Initial development completed at New Rise Reno 2, advancing XCF's second SAF production facility and positioning construction to begin in 2026.

$300 million planned investment will double XCF's total SAF production capacity to ~80 million gallons annually, positioning New Rise Reno as a major U.S. SAF production center.

Global demand accelerates as mandates tighten, creating one of the strongest growth opportunities in renewable fuels - one that XCF's modular SAF platform is positioned to capture.

HOUSTON, TX / ACCESS Newswire / December 5, 2025 / XCF Global, Inc. ("XCF") (Nasdaq:SAFX), a key player in decarbonizing the aviation industry through Sustainable Aviation Fuel ("SAF"), today announced new development milestones at its New Rise Reno 2 site, the Company's second SAF production facility and the next deployment of its scalable, modular production platform.

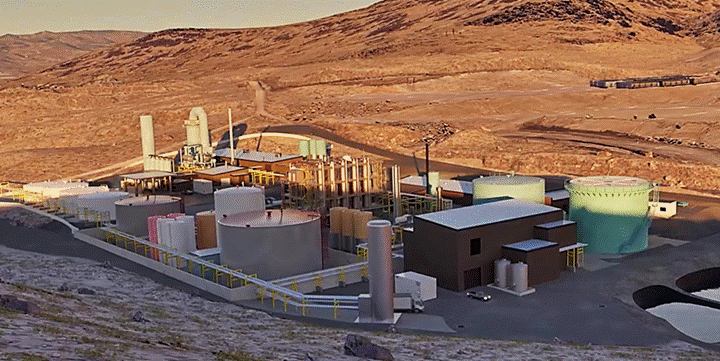

XCF has completed initial site work at New Rise Reno 2, including grading of the 10-acre parcel and construction of new access roads. Engineering, design, and project planning are underway, positioning construction to begin in 2026.

Located adjacent to the existing New Rise Reno facility in Nevada, the new site will benefit from integration with common facilities such as gas, water, rail, and personnel offices as well as existing pre-treatment, hydrogen production, and broader logistics infrastructure - reducing capital costs, lowering execution risk, and accelerating time to production.

Since inception, approximately $350 million has been invested in XCF's flagship New Rise Reno facility. New Rise Reno 2 represents the next phase of this growth strategy, with an expected $300 million investment enabling XCF to double SAF production capacity to ~80 million gallons annually.

Chris Cooper, CEO of XCF Global, commented:

"New Rise Reno 2 is the next leap forward in our growth strategy. By adding a second, fully integrated facility, we're turning New Rise Reno intoa major U.S. SAF production center and positioning XCF for sustained, long-term growth. This expansion exemplifies how XCF grows: intentionally, efficiently, and with a platform built to meet surging global demand."

Expanding Global Reach

The development of New Rise Reno 2 strengthens XCF's ability to meet rising SAF demand across the world's most important aviation markets. In November, XCF signed a Memorandum of Understanding ("MOU") with BGN INT US LLC ("BGN"), a global energy and commodities group, to jointly develop global distribution, marketing, and offtake frameworks across Europe, the Middle East, and other strategic markets.

The partnership would connect XCF's expanding production capacity with BGN's global logistics and trading network, creating an integrated supply chain from feedstock to finished fuel.

This strategic alignment comes as demand accelerates across major aviation markets.

U.S. SAF Grand Challenge: Federal targets call for 3 billion gallons of SAF per year by 2030 and 35 billion gallons to satisfy 100% of domestic demand by 2050; however, current U.S. production remains below 1% of jet fuel demand.

ReFuelEU Aviation Mandates: Airlines will be required to blend 2% SAF in 2025, increasing to 6% by 2030, and 20% by 2035, ultimately rising to 70% by 2050. With regional supply unable to meet these mandated volumes, Europe is expected to face structural shortages and persistently elevated SAF pricing.

Together, the U.S. and Europe represent one of the largest and fastest-growing opportunities in the clean-energy transition, with the U.S. SAF market projected to reach nearly $7 billion by 2030 and global demand exceeding $25 billion. XCF's scalable, modular SAF platform is built to scale directly into this opportunity.

XCF will continue to provide updates as development progresses.

About XCF Global, Inc.

