Medcaw Investments Plc - Proposed Initial Transaction, AIM Admission and Acquisition of 90 percent of the Eagle Lake Gold Project and Temporary Suspension to Trading

PR Newswire

LONDON, United Kingdom, December 19

19 December 2025

Medcaw Investments plc

("Medcaw" or the "Company")

Proposed Initial Transaction, AIM Admission and Acquisition of 90 per cent. of the Eagle Lake Gold Project (Ontario, Canada)

and

Temporary Suspension to Trading

Medcaw is pleased to announce that it has entered into binding heads of terms (which includes an exclusivity agreement until 31 October 2026) with Ulvestone Ltd ("Ulvestone") in respect of the proposed acquisition by the Company of 90% of the legal and beneficial interest in certain mineral exploration licences located in Ontario, Canada (the "Eagle Lake Gold Project") (the "Initial Transaction"). This comprises an initial transaction under UK Listing Rule 13.2.1.

The Initial Transaction is conditional, inter alia, on the cancellation of the Company's listing on the Official List of the FCA and cancellation of its admission to trading on the Main Market of the London Stock Exchange, and on the admission of its entire issued share capital, as enlarged by the Consideration Shares (as defined below) and any other shares to be issued on Admission, to trading on AIM ("AIM Admission").

Transaction Structure

The Initial Transaction is conditional on Wedgetail Ltd, a British Columbia incorporated company ("Wedgetail"), acquiring 100% of the legal and beneficial ownership of the Eagle Lake Gold Project, prior to the Initial Transaction completing, and conditional on an equity fundraise to be completed in conjunction with the AIM Admission. Wedgetail is currently wholly owned by Ulvestone.

Medcaw proposes to acquire 90% of the issued share capital of Wedgetail, thereby securing a 90% interest in the Eagle Lake Gold Project.

Consideration

The aggregate consideration payable by Medcaw is £4.17 million, to be satisfied as follows:

- £70,000 in cash on execution of the definitive share purchase agreement;

- £100,000 in cash on AIM Admission; and

- £4,000,000 satisfied through the issue of new ordinary shares in Medcaw at a price of 1.5 pence per share, to be issued on AIM Admission (the "Consideration Shares").

The Consideration Shares will be subject to customary AIM lock-in arrangements for a period of 12 months from completion, as required by the AIM Rules for Companies.

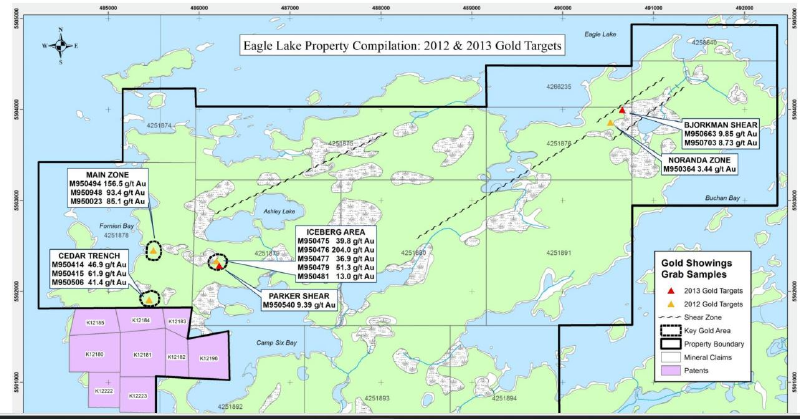

The Eagle Lake Gold Project - Overview

The Eagle Lake Gold Project comprises 95 mining claims covering approximately 1,960 hectares, located within the Wabigoon Greenstone Belt of Ontario, Canada, approximately 27 kilometres south-west of Dryden.

The Eagle Lake Gold Project benefits from:

- road access to within approximately 3 kilometres of the licence boundary;

- proximity to multiple multi-million ounce gold deposits operated by major and mid-tier producers within the region; and

- a well-documented history of exploration dating back to the 1950s.

Historical exploration across the Eagle Lake Gold Project includes shallow diamond drilling undertaken between 1951 and 1985, together with trenching and grab sampling.

Historical grab sampling has reported values of up to 204 g/t gold (see map set out further below in Schedule A), and a 2025 field campaign comprising 21 grab samples reported three samples grading more than 25 g/t gold, with a peak result of 75.7 g/t gold.

Historical drill results include multiple intersections in the 1-8 g/t gold range over narrow widths, including (selected examples):

1982 - 1985, Significant Results

DDH | From (m) | To (m) | Interval (m) | Au (g/t) |

R-82- 3 | 64.00 | 67.06 | 3.05 | 1.95 |

R-83- 6 | 53.34 | 59.44 | 6.10 | 1.64 |

R-83- 10 | 5.24 | 7.62 | 2.38 | 1.20 |

24.38 | 30.48 | 6.09 | 1.70 | |

35.05 | 38.10 | 3.05 | 1.13 | |

42.67 | 45.72 | 3.05 | 2.54 | |

99.01 | 102.11 | 3.05 | 3.94 | |

R-83- 11 | 17.98 | 18.75 | 0.76 | 1.95 |

101.50 | 103.02 | 1.52 | 2.78 | |

R-85- 12 | 18.29 | 19.51 | 1.22 | 2.74 |

23.16 | 24.23 | 1.07 | 8.23 | |

27.43 | 30.48 | 3.05 | 2.05 | |

36.58 | 39.62 | 3.05 | 2.05 | |

R-85- 13 | 51.82 | 54.86 | 3.05 | 7.54 |

R-85- 16 | 9.14 | 12.19 | 3.05 | 2.05 |

The Company notes that these results are historical in nature, have not been verified by a Qualified Person as defined in the AIM Note for Mining, Oil and Gas Companies, and should not be relied upon as indicative of future mineral resources.

