- Higher volumes and attractive model line-up support growing revenues

- Continuing reduction of materials costs and fixed costs

- Achieved target of three-digit million-dollar carbon credits sales ahead of plan at USD 123 million for the first nine months of 2025

- External headwinds continue to impact profitability

Polestar (Nasdaq: PSNY) reports select unaudited financial and operational results for the third quarter and first nine months of 2025.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251112358825/en/

Polestar model line-up

Michael Lohscheller, Polestar CEO, says: "We are making progress in our commercial transformation, expanding our dealer network and opening retail locations across our 28 markets, resulting in revenue growth of 49% in the first nine months of 2025. As market conditions remain challenging, we continue to take steps to make our organisation and operations more efficient."

Key financial highlights

| (in millions of U.S. dollars) | For the nine months ended 30 September | For the three months ended 30 September | ||||

(unaudited) | 2025 | 2024 | Change, % | 2025 | 2024 | Change, % |

Restated1 | Restated1 | |||||

Revenue | 2,171 | 1,459 | 48.8 | 748 | 550 | 36.0 |

Gross margin, % | (34.5) | (2.1) | (32.4) ppts | (6.1) | (1.2) | (4.9) ppts |

Adjusted Gross Margin (non-GAAP)2 | (1.8) | (2.1) | 0.3 ppts | (7.9) | (1.2) | (6.7) ppts |

Net loss | (1,558) | (867) | (79.7) | (365) | (323) | (13.0) |

Adjusted EBITDA (non-GAAP)2 | (561) | (610) | 8.0 | (259) | (176) | (47.2) |

Cash balance | 995 | 501 | 98.6 | |||

(1) | "Restated" as a result of the restated six-month periods ended 30 June 2024 filed on Form 6-K/A with the SEC on 1 July 2025. | |

(2) | Non-GAAP measure. See Appendix A for details and a reconciliation of non-GAAP metrics to the nearest GAAP measure. |

For the nine months ended 30 September 2025:

- Retail sales totalled an estimated 44,482 cars, representing growth of 36.5% year-on-year (YoY) from 32,595 cars in the comparable period, driven by an attractive model line-up and strong sales in Europe.

- Revenue at USD 2,171 million, up by 48.8% from USD 1,459 million a year earlier, driven predominantly by higher volumes, a growing share of higher priced models (Polestar 3 and Polestar 4) in the sales mix, and carbon credits sales partially offset by pressure on pricing due to competitive and challenging market environment and residual value guarantee costs related to the North American markets. Carbon credits sales totalled USD 123 million in the period from USD 0.04 million a year earlier, including USD 19 million worth of carbon credits sales booked in other operating income.

- Gross margin at a negative (34.5)%, a deterioration of 32.4 ppts YoY from (2.1)% in the comparable period, mainly due to the non-cash impairment expense on Polestar 3 of USD 739 million booked in the second quarter of 2025.

- Adjusted Gross Margin at a negative (1.8)%, better by 0.3 ppts YoY from (2.1)% a year earlier, mainly as a result of evolving product and geographical sales mix, reduction of materials costs of vehicles sold and carbon credits sales, partially offset by pressure on pricing, higher tariffs and adjustments of inventory to net realizable value and expenses related to residual value guarantees.

- Net loss of USD (1,558) million, compared to net loss of USD (867) million in the first nine months of 2024, primarily due to a higher gross loss driven by the impairment expense.

- Adjusted EBITDA of USD (561) million, better by USD 49 million from USD (610) million in the comparable period, a result of lower selling, general and administrative (SG&A) expenses driven by optimized marketing spend and lower headcount, higher other operating income including indirect carbon credits sales and a positive foreign exchange impact partially offset by higher Adjusted Gross Loss and higher sales agency remuneration linked to growing sales volumes.

- Cash position of USD 995 million, higher by USD 256 million versus the 2024 year-end cash position of USD 739 million. During the period, Polestar received a USD 200 million PIPE investment from PSD Investment Limited in June 2025 as well as secured and renewed financing facilities.

- Further details are provided in the reconciliation tables for non-GAAP measures in Appendix A.

For the three months ended 30 September 2025:

- Retail sales totalled an estimated 14,192 cars, up 13.1% YoY from 12,548 cars a year earlier, supported by an attractive model line-up and a European geographical sales mix.

- Revenue at USD 748 million, up by 36.0% from USD 550 million in the comparable period, driven predominantly by volumes and growing volumes of higher priced models (Polestar 3 and Polestar 4) in the sales mix with a further positive contribution from carbon credits sales offset by pricing pressure and residual value guarantee adjustments related to the North American markets. Carbon credits sales totalled USD 33 million in the period from USD nil million a year earlier, including USD 1 million worth of carbon credits sales booked in other operating income.

