- Subscription price: €1.35 per new share

- Subscription ratio: 8 new shares for 11 existing shares

- Theoretical value of the preferential subscription right: €0.79

- Trading period for preferential subscription rights: from November 26th to December 5th, 2025 inclusive

- Subscription period: from November 28th to December 9th, 2025 inclusive

- Subscription commitments: c. €475 million, i.e. c.71% of the total amount of the right issue, from the French Republic (the "French State") via the Agence des Participations de l'Etat (the "APE"), Bharti Space Ltd, His Majesty's Government, via The Secretary of State for Science, Innovation and Technology of the United Kingdom (the "UK Government"), CMA CGM Participations and the FondsStratégique de Participations (the "FSP") pro-rata to their shareholding

Regulatory News:

Not to be published, distributed or circulated directly or indirectly in the United States, Canada, Australia, Japan or South Africa.

Eutelsat (Paris:ETL) (LSE:ETL) (the "Company"), a global leader in satellite communications, announces today the launch of a share capital increase with shareholders' preferential subscription rights for a gross amount of approximately €670 million (the "Rights Issue"), which follows the Reserved Capital Increases (as defined below) of €828 million approved at the combined general meeting of September 30th, 2025, and completed on November 21st, 2025.

Context of the transaction

On June 19th, 2025, the Company presented a strategic roadmap aimed at accelerating the deployment of its low Earth orbit (LEO) satellite activities and supporting the future IRIS2 constellation, while strengthening its financial flexibility by accelerating its debt reduction. In this context, Eutelsat with its consolidated subsidiaries (the "Group") indicated that it would raise €1.5 billion in equity capital (as presented in the communication dated 10 July 2025, supplementing that of 19 June 2025) through: (i) reserved capital increases for a gross amount of €828 million at a price per share of €4.00, subscribed by the French State via the APE, Bharti Space Ltd, the UK Government, CMA CGM Participations and the FSP (the "Reserved Capital Increases", and together with the Rights Issue, the "Capital Increases"), as well as (ii) a Rights Issue of approximately €670 million, which would also be subscribed by the French State via the APE, Bharti Space Ltd, the UK Government, CMA CGM Participations and the FSP in proportion to their respective pro-rata shareholding in the Company after completion of the Reserved Capital Increases. These Capital Increases, combined with a refinancing plan including a bond financing, export credit financings and an extension of bank debt maturities, should enable the Company to finance its medium-term plan and cover investments of approximately €4 billion over the period 2026-2029, while contributing to reducing the Company's leverage ratio to around 2.5x at the end of the 2025-26 financial year.

The Reserved Capital Increases were completed on November 21st, 20251

The net proceeds from the Rights Issue are estimated at approximately €660 million and are part of the strategic roadmap described above. Together with the proceeds from the Reserved Capital Increases, they will be used by the Company to finance its growth and accelerate its debt reduction.

In parallel with the Capital Increases and as part of this strategy to strengthen its financial structure, the Group has initiated the refinancing of its bank and bond debt. While the majority of existing debt of the Group is issued at the level of Eutelsat SA subsidiary, the Company intends going forward to issue debt at the level of Eutelsat Communications SA, subject to market conditions. Eutelsat Communications SA has already signed with its banking partners the refinancing of its syndicated bank debt facilities through €500 million revolving credit facility and a €400 million term loan with maturities of three years and two one-year extensions. These agreements are subject to the completion of a bond issue at Eutelsat Communications SA and other customary conditions for this type of agreement. In accordance with the Company's recent communications, in order to cover the financing needs of its medium-term plan, the Group is also in advanced discussions with European public export credit financing agencies (ECA financing) and has appointed a coordinating bank to work on the implementation of this ECA financing.

Main terms of the Rights Issue

The Rights Issue will be carried out with shareholders' preferential subscription rights, pursuant to the 16th resolution of the combined general meeting of September 30th, 2025, leading to the issue of 496,129,728 new shares (the "New Shares"), at a subscription price of €1.35 per New Share.

