Worldwide Healthcare Trust PLC - Half-year Financial Report

PR Newswire

LONDON, United Kingdom, November 13

LONDON STOCK EXCHANGE ANNOUNCEMENT

Worldwide Healthcare Trust PLC

Unaudited Half Year Results for the six months ended

30 September 2025

This Announcement is not the Company's Half Year Report & Accounts. It is an abridged version of the Company's full Half Year Report & Accounts for the six months ended 30 September 2025. The full Half Year Report & Accounts, together with a copy of this announcement, will also shortly be available on the Company's website: www.worldwidewh.comwhere up to date information on the Company, including daily NAV, share prices and fact sheets, can also be found.

The Company's Half Year Report & Accounts for the six months ended 30 September 2025 has been submitted to the UK Listing Authority, and will shortly be available for inspection on the National Storage Mechanism (NSM): https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information please contact: Mark Pope, Frostrow Capital LLP 0203 008 4913.

Performance

Six months to | One year to | |

30 September | 31 March | |

2025 | 2025 | |

Net asset value per share (total return)* # | +5.0% | -10.3% |

Share price (total return)* # | +10.9% | -10.5% |

Benchmark (total return)^ # | -5.3% | -3.2% |

30 September | 31 March | Six months | |

2025 | 2025 | change | |

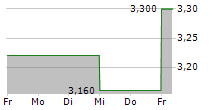

Net asset value per share | 354.4p | 339.5p | +4.4% |

Share price | 328.0p | 297.5p | +10.3% |

Discount of share price to the net asset value per share | (7.4)% | (12.4)% | |

Leverage 1 | 16.4% | 12.0% | |

Ongoing charges* | 0.9% | 0.8% | |

Ongoing charges (including performance fees crystallised during the period)* | 0.9% | 0.8% |

# Source - Morningstar.

^ Benchmark - MSCI World Health Care Index on a net total return, sterling adjusted basis (see Glossary).

* Alternative Performance Measure (See Glossary).

1 Leverage calculated under the Commitment Method (see Glossary).

Investing in the Future of Medicine: Worldwide Healthcare Trust PLC ("WWH") Targets Innovation in all Areas of Healthcare

INVESTMENT PROPOSITION

Ageing populations, rising global healthcare demand and accelerating scientific discovery, are all fuelling innovation and long-term growth in the healthcare sector. Furthermore, AI is having a significant impact on accelerating scientific discovery.

WWH is an LSE-listed investment company that was founded in 1995, (with a £16m IPO), to offer UK investors a 'one-stop shop' to gain exposure to the most innovative, fastest-growing healthcare companies in the world. Some of these companies are at the forefront of innovation in immunology, gene therapy, surgical robotics and diagnostics, as well as therapeutic areas such as cancer, cardiovascular and neurodegenerative diseases. Many of these companies generate billions in annual revenues, others are still small and going through the trial stages prior to regulatory approval. All of them strive to enhance human lives.

WWH PORTFOLIO MANAGER

The WWH portfolio has been managed since launch by OrbiMed Advisors LLP, the world's largest, specialist, healthcare fund manager, with over U.S.$19bn AUM and over 150 employees. OrbiMed is based in New York and has six other offices around the world.

WWH invests globally in a diversified portfolio of growing, innovative healthcare companies, across various sub-sectors. The OrbiMed team seeks innovative, growth companies to build a differentiated portfolio with a high active share, meaning that the portfolio looks very different to the global healthcare index, the MSCI World Health Care Index (net total return sterling adjusted). The team has analysts that cover all the sub-sectors and they understand the science and the likely economic prospects of portfolio companies and their rivals. They have the agility to respond quickly to changes within companies and sub-sectors, as well as to changes in the macroeconomic and political environments.

The portfolio is diversified by subsector and company size and one of the largest holdings is a biotech M&A swap basket, which is a derivative product constructed and managed by OrbiMed, consisting of around 50 biotech companies that they believe are the most likely to be acquired.

In addition, the search for innovation results in a geographical bias to countries where the most innovation takes place. This is mainly in North America and to a lesser extent Europe, and unlike the index, to emerging markets, in particular, China.

WWH PERFORMANCE

WWH has performed strongly since launch in 1995, generating a NAV total return of +13.4% p.a., compared to the index return of +10.9% p.a., as at 30 September 2025.

The healthcare sector is well placed to continue to grow strongly, based on supportive demographic trends and accelerating innovation. WWH is positioned to take advantage of these opportunities, and appealing current valuations, to offer attractive investment returns over the long run.

Statement from the Chair

"During the first half of the financial year, the Company's net asset value per share total return was +5.0% and the share price total return was +10.9%. Both significantly outperformed the Benchmark over the period."

PERFORMANCE

During the six-month period, global markets were shaped by a mix of economic and geopolitical factors. Early on, investors were concerned about aggressive U.S. tariff announcements, which triggered a sell-off of stocks worldwide and ignited global recession fears. However, a market rebound then followed, driven by strong corporate earnings, increased expectations for artificial intelligence (AI) technologies and an interest rate cut by the U.S. Federal Reserve.

In this context, Healthcare stocks significantly underperformed relative to the broader market during the period. The MSCI World Healthcare Index, measured on a net total return, sterling adjusted basis (the Company's Benchmark), fell by 5.3% compared to the MSCI World Index, which rose by almost 15%. The principal reasons for the sector's underperformance included President Trump's push to lower drug prices, which would decrease pharmaceutical profit margins, and potential trade tariffs targeted at healthcare products. Also, as markets recovered, there was a rotation by investors out of traditionally defensive sectors like pharmaceuticals into higher-growth areas such as technology and AI, which led to net outflows from healthcare-focused ETFs and exacerbated the sector's decline.

Despite the decline of the sector during the period, I am pleased to report that the Company's net asset value (NAV) per share total return was +5.0%, significantly outperforming the Benchmark by 10.3%. The NAV performance was achieved despite the headwind of sterling strengthening against the U.S. dollar by 4.3%, the U.S. dollar being the currency in which the majority of the Company's investments are denominated.

At +10.9%, the Company's share price total return was greater than its NAV per share total return, reflecting a narrowing of the discount of the Company's share price to its NAV per share from 12.4% at the beginning of the half year to 7.4% at the end.

The portfolio's proprietary swap basket of biotech companies that might be acquired and our exposure to Emerging Markets each made material positive contributions to performance during the period. Looking at specific names in the portfolio, the top two contributions came from Chinese pharmaceutical company JiangsuHengrui Pharmaceutical and U.S. Biotechnology company Alnylam Pharmaceuticals. Meanwhile, the two principal detractors from performance were the U.S. Pharmaceutical company Vertex Pharmaceuticalsand U.S. medical technology company Boston Scientific.

One significant event during the period was the successful Initial Public Offering in June of Caris Life Sciences, a U.S. precision medicine company that specialises in molecular profiling and AI-driven cancer diagnostics to guide personalised treatment decisions. At the time, Caris was the largest unquoted position in the portfolio. Since the offering, the company's share price has appreciated by more than 40% in the public markets.

The Caris IPO was a key driver of a reduction in our exposure to unquoted companies. In addition, no new unquoted investments were made during the period and the overall value of our public investments increased. Overall, unquoted companies comprised 4.5% of the total portfolio at the half year end compared to 6.3% at the beginning of the period.

Further information on the Company's investments and performance, including our unquoted holdings, can be found in the Portfolio Manager's Review.

As you will be aware, our Portfolio Manager uses modest leverage in the portfolio, which adds to performance in periods of rising portfolio share prices and benefits the Company over time. On average, leverage was 14.5% during the period, adding +0.6% to performance. As at the half year-end, leverage stood at 16.4%, compared to 10.8% at the beginning.

PERFORMANCE FEE

No performance fee was accrued as at 30 September 2025 and no performance fee can become payable within the next year. The performance fee arrangements are described in detail in the Company's Annual Report.

CAPITAL

Share price discounts continue to persist across the U.K. investment company sector. As at the period end, the average level of share price discount to NAV in the sector stood at 13.9%. (source: Winterflood Investment Trusts).

The Board's policy remains to buy back our shares if the Company's share price discount to the NAV per share exceeds 6% on an ongoing basis. Despite the Company's share buybacks, the discount can remain greater than 6% for extended periods of time, depending on overall sentiment towards the Company, the sector and investment trusts generally. Nonetheless, buybacks enhance the NAV per share for remaining shareholders. In addition, the Board believes that regular buybacks help to narrow the discount and go some way to dampening discount volatility.