- Gross margin at (6.1)%, a deterioration of 4.9 ppts from (1.2)% a year earlier, mainly due to pressure on pricing and higher cost of sales linked to tariffs, adverse mix effect, adjustment of inventory to net realizable value and costs related to residual value guarantees in the North American markets, partially offset by carbon credits sales in the quarter.

- Adjusted Gross Margin at a negative (7.9)%, a deterioration of 6.7 ppts from (1.2)% in the comparable period, is adjusted for a USD 12 million reversal of impairment expense.

- Net loss of USD (365) million, compared to net loss of USD (323) million for the third quarter of 2024, primarily driven by a higher gross loss, higher sales agency remuneration linked to growing sales volume, and lower other operating income partially offset by continued reduction of SG&A expenses.

- Adjusted EBITDA loss of USD (259) million, compared to Adjusted EBITDA loss of USD (176) million for the third quarter of 2024, mainly due to a higher gross loss, higher sales agency remuneration linked to growing sales volume, and negative foreign exchange impact partially offset by reduction of SG&A expenses.

Key operational highlights

The table below summarizes key operational highlights for the quarter and nine months ended September 30, 2025:

For the nine months ended 30 September, | For the three months ended 30 September, | |||||

2025 | 2024 | Change, % | 2025 | 2024 | Change, % | |

Retail sales 1 | 44,482 | 32,595 | 36.5 | 14,192 | 12,548 | 13.1 |

including external vehicles with repurchase obligations2 | 1,452 | 1,170 | 24.1 | 473 | 182 | 159.9 |

including internal vehicles | 2,683 | 2,204 | 21.7 | 777 | 1,243 | (37.5) |

Markets3 | 28 | 27 | + 1 market | |||

Sales points4 | 192 | 165 | 16.4 | |||

of which sales points, excluding China | 191 | 124 | 54.0 | |||

Service points5 | 1,269 | 1,170 | 8.5 | |||

(1) | Retail sales figures are sales to end customers. Retail Sales include new cars handed over via all sales channels and all sale types, including but not restricted to internal, fleet, retail, rental and leaseholders' channels across all markets irrespective of their market model and setup and may or may not generate directly revenue for Polestar. | |

(2) | In the 9 months ended 30 September 2025 this number includes 179 cars that were handed over as security under a financing arrangement. | |

(3) | Represents the markets in which Polestar operates. | |

(4) | Represents Sales Points, including retail locations which are physical facilities (such as showrooms), actively selling Polestar cars, and pre-space activations, which represent locations with an ongoing project to build a retail location that have already started selling Polestar cars. | |

(5) | Represents Volvo Cars service centres to provide access to customer service points worldwide in support of Polestar's international expansion. |

- Sales points, excluding China, continue to grow, as we transition to an active selling model. In Q3 2025, Polestar signed up another 11 new retail partners with a total of 141 active retail partners at the end of September 2025.

Key loan facilities and funding highlights

During the first nine months of 2025,

- Polestar secured a USD 200 million PIPE investment from PSD Investment Limited, an entity that is controlled by Mr. Shufu (Eric) Li, Founder and Chairman of Geely Holding Group, in June 2025.

- Approximately USD 2.2 billion of facilities were renewed and approximately USD 1.0 billion of new facilities were secured, totalling USD 3.2 billion (including USD 290 million of new facilities and the renewal of USD 1.1 billion of existing facilities in the third quarter).

- Debt covenants with club loan facility banks agreed and amended in June and July 2025 regarding revenue and debt-to-asset ratio covenants testing quarterly for the remainder of 2025 and full-year 2025.

The Company's debt level was in compliance with its loan covenants as of 30 September 2025.

With the support from Geely Holding Group, we continue to make progress towards securing new equity and debt funding.

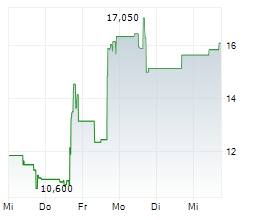

Reverse stock split

Polestar plans to launch the reverse stock split to effect a change of the ratio of its American Depositary Shares to its ordinary shares, which is currently 1:1. Details are expected to be announced shortly.

Key business and operational highlights

- Polestar 5 Grand Tourer revealed at IAA Mobility in Munich.

- Polestar 4 receives Red Dot "Best of the Best" design award.

