Initial 2025 Chicken Mountain Drill Assays Confirm Grade, Thickness, Continuity and Scale; Reinforcing A Bulk-Tonnage, Open-Pit, Heap Leach RIRGS Opportunity

VANCOUVER, BC / ACCESS Newswire / November 26, 2025 / Tectonic Metals Inc. ("Tectonic" or the "Company") (TSXV:TECT)(OTCQB:TETOF) today announced the initial assay results from 10 of the 79 holes drilled during the 2025 drill campaign at Chicken Mountain - a bulk-tonnage, open-pit, heap-leachable gold opportunity and one of six kilometre-scale intrusive centres at the Company's flagship ~99,800 acre Flat Gold Project ("Flat") in southwestern Alaska.

The Chicken Mountain intrusion (6.5 x 6.0 kilometres) is the largest and most geologically understood intrusive center at Flat and widely recognized as the primary lode source of the 1.4 million ounces of placer gold historically mined from the surrounding drainages.1

To date, the 2025 drill campaign represents the largest and most comprehensive program ever completed at Flat, totaling 18,373 metres ("m") drilled across 125 holes, including 10,780 m in 79 holes at Chicken Mountain.

The ten drill holes reported today account for just 1,811 m - approximately 17% of the total 2025 drilling at Chicken Mountain. Assay results from a further 114 drill holes across Chicken Mountain, Alpha Bowl, and other intrusive centres are pending and will be released as they are received, validated, and incorporated into the Company's geological model.

2025 DRILLING STRATEGY & HIGHLIGHTS - CONTINUITY, EXPANSION & RESOURCE DELINEATION AT CHICKEN MOUNTAIN

The 2025 Phase One and Phase Two drilling programs were strategically designed to accelerate Chicken Mountain toward resource readiness by extending mineralization along strike and at depth, validating historical information, tightening geological and structural controls, generating two-inch coarse-crush metallurgical samples for heap-leach column testing and collecting a comprehensive dataset required for 3D resource modelling and future engineering studies.

Definition of vectors to higher grade mineralized zones will be assisted by data collected and interpreted from orientated drill core measurements, characterization of alteration assemblages, vein geometry, vein density and quantitative assessment of mineralization styles.

Tectonic also utilized reverse-circulation ("RC") drilling to rapidly test for shallow, near-surface mineralization and extend mineralization across strike.

Together, these objectives underpin the project's progression from exploration drilling toward formal resource delineation and future economic assessment.

DRILL HIGHLIGHTS FROM FIRST TEN HOLES (FIVE DIAMOND, FIVE REVERSE CIRCULATION)

|

|

|

|

|

|

|

KEY TAKEAWAYS

1. 100% Drill-Hit Success Rate Continues

96 of 96 holes drilled to date and each drill hole has intersected gold mineralization

53 of 96 holes ended in gold mineralization, mineralization remains open at depth and is only constrained by drilled depth - not geology

2. A Bulk-Tonnage, Open-Pit, At Surface and Vertically Extensive Gold System is in Play

3 km of mineralized strike length starting at surface

Vertical extent now confirmed to >350 m, up from 325 m, and remains open in all directions

3. Accelerating Toward Resource Definition

Chicken Mountain continues to establish itself as the primary and fastest path toward a maiden resource estimation at Flat

Extensive, continuous zones of gold mineralization with emerging and clearly defined higher-grade domains; demonstrates the potential for high-margin mining starter-pits warranting targeted follow-up drilling

4. Geological Characteristics Consistent with RIRGS Models

Alteration, geometry, and grade distribution are consistent with Reduced Intrusion-Related Gold System (RIRGS) models, including notable similarities to Kinross Gold Corporation (TSX: K, NYSE: KGC) Fort Knox Mine in Alaska

5. Economic Heap Leaching Processing Potential - A Competitive Advantage

Four large-diameter metallurgical holes (PQ core) successfully drilled broad zones of gold mineralization confirming or exceeding expectations and producing high-quality coarse-crush material for two-inch crush heap leach column testing

Drill holes intersected oxidized to partially oxidized quartz monzonite, consistent with lithologies used in prior metallurgical test work

