Highlights

- Results from the ongoing drilling program include the following high-grade intercepts:

- Minto North west zone: 4.96% Cu, 0.85 g/t Au, 18.67 g/t Ag over 9.9 m from 225.1 m, within a broader zone of 2.34% Cu, 0.43 g/t Au and 8.69 g/t Ag over 24.0 m in drill hole 25SCM009, a 150 m southern step out at the Minto North west zone

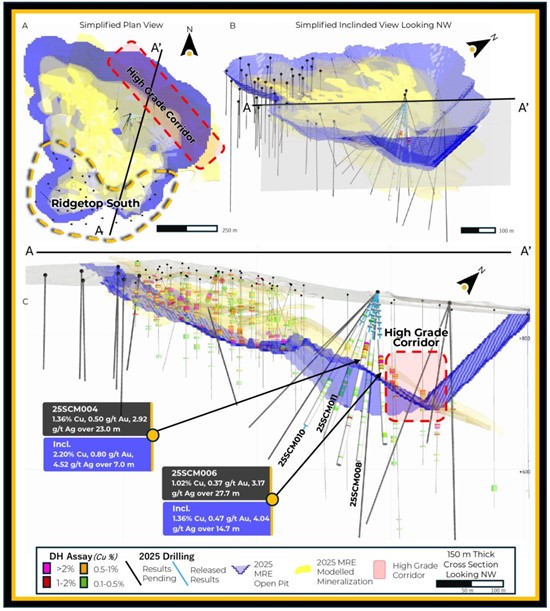

- Ridgetop zone: 1.46% Cu, 0.47 g/t Au, 4.04 g/t Ag over 14.7 m from 90.3 m within a zone of 1.02% Cu, 0.37 g/t Au, 3.17 g/t Ag over 27.7 m in drill hole 25SCM006 and 2.20% Cu, 0.80 g/t Au, 4.52 g/t Ag over 7.0 m from 108.0 within a zone of 1.36 % Cu, 0.5% g/t Au, 2.92 g/t Ag over 23 m in drill hole 25SCM004 both testing an under drilled area within the Ridgetop zone

- As of December 19, 2025, 32,026 m of drilling, or 64% of the planned 50,000 m program, in 121 drill holes has been completed including a total of 8,979 m at the Minto North west zone

Trade-Off Study and Metallurgical Testwork Program

- Hatch Ltd. and SRK Consulting (Canada) Inc. continue to advance design and engineering work in mine planning and design, metallurgy, mineral processing, waste rock and tailings management, all working directly with the Company and consultants representing the Selkirk First Nation

- Preliminary results from a metallurgical testwork program, with the aim of improving copper, gold, and silver recoveries on the Ridgetop deposit and to determine the possibility to improve recoveries of precious metals using gravity recovery, are positive

Annual General and Special Meeting

- Selkirk Copper Mines Inc. held its Annual General and Special Meeting (the "Meeting") on December 17th, 2025 in Whitehorse, YK where shareholders approved all the matters of business before the company

Vancouver, British Columbia and Pelly Crossing, Yukon--(Newsfile Corp. - December 22, 2025) - Selkirk Copper Mines Inc. (TSXV: SCMI) (FSE: IO20) ("Selkirk Copper" or the "Company") is pleased to provide a program update and announce new assay results from the on going 50,000 m drill program. The drill program has paused for the holiday break with the safe completion of 32,026 m across 121 drill holes which marks a 64% completion of the planned program. New results have been received from nine drill holes, three from the Minto North west zone, and six from the southern Ridgetop zone (Figure 1). Drilling continues to test the size and continuity of the high-grade Minto North west zone and these results confirm the expansion of the mineralized zone by 150 m south of the previously modelled zone. Drilling at the Ridgetop zone is testing a high-grade corridor within the open pit resource. Drill holes 25SCM004 and 25SCM006 successfully intercepted similar grade and width to the expected high-grade corridor.

