TAMPA FL / ACCESS Newswire / November 17, 2025 / Generation Income Properties, Inc. (NASDAQ:GIPR) ("GIPR" or the "Company") today announced its three-month financial and operating results for the period ended September 30, 2025.

Portfolio

Approximately 60% of our portfolio's annualized rent as of September 30, 2025, was derived from tenants that have (or whose parent company has) an investment grade credit rating from a recognized credit rating agency of "BBB-" or better. Our largest tenants are General Services Administration, Dollar General, EXP Services, Kohl's Corporation, and the City of San Antonio, who collectively contributed approximately 59% our portfolio's annualized base rent as of September 30, 2025.

Our portfolio is 98.6% leased and occupied, and tenants are currently 100% rent paying (based on ABR as of September 30, 2025).

Approximately 92% of the leases in our current portfolio (based on ABR as of September 30, 2025) provide for increases in contractual base rent during future years of the current term or during the lease extension periods.

Average effective annual rental per square foot is $16.30.

Liquidity and Capital Resources

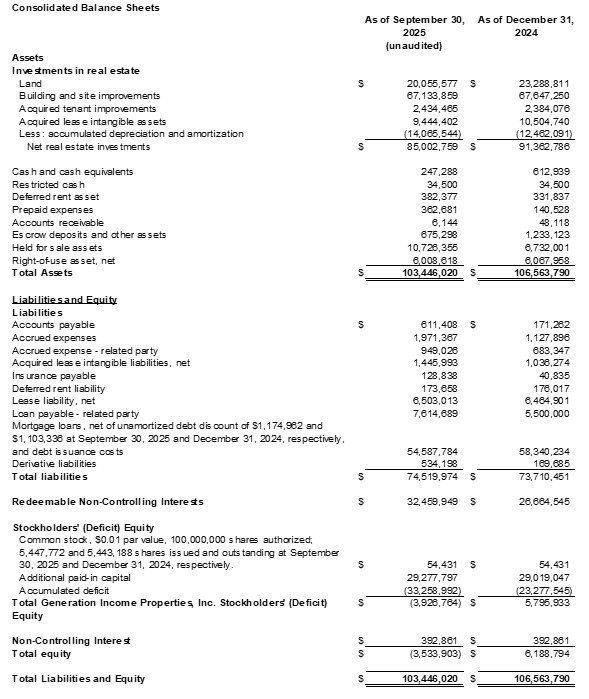

$282 thousand in total cash and cash equivalents as of September 30, 2025.

Total mortgage loans, net was $55.8 million as of September 30, 2025.

Financial Results

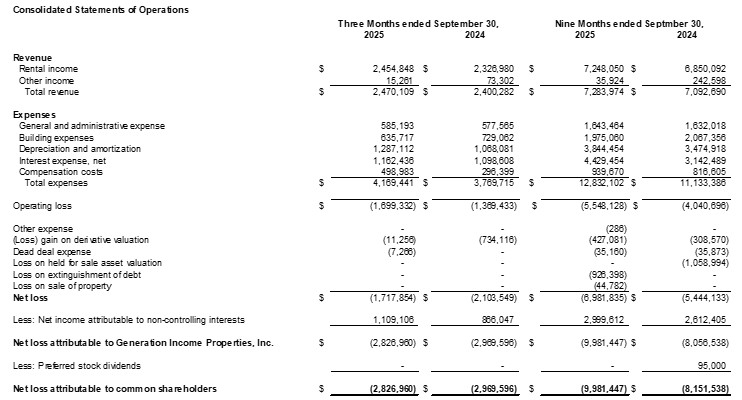

During the nine months ended September 30, 2025, total revenue from operations was $7.28 million, as compared to $7.09 million for the nine months ended September 30, 2024.

Operating expenses, including G&A, for the nine months ended September 30, 2025 were $12.83 million as compared to $11.13 million for the nine months ended September 30, 2024.

Net loss attributable to common shareholders was $9.98 million for the nine months ended September 30, 2025 as compared to $8.15 million for the nine months ended September 30, 2024.

Commenting on the quarter, a letter from CEO David Sobelman:

Dear Fellow Stockholders:

As I've done in the past, I feel like communicating with our shareholders is an important practice that should be done regularly. I hope you find my communication cadence sufficient, as it's important for our company to make sure that you have the most up-to-date information within the windows in which I'm able to publicly speak with you.

There is a palpable difference in the finance and real estate markets as of late, as we have experienced an increase in the number of conversations we're having about our balance sheet, our debt, and growth equity. We're finding that the relationships that we've garnered over the last four years or so, since our IPO to Nasdaq in 2021, are helping us have meaningful discussions about the prospects of advancing the company's stated goals of repositioning our portfolio and reducing our preferred equity exposure.

My intent is to deliver a clear, factual account of recent developments and outline the strategic actions that are underway to stabilize and grow shareholder value.