Each shareholder will receive one preferential subscription right per share recorded in its securities account at the end of the day falling on November 27th, 2025. In order to ensure that the shares are recorded in the securities account on that date, purchases of existing shares on the market must be executed at the latest on November 25th, 2025.

The preferential subscription rights will be detached from the underlying share on November 26th, 2025 and be tradable from November 26th, 2025 until December 5th, 2025 inclusive on the regulated market of Euronext Paris ("Euronext Paris") under ISIN code FR0014012K95 and can be exercised from November 28th, 2025 until December 9th, 2025 inclusive according to the indicative timetable. Existing shares will therefore trade ex-right from November 26th, 2025. 11 preferential subscription rights will entitle the relevant holder to subscribe for 8 New Shares at a subscription price of €1.35 per New Share (i.e. €1 of nominal value and €0.35 of issue premium). The preferential subscription rights not exercised at the end of the subscription period, i.e. on December 9th, 2025, according to the indicative timetable, will lapse automatically.

Subscriptions subject to reduction (à titre réductible) will be accepted. Any New Shares not absorbed by subscription orders not subject to reduction (à titre irréductible) will be allocated to the holders of the preferential subscription rights having submitted additional subscription orders subject to reduction (à titre réductible), within the limit of their requests in proportion to the number of preferential subscription rights whose will have been used to subscribe not subject to reduction (à titre irréductible), without this resulting into an allotment of fractional New Shares.

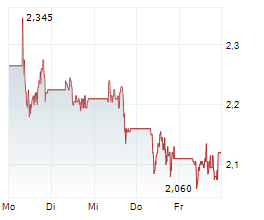

Based on the closing price of the Company shares on Euronext Paris on November 21st, 2025, i.e., €3.225:

- the subscription price of the New Shares of €1.35 shows a discount of (58.1%) on their face value,

- the theoretical value of the preferential subscription rights amounts to €0.79,

- the theoretical ex-right value of the Company share amounts to €2.44, and

- the subscription price of the New Shares shows a discount of (44.6%) to the theoretical ex-right value of the share.

These values do not prejudge either the value of the preferential subscription right during their trading period or the ex-right value of the Eutelsat share, or the discounts, as they will be recorded on Euronext Paris.

The Rights Issue will be open to the public in France only.

The New Shares will immediately entitle their holders, from the date of issuance, to receive all dividends and distribution decided by the Company from this date. They will be immediately assimilated with existing shares of the Company and will be traded on the same trading line under the same ISIN code (FR0010221234).

Subscription commitments

The French State via the APE, Bharti Space Ltd, the UK Government, CMA CGM Participations and the FSP have each undertaken to subscribe to the Rights Issue not subject to reduction (à titre irréductible) in proportion to their respective shareholding in the Company (following completion of the Reserved Capital Increases), representing respectively approximately 29.65%, 17.88%, 10.89%, 7.46% and 4.99%, or respectively approximately €199 million, €120 million, €73 million, €50 million and €33 million, representing collectively approximately 70.87% of the Rights Issue and an aggregate amount of approximately €475 million.

The Company is not aware of any intention to subscribe from shareholders or members of the administrative bodies other than those mentioned above.

Indicative timetable

November 26th, 2025 | Detachment of preferential subscription rights Start of the preferential subscription rights trading period on Euronext Paris |

November 28th, 2025 | Start of the subscription period of the Rights Issue |

December 5th, 2025 | End of the preferential subscription rights trading period on Euronext Paris |

December 9th, 2025 | End of the subscription period of the Rights Issue |

December 12th, 2025 | Publication by the Company of a press release announcing the results of subscriptions to the Rights Issue and if applicable the proportionate distribution of the subscriptions subject to reduction (à titre réductible |

December 16th, 2025 | Settlement and delivery of the New Shares Issue and admission of the New Shares to trading on Euronext Paris |

December 17th 2025 | Issue and admission of the New Shares to trading on the London Stock Exchange |

Lock-up commitments

As part of the underwriting agreement, the Company has agreed to an undertaking to abstain from issuing or selling any shares from the date of signature of an underwriting agreement with a syndicate of banks and expiring 180 calendar days following the settlement-delivery date of the New Shares, subject to certain customary exceptions.

