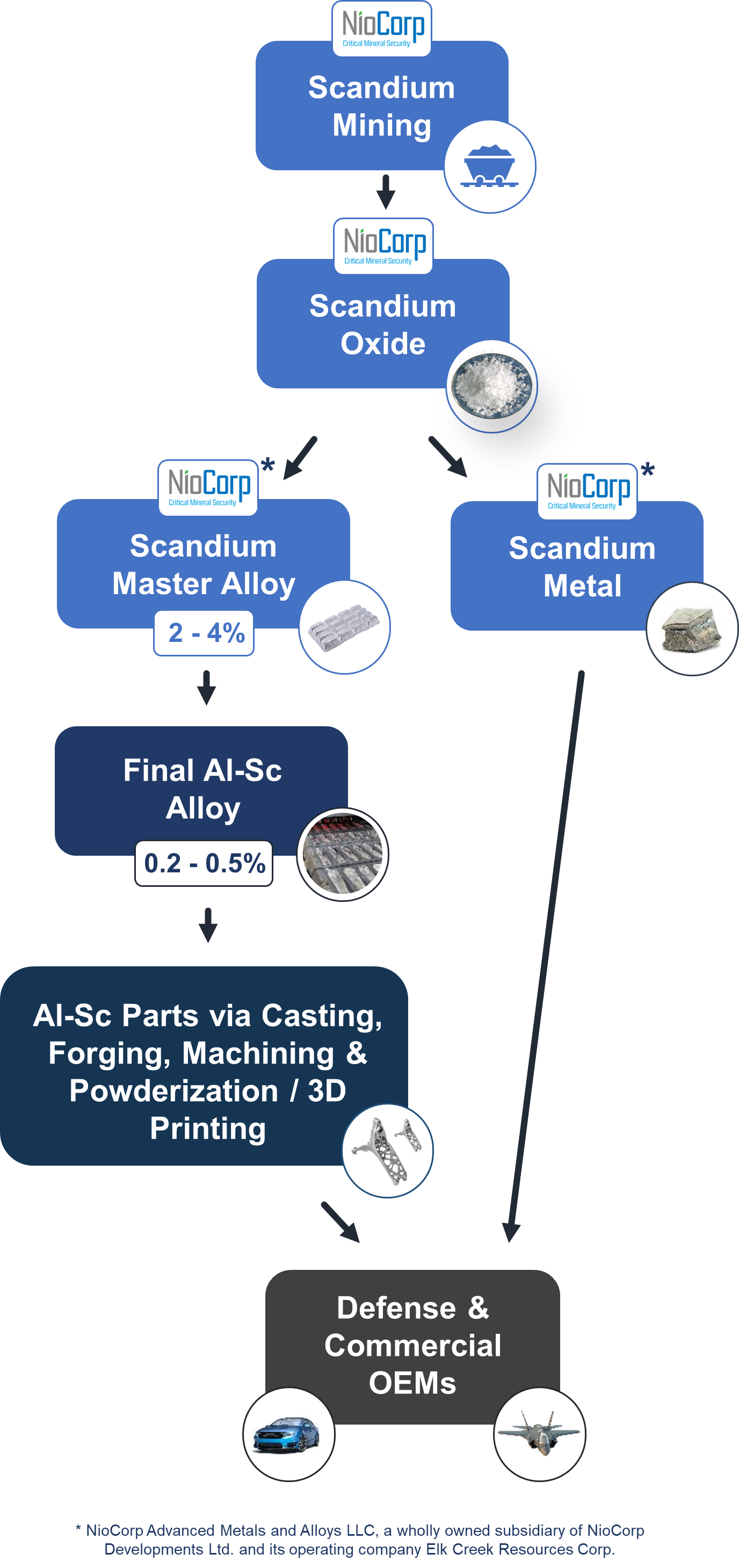

Acquisition of the Manufacturing Assets and IP from FEA Materials is Expected to Position NioCorp to Produce Master Alloy as Defense and Commercial Market Demand Grows

Once its Elk Creek Critical Minerals Project is Fully Financed and Operational, NioCorp Will be Positioned to Operate a Vertically Integrated Domestic Scandium Mine-to-Markets Supply Chain

NioCorp Also is Examining the Feasibility of Integrating Down to the Production of Finished Aluminum-Scandium Alloy Parts via Casting, Forging and Machining for OEM Manufacturers in Defense and Commercial Markets

CENTENNIAL, CO / ACCESS Newswire / December 4, 2025 / NioCorp Developments Ltd. ("NioCorp" or the "Company") (NASDAQ:NB), a leading U.S. critical minerals developer, is pleased to announce that it has completed the purchase of the manufacturing assets and intellectual property ("IP") of Massachusetts-based FEA Materials LLC ("FEA"), which is expected to enable NioCorp to produce aluminum-scandium ("Al-Sc") master alloy in the U.S. as market demand grows. Once its Nebraska mine and processing facility are fully financed and operational, the acquisition positions NioCorp to establish America's first scandium supply chain that vertically integrates mining, scandium oxide production, and Al-Sc master alloy production for both defense and commercial manufacturers.