M. Colin Joudrie, President & CEO, commented: "I am extremely pleased with results at the Minto North west zone which confirms our view that this zone has significant growth potential, with high copper and gold grades intersected over significant widths. In addition, the Trade-Off Study, including metallurgical testing, is advancing on schedule and is benefitting from input from Selkirk First Nation's consultants. I am particularly encouraged by initial results from the Ridgetop geometallurgical testwork which is showing potential for significant improvements in copper recovery from partially oxidized material compared to historic work. Lastly, I am very pleased with support from shareholders that resulted in Selkirk Copper completing its planned reverse-take-over and business amalgamation in October 2025, and the initiation of trading on the TSX Venture Exchange of Selkirk Copper Mines Inc. (TSXV: SCMI) in early November 2025."

2025 Drill Program Update

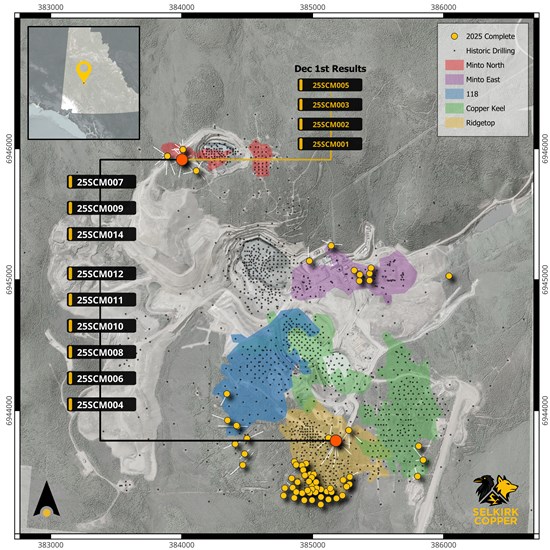

Drilling of 32,026 m of the planned 50,000 m program has been completed safely meeting our environmental and sustainability standards (Figure 1). Drilling is expected to resume mid-January 2026, with results continuing to be released as assays are received and validated. Table 1 summarizes meters and holes drilled by zone.

The remaining program is focused on the Ridgetop, Copper Keel, Minto East, and Minto North zones (Figure 1), exploration following up on historical high-grade results between the Minto East and Minto North zones referred to as the Inferno zone (Figure 2), testing greenfield targets north of the current infrastructure, and testing newly interpreted regional structures coincident with geophysical anomalies. To date, 9,382 samples have been prepared and shipped for analysis, with results to be released following completion of all QAQC reviews.

Figure 1: Plan view of the Minto Mine showing surface projections of mineralization zones (Ridgetop, Copper Keel, 118, Minto East and Minto North), relative to 2025 drill collars (yellow circles).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/278864_72711bb3a41878d0_001full.jpg

Table 1: Drilling by Zone

| Zone | Holes completed | Meters drilled | |||

| Minto North | 28 | 8,979 | |||

| Ridgetop | 58 | 11,911 | |||

| Minto East | 15 | 5,406 | |||

| Copper Keel | 7 | 1,990 | |||

| 118 | 13 | 3,740 | |||

| Total | 121 | 32,026 |

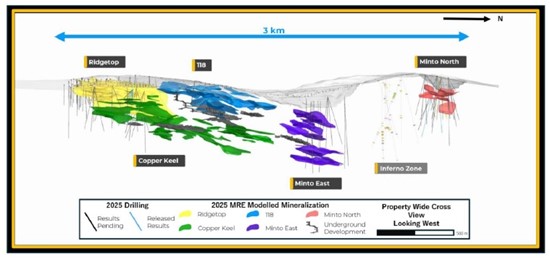

Figure 2: Global cross-section view looking west showing the five primary zones of mineralization: Ridgetop (yellow), 118 (blue), Copper Keel (green), Minto East (purple), and Minto North (red). The section illustrates gently north-dipping mineralized zones over approximately 3 km of strike length and down to approximately 550 m depth, which has hosted the majority of exploration activity within a larger 7 km long property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/278864_figure2.jpg