During the period under review, the Company repurchased a total of 87,115,980 shares for treasury at a cost of £273.8m and at an average discount of 7.0%. At the period end, there were 407,515,824 shares in issue (excluding the 194,149,376 shares held in treasury). From the period end to 11 November 2025, a further 16,363,770 shares have been bought back for treasury, at a cost of £58.1m and at an average discount of 7.1%.

Further reflecting the Company's commitment to its discount control policy, the Company held a General Meeting in October 2025 to renew shareholder authority to buy-back shares when it became clear that the shareholder authority to buy-back 14.99% of the Company's share capital granted at the Annual General Meeting held in July 2025 would be exhausted before the expected date of the 2026 Annual General Meeting. The Company's share buy-back authority will, as usual, be proposed for renewal at the Company's Annual General Meeting to be held in on Tuesday,14 July 2026.

DIVIDENDS

The Board has declared an unchanged interim dividend of 0.7p per share, for the year to 31 March 2026. It will be payable on 9 January 2026 to shareholders on the register of members on 28 November 2025. The associated ex-dividend date is 27 November 2025. The portfolio's exposure to larger, dividend-paying companies declined during the period. In the absence of any material change, it is expected that the final dividend for the year will be lower than that paid last year.

I remind shareholders that it remains the Company's policy to pay out dividends at least to the extent required to maintain investment trust status. These dividend payments are paid out of the Company's net revenue for the year and, in accordance with investment trust rules, a maximum of 15% of income can be retained by the Company in any financial year.

It is the Board's continuing belief that it is in shareholders' best interests to see the Company's capital deployed in its investment portfolio rather than paid out as dividends to achieve a particular target yield.

COMPOSITION OF THE BOARD

The renewal of the Board that I committed to oversee when I took on the role of Board Chair is now largely complete, following the additions last year of our newest Directors, Sian Hansen and William Hemmings. As such, I will be retiring from the Board at the conclusion of the 2026 Annual General Meeting in July. I am delighted to report that William Hemmings will succeed me at that time as Board Chair. I know that William will be a strong leader for the Board and the Company.

OUTLOOK

Your Board remains confident in the long-term prospects for investing in the global healthcare sector.

Our Portfolio Manager believes that long-term growth will be underpinned by strong innovation and demographic tailwinds. Nearer-term, it is also expected that additional policy clarity in the U.S. and continuing high levels of merger and acquisition activity, will be important investment drivers.

In the context of the Healthcare sector's dynamics, your Board believes that our Portfolio Manager will continue to generate attractive returns over time, through astute stock picking as well as through its ability to allocate capital nimbly and effectively across the different subsectors and geographies.

Doug McCutcheon

Board Chair

12 November 2025

Portfolio

AS AT 30 SEPTEMBER 2025

Market value | % of | |||

Investments | Sector | Country/region | £'000 | investments |

Eli Lilly | Pharmaceuticals | United States | 150,124 | 10.3 |

Boston Scientific | Health Care Equipment & Supplies | United States | 140,812 | 9.7 |

AstraZeneca | Pharmaceuticals | Britain | 110,190 | 7.6 |

Stryker | Health Care Equipment & Supplies | United States | 81,822 | 5.6 |

Edwards Lifesciences | Health Care Equipment & Supplies | United States | 79,373 | 5.4 |

Intuitive Surgical | Health Care Equipment & Supplies | United States | 77,794 | 5.3 |

Argenx | Biotechnology | Netherlands | 63,055 | 4.3 |

Alnylam Pharmaceuticals | Biotechnology | United States | 60,586 | 4.2 |

Caris Life Sciences | Life Sciences Tools & Services | United States | 44,653 | 3.1 |

Daiichi Sankyo | Pharmaceuticals | Japan | 40,384 | 2.8 |

Top 10 investments | 848,793 | 58.2 | ||

Natera | Life Sciences Tools & Services | United States | 35,970 | 2.5 |

Danaher | Life Sciences Tools & Services | United States | 34,225 | 2.4 |

Cigna Group | Health Care Providers & Services | United States | 29,684 | 2.0 |

Sino Biopharmaceutical | Pharmaceuticals | Hong Kong | 29,142 | 2.0 |

Axsome Therapeutics | Biotechnology | United States | 26,162 | 1.8 |

Apellis Pharmaceuticals | Biotechnology | United States | 25,290 | 1.7 |

CG Oncology | Biotechnology | United States | 24,339 | 1.7 |

Akeso | Biotechnology | China | 24,265 | 1.7 |

Crossover Health* | Health Care Providers & Services | United States | 23,874 | 1.6 |

Avidity Biosciences | Biotechnology | United States | 22,650 | 1.6 |

Top 20 investments | 1,124,394 | 77.3 | ||

Neurocrine Biosciences | Biotechnology | United States | 22,617 | 1.6 |

Exact Sciences | Life Sciences Tools & Services | United States | 22,270 | 1.5 |

Shanghai International Medical Instruments | Health Care Equipment & Supplies | China | 22,148 | 1.5 |

UCB | Pharmaceuticals | Belgium | 20,511 | 1.4 |

United Therapeutics | Biotechnology | United States | 19,698 | 1.4 |

SI-BONE | Health Care Equipment & Supplies | United States | 19,135 | 1.3 |

Integer Holdings | Health Care Equipment & Supplies | United States | 18,424 | 1.3 |

Thermo Fisher Scientific | Life Sciences Tools & Services | United States | 16,737 | 1.1 |

Roivant Sciences | Biotechnology | United States | 12,815 | 0.9 |

Beijing Yuanxin Technology* | Health Care Providers & Services | China | 12,353 | 0.8 |

Top 30 investments | 1,311,102 | 90.1 | ||

Zai Lab | Biotechnology | China | 11,945 | 0.8 |

Ruipeng Pet Group* | Health Care Providers & Services | China | 10,587 | 0.7 |

Ascendis Pharma | Biotechnology | Denmark | 10,557 | 0.7 |

Structure Therapeutics | Biotechnology | United States | 9,900 | 0.7 |

Hangzhou Tigermed Consulting | Life Sciences Tools & Services | China | 9,248 | 0.7 |

EDDA Healthcare & Technology* | Health Care Equipment & Supplies | China | 9,192 | 0.6 |

Carlsmed | Health Care Equipment & Supplies | United States | 8,472 | 0.6 |

Visen Pharmaceuticals | Biotechnology | China | 5,902 | 0.4 |

Jiangxi Rimag | Health Care Providers & Services | China | 5,322 | 0.4 |

API Holdings* | Health Care Providers & Services | India | 4,881 | 0.3 |

Top 40 investments | 1,397,108 | 96.0 | ||

MabPlex* | Health Care Providers & Services | China | 4,728 | 0.3 |

BrightSpring Health Services | Health Care Providers & Services | United States | 4,657 | 0.3 |

Gushengtang | Health Care Providers & Services | China | 4,081 | 0.3 |

CSPC Pharmaceutical | Pharmaceuticals | China | 4,075 | 0.3 |

ImageneBio | Pharmaceuticals | United States | 788 | 0.1 |

Peloton Therapeutics - Milestone* | Biotechnology | United States | 522 | 0.0 |

New Horizon Health^ | Life Sciences Tools & Services | China | - | - |

Total equities | 1,415,959 | 97.3 | ||

Biotech M&A Target Swap | Swap Baskets | United States | 162,978 | 11.2 |

Jiangsu Hengrui Pharmaceutical | Pharmaceuticals | China | 85,192 | 5.8 |

Apollo Hospitals Enterprise | Health Care Providers & Services | India | 16,486 | 1.1 |

Less: Gross exposure on financed swaps | (225,295) | (15.4) | ||

Total OTC Swaps |

|

| 39,361 | 2.7 |

Total investments including OTC Swaps |

|

| 1,455,320 | 100.0 |

* Unquoted holding

^ Suspended holding

SUMMARY

Market value | % of | |

Investments | £'000 | investments |

Listed Equities | 1,349,822 | 93.0 |

Unquoted Equities | 66,137 | 4.3 |

Equity Swaps | 39,361 | 2.7 |

Total of all investments | 1,455,320 | 100.0 |

Portfolio Manager's Review

MARKETS

The global equity markets for the six-month period ended 30 September 2025 were shaped by a variety of factors, beginning with the administration of U.S. President Donald Trump. The start of April 2025 saw significant volatility triggered by "Liberation Day" tariffs, which caused sharp drops in market indices. After that early turbulence, the market staged a sustained recovery through the rest of the period with positive momentum. In fact, each month saw new all-time highs recorded for the MSCI World Index and the S&P 500, respectively. The overall six - month run was generally a bullish period for equity markets, driven by the U.S. Federal Reserve's decision to cut interest rates, solid corporate earnings, and a resumption of the Technology rally post the April sell off, eschewing concerns on tariffs, unemployment, GDP growth, and inflation.

