Vancouver, British Columbia--(Newsfile Corp. - December 17, 2025) - First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) ("FAN" or the "Company") announces a fully allocated non-brokered private placement (the "Offering") of flow-through common shares only, with no warrants, for aggregate gross proceeds of up to $2,944,780 from the sale of a combination of the following:

Up to 4,971,219 charity flow-through common shares (each, a "CFT Share") issued at a price of $0.2432 per CFT Share on a "flow-through" basis pursuant to the Income Tax Act (Canada); and up to 8,265,618 flow-through common shares of the Company (each, a "FT Share") issued at a price of $0.21 per FT Share on a "flow-through" basis pursuant to the Income Tax Act (Canada).

The proceeds of the Offering will be used on the Company's Pipestone XL Nickel Alloy Project located in Newfoundland, to incur eligible "Canadian exploration expenses" that will qualify as "flow-through mining expenditures," as such terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures"), on or before December 31, 2026. All Qualifying Expenditures will be renounced in favour of the subscribers effective December 31, 2025.

The Company intends to use the proceeds to immediately advance drilling and exploration at the RPM Zone, test newly identified drill targets on the Pipestone XL Project, and expand the scope and scale of its metallurgical recovery and processing program.

Please call 844-592-6337 or email rob@fanickel.com to connect with Rob Guzman, First Atlantic Nickel's Investor Relations, for questions or more information.

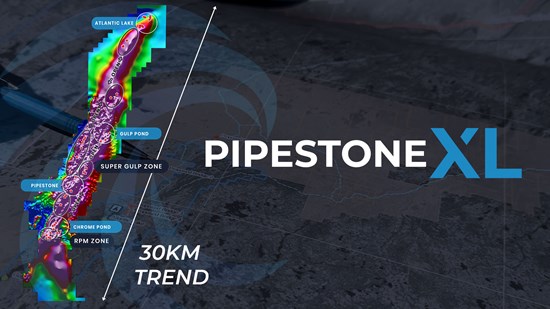

PIPESTONE XL ALLOY PROJECT

The Pipestone XL Nickel Alloy Project spans the entire 30-kilometer Pipestone Ophiolite Complex in central Newfoundland, a continuous belt of serpentinized ultramafic rocks enriched in nickel and chromium. First Atlantic holds 100% control of the complex, which hosts multiple discovery zones including the RPM Zone, Super Gulp, Atlantic Lake, and Chrome Pond, all containing awaruite (Ni3Fe), a naturally occurring nickel-iron-cobalt alloy with approximately 75% nickel content.

Figure 1: Pipestone XL Alloy Project showing awaruite target zones along 30km trend over total magnetic intensity (TMI).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6963/278424_0c7fdffc840ce8ea_001full.jpg

Unlike conventional nickel sulfide deposits that require energy-intensive smelting, awaruite's sulfur-free composition and strong magnetic properties enable concentration through simple magnetic separation, eliminating acid mine drainage risks while reducing dependence on overseas processing infrastructure. The project benefits from year-round road access and proximity to clean hydroelectric power within one of the world's top-ranked mining jurisdictions, positioning Pipestone XL to contribute to a secure and reliable North American nickel supply chain for the stainless steel, electric vehicle, aerospace, and defense industries.

FROM ROCKS TO POWER

"Awaruite is not a sulfide nor an oxide nickel ore but a high-content native nickel-iron ore. Simple beneficiation processes after mining could provide 60% Ni concentrate, ready for leaching for battery cathode purposes and would yield MHP as a by-product. This process would bypass pyrometallurgy or early hydrometallurgy stages and be among the lowest carbon-intensive nickel production sites in the global nickel market." (Battery Matals Association of Canada, From Rocks to Power)

Figure 2: United States Geological Survey (USGS) quote on awaruite nickel-iron-cobalt alloy deposits.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6963/278424_0c7fdffc840ce8ea_002full.jpg

The sulfur-free nature of awaruite (Ni3Fe), a naturally occurring nickel-iron-cobalt alloy already in metallic form, eliminates the need for secondary processes such as smelting, roasting or acid leaching that are typical of sulfide or laterite nickel ores. Unlike sulfides, which are not natural alloys, awaruite avoids the challenge of sourcing smelter capacity, a bottleneck in North America's nickel supply chain. With an average nickel grade of approximately 75%, awaruite significantly exceeds the ~25% nickel grade characteristic of pentlandite. Awaruite's strong magnetic properties enable concentration through magnetic separation, as demonstrated by Davis Tube Recovery (DTR) testing at First Atlantic's RPM Zone drill core.

Awaruite eliminates the electricity requirements, emissions, and environmental impacts associated with conventional smelting, roasting or acid leaching processes of common nickel minerals. Moreover, awaruite's sulfur-free composition removes the risks of acid mine drainage (AMD) and related permitting challenges commonly posed by sulfide minerals. As noted by the United States Geological Survey (USGS) in 2012: "The development of awaruite deposits in other parts of Canada may help alleviate any prolonged shortage of nickel concentrate. Awaruite, a natural iron-nickel alloy, is much easier to concentrate than pentlandite, the principal sulfide of nickel."

Investor Information

The Company's common shares trade on the TSX Venture Exchange under the symbol "FAN", the American OTCQB Exchange under the symbol "FANCF" and on several German exchanges, including Frankfurt and Tradegate, under the symbol "P21".

Investors can get updates about First Atlantic by signing up to receive news via email and SMS text at www.fanickel.com.