Drill Results

Minto North

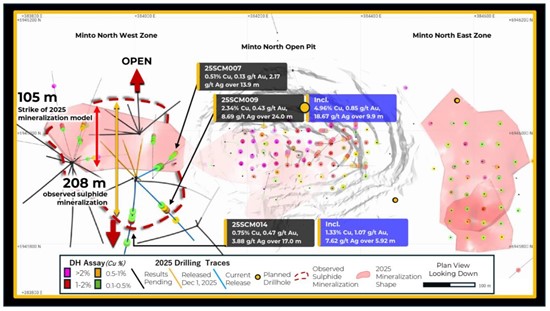

Drilling at the Minto North west zone continues to demonstrate a high-grade, laterally continuous copper-gold-silver system with strong geological consistency along strike. Drill hole 25SCM009, the most southerly step-out completed to date, successfully extended the mineralized footprint by approximately 150 m to the south. This zone remains open in the southern, eastern and northern directions (Figure 3).

Hole 25SCM009 intersected a broad >24 m mineralized interval beginning at 210.97 m, hosted within strongly deformed assimilation zone (ASMZ) and migmatitic (MIGM) lithologies characterized by increasing foliation intensity, magnetite alteration, and elevated sulphide content. Within this interval, a high-grade massive sulphide zone dominated by bornite and chalcopyrite was intersected from 233.07 m to 234.00 m, returning 34.1% Cu, 2.03 g/t Au and 170 g/t Ag. This style of mineralization, including massive to semi-massive sulphide textures and a high bornite-to-chalcopyrite ratio, is consistent with high-grade intervals previously reported in drill holes 25SCM001 and 25SCM002.

Drill holes 25SCM007 and 25SCM014 provide additional confirmation that the overall mineralized and altered system remains a thick and laterally extensive package. Hole 25SCM007 intersected a broad zone of altered ASMZ and MIGM lithologies with elevated copper values from approximately 210 m to 251 m, representing a >40 m thick package of deformed and altered host rock. In this drill hole, a significant intercept of 13.92 m from 237.00 m returned 0.51% Cu, 0.13 g/t Au and 2.17 g/t Ag, consistent with mineralization observed in 25SCM005 (see news release Dec 1, 2025). These results illustrate a gradual easterly transition from the high-grade, bornite-rich core characteristic of the Minto North west zone into a broad chalcopyrite-dominant halo.

Drilling to date has successfully identified chalcopyrite and bornite extending over 208 m in strike length, nearly doubling the 105-metre extent defined in the 2025 mineral resource estimate (MRE) model (Figure 3). For more information on the 2025 MRE see Table 4.

Figure 3: Plan View of the Minto North west zone. Sulphide mineralization observed in drilling extends the N-S strike direction to 208 meters (dashed outline) compared to the previously modelled 105 meter strike length (red shaded shape).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/278864_figure3.jpg

Ridgetop

Drill holes 25SCM004, 006, 008, 010, 011 and 012 drilled at the Ridgetop zone targeted an under-drilled portion of this open pit resource situated between the well-defined shallow western pit (to <150 m depth) and a higher-grade, deeper zone to the east (Figure 4). This corridor has historically returned assays exceeding 2% copper and represents a key area for improving geological confidence within the existing resource model.

Results from drill holes 25SCM004 and 006 successfully confirmed the width and grade of this deep mineralized zone, demonstrating continuity of copper-rich mineralization within ASMZ and migmatitic host rocks. However, drilling also indicates that the Ridgetop zone is more structurally complex than previously interpreted, with evidence for late-stage faulting and localized offsets disrupting portions of the mineralized horizon.

These recent drill results are informing structural reinterpretation at Ridgetop which will be integrated into updated geological and resource models to better constrain fault geometry and mineralization offsets. The systematic collection of oriented drill core and the development of a robust structural model are critical for improved geological modelling and better defined mine plans.