Conversely, healthcare stocks materially underperformed during the half year. More specifically, our Benchmark, the MSCI World Health Care Index, underperformed the MSCI World Index by approximately 20% (sterling; total return). A confluence of headwinds has weighed on healthcare stocks over the past six months, but the largest has been the Trump administration's highly threatening tariff and drug pricing policy initiatives. These issues, particularly the perceived threat of a calamitous change to federal drug pricing rules, have kept investors away from healthcare, especially given the broader stock market rally.

ALLOCATION

The Company's long-standing allocation strategy remained unchanged in the first half of the financial year. Overall, our allocation strategy represents a diverse distribution of investments across all the major subsectors and primary geographies. However, our prioritisation of innovation and growth as key pillars of our investment strategy impacts our allocation across the Benchmark sectors.

For example, allocation to Pharmaceuticals (ex-Japan) remained underweight, owing to (1) disparate fundamentals across the group, (2) the relatively large weight that is represented within the Benchmark, and (3) the persistent overhang of potential U.S. healthcare policy initiatives. As of 30 September 2025, total investments were 20.3% of NAV. Allocation to Pharmaceuticals decreased during the period, from 22.2% to 25.7% below the Benchmark as we actively reduced exposure to the subsector.

Additionally, allocation to Biotechnology remained above the collective Benchmark weighting, owing to (1) our bullishness around the enormous therapeutic innovation and new drug production that stems from Emerging Biotech companies and (2) the relatively small weight that is represented in the Benchmark. As of 30 September 2025, the total investment in Biotechnology was 30.8% or 21.6% above the Benchmark, an increase of relative exposure 1.3% since the beginning of the financial year.

As of 30 September 2025 | |||

Subsector | WWH % NAV | MSCI World HC % | Difference % |

Pharmaceuticals | 20.3 | 46.0 | (25.7) |

Big Pharma | 18.4 | 41.2 | (22.8) |

Spec Pharma/Generics | 1.9 | 4.8 | (2.9) |

Biotechnology | 30.8 | 9.2 | +21.6 |

Big Biotech | 0.0 | 6.4 | (6.4) |

Emerging Biotech | 30.8 | 2.8 | +28.0 |

Life Science Tools | 10.6 | 8.6 | +2.0 |

Medical Technology | 29.8 | 18.7 | +11.1 |

Healthcare Services | 2.8 | 13.7 | (10.9) |

Japan | 2.8 | 3.8 | (1.0) |

Emerging Markets | 14.7 | 0.0 | +14.7 |

Privates | 4.6 | 0.0 | +4.6 |

Total | 116.4 | 100.0 | +16.4 |

Figures expressed as a % of total Net Asset Value. This includes all derivatives as an economically equivalent position in the underlying holding and allocated to the underlying holding's respective Sector and Region.

Another highly innovative sector is Emerging Markets. Specifically, Chinese Biotechnology stocks which were a healthcare "hot bed" in 2025. Notably, this sector is not represented in the Benchmark. Our investments in Emerging Markets reached 14.7% of NAV, up from 8.4% at the start of the period. Share price appreciation and incremental purchases increased the exposure here.

In non-therapeutics, our exposure to the Life Science Tools sector turned bullish during the period, causing us to move from an underweight to an overweight position relative to the Benchmark. Additional investments in the liquid biopsy industry given robust tailwinds for these companies, in addition to positive portfolio attribution, increased our exposure. Conversely, our exposure to Healthcare Services remained bearish, increasing our underweight positioning to a position 10.9% below the Benchmark weighting. Exposure here declined due to a reduction in our managed care and hospital investments given ongoing policy risks and macro pressures, as well as negative attribution. Finally, Medical Technology exposure remained mostly constant, bullishly above the Benchmark, as strong fundamentals, outsized growth, and low policy risk support our positive investment view going forward.

PERFORMANCE

For the six-month period ended 30 September 2025, we are pleased to report both positive absolute and relative performance. Despite negative returns for global healthcare stocks in the period, the Company's total return was +5.0%, representing an excess return of 10.3% versus the Benchmark, MSCI World Health Care Index. This excess return represents the Company's best first half in 20 years and represents the best six-month period in the past 10 years.

Overall, the allocation effect was a key driver of outperformance, with positive returns enhanced by stock picking. Despite ongoing volatility within the Healthcare sector over the past four-plus years, the Company has persisted with its long-term recipe for success, namely overweighting the most highly innovative sectors, like Biotechnology and Emerging Markets, and overweighting secular growth sectors like Medical Technology. This is typically at the expense of Pharmaceuticals, a heterogeneous sector of companies at different ends of the innovation spectrum at any given time.

Whilst this strategy can be tested at times of broad market duress, when Healthcare turns defensive, the first half market environment was clearly "risk on." Lowered interest rates and economic resilience despite policy uncertainty and some geopolitical risk created a market environment favourable to the Company's ongoing allocation strategy. Clear outperformance was measured in China Healthcare stocks (the HSHCI) and Biotechnology stocks (the XBI) whilst Pharmaceuticals (the DRG) was negative, largely in line with the Benchmark.

Performance since inception to 30 September 2025 remains strong, with a +4,471% return since April 1995. This represents an average annualised return of 13.4% over the 30-plus year period. This ranks the Company in second place among all closed end trusts (>£250m) across this period, regardless of industry (source: Winterflood). These figures also show a clear outperformance of the (blended) Benchmark over this period and over the FTSE 100 index as well.

SUB-SECTOR CONTRIBUTION

During the period, outsized excess returns came primarily from three subsectors: Biotechnology, Emerging Markets, and Life Science Tools. The primary offset of import was Medical Technology.

In Biotechnology, the Company's total return was +6.4% versus -0.3% for the Benchmark for an excess return of +6.7%. This return includes +3.9% from individual equity investments and an additional +2.8% from our proprietary swap basket of mergers & acquisitions ("M&A") targeted securities (totalling 60 hand-selected stocks as of 30 September 2025). The combination of stock selection and allocation effect drove performance. A variety of tailwinds also contributed, including a multitude of clinical and commercial catalysts, an inflection in the pace of biotech M&A beginning in March, an interest rate cut, and further expected interest rate cuts.

In Emerging Markets, the Company's total return was +3.7%, virtually all represented by China Healthcare stocks. With the Benchmark devoid of this sub-sector, 100% of this contribution was excess return. After years of macro - factors obfuscating the innovation coming from China, the first half was largely clear of this obstacle. Moreover, a number of western companies doing a plethora of licensing deals with Chinese biotechnology companies triggered an overdue re-rating for the sector. Stock selection enhanced returns as well, including two investments that represented two of the top five contributors in the period, Jiangsu HengruiPharmaceutical and Sino Biopharmaceutical.

In Life Science Tools, the Company's total return was +1.2%, versus -0.2% for the Benchmark for an excess return of +1.4%. The majority return here came from a single investment, specifically the successful initial public offering ("IPO") of the diagnostics company, Caris Life Sciences.

In Medical Technology, the Company's total return was -2.1%, versus -0.4% for the Benchmark representing underperformance of -1.7%. Here a small allocation impact was exacerbated with stock picking as two of our larger holdings - Boston Scientificand Intuitive Surgical- were both included in the top five individual detractors in the first half.

PRIVATE HOLDINGS

During the half year period ended 30 September 2025, the Company strategically refrained from making new investments in unquoted companies. While we have seen significant improvement in the capital markets for small and mid-cap Healthcare companies, we have remained on the sidelines with respect to new unquoted investments. Most of our unquoted companies remain well capitalised and continue to be selective with regards to pursuing listings. We are confident that more of the Company's unquoted investments will achieve listings within the next year as the capital market funding environment further improves.

Caris Life Sciences, a precision medicine company that specialises in molecular profiling and AI-driven cancer diagnostics to guide personalized treatment decisions, completed its IPO in June. Caris was our largest unquoted position, and since the offering, the stock has appreciated more than 40% in the public markets.

At the end of the six-month period, unquoted investments made up 4.3% of the portfolio as compared to 6.1% at the end of the last financial year. For the six months ended 30 September 2025, the Company's unquoted investments fell £7.7 million, from an opening market value of £106.8 million across nine companies.