Previously announced heap-leach column tests on ¾ inch coarse crushed mixed oxide/fresh material yielded excellent gold recoveries of 96% and 91%

For context, heap leaching is one of several gold extraction methods suitable for the mineralization at Chicken Mountain. The average grade of many heap leach mines globally is 0.51 g/t Au2, and notably, Kinross Gold Corporation (TSX: K, NYSE: KGC) Fort Knox Mine in Alaska processes 0.30 g/t Au3 profitably

These metallurgical tests and results support ongoing evaluation of the potential for run-of-mine (ROM) heap-leach processing, a potential catalyst for improved capital efficiency, lower operating costs, and enhanced project economics

To learn more about the 2025 Drill Programs, click here: Tectonic Metals Delivers Record 18,372 Metres Across 125 Drill Holes at Flat Gold Project, Alaska

Tony Reda, Co-Founder, President & CEO of Tectonic Metals, commented:

"These latest results both justify and motivate our ambitious exploration strategy at Chicken Mountain. Big targets merit big programs, and with over 10,000 metres of drilling at Chicken Mountain alone and assays pending from 69 holes, we are only at the very front edge of what this system can reveal.

As more assays come in, they will refine grade, continuity, geometry and starter-pit potential - and ultimately form the foundation of Flat's maiden resource estimate and PEA. What excites me most is that everything we are seeing points to a real opportunity for a future open-pit, heap-leach gold mine in one of Alaska's great gold districts."

Click here to view drill plan maps and images. Select images below:

Figure 1: Plan View and Long Section looking Northeast, au composites with pending assays can be viewed at: https://www.tectonicmetals.com/_resources/news/nr-20251126-Figure1.png