XCF Global, Inc. ("XCF") is a pioneering sustainable aviation fuel company dedicated to accelerating the aviation industry's transition to net-zero emissions. Our flagship facility, New Rise Reno, has a nameplate production capacity of 38 million gallons per year, positioning XCF as an early mover among large-scale SAF producers in North America. XCF is advancing a pipeline of three additional sites in Nevada, North Carolina, and Florida, and is building partnerships across the energy and transportation sectors to scale SAF globally. XCF is listed on the Nasdaq Capital Market and trades under the ticker, SAFX. Current outstanding shares: ~208.3 million; <20% free float (as of December 5, 2025).

To learn more, visit www.xcf.global.

Contacts

XCF Global:

C/O Camarco

XCFGlobal@camarco.co.uk

Media:

Camarco

Andrew Archer | Rosie Driscoll | Violet Wilson

XCFGlobal@camarco.co.uk

Forward-Looking Statements

This Press Release includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expect", "intend", "will", "estimate", "anticipate", "believe", "predict", "potential" or "continue", or the negatives of these terms or variations of them or similar terminology. These forward-looking statements, including, without limitation, statements regarding XCF Global's expectations with respect to future performance and anticipated financial impacts of the recently completed business combination with Focus Impact BH3 Acquisition Company (the "Business Combination"), estimates and forecasts of other financial and performance metrics, and projections of market opportunity and market share, are subject to risks and uncertainties, which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by XCF Global and its management, are inherently uncertain and subject to material change. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) changes in domestic and foreign business, market, financial, political, and legal conditions; (2) unexpected increases in XCF Global's expenses, including manufacturing and operating expenses and interest expenses, as a result of potential inflationary pressures, changes in interest rates and other factors; (3) the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any agreements with regard to XCF Global's offtake arrangements; (4) the outcome of any legal proceedings that may be instituted against the parties to the Business Combination or others; (5) XCF Global's ability to regain compliance with Nasdaq's continued listing standards and thereafter continue to meet Nasdaq's continued listing standards; (6) XCF Global's ability to integrate the operations of New Rise and implement its business plan on its anticipated timeline; (7) XCF Global's ability to raise financing to fund its operations and business plan and the terms of any such financing; (8) the New Rise Reno production facility's ability to produce the anticipated quantities of SAF without interruption or material changes to the SAF production process; (9) the New Rise Reno production facility's ability to produce renewable diesel in commercial quantities without interruption during the ongoing SAF ramp-up process; (10) XCF Global's ability to resolve current disputes between its New Rise subsidiary and its landlord with respect to the ground lease for the New Rise Reno facility; (11) XCF Global's ability to resolve current disputes between its New Rise subsidiary and its primary lender with respect to loans outstanding that were used in the development of the New Rise Reno facility; (12) payment of fees, expenses and other costs related to the completion of the Business Combination and the New Rise acquisitions; (13) the risk of disruption to the current plans and operations of XCF Global as a result of the consummation of the Business Combination; (14) XCF Global's ability to recognize the anticipated benefits of the Business Combination and the New Rise acquisitions, which may be affected by, among other things, competition, the ability of XCF Global to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (15) changes in applicable laws or regulations; (16) risks related to extensive regulation, compliance obligations and rigorous enforcement by federal, state, and non-U.S. governmental authorities; (17) the possibility that XCF Global may be adversely affected by other economic, business, and/or competitive factors; (18) the availability of tax credits and other federal, state or local government support; (19) risks relating to XCF Global's and New Rise's key intellectual property rights, including the possible infringement of their intellectual property rights by third parties; (20) the risk that XCF Global's reporting and compliance obligations as a publicly-traded company divert management resources from business operations; (21) LOIs and MOUs may not advance to definitive agreements or commercial deployment; (22) the effects of increased costs associated with operating as a public company; and (23) various factors beyond management's control, including general economic conditions and other risks, uncertainties and factors set forth in XCF Global's filings with the Securities and Exchange Commission ("SEC"), including the final proxy statement/prospectus relating to the Business Combination filed with the SEC on February 6, 2025, this Press Release and other filings XCF Global made or will make with the SEC in the future. If any of the risks actually occur, either alone or in combination with other events or circumstances, or XCF Global's assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that XCF Global does not presently know or that it currently believes are not material that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect XCF Global's expectations, plans or forecasts of future events and views as of the date of this Press Release. These forward-looking statements should not be relied upon as representing XCF Global's assessments as of any date subsequent to the date of this Press Release. Accordingly, undue reliance should not be placed upon the forward-looking statements. While XCF Global may elect to update these forward-looking statements at some point in the future, XCF Global specifically disclaims any obligation to do so.

SOURCE: XCF Global, Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/clean-technology/xcf-global-moves-to-double-saf-production-with-new-rise-reno-expansion-1115025