The existing unquoted portfolio constitutes a diverse set of companies. Geographically, exposure is evenly distributed among Emerging Markets and North American companies. On a subsector basis, the exposure is concentrated in Services, with small exposures to Biotechnology and Medical Technology.

MAJOR CONTRIBUTORS TO PERFORMANCE

The top contributor in the six-month period was the Company's proprietary swap basket of M&A targeted securities. The basket returned +24.9% in the first half, outperforming both the XBI (+15.9%) and the Biotechnology portion of the Benchmark (-2.9%). This outperformance was driven by a concerted effort to populate the basket with Emerging and Commercial stage biotechnology companies, selected through a variety of factors. We use an ongoing screening process including but not limited to the examination of (1) therapeutic area, (2) clinical innovation, (3) management teams that are willing sellers, and (4) capital situation. Further discussion of the basket performance is contained below (see Derivative Strategy).

On an individual security basis, the largest contributor in the first half was Jiangsu Hengrui Pharmaceutical, a China-based, blue-chip, biotechnology company with the largest, best-in-class clinical pipeline in all of China. Share price appreciation came from a combination of reversion-to-the-mean and a renewed appreciation of the company's innovative pipeline. Licensing deals now account for over half of the company's revenue in the domestic market, and out-licensing deals with western companies also beat expectations. The strong pipeline with over 130 products in the clinical development stage serves Jiangsu HengruiPharmaceutical as a business development "supermarket" for multinational corporations.

Alnylam Pharmaceuticals is a commercial stage Biotechnology company that specialises in developing RNA interference (RNAi) therapeutics. These innovative medicines work by "silencing" the genes that cause or contribute to disease. The company enjoyed the landmark approval of first-in-class siRNA therapy AMVUTTRA (vutrisiran) in ATTR-cardiomyopathy - a rare, progressive form of heart disease caused by the accumulation of abnormal proteins called amyloid fibrils in the heart muscle - on 20 March 2025. Since the launch of AMVUTTRA, the company's share price has outperformed the broader biotech sector following the stronger than expected sales trajectory reported by the company. Long-term sales estimates now exceed U.S.$10 billion. The company is on track to achieve profitability by the end of calendar 2025 and continues to build on its rapidly expanding pipeline from its industry leading siRNA platform across targets and tissue types.

Another Chinese biotechnology company that is an emerging leader in novel research and development is Sino Biopharmaceutical. The company has evolved from a traditional generic drug company to a truly innovative biopharmaceutical player. Since 2024, revenue and profit growth have inflected. In addition, Sino Biopharmaceutical has been active on both acquisition of innovative assets and out-licensing innovative products to western pharmaceutical companies. Similar to Jiangsu Hengrui Pharmaceutical, the company's growth is coming from a recovery in earnings in the domestic market whilst out-licensing and business development deals have been key catalysts for share price outperformance.

A long-term pioneer in immunology and neuroscience, Belgium-based UCBhas emerged as a true leader in these fields after the approval and launch of BIMZELX (bimekizumab) for plaque psoriasis late in 2023. A better than expected launch triggered a share price re-rating in 2024. In late 2024, however, the company received a second approval for BIMZELX, for severe hidradenitis suppurativa (HS), a chronic, painful and potentially debilitating inflammatory skin disease. We were opportunistic in buying the stock when tariff-related concerns disrupted the share price. The share price subsequently recovered and then materially inflected at the end of the first half after a competitor's pipeline asset in HS failed to show a meaningful differentiated benefit.

Caris Life Sciences is a cutting-edge precision medicine company that uses advanced molecular profiling and artificial intelligence to guide personalised cancer treatment and drug development. The stock nearly doubled in the two months after a successful IPO in June 2025 given investor optimism around volume and pricing in their core tissue therapy business. This was affirmed after the company reported better than expected financials in the second quarter, with profit and cash flows beating analyst estimates. The stock did moderate in September, however, given the higher bar for a third quarter beat and some rotation out of diagnostics. We remain enthusiastic about the company's growth profile and pipeline opportunities which we believe are not fully reflected in the valuation.

MAJOR DETRACTORS TO PERFORMANCE

UnitedHealth Group is a global healthcare company that provides a wide range of healthcare services, primarily health insurance, pharmacy care, and data analytics. Several factors weighed on the share price in the first half, with the stock correcting 60% (local currency) from its April 2025 high to a July 2025 low. Whilst the company's earnings were challenged by rising medical costs that ailed all health insurers, idiosyncratic issues amplified earnings pressure, undermined sentiment, and hurt management credibility. Most notably, changes in Medicare reimbursement put earnings quality and durability into question, spurring the departure of both the CEO and CFO. Despite the losses, we exited the position given a valuation that still does not fully discount these issues and the potential for sustained headline risk.

The market focus on obesity inflected in 2024 and has not subsided in 2025 and Eli Lillyis the victim of such intense scrutiny. The commercial success of tirzepatide, the company's dual combination of "GLP + GIP", is undeniable. The formulations of tirzepatide in MOUNJARO (for diabetes) and ZEPBOUND (for obesity) have smashed pharmaceutical sales records, eclipsing U.S.$30 billion in combined global sales in 2025, in just over three years on the market. As the company attempts to prolong these fortunes, successful encores are a must. One commercial area up for grabs is orals: attempting to harness the power of these injectable medicines into an easy to make, easy to take oral pill. The company presented the first Phase III obesity data for its leading oral candidate - orfoglipron - in August 2025. The headline data for ATTAIN-1 (in over 3,000 obese patients) was impressive with average weight loss of 27 lbs and -12.4% of body weight. However, the investment community was expecting -13% to -15% weight loss. Despite reporting a strong quarterly result on the same day (sales growth +38%, EPS growth +61%, and raised guidance), the stock fell, beyond -15% (local currency). We remain bullish on the long-term success of these medications for the treatment and prevention of a variety of cardiovascular and metabolic diseases.

Intuitive Surgical is the global leader in the surgical robotics industry and is currently in the rollout of its fifth-generation robotic system, named "Davinci V". Despite positive commercial tailwinds and ongoing strong financial results, investors have become increasingly concerned about two key topics: (1) U.S. hospital capital spending and (2) emerging instrument competition. The Medicaid system in the U.S. has been under increased scrutiny in recent months. If Federal funding is cut, it could have a pronounced negative impact on hospital capital budgets. This could adversely impact vendors, such as Intuitive Surgical. Turning to competition, there are several competitor companies that have been attempting to refurbish and re-sell to hospitals the company's own consumable products (at a lower price). While these companies have been operating for several years with limited success, investors have only recently become aware of them and thus are perceived as a new threat. We remain confident in the company's ability to fend off competition, execute commercially in this environment, and to continue to innovate the future of robotic surgery for years to come.

Boston Scientific is one of the largest, most innovative Medical Technology companies in the world, operating in several end markets, including interventional cardiology, cardiac rhythm management, peripheral vascular, electrophysiology, urology, and gynecology. Last year, the company made one of the largest new medical technology product launches in years, the FARAPULSE Pulsed Field Ablation (PFA) - a non-thermal cardiac ablation system used to treat atrial fibrillation (AFib). The system delivers short, high-energy electrical pulses to selectively destroy abnormal heart tissue, while aiming to spare surrounding structures like the esophagus and phrenic nerve. A major step forward in treating AFib. Given the robust early success of the launch, investors grew concerned that growth would have to decelerate in the second half of calendar year. This began to pressure the share price. Moreover, shares in the company were also adversely impacted late in the review period due to an idiosyncratic sell-off in the space, exacerbated by a rotation into technology stocks. We remain convinced about the long-term growth prospects for BostonScientific. In fact, on the last day of the reported period, the company raised long-term revenue guidance during a company hosted analyst meeting, striking a positive tone for the future.

Boston-based Vertex Pharmaceuticalsis a leading, commercial-stage Biotechnology company with a focus on therapeutic categories like cystic fibrosis, cardiovascular, metabolic, and pain. The share price fell due to negative updates for its pain franchise. First, the company announced the Phase II failure of its next-generation acute pain treatment, VX-993, an experimental drug designed to treat pain by blocking specific sodium channels in the peripheral nervous system. Subsequently, the U.S. Food and Drug Administration ("FDA") informed the company that it would not approve a new, broad label for JOURNAVX (suzetragine), the company's first-generation product already on the market. Given the now stunted prospects for the company's pain franchise and the saturated growth for their innovative cystic fibrosis franchise, we exited the stock.