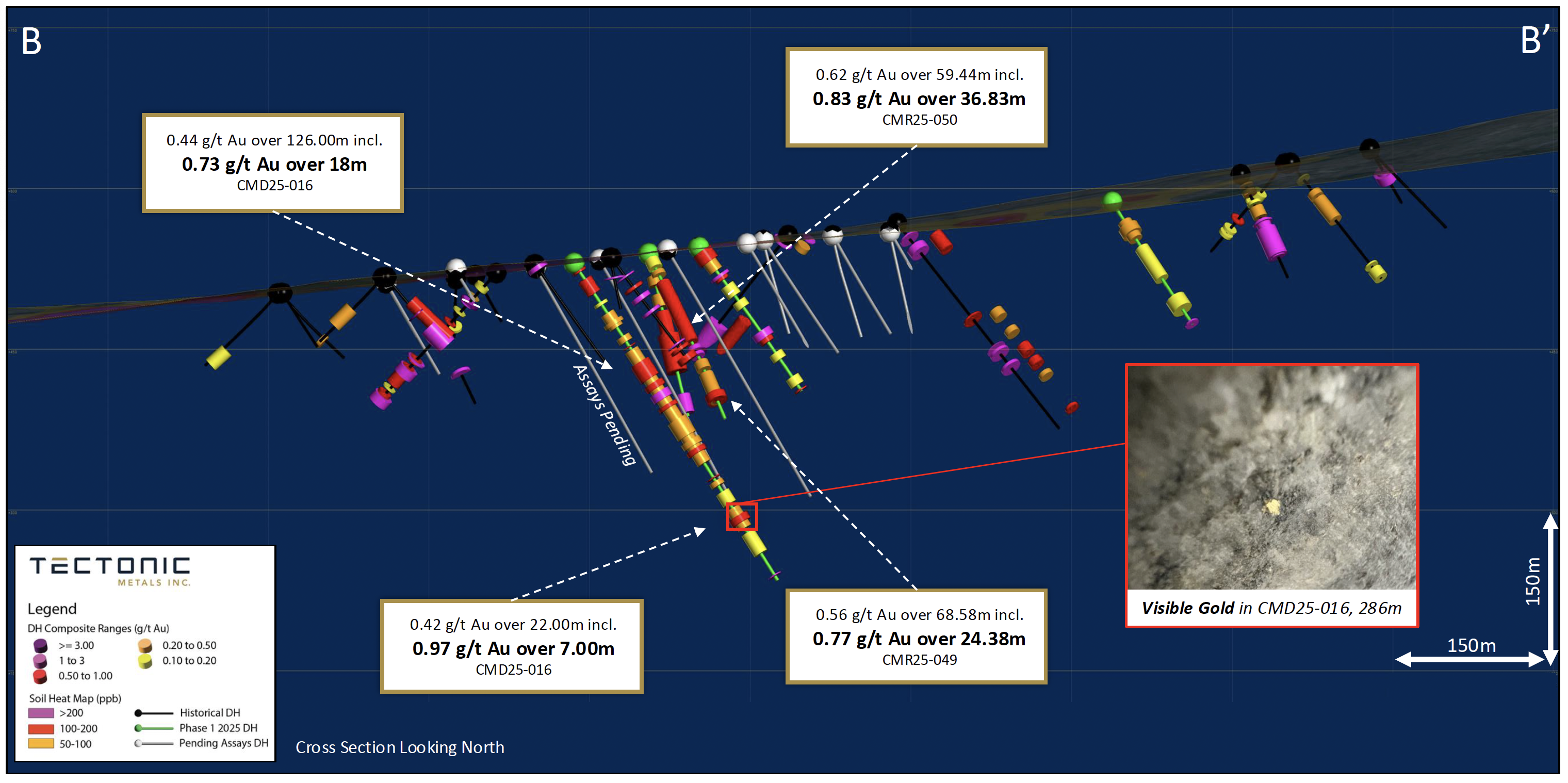

Figure 2 Cross Section B-B' showing 2025 Phase 1 drill holes CMD25-016, CMR25-049 and CMR-050. Phase 2 resource delineation drill holes (assays pending) depicted in white collars can be viewed at: https://www.tectonicmetals.com/_resources/news/nr-20251126-Figure2.png