Figure 4: A) Simplified plan view of the 2025 MRE Ridgetop open pit with 2025 drilling highlighting two main areas of focus including a high-grade corridor at depth and the expansion of drilling to the south. B) shows an inclined view of 2025 MRE open pit and the 2025 completed drill traces. C) is a 150 m thick cross-section looking NW highlighting results received to date.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/278864_figure4.jpg

The location, azimuth, dip and depth of hole of this new drilling is summarized in Table 2 and significant intervals is summarized in Table 3.

Table 2: Collar Locations and Header Information

| Hole ID | Easting | Northing | Azi | Dip | EOH | Zones |

| 25SCM004 | 385177 | 6943771 | 105 | -63 | 255 | Ridgetop |

| 25SCM006 | 385177 | 6943771 | 131 | -58 | 303 | Ridgetop |

| 25SCM007 | 384004 | 6945916 | 60 | -80 | 405 | Minto North |

| 25SCM008 | 385177 | 6943771 | 135 | -74 | 264 | Ridgetop |

| 25SCM009 | 384002 | 6945913 | 135 | -70 | 450 | Minto North |

| 25SCM010 | 385177 | 6943771 | 180 | -58 | 234 | Ridgetop |

| 25SCM011 | 385177 | 6943771 | 210 | -70 | 234 | Ridgetop |

| 25SCM012 | 385175 | 6943772 | 190 | -86 | 369 | Ridgetop |

| 25SCM014 | 384001 | 6945913 | 180 | -70 | 399 | Minto North |

Table 3: Significant Interval Table

| Hole ID | From | To | Length (m) | Cu % | Au g/t | Ag g/t | CuEq % | Lith | Zone |

