New York Stock Exchange ("NYSE") to be Primary Listing Venue of Shares and Delaware Incorporation of Diversified Energy Company

Diversified Will Retain UK listing on the Equity Shares (International Commercial Companies Secondary Listing) Category

BIRMINGHAM, Ala., Nov. 21, 2025 (GLOBE NEWSWIRE) -- Diversified Energy Company plc (the "Company") (NYSE:DEC, LSE: DEC) is pleased to announce that following the approval received at the shareholder meetings on November 10, 2025, the High Court of Justice of England and Wales (the "Court") has today issued an order sanctioning the scheme of arrangement under Part 26 of the Companies Act 2006 to introduce Diversified Energy Company, a new Delaware-incorporated company ("Diversified") as the parent holding company of the Company (the "Scheme"). A copy of the Court order will be delivered to the Registrar of Companies for England and Wales today, following which the Scheme will become effective. This marks a significant milestone for the Company.

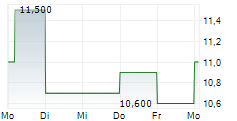

In addition, on September 30, 2025, the Company announced its intention to move its primary listing to the New York Stock Exchange while retaining a secondary listing on the London Stock Exchange and the prospectus in relation to the admission of Diversified's common stock to listing on the equity shares (international commercial companies secondary listing) category of the Official List of the FCA and trading on the London Stock Exchange's main market for listed securities was approved by the FCA and with the prospectus published on November 19, 2025. Following the Scheme becoming effective, it is expected that the NYSE notification of the primary listing of Diversified common stock will be released today and commencing on Monday, November 24, 2025, the Company's common stock are expected to be primarily listed on the NYSE and the LSE Admission is expected to become effective at 8.00am (London time) on November 24, 2025.

Further, as a result of the Scheme becoming effective, the listing of the ordinary shares of the Company on the equity shares (commercial companies) category of the Official List of the FCA will be cancelled with effect from 7.00am (London time) on November 24, 2025 and the last day of dealings in the Company's shares will be today, November 21, 2025. Following the Scheme becoming effective, Diversified will continue its share buyback program on the same terms as was previously announced by the Company on 20 March 2025, as updated on 11 August 2025.

For further information, please contact:

| Diversified Energy Company | +1 973 856 2757 |

| Doug Kris | dkris@dgoc.com |

| Senior Vice President, Investor Relations & Corporate Communications | |

FTI Consulting | dec@fticonsulting.com |

| U.S. & UK Financial Media Relations | |

About Diversified Energy Company

Diversified is a leading publicly traded energy company focused on acquiring, operating, and optimizing cash generating energy assets. Through our unique differentiated strategy, we acquire existing, long-life assets and invest in them to improve environmental and operational performance until retiring those assets in a safe and environmentally secure manner. Recognized by ratings agencies and organizations for our sustainability leadership, this solutions-oriented, stewardship approach makes Diversified the Right Company at the Right Time to responsibly produce energy, deliver reliable free cash flow, and generate shareholder value.

Forward-Looking Statements

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995). These forward-looking statements, which contain the words "anticipate", "believe", "intend", "estimate", "expect", "may", "will", "seek", "continue", "aim", "target", "projected", "plan", "goal", "achieve", "opportunity" and words of similar meaning, reflect the Company's beliefs and expectations and are based on numerous assumptions regarding the Company's present and future business strategies and the environment the Company will operate in and are subject to risks and uncertainties that may cause actual results to differ materially. No representation is made that any of these statements or forecasts will come to pass or that any forecast results will be achieved. Forward-looking statements involve inherent known and unknown risks, uncertainties and contingencies because they relate to events and depend on circumstances that may or may not occur in the future and may cause the actual results, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond the Company's ability to control or estimate precisely, including the risk factors described in the "Risk Factors" section in the Company's Annual Report and Form 20-F for the year ended December 31, 2024, filed with the United States Securities and Exchange Commission and the risk factors described in the "Risk Factors" section of the Prospectus published by Diversified and approved by the FCA. Forward-looking statements speak only as of their date and neither the Company nor any of its directors, officers, employees, agents, affiliates or advisers expressly disclaim any obligation to supplement, amend, update or revise any of the forward-looking statements made herein, except where it would be required to do so under applicable law. As a result, you are cautioned not to place undue reliance on such forward-looking statements.