Jaime Rogozinski Takes WallStreetBets Fight to Supreme Court Over Whether the Creations Born On the Internet Belongs to Its Creators or Hosting Platforms.

WASHINGTON, DC / ACCESS Newswire / November 20, 2025 / A legal battle now headed to the steps of the U.S. Supreme Court could redefine how power works on the internet, and who truly owns the communities that shape modern culture.

WallStreetBets asks Supreme Court to decide who owns creations born on the internet.

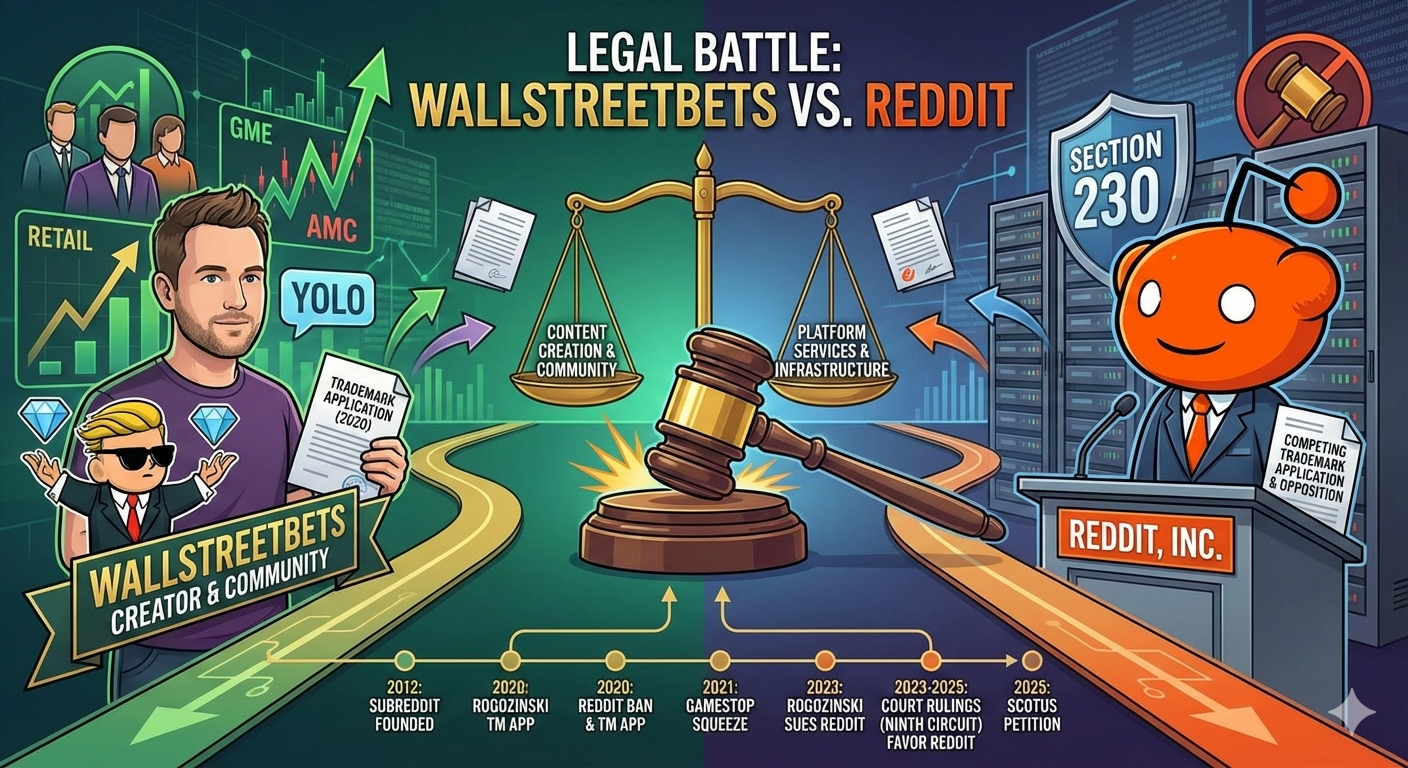

The founder of the wildly influential WallStreetBets community, which helped fuel the GameStop and AMC stock market saga, has petitioned the Court to determine whether tech platforms can ban creators and then claim ownership of their brands.

After building WallStreetBets from scratch and leading it for more than eight years, founder Jaime Rogozinski filled a trademark for WallStreetBets and was shortly after removed by Reddit in 2020. Days later, the platform attempted to secure the trademark rights to the brand he created.

In 2021, Rogozinski sued Reddit for the IP rights to the brand he created and has now worked its way up to the U.S. Supreme Court.

Critics warn that the lower court's ruling, which sided with Reddit, sets a dangerous precedent: Big Tech platforms can now legally take over user-built brands once they become valuable.

"This is a blueprint for digital eminent domain," said Rogozinski. "If it stands, no creator on any platform is safe."

Supporters argue that platforms already enjoy broad immunity for content under Section 230 of the Communications Decency Act - but now claim ownership of that same content when it becomes profitable. Rogozinski refers to this as a "rights without responsibility" paradox that leaves users and the public unprotected.

Financial experts emphasize that WallStreetBets isn't just a meme. It represents billions in market influence and the democratization of finance.

Experts warn that the decision could have sweeping consequences:

Creators could lose control of their names, communities, and livelihoods

Investors may face uncertainty over who owns valuable digital assets

Consumers could be misled by "zombie brands" run without the original creators

Platforms gain unilateral control over cultural movements they did not build

Jeopardize the Open-source community which relies on third party platforms to collaborate

Rogozinski fears "if corporations can erase founders and rewrite the legacy of grassroots communities, the open internet becomes a corporate mall then users are merely tenants, and the landlord owns everything."

By blurring the lines between the source of online content with the host, supporters also say the outcome will shape not only the future of online communities, but the authenticity of digital experiences.

"If brand identity can be quietly transferred without consumer awareness, the internet becomes a hall of mirrors," warns one supporting organization.

Rogozinski insists the case is not about fame or nostalgia: "This is about protecting the next generation of innovators."

For more information visit https://wallstreetbets.net or email legal@wallstreetbets.net

Contact Information

Jaime Rogozinski

Founder of WallStreetBets

legal@wallstreetbets.net

SOURCE: WSB Global, LLC

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/computers-technology-and-internet/creator-of-wallstreetbets-asks-u.s.-supreme-court-to-clarify-trad-1105463