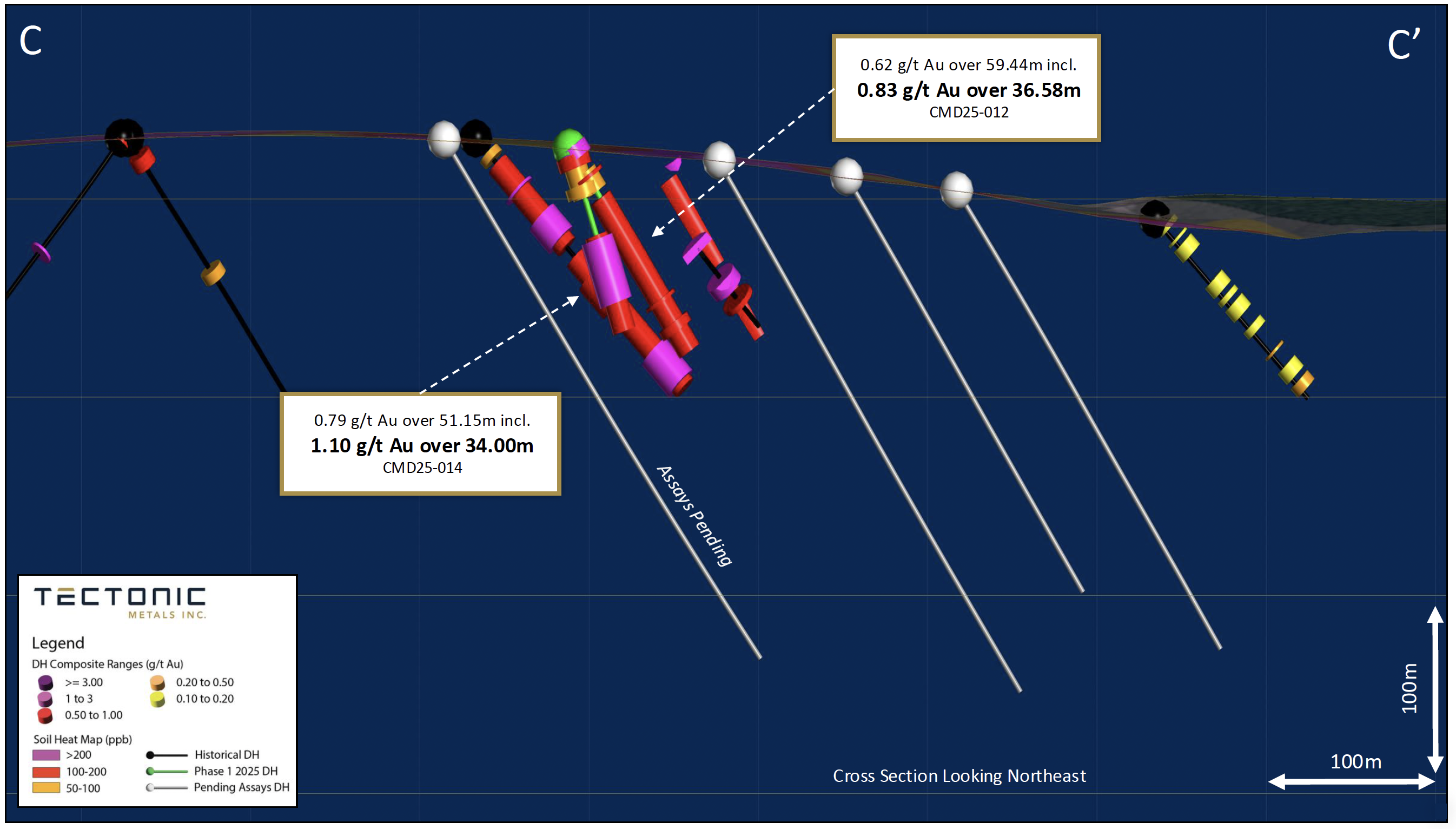

Figure 3: Cross Section C-C' showing 2025 Phase 1 metallurgical drill holes CMD25-012 and CMD25-014 and CMR-050. Phase 2 resource delineation drill holes (assays pending) depicted in white collars can be viewed at: https://www.tectonicmetals.com/_resources/news/nr-20251126-Figure3.png

Table 1. Summary of Composite Results Available for RC Holes Drilled at Chicken Mountain During Phase 1*

Hole No. | From (m) | To (m) | Length (m) | Au g/t |

CMR25-041 | 30.48 | 39.62 | 9.14 | 0.36 |

Including | 38.10 | 39.62 | 1.52 | 1.06 |

|

|

|

|

|

| 149.35 | 150.88 | 1.52 | 1.38 |

|

|

|

|

|

CMR25-047 | 1.52 | 27.43 | 25.91 | 0.33 |

Including | 4.57 | 16.76 | 12.19 | 0.52 |

|

|

|

|

|

| 32.00 | 38.10 | 6.10 | 0.80 |

Including | 32.00 | 35.05 | 3.05 | 1.43 |

|

|

|

|

|

| 97.54 | 109.73 | 12.19 | 0.96 |

Including | 97.54 | 105.16 | 7.62 | 1.46 |

|

|

|

|

|

CMR25-048 | 35.05 | 44.20 | 9.14 | 0.56 |

Including | 38.10 | 41.15 | 3.05 | 1.03 |

|

|

|

|

|

CMR25-049 | 33.53 | 102.11 | 68.58 | 0.56 |

Including | 38.10 | 62.48 | 24.38 | 0.77 |

Including | 71.63 | 83.82 | 12.19 | 0.87 |

|

|

|

|

|

| 108.20 | 118.87 | 10.67 | 1.97 |

Including | 114.30 | 115.82 | 1.52 | 12.64 |

|

|

|

|

|

| 138.68 | 169.16 | 30.48 | 0.32 |

Including | 161.54 | 169.16 | 7.62 | 0.71 |

|

|

|

|

|

CMR25-050 | 57.91 | 117.35 | 59.44 | 0.62 |

Including | 80.77 | 117.35 | 36.58 | 0.83 |

With | 82.30 | 88.39 | 6.10 | 1.36 |

And with | 92.96 | 99.06 | 6.10 | 0.84 |

And with | 105.16 | 117.35 | 12.19 | 1.06 |

|

|

|

|

|

| 140.21 | 158.50 | 18.29 | 1.08 |

*All reported intercepts are reported as downhole lengths, as insufficient data exists to determine true widths. Select composites utilizing 0.10, 0.30 or 0.50 g/t Au cut-off with a maximum 3.1m continuous (two sample) below the cut-off inclusion.