- Polestar 4 will be the first car to integrate Google Maps' live lane guidance.

- Polestar 3 sets Guinness World Record for longest journey travelled by an electric SUV on a single charge.

- Polestar 3 upgraded with 800 Volt electrical architecture and peak DC charging rate of up to 350 kW for the 2026 model year.

- Inaugural Polestar Festival marks a milestone of 45,000 Polestars on the road in the UK.

- Reduction of R&D staff announced, as a result of implementation of previously communicated strategy to make use of existing architectures from Geely Group for future models.

Conference call

Michael Lohscheller, CEO, and Jean-Francois Mady, CFO, will host a conference call today, 12 November 2025, at 14:00 CET. To join the call, please follow use this link https://edge.media-server.com/mmc/p/boejrfgq/ or follow the instructions available under Events on the Polestar Investor Relations website.

Notes

All financial figures are in millions of U.S. dollars (USD). Unless stated otherwise, the performance shown in this press release covers the three-month period ended 30 September 2025 (Q3 2025), compared to the three-month period ended 30 September 2024 (Q3 2024), and the nine-month period ended 30 September 2025 (first nine months of 2025), compared to the nine-month period ended 30 September 2024 (first nine months of 2024).

Calendar

Polestar expects to report its retail sales volumes for Q4 2025 on 9 January 2026.

About Polestar

Polestar (Nasdaq: PSNY) is the Swedish electric performance car brand with a focus on uncompromised design and innovation, and the ambition to accelerate the change towards a sustainable future. Headquartered in Gothenburg, Sweden, its cars are available in 28 markets globally across North America, Europe, and Asia Pacific.

Polestar has four models in its line-up: Polestar 2, Polestar 3, Polestar 4, and Polestar 5. Planned models include Polestar 7 compact SUV (to be introduced in 2028) and the Polestar 6 roadster. With its vehicles currently manufactured on two continents, North America and Asia, Polestar is diversifying its manufacturing footprint further, with production of Polestar 7 planned in Europe.

Polestar has an unwavering commitment to sustainability and has set an ambitious roadmap to reach its climate targets: halve greenhouse gas emissions by 2030 per-vehicle-sold and become climate-neutral across its value chain by 2040. Polestar's comprehensive sustainability strategy covers the four areas of Climate, Transparency, Circularity, and Inclusion.

Statement regarding unaudited financial and operational results

The unaudited financial and operational information published in this press release is subject to potential adjustments. Potential adjustments to operational and consolidated financial information may be identified from work performed during Polestar's year-end audit. This could result in differences from the unaudited operational and financial information published herein. For the avoidance of doubt, the unaudited operational and financial information published in this press release should not be considered a substitute for the financial information filed with the SEC in Polestar's Annual Reports on Form 20-F.

Forward-looking statements

Certain statements in this press release ("Press Release") may be considered "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or the future financial or operating performance of Polestar including the number of vehicle deliveries and gross margin. For example, projections of revenue, volumes, margins, cash flow break-even and other financial or operating metrics and statements regarding expectations of future needs for funding and plans related thereto are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expect", "intend", "will", "estimate", "anticipate", "believe", "predict", "potential", "forecast", "plan", "seek", "future", "propose" or "continue", or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements.