DERIVATIVE STRATEGY

The Company has the ability to utilise equity swaps and options as part of its financial strategy. Equity swaps are a financial tool (a derivative contract) that allow for synthetic exposure to a single stock (Single Stock Equity Swaps) or a basket of single stocks (Equity Basket Swaps).

Equity basket swaps are typically constructed within a well-defined theme and basket facilitates management of the investment theme and tracking of performance. For example, having 15 to 50+ additional positions at smaller weights in the portfolio (i.e., non-core) is suboptimal. The equity basket swap contains multiple single stock long positions, and the basket swap counterparty is Goldman Sachs, allowing for confidence in forward trading and rebalancing strategies.

The Company strategically invested in one customised tactical basket swap, targeting growth opportunities in undervalued small and mid-capitalisation Biotechnology, Pharmaceutical and Medtech companies. This basket was constructed to capitalise on investment opportunities possessing considerable potential as attractive acquisition targets for larger corporations (M&A swap basket). During the period under review, the equity basket swap gained £42.5 million, representing a +2.8% return for the Company and accounting for c.55% of the Company's total return for the six-month period.

LEVERAGE STRATEGY

Historically, the typical leverage level employed by the Company has been in the low-double digits to mid-to-high teens range. Considering the market volatility during the past four plus financial years, we have, more recently, used leverage in a more tactical fashion.

In 2025, we have flexed leverage more notably than in some recent periods, going as low as 9% (coming out of President Trump's "Liberation Day" tariff announcements, which created some market tumult and uncertainty) and as high as 20% (as performance inflected and our bullishness for a sustained move in Biotechnology and Emerging Markets increased).

The Company ended the period at 16%, underscoring our continued bullishness but with a nod to the possibility of further policy uncertainty, debate over another interest rate cut, and perhaps unforeseen geopolitical instability.

SECTOR DEVELOPMENTS

A recurring theme throughout 2025 has been the omnipresence of the Trump Administration and the rippling impact of his policy announcements and commentary, both formally (such as Executive Orders) and informally (such as social media). However, despite the routine rhetoric, there has yet to be any policy that has been objectively calamitous for the healthcare industry. Whilst there has been a range of both positives and negatives, given the low expectations, we think the net effect this far is largely neutral on industry fundamentals. That said, this ongoing uncertainty around new policy initiatives has been the primary reason for Healthcare underperformance in the first half.

In Healthcare, the two key overhangs weighing on therapeutic stocks have been U.S. drug pricing and pharmaceutical tariffs. Whilst these appeared to be separate issues early on in this administration, we believe these two issues are connected, again with President Trump making threats to ultimately achieve his policy goals. It is our view that there will be no "250% tariff" on pharmaceuticals (President Trump on 5 August 2025) or perhaps any tariffs at all. Moreover, we don't believe there will be (or can be, legally) unilateral lowering of "prescription drug prices by 80%" (President Trump on 12 May 2025).

What does President Trump want from the Biopharma industry? Some things are clear, including (1) re-shoring of drug manufacturing in the U.S., (2) ensure U.S. taxes are being paid by minimising manufacturing/IP loop holes, (3) address national security concerns given the absence of domestic antibiotic and vaccine manufacturing, (4) increase investment in U.S.-based R&D facilities, manufacturing, and employment, and (5) maintain the innovation lead over China, which has narrowed materially over the past two years. On the drug pricing front, we believe President Trump wants to alter the broad ecosystem of prescription drug pricing, such as (1) making developed countries "pay their fair share" for innovative drugs and raise drug prices ex-U.S., (2) lower list prices for cash-paying Americans, (3) lower out-of-pocket expenses for most impoverished Americans and seniors, and (4) tackle the issue of "middle men", the managed care providers who absorb 50-60% of the value of prescription medicines in the U.S.

Increased clarity on President Trump's tactics became clear on 30 September 2025, when an unexpected landmark agreement between the Trump Administration and Pfizer was announced. The deal rapidly closed much of the uncertainty around both tariffs and drug pricing in one sweeping package between the two sides. First, a new on - line website will be created, called "TrumpRx", where cash paying Americans will be able to fill their prescriptions at prices that will be up to 85% lower than current list prices, with an on average discount of 50%. This is a win for Pfizer (and ultimately the entire industry) as this level of discount (50% off list prices) is already what drug makers sell to Managed Care and PBMs in the commercial sales channel. In fact, we may see a dramatic increase in cash pay volumes given this new pricing scheme in what was otherwise a de minimis sales opportunity historically. And of course, this is a win for the administration as the prophecy of "lowering prescription drug prices by 80%" was not only achieved, but bettered.

Second, on tariffs, Pfizer received a complete stay on tariffs (for a minimum of three years) for accepting several specific deal terms, in addition to TrumpRx. This included a pledge to commit to U.S.$70 billion in U.S. manufacturing and R&D investments "over the next few years", building upon the U.S.$83 billion that Pfizer invested over the previous seven years. This is a clear win for Trump and mostly just "business as usual" for Pfizer from a capex perspective. We do note that over a dozen large cap pharmaceutical companies, such as Eli Lilly, GSK, and JNJ to name a few, have already publicly pledged U.S. investments across manufacturing and R&D, an amount totalling a staggering U.S.$432 billion over the next 3-10 years (source: company filings; Bloomberg).

Surprisingly, Pfizer also agreed to terms on a Most Favoured Nation (MFN) drug pricing scheme, one area that investors were most concerned. However, based on the details that were disclosed, the outcome appears to be rather benign for Pfizer. MFN pricing today will apply only to current Medicaid patients, where prices are already low, and represents only 2.5% of total company sales. We estimate that pricing compression here will result in <1% hit to Pfizer's topline, a completely manageable impact. A clear win for Pfizer. For President Trump, a double win: a key industry player agrees to MFN and a headline win of lowering out of pocket expenses for the poorest of Americans.

Finally, Pfizer agreed to MFN pricing to be applied to all NEW products going forward, across both Medicaid and Medicare channels. A blow to the industry? Hardly. Whilst most details have been kept confidential, what details we do know are suggestive of a benign outcome. Here, Pfizer will not be able to launch a new product ex-U.S. below the price in the U.S. The net effect of this will be that at the MFN price and the U.S. price will largely be the same, thereby avoiding any current or future pricing pressure in the U.S. This will also increase prices in foreign countries, a goal of President Trump. Applying this price scheme to only new products will prevent any immediate budgeting issues in foreign lands, rather, there will be a new 10 year runway for foreign payers to adjust budgets and redirect a proportion of GDP to drug spending, so that they "pay their fair share" for innovation going forward. Again, countries not electing to accept these new prices will forego lifesaving innovations and/or will be subject to (or at least threatened with) harsh tariffs.

On 10 October 2025, AstraZenecawas the second company to agree to similar terms with the U.S. government. Here agreed upon items were similar: (1) selling some select medicines on Trumps "at a discount of up to 80% off list prices", (2) investing U.S.$50 billion in manufacturing and R&D to support domestic sourcing, (3) MFN pricing scheme on current Medicaid products, (4) MFN pricing on all new products, and (5) delaying company-specific tariffs for three years.

Overall, we believe this deal sets a historic precedent, and other companies will be lining up to do something similar. The market reaction to the news was certainly historic with a two-day move of +10% for the DRG representing [a 5-standard deviation move]. The trickledown effect on Biotechnology stocks was also positive, with the XBI advancing its own +10% in a subsequent two-week move. Pfizer's CEO, Albert Bourla, commented as to why, "We now have the certainty and stability we need on two critical fronts, tariffs and pricing, that have suppressed the industry's valuations to historic lows."

The ongoing saga over U.S. drug pricing was not just a 2025 phenomenon. Rather, investor concern over putative drug pricing policy changes in the U.S. extends at least 10 years. A period which began September 2015 with an ominous Tweet by then-presidential hopeful, Senator Hillary Clinton, who said "Price gouging like this in the specialty drug market is outrageous. Tomorrow I'll lay out a plan to take it on" in reference to media headlines infamous drug developer (and later convicted criminal) Martin Skreli. This 10-year period coincides with a period in which the NASDAQ is up 4x, the S&P 500 up 3x, whilst the MSCI World Health Care Index is up <1x and the XBI is not up at all. We believe the "Wall of Worry" may be now over.

Elsewhere, as we survey the landscape of Trump appointees across the key Healthcare government positions, two are worth consideration here. First, Robert F. Kennedy Jr. as the Secretary of Health and Human Services has come mostly as advertised. His lack of conventional scientific credentials and history of controversial views has certainly marked his tenure and confirmed his reputation.

