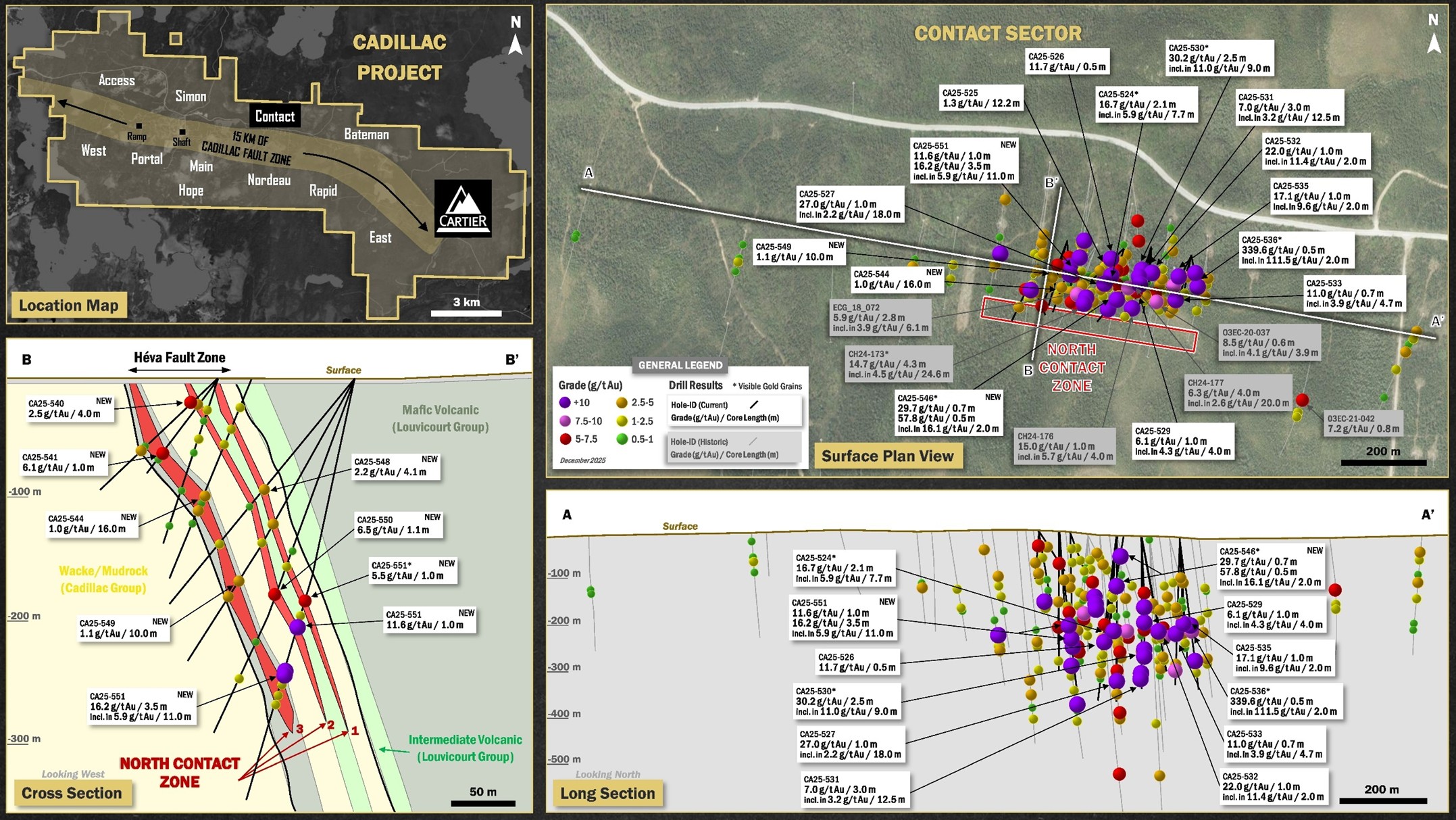

VAL-D'OR, Quebec, Dec. 02, 2025 (GLOBE NEWSWIRE) -- Cartier Resources Inc. (? Cartier ? or the ? Company ?) (TSXV: ECR; FSE: 6CA) is pleased to announce the fifth batch of results from the fully funded 100,000-m drilling program (2 drill rigs), for the Contact Sector and more precisely, the North Contact Zone (? NCZ ?), on its 100%-owned Cadillac Project, located in Val-d'Or (Abitibi, Quebec). The NCZ consists of three parallel high-grade gold zones: NCZ1, NCZ2 and NCZ3, spaced approximately 50 m apart.

