Topic: Yesterday, FWAG reported a solid set of Q3 results, in line with our estimates as well as consensus.

On the back of a 2.9% yoy higher group passenger number (thereof VIE: +1.1% yoy) and higher airport charges (+4.6% yoy; c. 40% of sales), FWAG increased Q3 sales by 5.6% yoy to € 321m in line with expectations (eNuW: € 321m; eCons: 321m). On a segment level, Airport grew by +7.5% yoy to € 159m (50% of sales), followed by Malta (+7.6% yoy to € 47m; 15% of sales) and Handling & Security (+5.6% yoy to € 52m). The non-aviation segment Retail & Properties grew by only 1% yoy to € 59m, on the back of lower rental revenues (-8% yoy to € 8.8m) against a tough comparable base (Q3'24: +22% yoy).

Q3 EBITDA remained strong at € 166m and arrived slightly higher than expectations (eNuW: € 164m, eCons: € 164m). Due to higher personnel costs (€ 102m, +11% yoy) on the back of wage inflation, EBITDA developed under-proportionate to sales (+1.4% yoy; 51.5% margin, -2.1pp yoy), which could not be compensated by the decline in material expenses (-7% yoy to € 12.4m), mainly linked to less third-party services.

Net income after minorities arrived at € € 90.9m and grew in line with EBITDA (+1.5% yoy; 27.9% margin; -1.2pp yoy) with only minor deviations from our D&A, financial result, tax and minority estimates.

Operating cashflow fell by 23% to € 111m solely due to a discrepancy between the tax results and taxes paid following tax pre-payments back at normal pre-COVID levels. FCF thus arrived at € 45m (-55% yoy) on the back of the scaled up CAPEX of € 66m (+49% yoy) for the south expansion of terminal 3 (€ 29m), CAPEX at Malta (€ 8m) as well as for an upgrade to the baggage sorting system (€ 5m).

The FY'25 financial and passenger guidance was confirmed and looks achievable. With passengers of c. 32m at VIE (eNuW: 32.2m) and c. 42m on group level (eNuW: 43m), the guidance of € c. 1.08bn in sales (eNuW: € 1.1bn) and an EBITDA of c. € 440m (eNuW: 451m) should be well achievable.

With 2026e, FWAG enters a mixed year. Recent reductions from low-cost carriers coupled with the resumption of the airport charge tariff formula (suspended from 2020-2025 due to COVID) should lead to a decline in passengers and revenues, as reflected in our current estimates. Consequently, the company already initiated an efficiency and cost-saving program in advance aimed to mitigate the effects.

October traffic results arrived with higher momentum. Passenger volume increased by 6.7% on group level (+3.7% yoy in VIE), on the back of a higher seat load factor and an expanded offering in the autumn holidays vs. Oct'24. Should this momentum continue into Nov' and Dec', our Q4 estimates appear conservative at the moment.

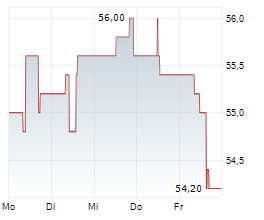

However, the shares remain priced adequately, which is why we maintain our HOLD recommendation and keep our DCF-based PT of € 58.00 unchanged.

ISIN: AT00000VIE62