Research Dynamics

/ Key word(s): Research Update

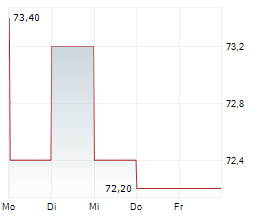

CPH Group marginally lowers guidance CPH Group has updated its earnings guidance for the full year 2025, revising expectations to reflect current market dynamics. Management now anticipates EBITDA will reach approximately CHF 50.0mn, compared to the previous year's CHF 53.8mn. Accordingly, EBIT and net results are expected to be lower than the previous year. This represents a change from earlier projections, which had pointed towards a slight increase in operating and net results. Sales, however, are expected to remain stable year-over-year. The adjustment is largely attributed to moderation in the Perlen Packaging division, where the global market, particularly in Europe, has seen softer demand this year. This trend has influenced capacity utilization, following recent expansions in Europe and Latin America, the company is managing a period where production ramp-up is outpacing current demand, affecting efficiency. In addition to these operational factors, results are being influenced by competitive pricing pressures, currency exchange effects, and increased financing and depreciation costs. To address these developments, management is advancing a series of initiatives focused on cost management, process optimisation, and realizable synergies to support margins. While the 2025 outlook has been reset, the company's broader strategic framework remains in place. Management has reaffirmed its medium-term targets-including 5-8% annual sales growth and EBITDA margins of 16-18%, and anticipates a return to earnings growth in 2026, viewing the current environment as a cyclical fluctuation rather than a structural shift. Valuation and conclusion The reaffirmation of mid-term targets provides stability for the long-term investment thesis, although the updated 2025 guidance is expected to prompt adjustments to near-term forecasts. Both the Packaging and Chemistry divisions present a strong long-term outlook, with their operating performance anticipated to remain resilient. In addition to this positive outlook, ongoing cost optimization initiatives are projected to enhance margins, keeping EBITDA in the 16-18% range. This should support robust earnings growth going forward. We value CPH using DCF and relative valuation techniques. Factoring in the guidance, our intrinsic value stands at CHF 86.4 per share implying an upside of 24.9% from current levels. For relative valuation, since the Group operates in two entirely different divisions, we compare CPH's divisions with various sets of relevant industry peers. We have employed three parameters - EV/EBITDA, P/S, and P/E - to analyse the relative valuation of the Group. CPH currently trades at an EV/EBITDA multiple of 8.9x (FY2025e), a 16.0% premium to the weighted average multiple of division peers.

End of Media Release |

2237660 28.11.2025 CET/CEST