Strategic Highlights from Contact Sector

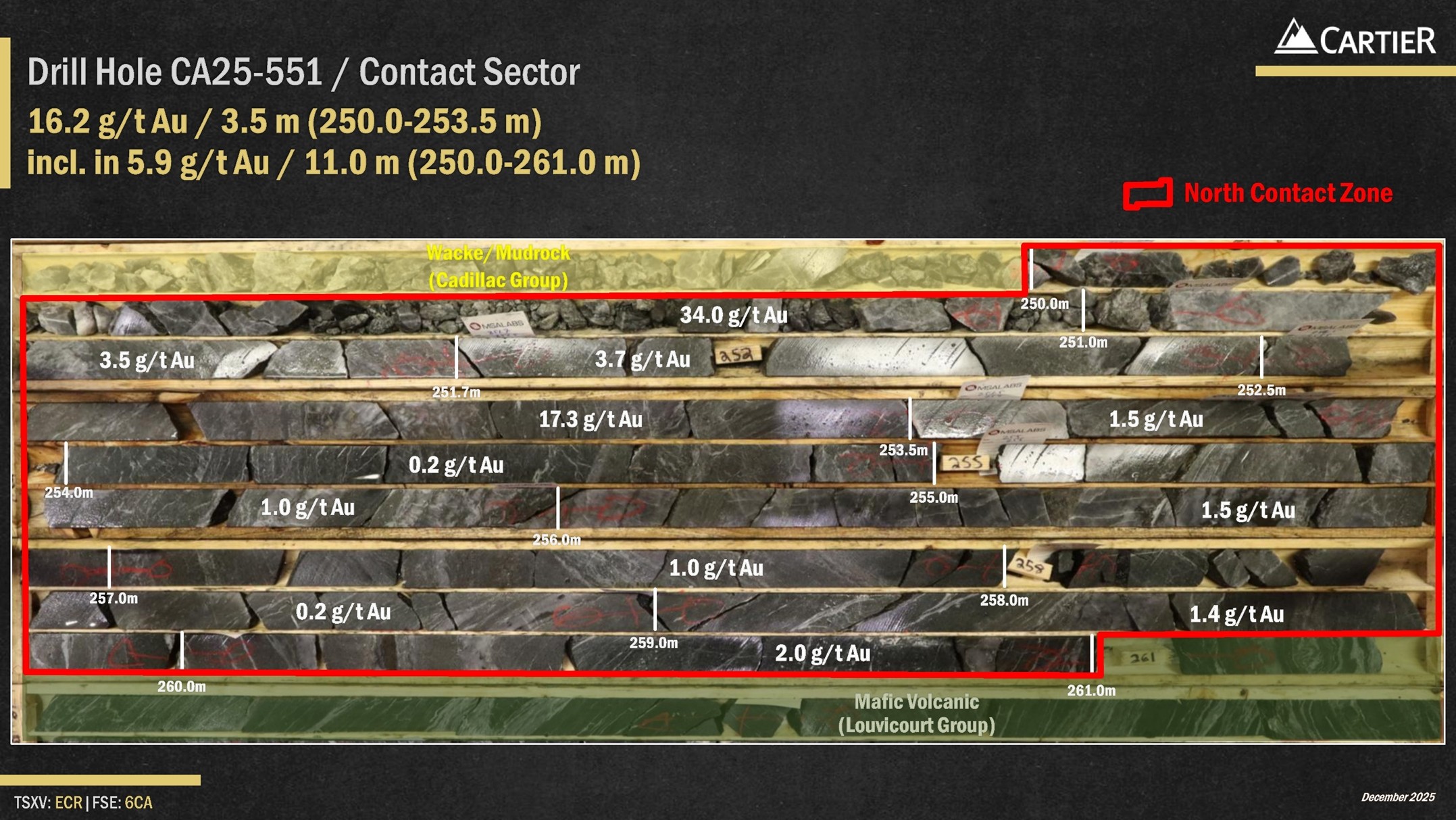

Drill Hole Results of NCZ (Figures 1 & 2)