Our Stock

If you haven't noticed, our company has seen a tremendous amount of attention over the last 30-60 days. In fact, one day, October 3,2025, our total transaction volume was close to 15 million shares. That one day put us in the same "neighborhood" of trading volume as companies like Ford, AT&T, Apple, Alphabet, and Snap as it relates to their average daily volumes. Clearly, we are not as large as those companies, but it demonstrates an increased level of attention on us for a short period. That unprecedented volume of our shares trading hands positively impacted our price and shares, on some days, were being sold well above today's price.

Ultimately, we are unsure of why this dynamic occurred, but we were encouraged to see that there is a market for our shares and that liquidity was possible for a company with our current market cap.

Our Portfolio

We are constantly reminded by those outside of our company, but working in conjunction with us, that we have an extremely solid portfolio. We are consistently underwriting the value of each asset and the credit worthiness of our tenants, all with the understanding that we may have to pivot at different points due to market dynamics. A recent example of that pivot was the selling of our one and only vacant property to an owner-user at a profit to what we purchased the building for approximately three years ago. In this case, when we originally purchased the property, we had an investment-grade credit tenant that was generating a tremendous amount of revenue for themselves at that single location. We felt confident that the real estate was very sound, and if even that high-performing tenant would ever leave (which they did at the expiration of their lease), we would be left with something that gave us an opportunity for liquidity. In this case, our underwriting worked, and we were able to sell the property at a profit even though it was vacant. This is all to the benefit of the shareholders and gives you some additional insight as to how we look at assets for the future.

We also used the proceeds from that sale to pay down in part our senior mortgage debt and preferred equity from Loci Capital. This worked extremely well for us, and we plan to continue these efforts as we look to sell other assets in order to reduce our debt and preferred equity exposure in the near term. One of our goals is to continue these efforts throughout the rest of this year and hopefully eliminate a substantial portion (or all) of our preferred equity with Loci by the end of 2025.

In the meantime, our portfolio remains performing at 100% with rent collection at the same level it has been since the inception of our company. We believe this to be a testament to our credit underwriting from our due diligence prior to entering into an agreement to ultimately purchasing any one property. Now, we are seeing the benefits of ongoing receivables from our tenants that have allowed us to remain performing at some of the highest rent-collection levels of any of the REITs in today's public markets.

You may have seen that we extended a lease from one of our investment-grade credit tenants, Best Buy, with an additional 5-year renewal that allowed us to increase the value of that property. We did all of that with roughly 2.5 years remaining on their primary lease term which allows us to own a property for approximately seven more years and gives us the optionality to own it for a total of nine and a half years since we originally purchased the property with roughly five years remaining. In essence, we bought a well-located, investment grade, net lease property and created value through our ongoing asset management and lease extension efforts. That extension was announced in August, and we are happy that we have not only increased the value of that property but also made it more appealing to potential buyers, if that need arose. Additionally, in September of this year, we also extended the lease for our 7-11 property in Washington, D.C. That investment-grade credit tenant also extended their lease and exercised one of their renewal options for five years, which has allowed us to increase the value of that property as well.

As you can see, to my earlier point, we are constantly looking at how to increase the value of each one of our properties with the understanding that the aggregate value of our portfolio could increase over time.

Recapitalization and Refinance of Debt and Preferred Equity

As we've reported in the past, we are in discussions with various parties on how to eliminate the most attention-getting portion of our balance sheet, which is our preferred equity with Loci Capital. Loci has been a good partner of ours, but we realize that it is time to move on and graduate from that form of equity. We continue to be compliant on all of the covenants that relate to our agreement with Loci, but we understand that when an investor looks at our financial statements, they see that liability, and it is up to us to find a solution to eliminate that portion of the discussion that is overshadowing many of our other simultaneous efforts. We are seeking to recapitalize Loci Capital's position within our balance sheet with senior debt that can offset the more expensive preferred equity. If we are successful with those efforts, then we will reduce the accrued interest by approximately two-thirds of what it is now, and we can then increase the equity for the shareholders going forward.

Additionally, with that potential recapitalization of the preferred equity with senior debt, we are also in discussions to simultaneously reduce the interest rate on some of our bank debt, which would also reduce our overall debt service payments and bring more value and cash flow to the company and subsequently to the shareholders.

Like I mentioned, if we are successful in this effort and it happens in the near term, we believe we will be well positioned to put that phase of our development behind us and start focusing on adding assets that are accretive to the overall value of the company. As I mentioned earlier, we are hopeful to complete the recapitalization of the preferred equity and refinancing of debt in 2025. If that's the case, we will start initiating our efforts for growth in the first quarter of 2026 to increase the value of the overall company. In essence, we know our marching orders, we know exactly what we need to do, we know exactly how we want to do it, and we are laser-focused on accomplishing those goals in order to get through this period.