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Polestar and its management, as the case may be, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) Polestar's ability to enter into or maintain agreements or partnerships with its strategic partners, including Volvo Cars and Geely, original equipment manufacturers, vendors and technology providers; (2) Polestar's ability to maintain relationships with its existing suppliers, source new suppliers for its critical components and enter into longer term supply contracts and complete building out its supply chain; (3) Polestar's ability to raise additional funding; (4) Polestar's ability to successfully execute cost-cutting activities and strategic efficiency initiatives; (5) Polestar's estimates of expenses, profitability, gross margin, cash flow, and cash reserves; (6) Polestar's ability to continue to meet stock exchange listing standards; (7) changes in domestic and foreign business, market, financial, political and legal conditions; (8) demand for Polestar's vehicles or car sale volumes, revenue and margin development based on pricing, variant and market mix, cost reduction efficiencies, logistics and growing aftersales; (9) delays in the expected timelines for the development, design, manufacture, launch and financing of Polestar's vehicles and Polestar's reliance on a limited number of vehicle models to generate revenues; (10) increases in costs, disruption of supply or shortage of materials, in particular for lithium-ion cells or semiconductors; (11) risks related to product recalls, regulatory fines and/or an unexpectedly high volume of warranty claims; (12) Polestar's reliance on its partners to manufacture vehicles at a high volume, some of which have limited experience in producing electric vehicles, and on the allocation of sufficient production capacity to Polestar by its partners in order for Polestar to be able to increase its vehicle production volumes; (13) the ability of Polestar to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (14) risks related to future market adoption of Polestar's offerings; (15) risks related to Polestar's current distribution model and the evolution of its distribution model in the future; (16) the effects of competition and the high barriers to entry in the automotive industry and the pace and depth of electric vehicle adoption generally on Polestar's future business; (17) changes in regulatory requirements (including environmental laws and regulations and regulations related to connected vehicles), governmental incentives, tariffs and fuel and energy prices; (18) Polestar's reliance on the development of vehicle charging networks to provide charging solutions for its vehicles and its strategic partners for servicing its vehicles and their integrated software; (19) Polestar's ability to establish its brand and capture additional market share, and the risks associated with negative press or reputational harm, including from electric vehicle fires; (20) the outcome of any potential litigation, including litigation involving Polestar and Gores Guggenheim, Inc., government and regulatory proceedings, including the NHTSA investigation into the Polestar 2 rear view camera, tax audits, investigations and inquiries; (21) Polestar's ability to continuously and rapidly innovate, develop and market new products; (22) the impact of the ongoing conflict between Ukraine and Russia and in Israel, the Gaza Strip and the Red Sea; and (23) the impact of the ongoing conflict between Ukraine and Russia and in Israel, the Gaza Strip and the Red Sea; and (24) other risks and uncertainties set forth in the sections entitled "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements" in Polestar's Form 20-F, and other documents filed, or to be filed, with the SEC by Polestar. There may be additional risks that Polestar presently does not know or that Polestar currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Nothing in this Press Release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Polestar assumes no obligation to update these forward-looking statements, even if new information becomes available in the future, except as may be required by law.

APPENDIX A

Polestar Automotive Holding UK PLC

Polestar uses both generally accepted accounting principles ("GAAP", i.e., IFRS) and non-GAAP (i.e., non-IFRS) financial measures to evaluate operating performance and for other strategic and financial decision-making purposes. Polestar believes non-GAAP financial measures are helpful to investors as they provide useful perspective on underlying business trends and assist in period-on-period comparisons. These measures also improve the ability of management and investors to assess and compare the financial performance and position of Polestar with those of other companies.

These non-GAAP measures are presented for supplemental information purposes only and should not be considered a substitute for financial information presented in accordance with GAAP. The measures are not presented under a comprehensive set of accounting rules and, therefore, should only be read in conjunction with financial information reported under GAAP when assessing Polestar's operating performance. The measures may not be the same as similarly titled measures used by other companies due to possible differences in calculation methods and items or events being adjusted. A reconciliation between non-GAAP financial measures and the most comparable GAAP performance measures is provided below.

In December 2024, management determined that both Adjusted Operating Loss and Adjusted Net Loss were non-GAAP measures which were no longer needed to be evaluated as they were no longer viewed as relevant measures for understanding the underlying performance of Polestar's core business operations or ongoing performance. Therefore, these measures are no longer being presented.

Non-GAAP financial measures used by management are Adjusted EBITDA, Free Cash Flow, Adjusted Gross Profit (Loss) and Adjusted Gross Margin

Adjusted EBITDA

Adjusted EBITDA is calculated as net loss, adjusted to exclude:

- Fair value change Earn-out rights;

- Fair value change Class C Shares;

- Finance expense;

- Finance income;

- Income tax benefit (expense);

- Depreciation and amortization1

- Impairment of property, plant and equipment, vehicles under operating leases, and intangibles assets;

- Restructuring costs2

- Gains losses on disposals of investments3; and

- Unusual other operating income and expenses that are considered rare or discrete events and are infrequent in nature.

1 Includes (a) depreciation and amortization capitalized into the carrying value of inventory sold (i.e., part of inventory costs), and (b) depreciation and amortization expense. 2 Restructuring costs include expenses associated with programs that were planned and controlled by management, and materially changed either (a) the scope of a business undertaken by the Group, or (b) the manner in which business is conducted. 3 Disposals of investments include disposals, by sales or otherwise, of (a) debt or equity financial instruments issued by another entity that are held as investments, (b) intangible assets, (c) property, plant, and equipment, and (d) groups of assets and liabilities representing disposal groups that were transferred together as part of individual transactions. |

Management reviews this measure and believes it provides meaningful insight into the core business's underlying operating performance and trends, before the effect of any adjusting items.