| 25SCM004 | 108.0 | 131.0 | 23.0 | 1.36 | 0.50 | 2.92 | 1.75% | ASMZ | RT |

| Incl. | 115.0 | 122.0 | 7.0 | 2.20 | 0.80 | 4.52 | 2.84% | ASMZ | |

| 144.23 | 145.0 | 0.8 | 2.45 | 0.02 | 2.19 | 2.49% | ASMZ | ||

| 237.14 | 244.7 | 7.6 | 0.44 | 0.09 | 1.67 | 0.53% | ASMZ | ||

| 25SCM006 | 90.29 | 118.0 | 27.7 | 1.02 | 0.37 | 3.17 | 1.32% | ASMZ | RT |

| Incl. | 90.29 | 105.0 | 14.7 | 1.46 | 0.47 | 4.04 | 1.85% | ASMZ | |

| 220.0 | 224.11 | 4.1 | 1.00 | 0.22 | 3.28 | 1.19% | ASMZ | ||

| 235.7 | 237.54 | 1.84 | 4.38 | 0.71 | 34.78 | 5.21% | ASMZ | ||

| 25SCM007 | 237.0 | 250.92 | 13.9 | 0.51 | 0.13 | 2.17 | 0.63% | ASMZ | MN |

| 25SCM008 | 111.0 | 116.0 | 5.0 | 0.59 | 0.24 | 2.20 | 0.79% | ASMZ | RT |

| 25SCM009 | 210.97 | 235.0 | 24.0 | 2.34 | 0.43 | 8.69 | 2.74% | ASMZ | MN |

| Incl. | 225.09 | 235.0 | 9.9 | 4.96 | 0.85 | 18.67 | 2.37% | ASMZ | |

| 25SCM010 | 85.0 | 88.5 | 3.5 | 0.47 | 0.21 | 1.88 | 0.29% | MIGT | RT |

| 25SCM011 | 123.0 | 131.0 | 8.0 | 0.35 | 0.05 | 0.66 | 0.39% | MIGT | RT |

| 141.0 | 146.0 | 5.0 | 0.33 | 0.04 | 0.82 | 0.39% | ASMZ | ||

| 162.0 | 165.64 | 3.6 | 0.39 | 0.06 | 1.23 | 0.37% | ASMZ | ||

| 25SCM012 | 92.5 | 103.5 | 11.0 | 0.33 | 0.21 | 0.82 | 0.45% | ASMZ | RT |

| 123.0 | 125.0 | 2.0 | 1.05 | 0.03 | 0.86 | 0.50% | ASMZ | ||

| 134.0 | 135.78 | 1.8 | 1.23 | 0.01 | 0.56 | 1.08% | ASMZ | ||

| 150.4 | 158.0 | 7.6 | 0.47 | 0.07 | 1.43 | 1.24% | ASMZ | ||

| 25SCM014 | 203.65 | 220.63 | 17.0 | 0.75 | 0.47 | 3.88 | 1.13% | ASMZ | MN |

| Incl. | 211.68 | 217.6 | 5.9 | 1.33 | 1.07 | 7.62 | 2.19% | ASMZ | |

| At the Minto North zone, the flat laying to shallowly dipping nature of the mineralized zones suggest that true widths are typically >90% of the reported drill intersection length. At Ridgetop, true widths are approximate 85-90% of reported drill intersection lengths. | |||||||||

| ASMZ = Assimilation Zone; MIGT = Migmatite RT = Ridgetop; MN = Minto North NSI = No Significant Intervals | |||||||||

| CuEq Calculation: CuEq = ((Cu% × CuP × RCu × 2204.62)+(Au g/t ÷ 31.1035 × AuP × RAu) + (Ag g/t ÷ 31.1035 × AgP × RAg ))/(CuP × RCu × 2204.62) Where: CuP/AuP/AgP = US$ commodity prices of $4.25/lb Cu, $2500/oz Au, $29/oz Ag; RCu = Cu Recovery = 98%; RAu = Au Recovery = 85%; RAg= Ag Recovery = 85% Recoveries as estimated from historical mineral processing results. | |||||||||

Trade-Off Study and Metallurgical Testing Update

Engineering work on the Trade-Off study continues to progress well, with Hatch Ltd. and SRK Consulting (Canada) Inc. advancing design and engineering work on all fronts including mine design, infrastructure, processing, mine waste, tailings, water management and treatment, and economics. Importantly, this work is being carried out in a collaborative manner with direct input from the Selkirk First Nation and their consultants as well as Selkirk Copper's senior team.

After a comprehensive review of previous operating data and historical metallurgical test work, the team identified opportunities to increase metallurgical recoveries in Ridgetop zone mineralization as well as opportunities to reduce power consumption in crushing, grinding, and milling of Minto-style mineralized material. Three areas with potential upside being investigated are: i) improved energy efficiency in the mill by increasing the primary grinding size; ii) additional processing options for material that has higher distribution of copper present as copper oxide; and iii) further investigating gravity concentrate to increase gold recovery.

In November 2025, Selkirk Copper began Phase 1 of a metallurgical test program, with the primary aim of better understanding Minto-style mineralization through an integrated geometallurgical program aimed at improving the mine's production capabilities and metallurgical recoveries of partially oxidized mineralization. The test work is being conducted at Blue Coast Research Ltd., located in Parksville, BC with input from Selkirk Copper and its consultants, including Fuse Advisors Inc., and Hatch Ltd. Initial test work has started based on existing core samples with plans for additional metallurgical test work based on materials from new drilling.

Eary indications from the test work are positive in all respects, specifically: i) initial results suggest coarsening the primary grind size maintains high copper recovery and would have the potential to reduce power consumption in milling; and ii) initial results from flotation tests are showing better copper recovery from partially oxidized mineralized material than previously modeled, which has the potential to convert material previously modeled as waste into potentially minable resources. Tests to assess gravity assisted recovery of gold and silver are underway.

In 2026 the Company will further advance the geometallurgical test work program using core acquired from the current drill program with the long-term goal of linking the geologic understanding of the mineralized zones at Minto directly to their metallurgical behavior ideally resulting in improved recovery of copper, gold and silver at lower cost.