Kennedy's handling of the Advisory Committee on Immunisation Practices was highly questionable after he dismissed the entire expert panel and replaced them with many dubiously qualified candidates. His focus on neglected public health issues (prevention, nutrition, environment) is welcome and could lead to meaningful changes if executed with sound science and strong leadership. However, whilst he has emphasised combating chronic disease, his unclear policy direction and possible policy risks has raised questions about his leadership abilities and ability to execute on implementation.

Overall, tangible industry negatives from Kennedy's tenure are primarily around vaccines (public perception, accessibility, regulatory obstruction, valuation impact, reduced federal funding). His consistent criticisms of large-cap pharmaceutical companies have, at least, qualitatively impacted their image and perhaps created some small degree of uncertainty in the minds of generalist investors. Otherwise, his impact has otherwise been benign (so far) and the industry has not been uniformly harmed like vaccine players have.

Of far more substantial import has been the tenure of the new FDA Commissioner, Martin Makary. He officially took office on 1 April 2025 and we view his first six months as consistent and positive. His early emphasis was on transparency, "common sense" regulation, and restoring trust in the FDA has been welcome to investors. His desire to lean toward regulatory flexibility: e.g., streamlining reviews, moving away from overly burdensome regulation, using less animal testing, and giving more weight to diverse types of evidence has been surprisingly progressive. He has also spent time addressing agency culture and trying to do "less with more" given budgetary cuts he was forced to deal with.

Perhaps Dr. Makary's signature program thus far is the Commissioner's National Priority Voucher (CNPV) program, a pilot "voucher-style" initiative under which selected drug developers can receive a voucher that entitles them to a dramatically shortened review timeline for a new drug or biologic, from 10-12 months to as little as 1-2 months. The focus on selection includes all of the criteria that an investor may favour, such as (1) a health crisis in the U.S. like COVID-19, (2) tackling a large unmet public health need, and (3) a drug candidate that delivers innovative cures. Finally, of note, we have seen no evidence of a slowdown in new drug approvals with this current FDA commissioner. Whilst we expect a modest dip in approvals year-over-year in 2025, the current trend is very much consistent with the past eight years of approvals, the majority of which have been under a Trump Administration, which has overseen a >70% inflection in new drug approvals versus President Obama's two terms.

OUTLOOK

In summary, the first half of financial 2025 underscores the Company's ability to generate strong relative and absolute returns even in a challenging sector environment. While global Healthcare stocks broadly underperformed the wider equity markets, the Company delivered double - digit outperformance through disciplined allocation, a focus on innovation-driven subsectors, and successful stock selection. Long-term performance remains exceptional, with a cumulative return of over +4,400% since inception, demonstrating the enduring strength of the Company's strategy and execution.

Looking ahead, we maintain a constructive outlook for both the Healthcare sector and the portfolio. Innovation remains robust across Biotechnology, Medical Technology, and Emerging Markets, whilst policy clarity in the U.S. is beginning to lift a decade-long overhang. Against this backdrop, we believe the Company is well positioned to continue delivering sustainable long-term value and superior returns to shareholders utilising our long-term recipe for success.

Sven H. Borho and Trevor M. Polischuk

OrbiMed Capital LLC

Portfolio Manager

12 November 2025

Contribution by Investment

ABSOLUTE CONTRIBUTION BY INVESTMENT

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2025

Principal contributors to and detractors from net asset value performance

Contribution | ||||

Contribution | per share^ | |||

Top five contributors | Sector | Country | £'000 | p |

Jiangsu Hengrui Pharmaceutical | Pharmaceuticals | China | 28,456 | 6.2 |

Alnylam Pharmaceuticals | Biotechnology | United States | 24,524 | 5.3 |

Sino Biopharmaceutical | Pharmaceuticals | China | 16,799 | 3.6 |

UCB | Pharmaceuticals | Europe | 11,178 | 2.4 |

Caris Life Sciences | Life Sciences Tools & Services | United States | 10,625 | 2.3 |

Contribution | ||||

Contribution | per share | |||

Top five detractors | Sector | Country | £'000 | p |

Vertex Pharmaceuticals* | Biotechnology | United States | -10,328 | -2.2 |

Boston Scientific | Healthcare Equipment and Supplies | United States | -11,251 | -2.4 |

Intuitive Surgical | Healthcare Equipment and Supplies | United States | -12,045 | -2.6 |

Eli Lilly | Pharmaceuticals | United States | -23,958 | -5.2 |

UnitedHealth Group* | Healthcare Providers and Services | United States | -50,312 | -10.9 |

^ Calculation based on 460,928,790 shares being the weighted average number of shares in issue during the six months ended 30 September 2025.

* Not held at 30 September 2025.

Interim Management Report

PRINCIPAL RISKS AND UNCERTAINTIES

The Directors continue to review the Company's key risk register, which identifies the risks and uncertainties that the Company is exposed to, and the controls in place and the actions being taken to mitigate them.

A review of the half year and the outlook for the Company can be found in the Chair of the Board's Statement and the Portfolio Manager's Review. The principal risks and uncertainties faced by the Company include the following:

• Exposure to market risks and those additional risks specific to the sectors in which the Company invests, such as political interference in drug pricing.

• The Company uses leverage (both through derivatives and gearing) the effect of which is to amplify the gains or losses the Company experiences.

• Macro events (including geo-political and regulatory) may have an adverse impact on the Company's performance by causing exchange rate volatility, changes in tax or regulatory environments, and/or a fall in market prices. Emerging markets, which a portion of the portfolio is exposed to, can be subject to greater political uncertainty and price volatility than developed markets.

• Unquoted investments are more difficult to buy, sell or value and so changes in their valuations may be greater than for listed assets.

• The risk that the individuals responsible for managing the Company's portfolio may leave their employment or may be prevented from undertaking their duties.

• The risk that, following the failure of a counterparty, the Company could be adversely affected through either delay in settlement or loss of assets.

• The Board is reliant on the systems of the Company's service providers and as such disruption to, or a failure of, those systems could lead to a failure to comply with law and regulations leading to reputational damage and/or financial loss to the Company.

• The risk that investing in companies that disregard Environmental, Social and Governance (ESG) factors will have a negative impact on investment returns and also that the Company itself may become unattractive to investors if ESG is not appropriately considered in the Portfolio Manager's decision making process.

• The risk, particularly if the investment strategy and approach are unsuccessful, that the Company may underperform, resulting in the Company becoming unattractive to investors and a widening of the share price discount to NAV per share. Also, falls in stock markets, and the risk of a global recession, are likely to adversely affect the performance of the Company's investments.

Further information on these risks is given in the Annual Report for the year ended 31 March 2025. The Board has noted that global markets are continuing to experience unusually high levels of uncertainty and heightened geopolitical risks. The Board continues to monitor this closely.

RELATED PARTY TRANSACTIONS

During the first six months of the current financial year no material transactions with related parties have taken place which have affected the financial position or the performance of the Company.

GOING CONCERN

The Directors believe, having considered the Company's investment objectives, risk management policies, capital management policies and procedures, the nature of the portfolio and expenditure projections, that the Company has adequate resources, an appropriate financial structure and suitable management arrangements in place to continue in operational existence for the foreseeable future and, more specifically, that there are no material uncertainties relating to the Company that would prevent its ability to continue in such operational existence for at least 12 months from the date of the approval of this half yearly financial report. For these reasons, they consider there is reasonable evidence to continue to adopt the going concern basis in preparing the accounts.

DIRECTORS' RESPONSIBILITIES

The Board of Directors confirms that, to the best of its knowledge:

(i) the condensed set of financial statements contained within the Half Year Report have been prepared in accordance with Financial Reporting Standard 104 (Interim Financial Reporting); and

(ii) the interim management report includes a true and fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an indication of important events that have occurred during the first six months of the financial year and their impact on the condensed set of financial statements; and a description of the principal risks and uncertainties for the remaining six months of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being related party transactions that have taken place in the first six months of the current financial year and that have materially affected the financial position or performance of the entity during that period; and any changes in the related party transactions described in the last annual report that could do so.

The Half Year Report has not been reviewed or audited by the Company's auditors.

This Half Year Report contains certain forward-looking statements. These statements are made by the Directors in good faith based on the information available to them up to the date of this report and such statements should be treated with caution due to the inherent uncertainties, including both economic and business risk factors, underlying any such forward-looking information.