- CA25-551 intersected 16.2 g/t Au over 3.5 m included in 5.9 g/t Au over 11.0 m (NCZ3).

- CA25-546 graded 57.8 g/t Au over 0.5 m included in 16.1 g/t Au over 2.0 m (NCZ3).

- CA25-544 intersected 1.0 g/t Au over 16.0 m (NCZ3).

- CA25-546 graded 29.7 g/t Au over 0.7 m (NCZ1).

- CA25-551 reported 11.6 g/t Au over 1.0 m (NCZ2).

Significance for Investors

- Recent drilling results continue to clearly demonstrate the presence of a shallow and extensive mineralized system (400 m in strike length by 300 m in depth), hosting multiple stacked high-grade gold zones with significant grades- widths and continuity-

- The newly identified Héva Fault Zone confirms the gold system remains robust and open in all directions, suggesting significant expansion potential-

- The combination of exposed bedrock- minimal overburden (5 m) and proximity to year-round road access (250 m) positions NCZ as a highly strategic asset for potential shallow operation scenarios-

Next Steps

- Upcoming exploration drilling is planned to test several new high-priority regional targets along strike of the Contact Sector, backed by detailed structural and geological modelling and VRIFY's artificial intelligence (AI) driven targeting, reinforcing the potential for additional gold discoveries-

- Advancing work on the new Nordeau Sector where initial mineralized showings have already been identified, but poorly tested and defined. Further drilling is expected to significantly refine the geological model and determine the gold enrichment-

- With the release of its fourth batch of results at the NCZ, we have again exceeded expectations confirming the strength and continuity of this high-grade gold system and reinforcing the strategic importance of directing exploration efforts at this sector. The Contact Sector clearly merits an expanded drilling program to obtain a more comprehensive evaluation of its gold potential. " - Philippe Cloutier, President and CEO of Cartier.

- The newly identified Héva Fault Zone is emerging as a highly promising growth opportunity. The first drill holes more than 500 m east of NCZ have already intersected visible gold, confirming the corridor's continuity and potential scale. Early regional drilling results are very encouraging, and with more than 5 km of untested ground still open to the east, this sector offers significant upside for additional gold discoveries. " - Ronan Deroff, Vice President Exploration of Cartier.

Figure 1: Plan view, cross and long sections of the Contact Sector

Figure 2: Photos of the drill core from hole CA25-551

Table 1: Drill hole best assay results from Contact Sector

| Hole Number | From (m) | To (m) | Core Length** (m) | Au (g/t) Uncut | Vertical Depth (m) | Zone |

