NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR

FOR DISSEMINATION IN THE UNITED STATES

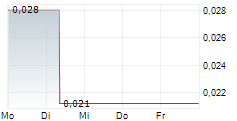

VANCOUVER, British Columbia, Dec. 23, 2025 (GLOBE NEWSWIRE) -- Algernon Health Inc. (the "Company" or "Algernon") (CSE: AGN) (FRANKFURT: AGW0) (OTCQB: AGNPF), a Canadian healthcare company, announces an increase to its non-brokered private placement financing, previously announced on November 6, 2025, to $750,000 and the closing of the third tranche (the "Third Tranche"). Gross proceeds from the Third Tranche totaled CAD $352,500 from the sale of 5,035,714 units (the "Units") at an issue price of CAD $0.07 per Unit. The closing of the Third Tranche brings the financing to a total of CAD $739,500 from the sale of 10,564,286 Units, including the closing of the first and second tranches on November 14, 2025 and November 28, 2025, respectively.

The Company did not pay any cash finder's fees pertaining to the Third Tranche of the Offering.

The Company will use the proceeds of the Offering towards advancing its Alzheimer's Disease ("AD") program including the opening of its first U.S. AD clinic, general and administrative expenses and for working capital purposes.

The securities issued and issuable, described in this and the previous news release on November 6, 2025, will be subject to a statutory hold period of four months plus a day from the date of issuance in accordance with applicable Canadian securities legislation.

The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and may not be offered or sold within the United States or to, or for the account or benefit of, "U.S. persons" (as such term is defined in Regulation S under the U.S. Securities Act) absent registration under the U.S. Securities Act and applicable state securities laws, or an exemption from such registration

For more information please contact:

Christopher J. Moreau

CEO

Algernon Health Inc.

604.398.4175 Ext 701

cjmoreau@algernonhealth.com

https://www.algernonhealth.com/

About Algernon Health

Algernon Health is a Canadian healthcare company focused on the provision of brain optimized PET scanning services through a planned network of new clinics in North America for the early-stage detection of Alzheimer's Disease, as well as other forms of dementia, epilepsy, neuro-oncology, and movement disorders. Algernon is also the parent company of a recently created private subsidiary called Algernon USA LLC, that will oversee all U.S. neuroimaging operations.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY DISCLAIMER STATEMENT: No Securities Exchange has reviewed nor accepts responsibility for the adequacy or accuracy of the content of this news release. This news release contains forward-looking statements relating to planned brain-specific neuroimaging PET scanning clinic opening timelines, planned financings in the Company and its subsidiary and the closings of additional tranches thereof, product development, licensing, commercialization and regulatory compliance issues and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include the failure to satisfy the conditions of the relevant securities exchange(s) and other risks detailed from time to time in the filings made by the Company with securities regulations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements as expressly required by applicable law.