Table 2. Summary of Composite Results Available for DDH Holes Drilled at Chicken Mountain During Phase 1*

Hole ID | From (m) | To (m) | Length (m) | Au g/t |

CMD25-008 | 15.03 | 130.01 | 114.98 | 0.37 |

Including | 39.93 | 71.32 | 31.39 | 0.42 |

With | 41.00 | 44.96 | 3.96 | 0.94 |

And with | 59.94 | 71.32 | 11.38 | 0.46 |

Including | 76.00 | 117.95 | 41.95 | 0.50 |

With | 86.87 | 115.05 | 28.18 | 0.63 |

And with | 101.80 | 115.05 | 13.25 | 0.61 |

|

|

|

|

|

| 177.00 | 236.52 | 59.52 | 0.32 |

Including | 178.00 | 192.31 | 14.31 | 0.40 |

With | 189.08 | 191.22 | 2.14 | 0.69 |

Including | 206.62 | 212.01 | 5.39 | 0.42 |

|

|

|

|

|

| 239.86 | 312.72 | 72.86 | 0.65 |

Including | 242.90 | 266.00 | 23.10 | 0.85 |

With | 254.81 | 261.52 | 6.71 | 2.48 |

Including | 275.30 | 296.50 | 21.20 | 0.76 |

With | 278.90 | 286.00 | 7.10 | 1.51 |

|

|

|

|

|

CMD25-011 | 0.00 | 124.97 | 124.97 | 0.69 |

Including | 20.00 | 72.00 | 52.00 | 0.91 |

With | 20.00 | 46.00 | 26.00 | 1.46 |

Including | 78.00 | 116.00 | 38.00 | 0.84 |

With | 97.00 | 116.00 | 19.00 | 1.27 |

|

|

|

|

|

CMD25-012 | 0.00 | 11.00 | 11.00 | 0.73 |

Including | 0.00 | 7.00 | 7.00 | 1.07 |

With | 6.00 | 7.00 | 1.00 | 5.63 |

|

|

|

|

|

| 31.00 | 124.66 | 93.66 | 0.54 |

Including | 34.00 | 70.00 | 36.00 | 0.92 |

With | 37.00 | 46.00 | 9.00 | 1.96 |

Or | 37.00 | 42.44 | 5.44 | 2.99 |

And with | 51.00 | 61.00 | 10.00 | 1.08 |

Or | 51.00 | 53.00 | 2.00 | 3.03 |

|

|

|

|

|

CMD25-014 | 0.00 | 27.00 | 27.00 | 0.33 |

Including | 4.00 | 11.00 | 7.00 | 0.58 |

|

|

|

|

|

| 47.00 | 98.15 | 51.15 | 0.79 |

Including | 49.00 | 83.00 | 34.00 | 1.10 |

|

|

|

|

|

CMD25-016 | 18.00 | 34.04 | 16.04 | 0.68 |

With | 19.00 | 25.05 | 6.05 | 1.41 |

|

|

|

|

|

| 97.00 | 223.00 | 126.00 | 0.44 |

Including | 111.00 | 129.00 | 18.00 | 0.73 |

With | 122.00 | 129.00 | 7.00 | 1.44 |

Including | 134.00 | 140.00 | 6.00 | 0.70 |

With | 136.00 | 139.00 | 3.00 | 1.13 |

Including | 144.00 | 152.00 | 8.00 | 1.83 |

With | 149.00 | 152.00 | 3.00 | 4.35 |

Including | 158.00 | 162.00 | 4.00 | 0.67 |

Including | 175.00 | 193.00 | 18.00 | 0.43 |

With | 175.00 | 176.00 | 1.00 | 1.24 |

And with | 188.00 | 193.00 | 5.00 | 0.67 |

Including | 198.00 | 199.00 | 1.00 | 1.10 |

Including | 207.00 | 212.00 | 5.00 | 0.78 |

|

|

|

|

|

| 273.00 | 295.00 | 22.00 | 0.42 |

Including | 282.00 | 289.00 | 7.00 | 0.97 |

With | 286.00 | 289.00 | 3.00 | 1.86 |

| 347.00 | 348.00 | 1.00 | 1.59 |

*All reported intercepts are reported as downhole lengths, as insufficient data exists to determine true widths. Select composites utilizing 0.10, 0.30 or 0.50 g/t Au cut-off with a maximum 3.1m continuous below cut-off inclusion.