| CA25-535 | 327.0 | 328.0 | 1.0 | 17.0 | ˜315 | NCZ3 |

| CA25-540 | 28.0 | 32.0 | 4.0 | 2.5 | ˜25 | NCZ2 |

| Including | 29.0 | 30.0 | 1.0 | 5.2 | ||

| CA25-541 | 91.0 | 93.0 | 2.0 | 3.6 | ˜65 | NCZ3 |

| Including | 92.0 | 93.0 | 1.0 | 6.1 | ||

| CA25-544 | 101.0 | 117.0 | 16.0 | 1.0 | ˜105 | NCZ3 |

| CA25-546 | 38.0 | 38.7 | 0.7 | 29.7 | ˜40 | NCZ1 |

| And | 106.5 | 108.5 | 2.0 | 16.1* | ˜105 | NCZ3 |

| Including | 107.3 | 107.8 | 0.5 | 57.8* | ||

| CA25-548 | 116.9 | 121.0 | 4.1 | 2.2 | ˜95 | NCZ1 |

| CA25-549 | 136.0 | 138.0 | 2.0 | 2.7 | ˜120 | NCZ1 |

| And | 201.0 | 211.0 | 10.0 | 1.1 | ˜180 | NCZ3 |

| CA25-550 | 187.9 | 189.0 | 1.1 | 6.5 | ˜180 | NCZ2 |

| CA25-551 | 188.0 | 189.0 | 1.0 | 5.5* | ˜180 | NCZ1 |

| And | 210.0 | 211.0 | 1.0 | 11.6 | ˜205 | NCZ2 |

| And | 250.0 | 261.0 | 11.0 | 5.9 | ˜250 | NCZ3 |

| Including | 250.0 | 253.5 | 3.5 | 16.2 |

* Occurrences of visible gold (VG) have been noted in the drill core at various intervals. ** Based on the observed intercept angles within the drill core, true thicknesses are estimated to represent approximately 60-85% of the reported core length intervals.

Contact Sector

The Contact Sector is a highly prospective area featuring the North Contact Zone and several newly defined high-priority drill targets.

The NCZ lies along an east-west trending, strongly sheared corridor (Héva Fault Zone), situated approximately 900 m north of the Cadillac Fault Zone, and occurs at the contact between the hanging wall mafic to intermediate volcanics (basalt to andesite) of Louvicourt Group and the footwall turbiditic sedimentary rocks (wacke-mudrock) of Cadillac Group. This lithological contact is a favorable horizon for hydrothermal fluid flow, likely related to synvolcanic gold deposition.

The NCZ, defined by at least three parallel gold-rich zones, are typically and primarily associated with a fine-grained and disseminated arsenopyrite-pyrrhotite mineralization, with a pervasive biotite-chlorite-carbonate alteration, all crosscut by late-stage smoky quartz vein and veinlet stockworks containing visible gold. Locally, accessory minerals such as sphalerite, galena and tourmaline are observed.

Milestones of 2025-2027 Exploration Program

100,000 m Drilling Program (Q3 2025 to Q2 2027)

The ambitious 600-hole drilling program will both expand known gold zones and test new shallow surface high-potential targets. The objective is to unlock the camp-scale, high-grade gold potential along the 15 km Cadillac Fault Zone. It is important to note that Cartier's recent consolidation of this large land holding offers the unique opportunity in over 90 years for unrestricted exploration.

Environmental Baseline Studies & Economic Evaluation of Chimo mine tailings (Q3 2025 to Q3 2026)

The baseline studies will be divided into two distinct parts which include 1) environmental baseline desktop study and 2) preliminary environmental geochemical characterization. The initial baseline studies will provide a comprehensive understanding of the current environmental conditions and implement operations that minimize environmental impact while optimizing the economic potential of the project. These studies will be supplemented by an initial assessment of the economic potential of the past-producing Chimo mine tailings to determine whether a quantity of gold can be extracted economically.

Metallurgical Sampling and Testwork Program (Q4 2025 to Q1 2026)

The metallurgical testwork program includes defining of expected gold recovery rates and improving historical results from the Chimo deposit, as well as establishing metallurgical recovery data for the first-time for the East Chimo and West Nordeau satellite deposits, where no previous data exists. This comprehensive program will characterize the mineralized material, gold recovery potential and validate optimal grind size defining the most efficient and cost-effective flowsheet. The data generated will directly support optimized project development and have the potential to significantly reduce both capital and operating costs, while also improving the environmental footprint.

Mineral Resource Estimate Update (Q4 2025 to Q1 2026)

The upcoming gold resource update will, for the first time, consolidate all mineralized zones across the entire project, providing a more complete picture of its growth potential. This update will integrate the current resource with over 52,000 meters of drilling completed by Cartier between 2022 and 2024, as well as all data from the historic East Cadillac property.