The definition of Adjusted EBITDA was refined in December 2024. Accordingly, Adjusted EBITDA for the six months ended 30 June 2024 is recast for the changed definition. For more information regarding the changes in the Adjusted EBITDA definition, please refer to the section Non-GAAP Financial Measures in the 2024 20-F.

Free Cash Flow

Free Cash Flow is calculated as cash used for operating activities, adjusted to exclude cash flows to acquire property, plant and equipment and intangible assets. This measure is reviewed by management and management considers it to be a relevant measure for assessing cash generated by operating activities that is available to repay debts and spend on other strategic initiatives.

Adjusted Gross Profit (Loss) and Adjusted Gross Margin

Adjusted Gross Profit (Loss) is calculated as Gross profit (loss), adjusted to exclude expenses arising from the impairment of property, plant and equipment, vehicles under operating leases, and intangibles assets. Adjusted Gross Margin is calculated as Adjusted Gross Profit (Loss) divided by revenue. These measures are reviewed by management and management considers them to be useful measures for assessing Polestar's historical operating performance as they facilitate comparison between periods by excluding the non-cash impairment expense, the measurement of which includes significant assumptions related to future periods.

Unaudited reconciliation of Non-GAAP measures

Adjusted EBITDA

(in millions of U.S. dollars) | For the nine months ended 30 September | |

2025 | 2024 Restated1 | |

Net loss | (1,558.4) | (866.7) |

Fair value changes on Earn-out rights and Class C shares | (19.7) | (75.2) |

Finance expense | 280.5 | 261.3 |

Finance income | (51.4) | (10.6) |

Income tax (benefit) expense | (46.4) | 4.2 |

Depreciation and amortization | 111.9 | 75.8 |

Impairment expense, net of reversals | 711.6 | (0.0) |

Losses (gains) on disposals of investments, PPE and intangibles | (4.5) | 1.4 |

Restructuring costs | 15.8 | (0.0) |

Adjusted EBITDA | (560.6) | (609.8) |

(1) | "Restated" as a result of the restated six-month periods ended 30 June 2024 filed on Form 6-K/A with the SEC on 1 July 2025. |

Adjusted EBITDA

(in millions of U.S. dollars) | For the three months ended 30 September | |

2025 | 2024 Restated1 | |

Net loss | (365.3) | (322.8) |

Fair value changes on earn-out rights and Class C shares | (3.9) | 66.9 |

Finance expense | 95.2 | 87.4 |

Finance income | 1.4 | (28.0) |

Income tax (benefit) expense | (2.9) | (10.1) |

Depreciation and amortization | 35.3 | 28.9 |

Impairment expense, net of reversals | (12.0) | (0.0) |

Losses (gains) on disposals of PPE and intangibles | (9.1) | 1.4 |

Restructuring costs | 2.2 | (0.0) |

Adjusted EBITDA | (259.1) | (176.3) |

(1) | "Restated" as a result of the restated six-month periods ended 30 June 2024 filed on Form 6-K/A with the SEC on 1 July 2025. |

Adjusted Gross Loss

(in millions of U.S. dollars) | For the nine months ended 30 September | |

2025 | 2024 | |

Gross loss | (748.7) | (30.0) |

Impairment expense, net of reversals | 709.6 | 0.0 |

Adjusted Gross Loss | (39.1) | (30.0) |

Adjusted Gross Loss

(in millions of U.S. dollars) | For the three months ended 30 September | |

2025 | 2024 | |

Gross loss | (45.5) | (6.4) |

Impairment expense, net of reversals | (13.9) | 0.0 |

Adjusted Gross Loss | (59.4) | (6.4) |

Adjusted Gross Margin

(in millions of U.S. dollars) | For the nine months ended 30 September | |

2025 | 2024 | |

Adjusted Gross Loss (a) | (39.1) | (30.0) |

Revenue (b) | 2,171.0 | 1,459.0 |

Adjusted Gross Margin (a/b), % | (1.8)% | (2.1)% |

Adjusted Gross Margin

(in millions of U.S. dollars) | For the three months ended 30 September | |

2025 | 2024 | |

Adjusted Gross Loss (a) | (59.4) | (6.4) |

Revenue (b) | 748.0 | 550.0 |

Adjusted Gross Margin (a/b), % | (7.9)% | (1.2)% |

View source version on businesswire.com: https://www.businesswire.com/news/home/20251112358825/en/

Contacts:

Anna Gavrilova

Head of Investor Relations

anna.gavrilova@polestar.com

Theo Kjellberg

Head of Corporate Communications

theo.kjellberg@polestar.com