The French State via the APE, Bharti Space Ltd, the UK Government, CMA CGM Participations and the FSP have agreed to a lock-up period beginning from the launch date of the Rights Issue and expiring 180 calendar days following the settlement-delivery date of the New Shares, subject to certain customary exceptions.

Dilution

For illustrative purposes only, a shareholder holding 1% of the Company's share capital as of November 24th, 2025, (after completion of the Reserved Capital Increases), and who does not participate in the Rights Issue, would hold 0.58% following completion of the Rights Issue.

Underwriting

The issue of New Shares (to the extent not covered by the subscription commitments described above) is the subject of an underwriting agreement with a syndicate of banks.

Note: The English version of this press release may differ from the French version for regulatory purposes.

About Eutelsat

Eutelsat is a global leader in satellite communications, delivering connectivity and broadcast services worldwide. Eutelsat was formed through the combination of the Company and OneWeb in 2023, becoming the first fully integrated GEO-LEO satellite operator with a fleet of 34 Geostationary (GEO) satellites and a Low Earth Orbit (LEO) constellation of more than 600 satellites. Eutelsat addresses the needs of customers in four key verticals of Video, where it distributes around 6,400 television channels, and the high-growth connectivity markets of Mobile Connectivity, Fixed Connectivity, and Government Services. Eutelsat's unique suite of in-orbit assets and ground infrastructure enables it to deliver integrated solutions to meet the needs of global customers. The Company is headquartered in Paris and Eutelsat employs more than 1,600 people across more than 75 countries. Eutelsat is committed to delivering safe, resilient, and environmentally sustainable connectivity to help bridge the digital divide. The Company is listed on the Euronext Paris Stock Exchange (ticker: ETL) and the London Stock Exchange (ticker: ETL).

Disclaimer

This press release includes "forward-looking statements". All statements other than statements of historical facts included in this press release, including, without limitation, those regarding the Company's financial position, business strategy, plans and objectives of management for future operations, are forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company's present and future business strategies and the environment in which the Company will operate in the future. Additional factors could cause actual results, performance or achievements to differ materially.

No communication and no information in respect of this transaction may be distributed to the public in any jurisdiction where a registration or approval is required. No steps have been or will be taken in any jurisdiction (other than France and the United Kingdom) where such steps would be required. The issue, the subscription for or the purchase of Eutelsat Communications' securities may be subject to specific legal or regulatory restrictions in certain jurisdictions. Eutelsat Communications assumes no responsibility for any violation of any such restrictions by any person.

This press release is not and should not be construed as a prospectus within the meaning of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017, as amended (the "Prospectus Regulation") or Prospectus Regulation as it forms part of domestic law of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (the "UK Prospectus Regulation

With respect to the member States of the European Economic Area other than France (the "Member States"), no action has been undertaken or will be undertaken to make an offer to the public of securities requiring the publication of a prospectus in any Member States. As a result, any securities of Eutelsat Communications may only be offered in Member States (i) to qualified investors, as defined by the Prospectus Regulation; (ii) to fewer than 150 natural or legal persons per Member State, other than qualified investors (as defined in the Prospectus Regulation); or (iii) in any other circumstances, not requiring Eutelsat Communications to publish a prospectus as provided under Article 1(4) of the Prospectus Regulation; and provided that none of the offers mentioned in paragraphs (i) to (iii) above requires the publication of a prospectus by Eutelsat Communications pursuant to Article 3 of the Prospectus Regulation, or a supplement to the Prospectus Regulation pursuant to Article 23 of the Prospectus Regulation.