Table 2: Drill hole collar coordinates from Contact Sector

| Hole Number | UTM Easting (m) | UTM Northing (m) | Elevation (m) | Azimuth | Hole Length (m) | |

| CA25-540 | 335448 | 5320085 | 366 | 205 | -47 | 132 |

| CA25-541 | 335448 | 5320085 | 366 | 153 | -45 | 114 |

| CA25-542 | 335448 | 5320085 | 366 | 166 | -71 | 147 |

| CA25-543 | 335527 | 5320083 | 365 | 180 | -45 | 120 |

| CA25-544 | 335527 | 5320083 | 365 | 203 | -69 | 177 |

| CA25-546 | 335647 | 5320071 | 361 | 221 | -65 | 171 |

| CA25-548 | 335534 | 5320170 | 367 | 197 | -52 | 240 |

| CA25-549 | 335534 | 5320170 | 367 | 203 | -62 | 270 |

| CA25-550 | 335534 | 5320170 | 367 | 203 | -71 | 312 |

| CA25-551 | 335534 | 5320170 | 367 | 173 | -78 | 375 |

Table 3: Drill hole detailed assay results from Contact Sector

| Hole Number | From (m) | To (m) | Core Length* (m) | Au (g/t) Uncut | Vertical Depth (m) | Zone |