Investors are invited to sign up for the official FAN (First Atlantic Nickel) List found at www.fanickel.com and can follow First Atlantic Nickel on the following social media.

FOR MORE INFORMATION:

First Atlantic Investor Relations

Robert Guzman

Tel: +1 844 592 6337

rob@fanickel.com

Disclosure

The Company may pay finders' fees in connection with the Offering to eligible arm's length finders in accordance with TSX-V policies and applicable securities laws.

The FT Shares and CFT Shares will be offered by way of private placement pursuant to applicable exemptions from the prospectus requirements under applicable securities laws. All securities issued in connection with the Offering will be subject to a hold period of four months and one day following the closing of the Offering under applicable Canadian securities laws. The Offering remains subject to receipt of final approval from the TSX Venture Exchange.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States or any other jurisdiction. No securities may be offered or sold in the United States absent registration under the U.S. Securities Act of 1933, as amended, or an applicable exemption from such registration, or in any other jurisdiction in which such offer or sale would be unlawful.

Adrian Smith, P.Geo., a director and the Chief Executive Officer of the Company is a qualified person as defined by NI 43-101. The qualified person is a member in good standing of the Professional Engineers and Geoscientists Newfoundland and Labrador (PEGNL) and is a registered professional geoscientist (P.Geo.). Mr. Smith has reviewed and approved the technical information disclosed herein.

ABOUT FIRST ATLANTIC NICKEL CORP.

First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) is a critical mineral exploration company in Newfoundland & Labrador developing the Pipestone XL Nickel Alloy Project. The project spans the entire 30-kilometer Pipestone Ophiolite Complex, where multiple zones, including RPM, Super Gulp, Atlantic Lake, and Chrome Pond, contain awaruite (Ni3Fe), a naturally occurring magnetic nickel-iron-cobalt alloy of approximately ~75% nickel with no-sulfur and no-sulfides, along with secondary chromium mineralization. Awaruite's sulfur-free composition removes acid mine drainage (AMD) risks, while its unique magnetic properties enable processing through magnetic separation, eliminating the electricity requirements, emissions, and environmental impacts of conventional smelting, roasting, or high-pressure acid leaching while reducing dependence on overseas nickel processing infrastructure.

The U.S. Geological Survey recognized awaruite's strategic importance in its 2012 Annual Report on Nickel, noting that these deposits may help alleviate prolonged nickel concentrate shortages since the natural alloy is much easier to concentrate than typical nickel sulfides1. The Pipestone XL Nickel Alloy Project is located near existing infrastructure with year-round road access and proximity to hydroelectric power. These features provide favorable logistics for exploration and future development, strengthening First Atlantic's role to establish a secure and reliable source of North American nickel production for the stainless steel, electric vehicle, aerospace, and defense industries. This mission gained importance when the US added nickel to its critical minerals list in 20222, recognizing it as a non-fuel mineral essential to economic and national security with a supply chain vulnerable to disruption.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and/or assumptions made by, and information currently available to, the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors that may cause actual results and future events to differ materially from those expressed or implied by such forward-looking information.

Forward-looking information in this news release includes, but is not limited to, statements regarding: the Offering, including the anticipated aggregate gross proceeds, the terms and timing of the closing of the Offering, the completion of the Offering (including the number of FT Shares and CFT Shares to be issued), the payment of any finders' fees, and the receipt of all required approvals, including acceptance of the TSX Venture Exchange; the intended use of proceeds of the Offering; the Company's ability to incur eligible "Canadian exploration expenses" that will qualify as "flow-through mining expenditures" (as such terms are defined in the Income Tax Act (Canada)); the timing of incurring the Qualifying Expenditures; and the timing and ability of the Company to renounce Qualifying Expenditures to subscribers, including the anticipated effective renunciation date.

Forward-looking information is based on, among other things, assumptions regarding: the Company's ability to complete the Offering on the terms described or at all; the Company's ability to obtain TSX Venture Exchange acceptance and any other required regulatory approvals in a timely manner; market conditions and investor demand for the securities issued under the Offering; the Company's ability to allocate and incur Qualifying Expenditures as intended and within the time periods required; the Company's continued ability to access its properties and carry out exploration and related programs on the Company's Pipestone XL Nickel Alloy Project as currently planned; the availability, performance and cost of personnel, services, equipment and supplies; the timing of, and ability to obtain, necessary permits and regulatory authorizations; and general business, economic and financial market conditions.

Readers are cautioned that such forward-looking information is neither promises nor guarantees and is subject to known and unknown risks and uncertainties including, but not limited to, risks related to: the inability to obtain TSX Venture Exchange acceptance or other required approvals; changes in market conditions; the Company's ability to complete the Offering on the terms described or at all, including the anticipated gross proceeds; the Company's ability to use the proceeds as currently contemplated; the Company's ability to incur Qualifying Expenditures and renounce them to subscribers within the timelines required under the Income Tax Act (Canada); exploration and development risks; environmental and permitting risks; changes in commodity prices; uncertain and volatile equity and capital markets; lack of available capital; operating risks; accidents; labour issues; and other risks in the mining industry. Additional factors and risks are discussed in the Company's disclosure documents available under the Company's profile on SEDAR+ at www.sedarplus.ca. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no mineral reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Not for Distribution to U.S. Newswire Services or for Dissemination in the United States.

1 https://d9-wret.s3.us-west-2.amazonaws.com/assets/palladium/production/mineral-pubs/nickel/mcs-2012-nicke.pdf

2 https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278424

Source: First Atlantic Nickel Corp.