NioCorp Advanced Metals and Alloys LLC ("NAMA"), a newly formed subsidiary of NioCorp and its operating company Elk Creek Resources Corp. ("ECRC"), completed the all-cash $8.4 million purchase of FEA's assets and IP on December 4, 2025. FEA has been engaged in the commercial manufacturing of 2% - 4% Al-Sc master alloy via an innovative process that converts scandium oxide directly into Al-Sc master alloy, bypassing the interim step of first converting the oxide into metal before making Al-Sc master alloy.

NioCorp plans to begin mining scandium-containing ore and producing scandium oxide at its Elk Creek Critical Minerals Project in Nebraska as soon as possible, contingent upon final project financing and construction. In addition to scandium, NioCorp also intends to produce niobium and titanium products and, potentially, light and heavy rare earth oxides in Nebraska.

NioCorp is now examining the feasibility of extending its potential domestic scandium supply chain to include production of finished Al-Sc alloy (0.1% - 0.5% scandium content) for sale to Al-Sc powder manufacturers and to support the manufacturing of custom Al-Sc alloy parts that are cast, forged, and/or machined in the U.S.

"This strategic acquisition positions NioCorp to potentially build out America's first vertically integrated U.S. scandium supply chain from the mine to finished alloy parts for both defense and commercial manufacturers," said Mark A. Smith, CEO and Chairman of NioCorp.

"Our scandium alloying technology is the result of strong U.S. ingenuity and engineering and will be a key to helping grow scandium-based structural alloys in the years to come. NioCorp is the best group to pioneer this market with its vertically-integrated strategy," said Eugene Prahin, CEO of FEA Materials.

On August 5, 2025, it was announced that the Pentagon's Title III Program had agreed to provide ECRC with up to $10 million in funding to advance the Elk Creek Critical Minerals Project and to support the production of scandium oxide. (See this announcement). Following that award, ECRC entered into a collaboration with Lockheed Martin on the design, testing, and production of airworthy aluminum-scandium parts for advanced fighter jets and other aerospace platforms. (See this announcement). Finally, the Pentagon award also included funding to allow ECRC to demonstrate the ability to convert scandium oxide into high-purity scandium metal, used in advanced electronics applications for both defense and commercial applications.

"We are extremely grateful for the Pentagon's support in our effort to build out this supply chain, and we are now pleased to invest our own resources to leverage the Pentagon's investment and further build out this U.S. domestic supply chain," Mr. Smith said. "Working jointly with the Pentagon, NioCorp is committed to positioning America to better insulate our nation from years of scandium market and price manipulation by the People's Republic of China, which has held back the development of many scandium-based technologies that would greatly benefit our men and women in uniform."

Mr. Smith also praised Rio Tinto, through its Element 21 North subsidiary, for its production of scandium oxide and Al-Sc master alloy at its facility in Sorel-Tracy, Quebec. "Rio Tinto has served as a commercial pioneer in the development of a North American supply chain and deserves a lot of credit for making scandium available for several developing markets and applications of importance to the U.S."

Prospective U.S. Scandium Mine-to-Markets Supply Chain

The development of a complete U.S. domestic scandium mine-to-markets supply chain is likely to include the following components. NioCorp is examining the feasibility of operating across several portions of this prospective supply chain.

Qualified Persons:

Scott Honan, M.Sc., SME-RM, COO of NioCorp Developments Ltd., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information contained in this news release.

# # #

FOR MORE INFORMATION:

Jim Sims, Corporate Communications Officer, NioCorp Developments Ltd., (720) 334-7066, jim.sims@niocorp.com

Alex Guthrie, Director, Investor Relations, NioCorp Developments Ltd., (647) 999-0527, aguthrie@niocorp.com