| CA25-540 | 28.0 | 32.0 | 4.0 | 2.5 | ˜25 | NCZ2 |

| Including | 28.0 | 29.0 | 1.0 | 2.6 | ||

| Including | 29.0 | 30.0 | 1.0 | 5.2 | ||

| Including | 31.0 | 32.0 | 1.0 | 1.5 | ||

| And | 85.0 | 86.0 | 1.0 | 4.6 | ˜60 | NCZ3 |

| CA25-541 | 29.0 | 33.0 | 4.0 | 1.8 | ˜25 | NCZ2 |

| Including | 29.0 | 30.0 | 1.0 | 1.9 | ||

| Including | 30.0 | 31.0 | 1.0 | 1.8 | ||

| Including | 32.0 | 33.0 | 1.0 | 2.8 | ||

| And | 91.0 | 93.0 | 2.0 | 3.6 | ˜65 | NCZ3 |

| Including | 91.0 | 92.0 | 1.0 | 1.1 | ||

| Including | 92.0 | 93.0 | 1.0 | 6.1 | ||

| CA25-542 | 28.0 | 30.0 | 2.0 | 1.9 | ˜30 | NCZ1 |

| Including | 28.0 | 29.0 | 1.0 | 2.2 | ||

| Including | 29.0 | 30.0 | 1.0 | 1.5 | ||

| And | 51.0 | 52.0 | 1.0 | 1.0 | ˜50 | NCZ2 |

| And | 53.0 | 54.0 | 1.0 | 1.7 | ||

| CA25-543 | 31.0 | 32.0 | 1.0 | 1.2 | ˜25 | NCZ1 |

| And | 51.0 | 52.0 | 1.0 | 1.1 | ˜40 | NCZ2 |

| And | 73.0 | 74.0 | 1.0 | 2.2 | ˜55 | NCZ3 |

| And | 86.0 | 87.0 | 1.0 | 1.2 | ˜65 | |

| CA25-544 | 26.0 | 27.0 | 1.0 | 1.2 | ˜25 | - |

| And | 42.0 | 43.0 | 1.0 | 1.8 | ˜45 | NCZ1 |

| And | 55.0 | 56.0 | 1.0 | 1.5 | ˜55 | NCZ2 |

| And | 101.0 | 117.0 | 16.0 | 1.0 | ˜105 | NCZ3 |

| Including | 101.0 | 102.0 | 1.0 | 2.8 | ||

| Including | 102.0 | 103.0 | 1.0 | 2.0 | ||

| Including | 111.0 | 112.0 | 1.0 | 1.2 | ||

| Including | 112.0 | 113.0 | 1.0 | 1.7 | ||

| Including | 113.0 | 114.0 | 1.0 | 2.4 | ||

| Including | 116.0 | 117.0 | 1.0 | 3.9 | ||

| CA25-546 | 38.0 | 38.7 | 0.7 | 29.7 | ˜40 | NCZ1 |

| And | 106.5 | 108.5 | 2.0 | 16.1* | ˜105 | NCZ3 |

| Including | 106.5 | 107.3 | 0.8 | 1.0 | ||

| Including | 107.3 | 107.8 | 0.5 | 57.8* | ||

| Including | 107.8 | 108.5 | 0.7 | 3.7 | ||

| And | 119.0 | 120.0 | 1.0 | 1.1 | ˜120 | |

| And | 121.0 | 122.0 | 1.0 | 1.0 | ||

| And | 124.0 | 124.7 | 0.7 | 1.9 | ||

| CA25-548 | 116.9 | 121.0 | 4.1 | 2.2 | ˜95 | NCZ1 |

| Including | 116.9 | 118.0 | 1.1 | 2.7 | ||

| Including | 119.0 | 120.0 | 1.0 | 4.3 | ||

| Including | 120.0 | 121.0 | 1.0 | 1.2 | ||

| And | 173.0 | 174.0 | 1.0 | 1.4 | ˜135 | NCZ3 |

| And | 174.0 | 175.0 | 1.0 | 1.8 | ||

| CA25-549 | 136.0 | 137.0 | 1.0 | 4.5 | ˜120 | NCZ1 |

| And | 137.0 | 138.0 | 1.0 | 1.0 | ||

| And | 153.6 | 154.5 | 0.9 | 1.1 | ˜135 | NCZ2 |

| And | 191.0 | 192.0 | 1.0 | 3.6 | ˜165 | NCZ3 |

| And | 201.0 | 211.0 | 10.0 | 1.1 | ˜180 | |

| Including | 201.0 | 202.0 | 1.0 | 1.3 | ||

| Including | 203.0 | 204.0 | 1.0 | 2.9 | ||

| Including | 204.0 | 204.5 | 0.5 | 1.4 | ||

| Including | 208.0 | 209.0 | 1.0 | 4.7 | ||

| CA25-550 | 163.0 | 164.2 | 1.2 | 2.3 | ˜155 | NCZ1 |

| And | 187.9 | 189.0 | 1.1 | 6.5 | ˜180 | NCZ2 |

| And | 263.9 | 264.7 | 0.8 | 2.3 | ˜245 | NCZ3 |

| CA25-551 | 183.0 | 189.0 | 6.0 | 1.3* | ˜180 | NCZ1 |

| Including | 183.0 | 184.0 | 1.0 | 1.5 | ||

| Including | 188.0 | 188.5 | 0.5 | 5.8* | ||

| Including | 188.5 | 189.0 | 0.5 | 5.3 | ||

| And | 201.0 | 202.0 | 1.0 | 1.1 | ˜195 | - |

| And | 210.0 | 211.0 | 1.0 | 11.6 | ˜205 | NCZ2 |

| And | 250.0 | 261.0 | 11.0 | 5.9 | ˜250 | NCZ3 |

| Including | 250.0 | 251.0 | 1.0 | 34.0 | ||

| Including | 251.0 | 251.7 | 0.7 | 3.5 | ||

| Including | 251.7 | 252.5 | 0.8 | 3.7 | ||

| Including | 252.5 | 253.5 | 1.0 | 17.3 | ||

| Including | 253.5 | 254.0 | 0.5 | 1.5 | ||

| Including | 255.0 | 256.0 | 1.0 | 1.0 | ||

| Including | 256.0 | 257.0 | 1.0 | 1.5 | ||

| Including | 257.0 | 258.0 | 1.0 | 1.0 | ||

| Including | 259.0 | 260.0 | 1.0 | 1.4 | ||

| Including | 260.0 | 261.0 | 1.0 | 2.0 | ||

| And | 268.0 | 269.0 | 1.0 | 1.3 | ˜265 | |

| And | 274.0 | 275.0 | 1.0 | 1.2 |

* Occurrences of visible gold (VG) have been noted in the drill core at various intervals. ** Based on the observed intercept angles within the drill core, true thicknesses are estimated to represent approximately 60-85% of the reported core length intervals.

