LONGUEUIL, Quebec, Nov. 12, 2025 (GLOBE NEWSWIRE) -- Azimut Exploration Inc. ("Azimut" or the "Company") (TSXV: AZM) (OTCQX: AZMTF) is pleased to announce the signing of a Sale and Purchase Agreement (the "Agreement") with PMET Resources Inc. ("PMET") (TSX:PMET, ASX:PMT) for the Pikwa Property (the "Property") in the Eeyou Istchee James Bay region of Quebec. The Property is a 50/50 joint venture between the Company and SOQUEM Inc. and is located adjacent to PMET's Shaakichiuwaanaan lithium project (see Figures 1 and 2).

This transaction aligns with the Company's objective to focus on its flagship assets while maintaining exposure to an emerging lithium district through its equity ownership in PMET and retained royalties.

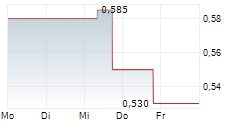

Under the Agreement, PMET will acquire a 100% interest in the Property by issuing 420,958 shares each to Azimut and SOQUEM (the "Share Consideration"), representing a total consideration of $3.1 million based on the 20-day volume weighted average price of PMET's common shares (the "20-day VWAP") on the Toronto Stock Exchange (the "TSX"). In addition, Azimut and SOQUEM will each retain a 1.0% NSR royalty on the Property. For a 24-month period, the Share Consideration will be subject to resale restrictions, whereby 65% of the Share Consideration may only be sold if the 20-day VWAP exceeds $5, $10, and $12, with 1/3 of these shares released at each milestone.

The Pikwa Property (509 claims, 261 km2) covers part of the same greenstone belt hosting the Shaakichiuwaanaan lithium project, and lies directly on strike with the major lithium pegmatite trend identified on that project. Azimut and SOQUEM's exploration work on Pikwa has confirmed the presence of spodumene in pegmatite outcrops and spodumene crystals in till samples. This supports the potential of the Shaakichiuwaanaan trend to extend onto Pikwa.

The parties were dealing at arm's length. The Agreement is subject to customary closing conditions for a transaction of this nature, including obtaining approval of the TSX.

Dr. Jean-Marc Lulin (P.Geo.), Azimut's President and CEO, prepared this press release and approved the scientific and technical information disclosed herein. He is acting as the Company's qualified person within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Amendments to the Azimut Stock Option Plan

The Board of Directors has approved amendments to the Company's stock option plan (the "Option Plan") in accordance with the provisions of Policy 4.4 of the TSX Venture Exchange. Azimut has increased the number of common shares reserved for future issuance under the Option Plan by 1,862,000 for a total of 10,052,000, representing approximately 9.99% of the 100,629,310 issued and outstanding common shares of the Company as of November 11, 2025. The amendement is subject to the approval of the TSX Venture Exchange.

About SOQUEM

SOQUEM, a mineral exploration company and a subsidiary of Investissement Québec, is dedicated to exploring, discovering and developing mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec's mineral wealth, SOQUEM relies on innovation, research, and strategic minerals to guide its future actions.

About Azimut

Azimut is a leading mineral exploration company with a solid reputation for target generation and partnership development. The Company holds the largest mineral exploration portfolio in Quebec, controlling strategic land positions for gold, copper, nickel and lithium. Azimut is concurrently advancing several high-potential projects:

- Wabamisk (100% Azimut) - Fortin Zone (antimony-gold): results for 7 holes are pending and will be reported as soon as they are received; Rosa Zone (gold): drilling in progress.

- Elmer (100% Azimut) - Patwon gold deposit at the resource stage (311,200 oz Indicated and 513,900 oz Inferredi); internal scoping study in progress; field assessment of the K2 claim block.

- Wabamisk East (Rio Tinto option) - Lithos North & South (lithium): comprehensive field evaluation underway to prepare for drilling phase.

- Kukamas (KGHM option) - Perseus Zone (nickel-copper-PGE): drilling phase completed; assay results are pending and will be reported as soon as they are received.

The Company also holds an important position in an emerging lithium district with its Galinée discovery, a joint venture project with SOQUEM.

Azimut uses a pioneering approach to big data analytics (the proprietary AZtechMine expert system), enhanced by extensive exploration know-how. The Company's competitive edge is based on systematic regional-scale data analysis. Azimut maintains rigorous financial discipline and a strong balance sheet.

Azimut has two strategic investors among its shareholders, Agnico Eagle Mines Limited and Centerra Gold Inc., which hold approximately 11% and 9.9%, respectively, of the Company's issued and outstanding shares.

Contact and Information

Jean-Marc Lulin, President and CEO

Tel.: (450) 646-3015 - Fax: (450) 646-3045

Jonathan Rosset, Vice President Corporate Development

Tel.: (604) 202-7531

info@azimut-exploration.comwww.azimut-exploration.com

Cautionary note regarding forward-looking statements

This press release contains forward-looking statements, which reflect the Company's current expectations regarding future events related to the Pikwa Property. To the extent that any statements in this press release contain information that is not historical, the statements are essentially forward-looking and are often identified by words such as "consider", "anticipate", "expect", "estimate", "intend", "project", "plan", "potential", "suggest" and "believe". The forward-looking statements involve risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Many factors could cause such differences, particularly volatility and sensitivity to market metal prices, the impact of changes in foreign currency exchange rates and interest rates, imprecision in reserve estimates, recoveries of gold and other metals, environmental risks including increased regulatory burdens, unexpected geological conditions, adverse mining conditions, community and non-governmental organization actions, changes in government regulations and policies, including laws and policies, global outbreaks of infectious diseases, including COVID-19, and failure to obtain necessary permits and approvals from government authorities, as well as other development and operating risks. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this document. The Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, other than as required to do so by applicable securities laws. The reader is directed to carefully review the detailed risk discussion in our most recent Annual Report filed on SEDAR+ for a fuller understanding of the risks and uncertainties that affect the Company's business.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

i Technical Report and Initial Mineral Resource Estimate for the Patwon Deposit, Elmer Property, Québec, Canada, prepared by Martin Perron, P.Eng., Chafana Hamed Sako, P.Geo., Vincent Nadeau-Benoit, P.Geo. and Simon Boudreau, P.Eng. of InnovExplo Inc., dated January 4, 2024. The initial MRE comprises Indicated resources of 311,200 ounces in 4.99 million tonnes grading 1.93 g/t Au and Inferred resources of 513,900 ounces in 8.22 million tonnes grading 1.94 g/t Au.