Exploration Strategy

Subject to completion of the Initial Transaction, equity fundraise and successful AIM Admission, Medcaw intends to undertake a phased exploration programme.

A programme of historical data compilation and digitisation is ongoing (funded via 10% equity holder - AIM quoted Gunsynd plc) to define high-priority drill targets for a maiden drill programme. Thirty-five historical assessment reports are being reviewed, and the available geophysical, geochemical and diamond-drill datasets are being digitised and combined to inform field design and permitting. Initial work has identified multiple high priority targets along the largely under-explored approximately 7 km strike extent, warranting a large follow-up geochemical survey and targeted drilling.

Further details will be provided in the AIM admission document.

Conditions Precedent and Timetable

The Proposed Transaction remains subject to a number of conditions, including:

- completion of satisfactory legal, technical and financial due diligence;

- execution of a definitive share purchase agreement;

- AIM Admission;

- shareholder approval where required;

- a waiver by the Takeover Panel of any requirement under Rule 9 of the Takeover Code that would otherwise arise on Ulvestone (whether individually or as a concert party or otherwise) to make a general offer to Medcaw shareholders as a result of the issue to Ulvestone (or such other parties as Ulvestone directs) of the Consideration Shares; and

- securing adequate working capital for at least 12 months post-admission.

The long-stop date for completion is currently 31 October 2026.

Suspension

This announcement is being made to disclose Inside Information.

On the basis that the Initial Transaction is completed on the contemplated terms, this would result in the Company's existing shareholders having a minority interest in the enlarged group (and would constitute an initial transaction under the FCA's UK Listing Rules).

At the request of the Company, the FCA has suspended the Company's listing on the Official List and trading on the Main Market of the London Stock Exchange has also been suspended as of 7.30 a.m. today, pending the publication by the Company of an AIM Admission document or an announcement that the Initial Transaction is not proceeding.

The Company has requested the temporary suspension because of the lack of available information about Wedgetail in relation to the Initial Transaction, which could prevent the smooth operation of the market in the shares of the Company.

Should the final terms of the Initial Acquisition be agreed, the Company will issue an announcement with further details pursuant to UKLR13.4.22R and UKLR13.4.23R.

Takeover Code

The Takeover Panel will be consulted in due course regarding the requirement or otherwise for the Company to seek a Rule 9 waiver pursuant to Appendix 1 of the Takeover Code in respect of the vendors of Wedgetail and any other parties who may be acting in concert with them holding 30% or more as a result of the Initial Transaction and any other associated matters.

Appointment of Sponsor and Nominated Adviser

The Company is also pleased to announce that it has appointed Cairn Financial Advisers LLP as its Sponsor and Nominated Adviser in connection with the Initial Transaction and intended AIM Admission.

Charlie Wood, Director of Medcaw Investments plc,commented:

"We believe the proposed acquisition of the Eagle Lake Gold Project comes at a highly attractive point in the gold cycle. Gold prices remain strong, underpinned by macroeconomic uncertainty, central bank buying and sustained investor demand for hard assets.

"Against this backdrop, there is a clear lack of high-quality, pure-play gold exploration companies available to UK public market investors. Eagle Lake offers exposure to a proven Canadian gold jurisdiction with compelling historical exploration results and significant scope for modern exploration techniques to add value.

"We see this transaction as an opportunity to reposition Medcaw as a focused gold exploration company on AIM, at a time when investor appetite for quality gold assets is returning."

For further information:

Medcaw Investments plc

Charlie Wood

Director

Tel: +44 (0)203 918 8797

Broker

GIS

James Sheehan

Tel: +44 (0)20 7048 9400

Sponsor

Cairn Financial Advisers LLP

Liam Murray / Emily Staples / Ludovico Lazzaretti / Louise O'Driscoll

Tel: +44 (0)20 7213 0880

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed to be, forward looking statements. Forward looking statements are identi?ed by their use of terms and phrases such as 'believe', 'could', "should" 'envisage', 'estimate', 'intend', 'may', 'plan', 'potentially', "expect", 'will' or the negative of those, variations or comparable expressions, including references to assumptions. These forward-looking statements are not based on historical facts but rather on the Directors' current expectations and assumptions regarding the Company's future growth, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities. Such forward-looking statements re?ect the Directors' current beliefs and assumptions and are based on information currently available to the Directors.

This announcement contains inside information for the purposes of Article 7 of UK MAR and the Directors of the Company are responsible for the release of this announcement.

Schedule A - Eagle map & historic grab sample data

4284623_0.png |