Nasdaq Listing

In August of 2025, we were sent a notice by NASDAQ of the potential to delist our shares because of our noncompliance with the Nasdaq rules that requires stockholder equity to be at least $2.5 million. We realize that that is not something that any shareholder would like to see about their company. However, we have sent Nasdaq our plan on how to come back into compliance of the stockholder equity rule, and it is inclusive of everything I have outlined within this letter. We have not received a response yet from Nasdaq and we believe that our plan is sound and executable. However, to reiterate this point, that plan includes a recapitalization and refinance of our debt and equity, the sale of our assets that we have targeted for disposition, which will generate a healthy amount of cash and would put us back on track for Nasdaq compliance and long-term growth.

Strategic Alternatives Process

The Special Committee of the Board of Directors is still engaging with GIPR's investment bank to determine whether there are any potential opportunities for the company. Conversations continue with potential parties interested in what we have built. As has been stated previously, no assurances can be given regarding the outcome or timing of the Board's review of potential strategic alternatives, and GIPR does not intend to comment further unless or until the Board has approved a specific course of action or the process concludes.

Looking Ahead

If things go according to plan, the fourth quarter of 2025 should be a pivotal turning point for the entire company. With a cleaner balance sheet, a smaller portfolio, less debt, and elimination of our current preferred equity, we will be in a position to look forward. What does "looking forward" mean to me?

With a sound portfolio and a real estate track record to point to, we believe have built a solid foundation in which to raise additional capital for growth in the future after improving our balance sheet. We have a number of different case studies or examples of how our investment thesis played out, to show potential new shareholders what we're capable of doing and how our thesis actually works. If you're following the overall public real estate markets, you can see that most REITs are trading well below their net asset value, or NAV. I've seen some reports where all REITs are currently on sale right now, sometimes between 20% and 50% off. Even with our portfolio performing at 100%, we have been drastically discounted due to our size and the pressures of the financial markets, mainly having to do with interest rates and lack of capital raising in the public markets.

I have noticed that, in essence, many of the small real estate companies are struggling to find their place in today's REIT ecosystem. While everyone may be performing well, the small REITs are in a place where some decisions have to be made regarding whether to combine with other REITS. These are the types of markets where it's important to remain flexible, but also instill creative thought processes in order to take advantage of opportunities that may not be present when the financial markets are much stronger.

Additionally, with an improved balance sheet, it'll be easier for us to have conversations with property owners who are looking to contribute assets to our portfolio in exchange for limited partnership units (LP units) through our UPREIT contribution program. We're one of the few REITs, especially micro-cap REITs, that have been successful in this effort. I can honestly say that it's mainly due to our relational values that we put in the forefront of our culture. Our UPREIT contributors from past transactions are all still a part of our company, with one converting his shares to common shares approximately three years ago.

So in essence, even though we are working on repositioning our capital stack within our company, selling assets in order to pay down debt and preferred equity, our mindset remains on the growth and long-term success of your company. We believe this could be the market for us to do that.

Summary

As you can see, as usual, we are working for you to make sure that your investment in your company is one that is positioned well for long-term growth. We are navigating very complex markets and competing interests, but the one mainstay that we have is that our assets are strong, our team is motivated and encouraged, and those attributes are resonating throughout the segment of the market in which we operate.

We appreciate your continued support and patience as we go through this phase. Our board and management team remain focused on executing this plan responsibly, preserving shareholder interests, and positioning Generation Income Properties for a stronger future.

Sincerely,

David Sobelman

Chairman, Chief Executive Officer & President

Generation Income Properties, Inc.

About Generation Income Properties

Generation Income Properties, Inc., located in Tampa, Florida, is an internally managed real estate investment trust formed to acquire and own, directly and jointly, real estate investments focused on retail, office, and industrial net lease properties in densely populated submarkets. Additional information about Generation Income Properties, Inc. can be found at the Company's corporate website: www.gipreit.com.

Forward-Looking Statements

This Current Report on Form 8-K may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainty. Words such as "anticipate," "estimate," "expect," "intend," "plan," and "project" and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Such statements are based on management's current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements.

Investors are cautioned that there can be no assurance actual results or business conditions will not differ materially from those projected or suggested in such forward-looking statements as a result of various factors. Please refer to the risks detailed from time to time in the reports we file with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on March 28, 2025, as well as other filings on Form 10-Q and periodic filings on Form 8-K, for additional factors that could cause actual results to differ materially from those stated or implied by such forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law.