With respect to the United Kingdom, no action has been undertaken or will be undertaken to make an offer to the public of securities requiring the publication of a prospectus in the United Kingdom. As a result, any securities of Eutelsat Communications may only be offered in the United Kingdom (i) to qualified investors, as defined under Article 2 of the UK Prospectus Regulation; (ii) to fewer than 150 natural or legal persons, other than qualified investors (as defined in the UK Prospectus Regulation); or (iii) in any other circumstances falling within Section 86 of the Financial Services and Markets Act 2000 (the "FSMA"), provided that no such offer shall require Eutelsat Communications to publish a prospectus pursuant to Section 85 of the FSMA or supplement a prospectus pursuant to Article 23 of the UK Prospectus Regulation. However, it should be noted that a prospectus has been prepared by the Company in accordance with the UK Prospectus Regulation pursuant to Section 73(A) of the FSMA and approved by the Financial Conduct Authority ("FCA"), in connection with the application for admission of the new shares resulting from the Rights Issue to the equity shares segment (international commercial companies secondary listing) of the FCA's Official List and their admission to trading on the main market for listed securities of the London Stock Exchange.

This press release and any other materials in relation to the securities of Eutelsat Communications have not been made, and have not been approved, by an "authorised person" within the meaning of section 21(1) of the Financial Services and Markets Act 2000. As a consequence, in the United Kingdom, this press release is directed only at persons who are qualified investors, as defined under Article 2 of the UK Prospectus Regulation, who are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the "Order"), or (ii) are high net worth body corporates, unincorporated associations or partnerships, trustees of a high value trust or (iii) other persons to whom it may be lawfully communicated within Article 49(2)(a) to (e) of the Order (all such persons mentioned in paragraphs (i), (ii) and (iii) collectively being referred to as "Relevant Persons"). In the United Kingdom, any securities are intended only for Relevant Persons and no invitation, offer or agreements to subscribe, purchase or acquire the securities may be proposed or made other than with Relevant Persons. Any person other than a Relevant Person may not act or rely on this press release or any provision thereof. This press release is not a prospectus which has been approved by the FCA or any other United Kingdom regulatory authority within the meaning of Section 85 of the FSMA.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States of America, its territories and possessions, any State of the United State of America and the District of Columbia (the "United States"). Securities may not be offered, subscribed or sold in the United States absent registration under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"), except pursuant to an exemption from, or in a transaction not subject to, the registration requirements thereof. The securities in respect thereof have not been and will not be registered under the U.S. Securities Act and Eutelsat Communications does not intend to make a public offer of its securities in the United States.

This press release is not, and under no circumstances is it to be construed as, a prospectus, offering memorandum, advertisement or an offer to sell or solicitation of an offer to buy any of the securities referred to herein in Canada. Any offering in Canada will be made on a private placement basis only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations, and is exempt from the requirement that the Company prepares and files a prospectus under applicable Canadian securities laws. No securities commission or regulatory authority in Canada has reviewed or in any way passed upon the Rights Issue documentation or on the merits of the Rights Issue.

The distribution of this press release in certain countries may constitute a breach of applicable law.

The information contained in this press release does not constitute an offer of securities for sale in the United States, Canada, Australia, Japan or South Africa.

This press release may not be published, forwarded or distributed, directly or indirectly, in the United States of America, Australia, Canada, Japan or South Africa.

| 1 The Reserved Capital Increases have consisted in the issuance of 207,000,000 new shares, representing a dilution of 30%. The settlement and delivery of the new shares issued in the Reserved Capital Increase occurred on 21 November 2025, with an admission to trading on Euronext Paris expected on 25 November 2025 and on the London Stock Exchange on 28 November 2025. | |

View source version on businesswire.com: https://www.businesswire.com/news/home/20251124963611/en/

Contacts:

Media enquiries

Joanna Darlington

Tel. +33 674 521 531

joanna.darlington@eutelsat.net

Anita Baltagi

Tel. +33 643 930 178

anita.baltagi@eutelsat.net

Katie Dowd

Tel. +1 202 271 2209

katie.dowd@eutelsat.net

Investors

Joanna Darlington

Tel. +33 674 521 531

joanna.darlington@eutelsat.net

Hugo Laurens-Berge

Tel. +33 670 80 95 58

hugo.laurens-berge@eutelsat.net