FWAG reported November traffic figures with better than expected momentum.

On group level, passengers climbed 8.2% yoy to 3.18m (eNuW: 3.08m), largely driven by VIE (+5.8% yoy to 2.4m) and with strong momentum from MLA (+16.5% yoy to 0.73m).

At VIE, passengers developed better than expected, mainly on the back of a higher no. of aircrafts deployed by the airlines (no. of movements +4.7% yoy) coupled with slightly better utilization rates (passengers per movement: +1.1% yoy). Noteworthy, growth solely stemmed from local passengers, which grew by 6.5% yoy, whereas the no. of transfer passengers remained flat (+0.1% yoy). With November in the books, YTD performance at VIE stands at 30.03m passengers, providing more than enough leeway to reach the guidance of "c. 32m" (eNuW: 32.5m), implying 2.45m (+3% yoy) passengers for Dec'25e (eNuW).

At the popular destination of Malta, passenger growth in November continued with strong momentum (+16.5% yoy to 0.73m), visible throughout the year. Here, the growth was also volume-driven, as aircraft movements increased by 18.5% yoy, whereas utilization rates showed a modest decline from high levels (passengers per movement: -1.7% yoy). On a YTD basis, MLA recorded a 11.8% yoy passenger growth, outperforming most European airports.

At Kosicé (KSC), passengers also grew strongly in November (+13.5% yoy to 0.046m), but remain immaterial for the FWAG group.

The three airports of the FWAG group compare well against its peer group (see p. 2 for details). Especially VIE with Austrian Airlines (AUA) as a home-carrier and thus an important hub within the Lufthansa Group, outperformed other Lufthansa hubs like Frankfurt (+4% yoy) and Munich (+2.6% yoy). Only Zurich (with home-carrier SWISS, part of LH group) outperformed VIE by showing a 7.1% yoy increase in November. Also, the strategic investment Malta has outperformed other holiday destinations (e.g. Athens; + 9.6% yoy), showing its popularity as a travel destination.

Looking ahead, FWAG enters a transitional FY'26e, where lower airport charges (eNuW: -4% yoy) coupled with declining capacities from low-cost carriers (namely Ryanair and Wizz Air) should lead to the first sales decline since FY'20. To offset margin effects from negative operating leverage, FWAG has already started an efficiency and cost reduction programme. Overall, the impact should not be dramatic (eNuW: only -3.5% yoy passengers at VIE; -1.6% on group level) and is expected to be gradually absorbed by the home-carrier AUA (eNuW: fully compensated by Q4 2027e). In addition, the south expansion of Terminal 3 should be completed by early 2027 and looks set to provide additional non-aviation sales thereafter, leading to a return to sustainable sales growth by FY'27e (eNuW).

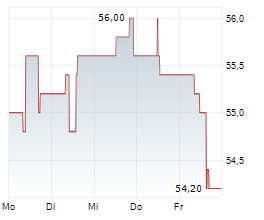

Against this backdrop, shares remain priced adequately. Therefore, we confirm our HOLD recommendation with unchanged PT of € 58.00, based on DCF.

ISIN: AT00000VIE62