~ Founder Commits Personal Capital at $4.00 Per Share, Demonstrating Strong

Insider Confidence ~

~ Investment Follows October Open Market Purchases by Management Team -

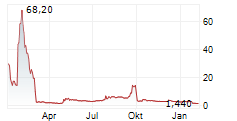

NEW YORK, Dec. 05, 2025 (GLOBE NEWSWIRE) -- Nuvini Group Limited (Nasdaq: NVNI) ("Nuvini" or the "Company"), Latin America's leading serial acquirer of B2B SaaS companies, today announced that Founder and Chief Executive Officer Pierre Schurmann has entered into a binding investment agreement to invest $6 million of personal capital in the Company through a direct private placement of equity securities, subject to closing conditions.

The investment represents one of the strongest demonstrations of insider confidence, with Mr. Schurmann committing substantial personal funds at a purchase price of $4.00 per share-a significant premium to current market price-alongside warrants to purchase additional 300,000 shares at $25.00 per share. This transaction follows open market share purchases by members of Nuvini's management team in October 2025.

Founder Doubles Down on Growth Vision

Under the terms of the agreement, Xurmann Investments Ltd, an investment vehicle wholly-owned by Mr. Schurmann, will acquire 1,500,000 ordinary shares at $4.00 per share, along with five-year warrants to purchase 300,000 additional shares at an exercise price of $25.00 per share. If the warrants are fully exercised, they would generate an additional $7.5 million in proceeds for the Company.

Following the closing, the Company will have 11,533,802 ordinary shares outstanding. The proceeds will be deployed for debt repayment and to support Nuvini as the Company executes on its acquisition strategy.

"This investment reflects my unwavering confidence in Nuvini's business model, our execution capabilities, and the significant value creation opportunity ahead," said Pierre Schurmann, Founder and Chief Executive Officer of Nuvini. "By committing $6 million of personal capital at a substantial premium to current market prices, I am reinforcing my belief that Nuvini's shares represent exceptional value at these levels. We have a robust pipeline of high-quality acquisition targets, a proven track record of integration, and an AI-first operating strategy that is driving meaningful margin expansion across our portfolio."

Strong Signal of Management Alignment

The investment underscores the deep alignment between management and shareholders, with Mr. Schurmann significantly increasing his economic stake in the Company's future success. The transaction follows a series of strategic initiatives announced throughout 2025, including:

- FY2025 EBITDA guidance of $9-11 million USD, with a clear path to $85-95 million run-rate EBITDA by end of Q1 2026 through strategic acquisitions

- Launch of NuviniAI Lab and NuviniAI Index, driving 40% average productivity gains and positioning the Company as a leader in AI-enabled SaaS operations

- Implementation of performance-based executive compensation tied to ROIC and organic revenue growth

- Regaining and maintaining NASDAQ compliance throughout 2025

"When a founder commits this level of personal capital at a significant premium, it sends an unambiguous message to the market," Schurmann continued. "I am investing because I believe we are dramatically undervalued relative to our earnings power, growth trajectory, and the quality of our business "

Transaction Terms and Closing

The transaction is expected to close within 45 days, subject to customary closing conditions including corporate and regulatory approvals.

About Nuvini

Headquartered in São Paulo, Brazil, Nuvini is Latin America's leading private serial acquirer of business to business (B2B) software as a service (SaaS) companies. The Company focuses on acquiring profitable, high-growth SaaS businesses with strong recurring revenue and cash flow generation. By fostering an entrepreneurial environment, Nuvini enables its portfolio companies to scale and maintain leadership within their respective industries. The company's long-term vision is to buy, retain, and create value through strategic partnerships and operational expertise.

Forward-Looking Statements

Statements about future expectations, plans and prospects, as well as any other statements regarding matters that are not historical facts, may constitute "forward-looking statements" within the meaning of The Private Securities Litigation Reform Act of 1995. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "will," "would" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. The Company cannot guarantee future results, levels of activity, performance, or achievements. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including, without limitation: the Company's ability to complete the potential acquisitions on the anticipated timeline or at all; general market conditions that could affect the consummation of the potential acquisition; if definitive documents with respect to a potential acquisition are executed, whether the parties will achieve any of the anticipated benefits of any such transactions; and other factors discussed in the "Risk Factors" section of the Company's Ouarterly and Annual Reports filed with the Securities and Exchange Commission ("SEC") and the risks described in other filings that the Company may make with the SEC. Factors or events that could cause the Company's actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. Any forward-looking statements speak only as of the date hereof, and the Company specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. We caution you, therefore, against relying on any of these forward-looking statements.

Investor Relations Contact

Sofia Toledo

ir@nuvini.co

MZ North America

NVNI@mzgroup.us