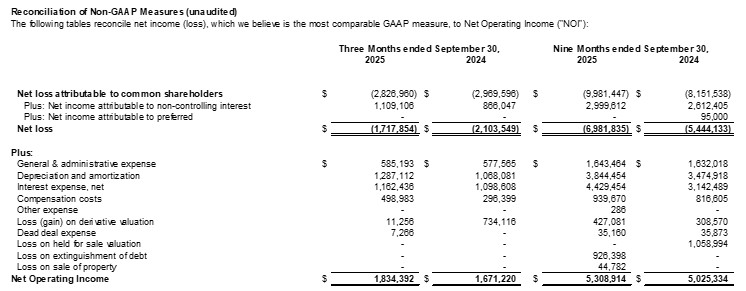

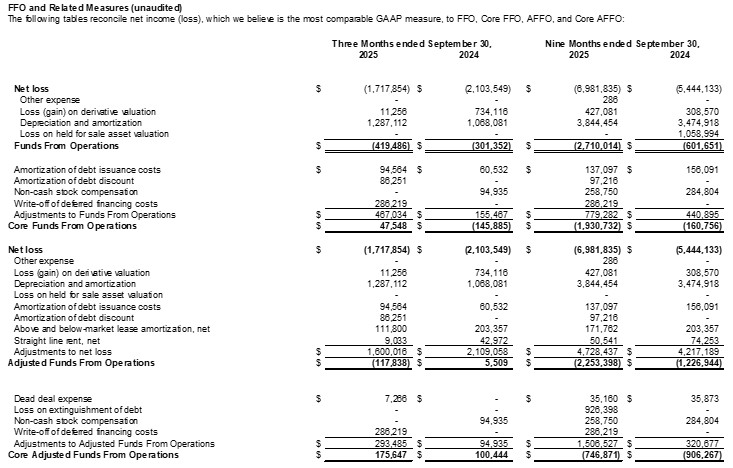

Notice Regarding Non-GAAP Financial Measures

In addition to our reported results and net earnings per diluted share, which are financial measures presented in accordance with GAAP, this press release contains and may refer to certain non-GAAP financial measures, including Funds from Operations ("FFO"), Core Funds From Operations ("Core FFO"), Adjusted Funds from Operations ("AFFO"), Core Adjusted Funds from Operations ("Core AFFO"), and Net Operating Income ("NOI"). We believe the use of Core FFO, Core AFFO and NOI are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs. FFO and related measures, including NOI, should not be considered alternatives to net income as a performance measure or to cash flows from operations, as reported on our statement of cash flows, or as a liquidity measure, and should be considered in addition to, and not in lieu of, GAAP financial measures. You should not consider our Core FFO, Core AFFO, or NOI as an alternative to net income or cash flows from operating activities determined in accordance with GAAP. Our reconciliation of non-GAAP measures to the most directly comparable GAAP financial measure and statements of why management believes these measures are useful to investors are included below.

Our reported results are presented in accordance with GAAP. We also disclose funds from operations ("FFO"), adjusted funds from operations ("AFFO"), core funds from operations ("Core FFO") and core adjusted funds of operations ("Core AFFO") all of which are non- GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs.

FFO and related measures do not represent cash generated from operating activities and are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income or loss as a performance measure or cash flows from operations as reported on our statement of cash flows as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures.

We compute FFO in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts ("NAREIT"). NAREIT defines FFO as GAAP net income or loss adjusted to exclude extraordinary items (as defined by GAAP), net gains from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets, and real estate related depreciation and amortization, including the pro rata share of such adjustments of unconsolidated subsidiaries. We then adjust FFO for non-cash revenues and expenses such as amortization of deferred financing costs, above and below market lease intangible amortization, straight line rent adjustment where the Company is both the lessor and lessee, and non-cash stock compensation to calculate Core AFFO.

FFO is used by management, investors, and analysts to facilitate meaningful comparisons of operating performance between periods and among our peers primarily because it excludes the effect of real estate depreciation and amortization and net gains on sales, which are based on historical costs and implicitly assume that the value of real estate diminishes predictably over time, rather than fluctuating based on existing market conditions. We believe that AFFO is an additional useful supplemental measure for investors to consider because it will help them to better assess our operating performance without the distortions created by other non-cash revenues or expenses. FFO and AFFO may not be comparable to similarly titled measures employed by other companies. We believe that Core FFO and Core AFFO are useful measures for management and investors because they further remove the effect of non-cash expenses and certain other expenses that are not directly related to real estate operations. We use each as measures of our performance when we formulate corporate goals.

As FFO excludes depreciation and amortization, gains and losses from property dispositions that are available for distribution to stockholders and extraordinary items, it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses and interest costs, providing a perspective not immediately apparent from net income or loss. However, FFO should not be viewed as an alternative measure of our operating performance since it does not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties which could be significant economic costs and could materially impact our results from operations. Additionally, FFO does not reflect distributions paid to redeemable non-controlling interests.

Investor Contacts

Investor Relations

ir@gipreit.com

SOURCE: Generation Income Properties

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/real-estate/generation-income-properties-announces-q3-2025-financial-and-operating-results-1103138