@NioCorp $NB Niobium Scandium rareearth neodymium dysprosium terbium ElkCreek

ABOUT NIOCORP

NioCorp is developing the Elk Creek Project that is expected to produce niobium, scandium, and titanium. The Company also is evaluating the potential to produce several rare earths from the Elk Creek Project. Niobium is used to produce specialty alloys as well as High Strength, Low Alloy steel, which is a lighter, stronger steel used in automotive, structural, and pipeline applications. Scandium is a specialty metal that can be combined with Aluminum to make alloys with increased strength and improved corrosion resistance. Scandium is also a critical component of advanced solid oxide fuel cells. Titanium is used in various lightweight alloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor, and medical implants. Magnetic rare earths, such as neodymium, praseodymium, terbium, and dysprosium are critical to the making of neodymium-iron-boron magnets, which are used across a wide variety of defense and civilian applications.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws (collectively "forward-looking statements"). Forward-looking statements may include, but are not limited to, statements that the acquisition of the manufacturing assets and IP of FEA is expected to enable NioCorp to produce Al-Sc master alloy in the U.S. as market demand grows; NioCorp's ability to establish America's first scandium supply chain that vertically integrates mining, scandium oxide production, and Al-Sc master alloy production for both defense and commercial manufacturers; the Company's plans to mine scandium-containing ore and produce scandium oxide at its Elk Creek Critical Minerals Project; NioCorp's ability to extend its potential domestic scandium supply chain to include production of finished Al-Sc alloy (0.1% - 0.5% scandium content) for sale to Al-Sc powder manufacturers and to support the manufacturing of custom Al-Sc alloy parts that are cast, forged, and/or machined in the U.S.; statements regarding the components of a complete U.S. domestic scandium mine-to-markets supply chain; NioCorp's ability to operate across several portions of this prospective supply chain; the Company's expectation and intention of producing niobium, scandium, and titanium, and the potential of producing rare earths, at the Elk Creek Project; and NioCorp's ability to secure sufficient project financing to complete construction of the Elk Creek Project and move it to commercial operation. Forward-looking statements are typically identified by words such as "plan," "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of NioCorp and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations and assumptions relating to: NioCorp's ability to receive sufficient project financing for the construction of the Elk Creek Project on acceptable terms, or at all; the future price of and demand for metals, including Al-Sc alloy; and the stability of the financial and capital markets. Such expectations and assumptions are inherently subject to uncertainties and contingencies regarding future events and, as such, are subject to change. Forward-looking statements involve a number of risks, uncertainties or other factors that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made by NioCorp with the Securities and Exchange Commission and with the applicable Canadian securities regulatory authorities and the following: NioCorp's requirement of significant additional capital; NioCorp's ability to receive sufficient project financing for the construction of the Elk Creek Project on acceptable terms, or at all; NioCorp's ability to achieve the required milestones and receive the full $10.0 million in reimbursement under the Project Sub-Agreement with Advanced Technology International, an entity acting on behalf of the Defense Industrial Base Consortium under the authority of the U.S. Department of War; NioCorp's ability to receive a final commitment of financing from the Export-Import Bank of the United States or other debt financing or financial support on acceptable timelines, on acceptable terms, or at all; NioCorp's ability to access the full amount of the expected net proceeds under the standby equity purchase agreement (the "Yorkville Equity Facility Financing Agreement") with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP; NioCorp's ability to continue to meet the listing standards of The Nasdaq Stock Market LLC; risks relating to NioCorp's common shares, including price volatility, lack of dividend payments and dilution or the perception of the likelihood of any of the foregoing; the extent to which NioCorp's level of indebtedness and/or the terms contained in agreements governing NioCorp's indebtedness, if any, the Yorkville Equity Facility Financing Agreement or other agreements may impair NioCorp's ability to obtain additional financing, on acceptable terms, or at all; covenants contained in agreements with NioCorp's secured creditors that may affect its assets; NioCorp's limited operating history; NioCorp's history of losses; the material weaknesses in NioCorp's internal control over financial reporting, NioCorp's efforts to remediate such material weaknesses and the timing of remediation; the possibility that NioCorp may qualify as a passive foreign investment company under the U.S. Internal Revenue Code of 1986, as amended (the "Code"); the potential that the business combination with GX Acquisition Corp. II and other related transactions could result in NioCorp becoming subject to materially adverse U.S. federal income tax consequences as a result of the application of Section 7874 and related sections of the Code; cost increases for NioCorp's exploration and, if warranted, development projects; a disruption in, or failure of, NioCorp's information technology systems, including those related to cybersecurity; equipment and supply shortages; variations in the market demand for, and prices of, niobium, scandium, titanium and rare earth products; current and future offtake agreements, joint ventures, and partnerships, including NioCorp's ability to negotiate extensions to existing agreements or to enter into new agreements, on favorable terms or at all; NioCorp's ability to attract qualified management; estimates of mineral resources and reserves; mineral exploration and production activities; feasibility study results; the results of metallurgical testing; the results of technological research; changes in demand for and price of commodities (such as fuel and electricity) and currencies; competition in the mining industry; changes or disruptions in the securities markets; legislative, political or economic developments, including changes in federal and/or state laws that may significantly affect the mining and scandium alloy industries; trade policies and tensions, including tariffs; inflationary pressures; the impacts of climate change, as well as actions taken or required by governments related to strengthening resilience in the face of potential impacts from climate change; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the timing and reliability of sampling and assay data; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of NioCorp's projects; risks of accidents, equipment breakdowns, and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining, development or scandium alloy production activities; management of the water balance at the Elk Creek Project site; land reclamation requirements related to the Elk Creek Project; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; claims on the title to NioCorp's properties; [the infringement or loss of NioCorp's intellectual property rights;] potential future litigation; and NioCorp's lack of insurance covering all of NioCorp's operations.

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of NioCorp prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the matters addressed herein and attributable to NioCorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Except to the extent required by applicable law or regulation, NioCorp undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

SOURCE: NioCorp Developments Ltd.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/niocorp-acquires-scandium-alloy-assets-to-support-potential-first-ever-vertically-1114774