QAQC Procedures and Data Validation

The Company is drilling NQ sized core. Following data collection, core is cut along the long axis, with half of the core going to the lab for chemical analysis and the remaining half kept in sequence as record. The half core samples are packaged with the corresponding sample tag id and sealed. All sampling is conducted by Selkirk Copper Mines Inc. and subject to Company standard internal quality control and quality assurance (QAQC) programs which include the insertion of certified reference material, coarse blank materials, and field duplicate analysis, on top of the standard laboratory QAQC procedures to monitor contamination during preparation and analytical accuracy and precision. QAQC insertion rates approximate 15% of all samples at set intervals. For the 2025 program all samples were sent to ALS Laboratory's prep laboratory in Whitehorse, YK, then shipped to ALS Vancouver for gold fire assay and four-acid multi-element analysis. All samples are prepared by crushing rock to 70% passing 2mm screen, then splitting a 250g sub-sample using a riffle splitter before being pulverized 85% passing 75 microns. Gold is analyzed by 30 g Fire Assay (Au-AA23) with atomic absorption (AAS) analysis followed by gravimetric finish for overlimit results. Copper is analyzed by four-acid digest (ME-ICP61) with inductivity coupled plasma - atomic emission spectroscopy (ICP-AES) finish. If Cu overlimit results are triggered a second four-acid digest for high grade copper (Cu-OG62) is conducted. For any samples where oxide copper minerals are identified, a sulphuric acid leach (Cu-AA05) analysis with AAS finish is preformed. ALS Vancouver holds an ISO/IEC 17025 standard accreditation.

QAQC results are reviewed open receipt of results. Overall QAQC results show strong analytical performance across Cu, Au, and Ag datasets. All control standards are within acceptable tolerance, with no significant outliers or systematic bias observed.

Primary intervals are reported as drill core length, with true widths estimated to be approximately 90% of core lengths, based on the sub-horizontal to shallow dipping nature of the modelled mineralized zones.

Mineral Resource Details

The following table (Table 4) summarizes the current Minto Mineral Resource:

Table 4: Global Mineral Resource Estimate for the Minto Project (Effective Date: April 7, 2025)

| Type | Cut | Class | ROM | In Situ Grade | Metal | |||||||

| (CDN$) | Tonnage (000) | NSR (CDN$) | Cu (%) | Au (gpt) | Ag (gpt) | Ox Ratio | ASCu (%) | Cu (Mlbs) | Au (Koz) | Ag (Koz) | ||

| OP | $30 | Indicated | 6,085 | $89.11 | 0.897 | 0.274 | 2.9 | 0.15 | 0.163 | 120.3 | 53.7 | 560.4 |

| Inferred | 9,496 | $73.71 | 0.702 | 0.162 | 2.4 | 0.07 | 0.057 | 146.9 | 49.3 | 738.4 | ||

| UG | $80 | Indicated | 6,504 | $183.90 | 1.489 | 0.636 | 5.6 | 0.06 | 0.090 | 213.5 | 132.9 | 1,167.6 |

| Inferred | 14,162 | $156.85 | 1.281 | 0.539 | 4.9 | 0.06 | 0.075 | 399.9 | 245.4 | 2,229.6 | ||

| Total | Varies as Above | Indicated | 12,588 | $138.08 | 1.203 | 0.461 | 4.3 | 0.10 | 0.125 | 333.8 | 186.6 | 1,728.0 |

| Inferred | 23,658 | $123.48 | 1.048 | 0.387 | 3.9 | 0.07 | 0.068 | 546.8 | 294.7 | 2,968.1 | ||

| Notes |

CuEq = NSR/(Cu*CuRec*22.0462)

| |||||||||||

References

1 See 2023-02-02 News Release "Minto Metals Reports Multiple High-Grade Copper Intersections From Follow-up Drilling at Minto North Including 1.91% Copper Over 34.59 Metres" filed by Minto Metals Corp.