Table 3. Details of Phase One Drill Holes at Chicken Mountain

Hole No. | Type | Azimuth (o) | Dip (o) | Length (m) | UTM E | UTM N | Prospect | Purpose |

CMD25-008 | DDH | 115 | -55 | 312.72 | 552555 | 6917253 | Chicken Mountain | Metallurgical |

CMD25-011 | DDH | 120 | -55 | 124.97 | 552592 | 6916984 | Chicken Mountain | Metallurgical |

CMD25-012 | DDH | 115 | -55 | 124.66 | 552512 | 6916931 | Chicken Mountain | Metallurgical |

CMD25-014 | DDH | 115 | -70 | 98.15 | 552511 | 6916932 | Chicken Mountain | Metallurgical |

CMD25-016 | DDH | 90 | -55 | 352.65 | 552359 | 6917509 | No Mans Land | Exploration |

CMR25-041 | RC | 125 | -55 | 150.90 | 552866 | 6917442 | Chicken Mountain | Exploration |

CMR25-047 | RC | 90 | -55 | 165.20 | 552481 | 6917405 | No Mans Land | Exploration |

CMR25-048 | RC | 90 | -75 | 129.50 | 552481 | 6917405 | No Mans Land | Exploration |

CMR25-049 | RC | 135 | -55 | 189.00 | 552422 | 6917639 | Adit | Exploration |

CMR25-050 | RC | 135 | -70 | 161.50 | 552422 | 6917639 | Adit | Exploration |

Upcoming Virtual Core Shack

Following the strong engagement and positive feedback from its inaugural Virtual Drill Core Shack held on September 4, 2025, the Company will host its second "Virtual Drill Core Shack" webcast on Wednesday, December 3, 2025. This follow-up session will provide drill core observations, highlights, and geological insights from the 2025 exploration program. Investors, analysts, and interested stakeholders will have the opportunity to view core photographs and hear directly from Tectonic's technical team in an interactive webcast format. Registration details will be made available in advance of the event.

To Learn More About Tectonic Metals:

Visit https://www.tectonicmetals.com/about/

View our 2025 Fact Sheet or Corporate Presentation

Tectonic invites you to take a virtual tour of our Flat Gold Project with both the CEO of Tectonic and one of Alaska's largest for-profit Native Regional Corporations, Doyon Ltd.

To Be a Part Of "The Shift", please subscribe to our email list by clicking here and follow us on social media: ?

X

LinkedIn

Instagram

Facebook

YouTube

Footnotes and References:

Placer production figures from?"Mineral Occurrence and Development Potential Report, Locatable?and Salable Minerals, Bering Sea-Western Interior Resource Management Plan, BLM-Alaska"

Average Grade of Many Heap Leach Mines Per 3L Capital Thematic Note: Sourvenir, M., & Therrien, S. (2025, January 6). Heap leach and reap: The low-cost solution for low-grade ores, Analyst report, 3L Capital.

Fort KnoxDec. 31,?2022?Annual Mineral and Resource Statement.?Proven & Probable Mineral Reserves 1,935koz Au. Mineral Resources are estimated at a cutoff grade of 0.30 g/t Au.

Qualified Person??

Tectonic Metals' disclosure of technical or scientific information in this press release has been reviewed, verified and approved by Peter Kleespies, M.Sc., P.Geo., Vice President of Exploration, who is a Qualified Person in accordance with Canadian regulatory requirements set out in National Instrument 43-101.?

