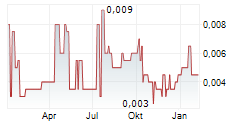

We have refreshed our investment case for Percheron as the company heads into CY26 with a clearly defined Phase II plan for HMBD-002, backed by positive Phase I data and a strengthened management team. Our model now reflects the likely Phase II basket design, comprising exploratory and subsequent expansion cohorts, along with refined assumptions on study size, sequencing and timelines across the four priority indications: triple-negative breast cancer (TNBC), EGFR-mutant non-small cell lung cancer (NSCLC), HER2-negative oesophageal adenocarcinoma and endometrial cancer. With trial initiation likely to be staggered (we model a three- to six-month gap between each arm), we anticipate TNBC and NSCLC to be the lead indications, reflecting their larger addressable markets and clearer early-stage partnering interest. We expect the company to self-sponsor the Phase II studies with a global licensing deal in 2029, ahead of Phase III. Our valuation increases to A$79.0m or 7.3c/share, from A$66.7m or 6.1c/share.Den vollständigen Artikel lesen ...

© 2025 Edison Investment Research