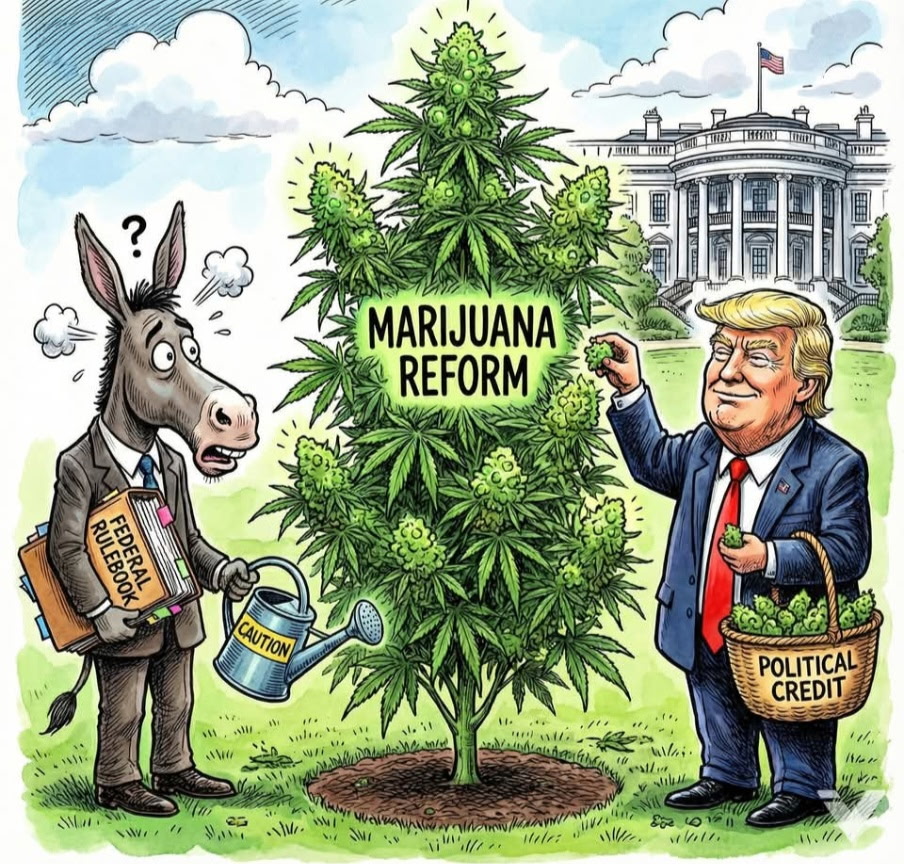

"Federal Marijuana Reform Is Coming-But FDA-Ready Companies Will Benefit the most" Duane Boise CEO MMJ International Holdings stated.

WASHINGTON, DC / ACCESS Newswire / December 17, 2025 / As President Donald Trump considers an executive order to reclassify cannabis to Schedule III and potentially authorize limited Medicare pilot programs MMJ International Holdings today clarified the regulatory reality of this shift: any cannabinoid reimbursed by Medicare must comply with the FDA's rigorous drug approval framework, not the unregulated dietary supplement market.

The anticipated policy shift would mark a definitive end to the era of "medical" speculation and the beginning of a federally recognized, evidence-based pharmaceutical era.

"This is not about bypassing science," said Duane Boise, President & CEO of MMJ International Holdings. "This is about finally allowing science to move forward under the FDA's clearly established botanical drug pathway-a pathway that has existed for years but has been blocked by outdated DEA practices. Seniors deserve science, not speculation."

THC, CBD, or Both? The FDA Already Answered This

Contrary to public speculation that Medicare pilots would be limited to CBD-only isolates, the FDA's Botanical Drug Development Guidance explicitly allows drugs derived from whole plant cannabis extracts, including formulations containing both THC and CBD-provided they are GMP standardized and clinically tested.

MMJ's medicine is distinct from CBD synthetics like Epidiolex. It is a defined, reproducible, natural full-spectrum extract containing both THC and CBD, manufactured as a pharmaceutical soft-gel-not a supplement.

Medicare Coverage Requires the FDA Gold Standard

A critical distinction for the industry is that Medicare reimbursement is legally tied to FDA oversight. There is no "shortcut" through real-world data that bypasses clinical trials.

MMJ a U.S. company currently positioned for this standard:

FDA Orphan Drug Designation: Held for Huntington's Disease, a neurodegenerative condition affecting seniors.

GMP Manufacturing: MMJ's medicine is already fully manufactured as a GMP soft-gel capsule.

Clinical Readiness: Supported by completed stability and chromatography data, the company is prepared to move into Phase 2 and Phase 3 clinical trials immediately.

"Our patients aren't looking for gummies," Boise added. "They're looking for regulated medicine that can be prescribed, monitored, and reimbursed like any other serious therapy. We aren't asking for a shortcut; we've already built the infrastructure the FDA requires."

Correcting the Record: Rescheduling Ends the Research Blockade

While critics often cite "limited evidence" for cannabis, that gap is a direct result of the Schedule I blockade, which has historically prevented multi-site placebo-controlled trials. Rescheduling Marijuana to Schedule III removes these barriers, allowing MMJ to finalize its Orphan Designated Huntington's Disease clinical trials.

The Institutional Magnet: Separating Medicine from Merchandise

As noted by market experts like CNBC's Timothy Seymour, federal recognition and Medicare coverage act as a powerful magnet for institutional capital. However, this dynamic will not lift all boats equally. It will favor:

FDA-aligned companies

Orphan drug developers

GMP-certified manufacturers

"Schedule III doesn't lift all boats; it separates medicine from merchandise," Boise concluded. "MMJ is built for that moment. We know our medicine works-now, let us prove it."

About MMJ International Holdings

MMJ International Holdings is a U.S.-based biopharmaceutical company developing natural, plant-derived cannabinoid medicines for FDA approval. Its subsidiaries-MMJ BioPharma Cultivation and MMJ BioPharma Labs-operate under federal law to advance pharmaceutical soft-gel cannabinoid formulations targeting Huntington's Disease and Multiple Sclerosis.

MMJ is represented by attorney Megan Sheehan.

CONTACT:

Madison Hisey

MHisey@mmjih.com

203-231-85832

SOURCE: MMJ International Holdings

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/trumps-marijuana-reclassification-is-only-the-beginning-why-mmj-inter-1118803