The analytical work for the 2025 Flat drilling program was performed by MSA Labs (MSA) an internationally recognized and accredited analytical services provider, which is independent of Tectonic. All core and RC samples were submitted to MSA's Fairbanks, Alaska facility. Certain sample shipments were shipped to MSA's Prince George, British Columbia facility to expedite analysis times. At either lab the entire sample was dried, crushed to 2mm and riffle split into nominal 500 g subsample jars for analysis (prep code CRU-CPA). ?Sample split jars were then analysed for gold using PhotonAssayTM (CPA-Au1). If additional nominal 500-gram PhotonAssay TM analysis splits are conducted for a given samples results from all splits are combined on a weight average basis. All initial PhotonAssay TM samples will undergo further analysis for a suite of 48 elements (IMS-230), with pulverization of jar contents to 85% passing 75um (PPU-510), with four acid digestion and ICP-MS finish.?

QA/QC procedures for the drill program included insertion of a certificated reference material every 20 samples, blanks at rate of approximately every 25 samples and a field duplicate sample (split of the 1.5 m original sample) every 25 samples. All QAQC control samples returned values within acceptable limits??

Samples are placed in sealed and security tagged bags and shipped directly to the MSA facility in Fairbanks, Alaska, utilizing strict Chain of Custody protocols.??

On behalf of Tectonic Metals Inc.,?

Tony Reda?

President and Chief Executive Officer?

For further information about Tectonic Metals Inc. or this news release, please visit our website at www.tectonicmetals.com or contact Investor Relations, toll-free at 1.888.685.8558 or by email at investorrelations@tectonicmetals.com

Cautionary Note Regarding Forward-Looking Statements, Historical Information and Visual Observations

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable Canadian securities laws. All statements herein that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often, but not always, identified by words such as "may," "will," "should," "anticipate," "believe," "expect," "intend," "plan," "estimate," "potential," "target," or similar terminology, or that events or conditions "may" or "will" occur.??

Forward-looking statements in this release include, but are not limited to, statements regarding: the potential for mineralization at Tectonic's projects; the nature, scope, and timing of future exploration activities; the interpretation of geological observations; the possible size or scale of mineralized systems; the receipt of regulatory approvals, and the anticipated benefits of current and future exploration programs.

This release also refers to historical information, including results from past exploration activities and placer production figures. Such historical information has not been independently verified by Tectonic, may not be reliable, and should not be relied upon as current, NI 43-101 compliant data.

In addition, this release contains, detailed geological notes, and descriptive observations such as alteration styles, mineralogy and visible gold. These observations are preliminary in nature, may not be representative of the entire interval or system, and should not be relied upon as a guarantee of mineralized assay results or as the basis for any investment decision. Investors and readers are cautioned that visual estimates, core photographs, and geological descriptions are not substitutes for laboratory assay results and do not demonstrate the economic viability of any mineral deposit.

Forward-looking statements are not guarantees of future performance. They are based on a number of assumptions made as of the date such statements are provided, including, among others: assumptions regarding future gold and other metal prices; currency exchange and interest rates; favourable operating and political conditions; timely receipt of permits and regulatory approvals; availability of labour, equipment, and services; stability of financial and capital markets; availability of financing on acceptable terms; accuracy of exploration data and geological models; and the ability to successfully advance planned exploration programs. Many of these assumptions are beyond the control of Tectonic and may prove to be incorrect.

Forward-looking statements are subject to known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from those expressed or implied. These risks include, without limitation: risks inherent to mineral exploration and development; volatility of commodity prices; changes in laws, regulations, and policies; delays or inability to obtain required approvals and permits; availability of financing; general economic, political, and market conditions; labour disputes and shortages; equipment and supply risks; environmental and social risks; competition; inaccuracies in exploration results or geological interpretations; and other risks detailed from time to time in the Company's continuous disclosure filings.

Although management believes the expectations expressed in such forward-looking statements are reasonable as of the date made, there can be no assurance they will prove to be correct. Readers are cautioned not to place undue reliance on forward-looking statements, historical information, or preliminary visual geological observations. Actual results and future events may differ materially from those anticipated. All forward-looking statements contained in this news release are expressly qualified by this cautionary statement. Tectonic disclaims any intention or obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.?

SOURCE: Tectonic Metals Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/tectonic-metals-intersects-1.46-g%2ft-au-over-26-metres-within-broader-zone-of-0.69-1112334