For and on behalf of the Board

Doug McCutcheon

Chair

12 November 2025

Income Statement

For the six months ended 30 September 2025

(Unaudited) 30 September 2025 | (Unaudited) 30 September 2024 | |||||

Revenue | Capital | Revenue | Capital | |||

Return | Return | Total | Return | Return | Total | |

£'000 | £'000 | £'000 | £'000 | £'000 | £'000 | |

Gains on investments | - | 52,547 | 52,547 | - | 2,585 | 2,585 |

Exchange (losses)/gains on currency balances | - | (2,844) | (2,844) | - | 6,906 | 6,906 |

Income from investments (note 2) | 5,438 | - | 5,438 | 8,830 | - | 8,830 |

AIFM, portfolio management, and performance fees (note 3) | (314) | (5,975) | (6,289) | (408) | (7,751) | (8,159) |

Other expenses | (665) | - | (665) | (654) | - | (654) |

Net return before finance charges and taxation | 4,459 | 43,728 | 48,187 | 7,768 | 1,740 | 9,508 |

Finance charges | (60) | (1,130) | (1,190) | (176) | (3,342) | (3,518) |

Net return/(loss) before taxation | 4,399 | 42,598 | 46,997 | 7,592 | (1,602) | 5,990 |

Taxation | (63) | - | (63) | (357) | - | (357) |

Net return/(loss) after taxation | 4,336 | 42,598 | 46,934 | 7,235 | (1,602) | 5,633 |

Return/(loss) per share (note 4) | 0.9p | 9.7p | 10.6p | 1.4p | (0.3)p | 1.1p |

The "Total" column of this statement is the Income Statement of the Company. The "Revenue" and "Capital" columns are supplementary to this and are prepared under guidance published by the Association of Investment Companies.

All revenue and capital items in the above statement derive from continuing operations.

The Company has no recognised gains and losses other than those shown above and therefore no separate Statement of Total Comprehensive Income has been presented.

The accompanying notes are an integral part of these statements.

Statement of Changes in Equity

For the six months ended 30 September 2025

(Unaudited) | (Unaudited) | |

30 September | 30 September | |

2025 | 2024 | |

£'000 | £'000 | |

Opening shareholders' funds | 1,679,346 | 2,080,417 |

Shares purchased for treasury | (273,843) | (99,759) |

Return for the period | 46,934 | 5,633 |

Dividends paid - revenue | (8,174) | (11,198) |

Closing shareholders' funds | 1,444,263 | 1,975,093 |

Statement of Financial Position

As at 30 September 2025

(Unaudited) | (Audited) | |

30 September | 31 March | |

2025 | 2025 | |

£'000 | £'000 | |

Fixed assets | ||

Investments | 1,415,959 | 1,673,659 |

Derivatives - OTC swaps | 39,361 | 1,487 |

1,455,320 | 1,675,146 | |

Current assets | ||

Debtors | 31,844 | 8,003 |

Cash and cash equivalents | 31,267 | 93,584 |

63,111 | 101,587 | |

Current liabilities | ||

Creditors: amounts falling due within one year | (74,168) | (72,109) |

Derivative - OTC Swaps | - | (25,278) |

(74,168) | (97,387) | |

Net current liabilities | (11,057) | 4,200 |

Total net assets | 1,444,263 | 1,679,346 |

Capital and reserves | ||

Ordinary share capital - (note 5) | 15,042 | 15,042 |

Capital redemption reserve | 9,564 | 9,564 |

Share premium account | 841,599 | 841,599 |

Capital reserve | 563,588 | 794,833 |

Revenue reserve | 14,470 | 18,308 |

Total shareholders' funds | 1,444,263 | 1,679,346 |

Net asset value per share - (note 6) | 354.4p | 339.5p |

Cash Flow Statement

For the Six months ended 30 September 2025

(Unaudited) | (Unaudited) | ||

Six months ended | Six months ended | ||

30 September | 30 September | ||

2025 | 2024 | ||

Note | £'000 | £'000 | |

Net cash outflow from operating activities | 8 | (1,959) | (4,336) |

Purchases of investments and derivatives | (385,106) | (411,658) | |

Sales of investments and derivatives | 609,006 | 420,462 | |

Realised (losses)/gains on foreign exchange | (2,690) | 4,803 | |

Net cash inflow from investing activities | 221,210 | 13,607 | |

Shares repurchased | (272,097) | (98,072) | |

Equity dividends paid | (8,174) | (11,198) | |

Interest paid | (1,190) | (3,518) | |

Net cash outflow from financing activities | (281,461) | (112,788) | |

Increase in net debt | (62,210) | (103,517) |

Cash flows from operating activities includes interest received of £1,767,000 (2024: £1,684,000) and dividends received of £3,660,000 (2024: £7,448,000).

RECONCILIATION OF NET CASH FLOW MOVEMENT TO MOVEMENT IN NET DEBT

(Unaudited) | (Unaudited) | |

Six months ended | Six months ended | |

30 September | 30 September | |

2025 | 2024 | |

£'000 | £'000 | |

Increase in net debt resulting from cash flows | (62,210) | (103,517) |

(Losses)/gains on foreign currency cash and cash equivalents | (154) | 2,103 |

Movement in net debt in the period | (62,364) | (101,414) |

Net debt at 1 April | 25,511 | 4,855 |

Net debt at 30 September* | (36,853) | (96,559) |

* The net debt figure as at 30 September 2025 includes cash and cash equivalents less the overdraft drawn of £68,120,000 (30 September 2024: £138,055,000).

Notes to the Financial Statements

1. ACCOUNTING POLICIES

The condensed Financial Statements for the six months to 30 September 2025 comprise the primary statements together with the related notes below. They have been prepared in accordance with FRS 104 'Interim Financial Reporting', the AIC's Statement of Recommended Practice published in July 2022 ('SORP') and using the same accounting policies as set out in the Company's Annual Report and Financial Statements at 31 March 2025.

Going concern

After making enquiries, and having reviewed the Investments, Statement of Financial Position and projected income and expenditure for the next 12 months, the Directors have a reasonable expectation that the Company has adequate resources to continue in operation for the foreseeable future. The Directors have therefore adopted the going concern basis in preparing these condensed financial statements.

Fair value

Under FRS 102 and FRS 104 investments have been classified using the following fair value hierarchy:

Level 1 - Quoted market prices in active markets

Level 2 - Prices of a recent transaction for identical instruments

Level 3- Valuation techniques that use:

(i) observable market data; or

(ii) non-observable data

As at 30 September 2025 | Level 1 | Level 2 | Level 3 | Total |

£'000 | £'000 | £'000 | £'000 | |

Investments held at fair value through profit or loss | 1,349,822 | - | 68,023 | 1,417,845 |

Derivatives: OTC swaps (assets) | - | 39,361 | - | 39,361 |

Derivatives: OTC swaps (liabilities) | - | - | - | - |

Financial instruments measured at fair value | 1,349,822 | 39,361 | 68,023 | 1,457,206 |

As at 31 March 2025 | Level 1 | Level 2 | Level 3 | Total |

£'000 | £'000 | £'000 | £'000 | |

Investments held at fair value through profit or loss | 1.566,854 | - | 106,805 | 1,673,659 |

Derivatives: OTC swaps (assets) | - | 1,487 | - | 1,487 |

Derivatives: OTC swaps (liabilities) | - | (25,278) | - | (25,278) |

Financial instruments measured at fair value | 1,566,854 | (23,791) | 106,805 | 1,649,868 |

2. INCOME

(Unaudited) | (Unaudited) | |

Six months ended | Six months ended | |

30 September | 30 September | |

2025 | 2024 | |

£'000 | £'000 | |

Investment income | 3,671 | 7,146 |

Interest Income | 1,767 | 1,684 |

Total | 5,438 | 8,830 |

3. AIFM, PORTFOLIO MANAGEMENT AND PERFORMANCE FEES

(Unaudited)

| (Unaudited)

| |||||

Revenue | Capital | Total | Revenue | Capital | Total | |

£'000 | £'000 | £'000 | £'000 | £'000 | £'000 | |

AIFM fee | 62 | 1,183 | 1,245 | 72 | 1,365 | 1,437 |

Portfolio management fee | 252 | 4,792 | 5,044 | 336 | 6,386 | 6,722 |

Performance fee charge for the period | - | - | - | - | - | - |

314 | 5,975 | 6,289 | 408 | 7,751 | 8,159 | |

As at 30 September 2025 no performance fees were accrued or payable (31 March 2025: nil accrued).