Quality Assurance and Quality Control (QA/QC) Program

The drill core from the Cadillac Project is NQ-size and, upon receipt from the drill rig, is described and sampled by Cartier geologists. Core is sawn in half, with one half labelled, bagged and submitted for analysis and the other half retained and stored at Cartier's coreshack facilities located in Val-d'Or, Quebec, for future reference and verification. As part of Quality Assurance and Quality Control (QA/QC) program, Cartier inserts blank samples and certified reference materials (standards) at regular intervals into the sample stream prior to shipment to monitor laboratory performance and analytical accuracy.

Drill core samples are sent to MSALABS's analytical laboratory located in Val-d'Or, Quebec, for preparation and gold analysis. The entire sample is dried and crushed (70% passing a 2-millimeter sieve). The analysis for gold is performed on an approximately 500 g aliquot using Chrysos Photon Assay technology, which uses high-energy X-ray excitation with gamma detection to quickly and non-destructively measure gold content.

Alternatively, samples are submitted to Activation Laboratories Ltd. ("Actlabs"), located in either Val-d'Or or Ste-Germaine-Boulé, both in Quebec, for preparation and gold analysis. The entire sample is dried, crushed (90% passing a 2-millimetre sieve) and 250 g is pulverized (90% passing a 0.07-millimetre sieve). The analysis for gold is conducted using a 50 g fire assay fusion with atomic absorption spectroscopy (AAS) finish, with a detection limit up to 10,000 ppb. Samples exceeding this threshold are reanalyzed by fire assay with a gravimetric finish to determine high-grade values accurately.

Both MSALABS and Actlabs are ISO/IEC 17025 accredited for gold assays and implement industry-standard QA/QC protocols. Their internal quality control programs include the use of blanks, duplicates, and certified reference materials at set intervals, with established acceptance criteria to ensure data integrity and analytical precision.

Qualified Person

The scientific and technical content of this press release has been prepared, reviewed and approved by Mr. Ronan Déroff, P.Geo., M.Sc., Vice President Exploration, who is a ?Qualified Person? as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects (?NI 43-101?).

About Cadillac Project

The Cadillac Project, covering 14,000 hectares along a 15-kilometre stretch of the Cadillac Fault, is one of the largest consolidated land packages in the Val-d'Or mining camp. Cartier's flagship asset integrates the historic Chimo Mine and East Cadillac projects, creating a dominant position in a world class gold mining district. With excellent road access, year-round infrastructure and nearby milling capacity, the project is ideally positioned for rapid advancement and value creation.

Using a gold price of US$1,750/oz, a Preliminary Economic Assessment demonstrated the economic viability of a 2-km segment, compared to the 15 km that will be the subject of the 100,000 m drilling program, with an average annual gold production of 116,900 oz over a 9.7-year mine life. Indicated resources are estimated at 720,000 ounces (7.1 million tonnes at 3.1 g/t Au) and inferred resources at 1,633,000 ounces (18.5 million tonnes at 2.8 g/t Au). Please see the NI 43-101 ?Technical Report and Preliminary Economic Assessment for Chimo Mine and West Nordeau Gold Deposits, Chimo Mine and East Cadillac Properties, Quebec, Canada, Marc R. Beauvais, P.Eng., of InnovExplo Inc., Mr. Florent Baril of Bumigeme and Mr. Eric Sellars, P.Eng. of Responsible Mining Solutions? effective May 29, 2023.

About Cartier Resources Inc.

Cartier Resources Inc., founded in 2006 and headquartered in Val-d'Or (Quebec) is a gold exploration company focused on building shareholder value through discovery and development in one of Canada's most prolific mining camps. The Company combines strong technical expertise, a track record of successful exploration, and a fully funded program to advance its flagship Cadillac Project. Cartier's strategy is clear: unlock the full potential of one of the largest undeveloped gold landholdings in Quebec.

For further information, contact:

Philippe Cloutier, P. Geo.

President and CEO

Telephone: 819-856-0512

philippe.cloutier@ressourcescartier.com

www.ressourcescartier.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c61ca3f9-673a-4b43-b0dc-d0948b87280b

https://www.globenewswire.com/NewsRoom/AttachmentNg/532c6509-160c-43fc-84ba-38a8e370fbfd