2 See 2022-03-15 News Release "Minto Metals Reports Multiple High-Grade Copper Intersections From 2021 Drilling" filed by Minto Metals Corp.

3 See 2025-08-06 Technical Report "NI 43-101 2025 Mineral Resource Estimate Update for the Minto Property, Yukon, Canada" effective date 2025-04-07 filed by Venerable Ventures Ltd., available on SEDAR+ (sedarplus.ca).

Technical aspects of this news release have been reviewed, verified and approved by Stacie Jones-Clark, P.Geo., Vice President Exploration of Selkirk Copper Mines Inc., who is a qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Annual General and Special Meeting Results

The Company announces the results of voting at its Annual General and Special Meeting (the "Meeting"), held on December 17th, 2025.

At the Meeting, shareholders approved the election of directors, the appointment of Deloitte LLP as auditor of the Company for the ensuing year with authorization for the directors to fix the auditor's remuneration, the re-approval of the Company's rolling stock option plan, and an amendment to the Company's articles to permit the directors to determine the location of shareholder meetings.

A total of 65,827,507 common shares were represented at the Meeting, consisting of approximately 52.09% of the total issued and outstanding common shares of the Company as of the record date of the Meeting.

About Selkirk First Nation

Selkirk First Nation is centered in Pelly Crossing, a community in central Yukon, 280km north of Whitehorse. They are a self-governing First Nation, having signed its Final and Self-Government Agreements in 1997. Selkirk owns 4,740 square kilometers of Settlement Land, including 2,408 square kilometers where Selkirk owns both the surface and subsurface. Selkirk First Nation is one of three self-governing Northern Tutchone First Nations in the Yukon. The Selkirk First Nation, indirectly, holds a controlling equity stake in Selkirk Copper.

About Selkirk Copper

Selkirk Copper is a well-financed, newly formed company with a controlling interest held by the Selkirk First Nation through its wholly owned subsidiary, that, in partnership with the Selkirk First Nation, is completing a thorough exploration drilling campaign and a restart and redevelopment plan for the former Minto copper-gold-silver mine based on best-in-class environmentally sustainable mining, development and reclamation practice. Selkirk Copper controls 26,850 hectares of prospective mineral claims located in the Minto-Carmacks copper belt as well as significant open-pit and underground infrastructure, a 4,100 tonne per day processing plant, 400-person camp, water treatment facilities, numerous ancillary buildings, and mobile equipment centered on the former Minto copper-gold-silver mine. Selkirk Copper's mineral tenure, operation infrastructure, access roads and powerline, is located on or adjacent to Lands of the Selkirk First Nation much of which is surrounded by prospective Selkirk First Nation Category A Lands.

Selkirk Copper Mines Inc. is listed on the TSX Venture Exchange under the symbol TSXV: SCMI and has a secondary listing on the Frankfurt Exchange under the symbol FSE: IO20.

On behalf of the Board of Directors of Venerable Ventures Ltd.

M. Colin Joudrie

President and Chief Executive Officer

For more information, please contact:

M. Colin Joudrie, President & CEO

colin.joudrie@selkirkcopper.com

(604) 760-3157

Justin Stevens, Vice-President Corporate Development

justin.stevens@selkirkcopper.com

(604) 240-2959

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. When used in this news release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words, or variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this news release include information relating to: the remainder of the Company's drill program and integrating results into ongoing trade-off studies, the business plans and objectives of the Company. Such forward-looking information is based on the Company's expectations, estimates and projections as at the date of this news release.

By their nature, forward-looking statement involve known and unknown risks, uncertainties and other factors, which may cause actual result, performance or achievements to differ materially from those expressed or implied by such statements, including but not limited to: the potential inability of the Company to continue as a going concern, risks associated with potential governmental and/or regulatory action with respect to the Company's operations, the potential inability of the Company to implement its business plan going forward. Such statements and information reflect the current view of the Company and are based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's ability to execute on its business plans. The Company has also assumed that no significant events will occur outside the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278864

Source: Selkirk Copper Mines Inc.