No performance fee could become payable by 30 September 2026.

See Glossary for further information on the performance fee.

4. RETURN/(LOSS) PER SHARE

(Unaudited) | (Unaudited) | |

Six months ended | Six months ended | |

30 September | 30 September | |

2025 | 2024 | |

£'000 | £'000 | |

The return per share is based on the following figures: | ||

Revenue return | 4,336 | 7,235 |

Capital return/(loss) | 42,598 | (1,602) |

Total return | 46,934 | 5,633 |

Weighted average number of shares in issue for the period | 461,175,923 | 531,229,280 |

Revenue return per share | 0.9p | 1.4p |

Capital return/(loss) per share | 9.3p | (0.3)p |

Total return per share | 10.2p | 1.1p |

The calculation of the total, revenue and capital returns per ordinary share is carried out in accordance with IAS 33, "Earnings per Share (as adopted in the EU)".

5. SHARE CAPITAL

Total | |||

Treasury | shares | ||

Shares | shares | in issue | |

number | number | number | |

|

As at 1 April 2025 | 494,631,804 | 107,033,396 | 601,665,200 |

Purchase of shares into treasury | (87,115,980) | 87,115,980 | - |

As at 30 September 2025 | 407,515,824 | 194,149,376 | 601,665,200 |

(Unaudited) | (Audited) | |

30 September | 31 March | |

2025 | 2025 | |

£'000 | £'000 | |

Issued and fully paid: | ||

Nominal value of ordinary shares of 2.5p | 15,042 | 15,042 |

During the period ended 30 September 2025 the Company bought back ordinary shares into treasury at a cost of £273.8m (Year ended 31 March 2025: £176.5m).

6. NET ASSET VALUE PER SHARE

The net asset value per share is based on the assets attributable to equity shareholders of £1,444,263,000 (31 March 2025: £1,679,346,000) and on the number of shares in issue at the period end of 407,515,824 (31 March 2025: 494,631,804).

* restated to reflect the ten for one share split.

7. TRANSACTION COSTS

Purchase transaction costs for the six months ended 30 September 2025 were £277,000 (six months ended 30 September 2024: £204,000). Sales transaction costs for the six months ended 30 September 2025 were £484,000 (six months ended 30 September 2024: £340,000).

These expenses are charged to the capital column of the Income Statement and included within Gains on investments.

8. RECONCILIATION OF OPERATING RETURN TO NET CASH INFLOW/(OUTFLOW) FROM OPERATING ACTIVITIES

(Unaudited) | (Unaudited) | |

Six months ended | Six months

| |

30 September | 30 September | |

2025 | 2024 | |

£'000 | £'000 | |

Gains before finance costs and taxation | 48,187 | 9,508 |

Less: capital gains before finance charges and taxation | (43,728) | (1,740) |

| Revenue return before finance charges and taxation | 4,459 | 7,768 |

Expenses charged to capital | (5,975) | (7,751) |

(Increase)/decrease in other debtors | (29) | 226 |

Decrease in other creditors and accruals | (97) | (3,754) |

Net taxation suffered on investment income | (317) | (825) |

Net cash outflow from operating activities | (1,959) | (4,336) |

9. PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks facing the Company are listed in the Interim Management Report. An explanation of these risks and how they are managed is contained in the Strategic Report and note 16 of the Company's Annual Report & Accounts for the year ended 31 March 2025.

10. COMPARATIVE INFORMATION

The condensed financial statements contained in this half year report do not constitute statutory accounts as defined in section 434 of the Companies Act 2006. The financial information for the half years ended 30 September 2025 and 30 September 2024 has not been audited or reviewed by the Company's auditor.

The information for the year ended 31 March 2025 has been extracted from the latest published audited financial statements of the Company. Those financial statements have been filed with the Registrar of Companies. The report of the auditor on those financial statements was unqualified, did not include a reference to any matters to which the auditors drew attention by way of emphasis without qualifying the report, and did not contain statements under either section 498 (2) or 498 (3) of the Companies Act 2006.

Earnings for the first six months should not be taken as a guide to the results for the full year.

Glossary of Terms and Alternative Performance Measures ("APMs")

ALTERNATIVE INVESTMENT FUND MANAGERS DIRECTIVE ("AIFMD")

Agreed by the European Parliament and the Council of the European Union and transposed into UK legislation, the AIFMD classifies certain investment vehicles, including investment companies, as Alternative Investment Funds ("AIFs") and requires them to appoint an Alternative Investment Fund Manager ("AIFM") and depositary to manage and oversee the operations of the investment vehicle. The Board of the Company retains responsibility for strategy, operations and compliance and the Directors retain a fiduciary duty to shareholders.

BENCHMARK

The performance of the Company is measured against the MSCI World Health Care Index on a net total return, sterling adjusted basis. (Please also see the Glossary).

The net total return is calculated by reinvesting dividends after the deduction of withholding taxes.

LARGE CAP BIOTECH

Biotechnology company with fully integrated discovery, development and commercial capabilities and considered sustainably profitable.

LARGE CAP PHARMA

Global, multinational pharmaceutical companies with fully integrated discovery, development and commercial capabilities.

DISCOUNT OR PREMIUM

A description of the difference between the share price and the net asset value per share. The size of the discount or premium is calculated by subtracting the share price from the net asset value per share and then dividing by the net asset value per share. It is usually expressed as a percentage (%) of the net asset value per share. If the share price is higher than the net asset value per share the result is a premium. If the share price is lower than the net asset value per share, the shares are trading at a discount.

EMERGING BIOTECH

Biotechnology company that does not fit the criteria of Large Cap Biotech, ranging from early-stage development to newly profitable.

EQUITY SWAPS

An equity swap is an agreement in which one party (counterparty) transfers the total return of an underlying equity position to the other party (swap holder) in exchange for a one-off payment at a set date. Total return includes dividend income and gains or losses from market movements. The exposure of the holder is the market value of the underlying equity position.

Your Company uses two types of equity swap:

- funded, where payment is made on acquisition. They are equivalent to holding the underlying equity position with the exception of additional counterparty risk and not possessing voting rights in the underlying; and,

- financed, where payment is made on maturity. As there is no initial outlay, financed swaps increase economic exposure by the value of the underlying equity position with no initial increase in the investments value - there is therefore embedded leverage within a financed swap due to the deferral of payment to maturity.

The Company employs swaps for two purposes:

- To gain access to individual stocks in the Indian, Chinese and other emerging markets, where the Company is not locally registered to trade or is able to gain in a more cost efficient manner than holding the stocks directly; and,

- To gain exposure to thematic baskets of stocks (a Basket Swap). Basket Swaps are used to build exposure to themes, or ideas, that the Portfolio Manager believes the Company will benefit from and where holding a Basket Swap is more cost effective and operationally efficient than holding the underlying stocks or individual swaps.

GENERICS

Any therapeutics company, domestic or global, that focuses a majority of its efforts (not necessarily 100%) on developing and selling generic and/or biosimilar prescription and/or OTC products.

LEVERAGE

Leverage is defined in the AIFMD as any method by which the AIFM increases the exposure of an AIF. In addition to the gearing limit the Company also has to comply with the AIFMD leverage requirements. For these purposes the Board has set a maximum leverage limit of 140% for both methods. This limit is expressed as a percentage with 100% representing no leverage or gearing in the Company. There are two methods of calculating leverage as follows:

The Gross Method is calculated as total exposure divided by Shareholders' Funds. Total exposure is calculated as net assets, less cash and cash equivalents, adding back cash borrowing plus derivatives converted into the equivalent position in their underlying assets.

The Commitment Method is calculated as total exposure divided by Shareholders' Funds. In this instance total exposure is calculated as net assets, less cash and cash equivalents, adding back cash borrowing plus derivatives converted into the equivalent position in their underlying assets, adjusted for netting and hedging arrangements.

See the definition of Equity Swaps (in the Glossary) for more details on how exposure through derivatives is calculated.

As at

| As at

| |||

Fair Value | Exposure* | Fair Value | Exposure* | |

£'000 | £'000 | £'000 | £'000 | |

Investments | 1,415,959 | 1,415,959 | 1,673,659 | 1,673,659 |

OTC equity swaps | 39,361 | 264,656 | (23,791) | 207,565 |

1,455,320 | 1,680,615 | 1,649,868 | 1,881,224 | |

Shareholders' funds | 1,444,263 | 1,679,346 | ||

Leverage % | 16.4% | 12.0% | ||

* Calculated in accordance with AIFMD requirements using the Commitment Method