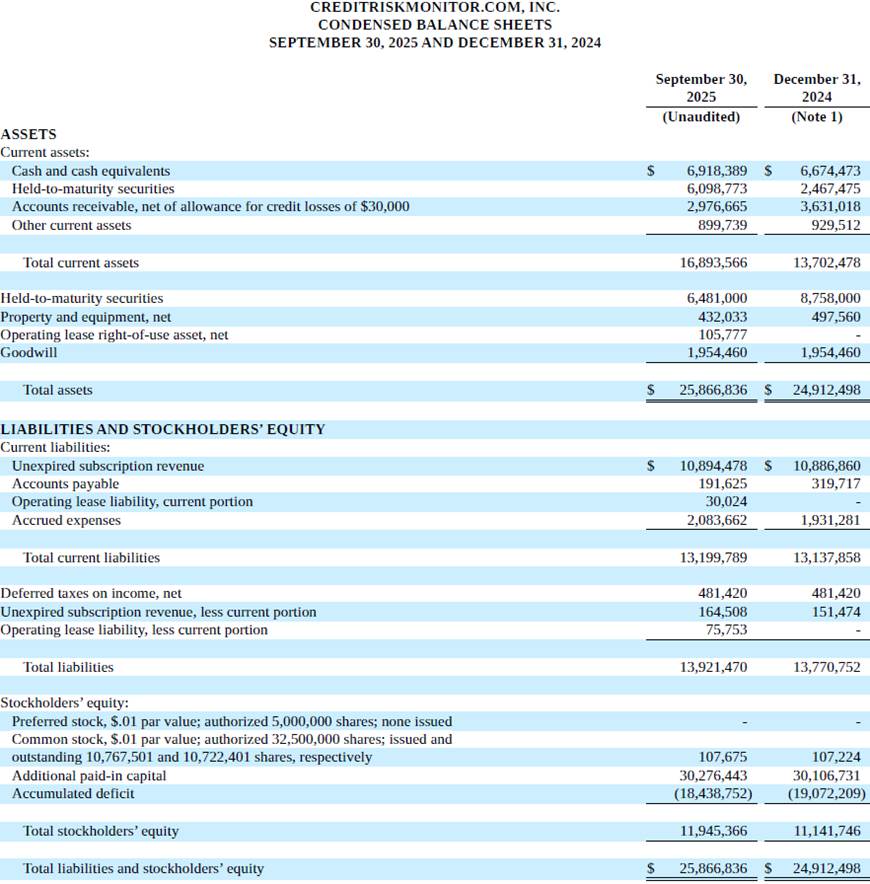

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor.com, Inc. (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. Our primary SaaS subscription products for analyzing commercial financial risk are CreditRiskMonitor® and SupplyChainMonitor. These products help corporate credit and procurement professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively. Our subscribers include nearly 40% of the Fortune 1000 and well over a thousand other large corporations worldwide.

To help subscribers prioritize and monitor counterparty financial risk, our SaaS platforms offer the proprietary FRISK® and PAYCE® Scores as well as the FAST Rating, the well-known Altman Z"-Score, agency ratings from key Nationally Recognized Statistical Rating Organizations ("NRSROs"), curated news, and detailed financial spreads & ratios. Our FRISK® and PAYCE® Scores are financial distress classification models that measure a business's probability of bankruptcy within a year. The FRISK® score also includes a risk signal based on the aggregate research behaviors of our subscribers, who control counterparty access to trade credit at some of the most sophisticated companies in the world. The inclusion of this risk signal boosts the overall accuracy of this bankruptcy analytic by lowering the false positive rate for the riskiest corporations.

Through its Trade Contributor Program, the Company receives monthly confidential accounts receivables data from hundreds of subscribers and non-subscribers, which it parses, processes, aggregates, and reports to summarize the invoice payment behavior of B2B counterparties without disclosing the specific contributors of this information. The size of the Trade Contributor Program's current annualized trade credit transaction data is approximately $3 trillion.

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, Chief Executive Officer

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/computers-technology-and-internet/creditriskmonitor-announces-third-quarter-results-1099740