West Palm Beach, FL, Jan. 05, 2026 (GLOBE NEWSWIRE) -- Evolution Metals & Technologies Corp. ("EM&T" or the "Company"), a company focused on building a secure, reliable, and vertically integrated global supply chain for critical minerals and materials ("CMM"), including battery and magnet materials, through a closed-loop integrating recycling model, midstream processing, and advanced manufacturing powered by AI and smart-machine technologies, today announced the completion of the merger (the "Business Combination") between Welsbach Technology Metals Acquisition Corp. ("WTMA") and Evolution Metals LLC ("EM").

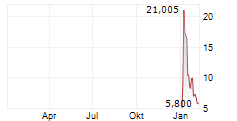

Evolution Metals & Technologies Corp. is the name of the post-merger business entity, which is expected to begin trading on the NASDAQ Global Markets on January 6, 2026 with the ticker symbol "EMAT."

EM&T, headquartered in the United States, has been manufacturing rare earth magnets and magnet materials on a commercial scale for over 18 years through its operating subsidiaries, and selling these products to some of the world's largest branded OEMs.

EM&T is scaling these existing operations, processes, and intellectual property to build a United States-based, integrated industrial campus capable of producing rare earth magnets, battery materials, and critical materials on a large, market-wide scale, without reliance on China.

EM&T leverages advanced technologies, including robotics and automation, to deliver integrated midstream and downstream CMM recycling and processing of oxides, metals, magnet alloys, battery materials, and rare earth magnet materials and finished rare earth magnets, including high-performance rare earth magnets. The Company serves a broad range of market segments, including the automotive, aerospace, defense, healthcare, high-technology, consumer electronics & appliances, and renewable energy industries, while supporting a more resilient and sustainable business ecosystem.

David Wilcox, Executive Chairman of EM&T, said: "This business combination between WTMA and EM brings together a carefully structured roll-up of operating companies with proven commercial-scale operations. By combining these operating companies in a public company structure, we are delivering a U.S. based platform that will be a credible alternative, at large commercial scale, to China's dominance in rare earth magnets and critical materials."

Frank Moon, Chief Executive Officer of EM&T, added: "This Business Combination brings together operating businesses that have been producing and selling rare earth magnets to notable commercial customers for well over a decade. Our focus now is to replicate and scale those capabilities in the United States using proven technology and world class execution."

Large Commercial-Scale Alternative to China's Dominance in Rare Earth Magnets and CMM Mid-stream Materials Production

EM&T's mission is to eliminate China's global monopoly in rare earth magnet production by becoming a dominant global player in rare earth magnet manufacture, including high-performance magnets, and production of critical materials supply chain products.

Through the Business Combination, EM&T merged EM with a portfolio of operating businesses in South Korea that have been manufacturing and selling rare earth magnets to global OEM customers, such as Ford, Hyundai, and Samsung, since 2007. As a result, EM&T believes it is the only company outside of communist China with proven, real-world operational expertise to produce rare earth magnets, including high-performance magnets, at large commercial scale in the United States. Unlike many announced rare earth magnet initiatives that are still at pilot or conceptual stages, EM&T's strategy is based on modular, proven technologies that have already been operating at commercial scale for over 18 years.

Battery Materials and Multi-Feedstock Hydro- and Pyrometallurgical Platform

In parallel with its rare earth magnet strategy, EM&T plans to develop industrial-scale midstream processing capacity in the United States to support a targeted annual production capacity of up to 55,000 tons of rare earth magnets by 2028.

This midstream capacity is expected to be supported by a multi feedstock processing platform that integrates both hydrometallurgical and pyrometallurgical technologies and is designed to support battery materials production alongside rare earth magnet materials.

In the same industrial campus, EM&T plans to develop battery recycling operations that process spent lithium-ion batteries sourced from third-party suppliers and manufacturers into "black mass," which is an important, elemental feedstock the Company would use in the manufacturing process. Through integrated hydro- and pyrometallurgical processing, EM&T expects to convert the black mass and other third-party sourced materials into battery grade carbonates, sulphates, and precursor cathode active materials (pCAM) necessary to manufacture the rare earth magnets and batteries.

By combining battery recycling, multi feedstock processing, and downstream materials production within a single integrated midstream platform, EM&T's closed loop model is intended to improve material recovery, enhance process flexibility, and support scalable commercial scale production across both battery materials and rare earth magnet value chains. Simultaneously, this integrated midstream platform will serve as the primary source of end-of-life magnet recovery and feed material refining point.

Technology Differentiation and Strategic Partnership

As previously announced, EM&T has entered into technology license and cooperation agreements with the Korea Institute of Geoscience and Mineral Resources (KIGAM), one of the world's leading authorities outside China on rare earth separation, magnet materials, and battery recycling technologies. EM&T plans to integrate the KIGAM technologies with its existing commercial and proprietary technologies and intellectual property to further expand its already advanced separation and beneficiation capabilities for the recovery of rare earth and battery materials.

Frank Moon brings more than 35 years of experience in the rare earth magnet industry and leads an engineering team of 42 operating engineers, including 11 PhD specialists. Collectively, the team has designed, built, and operated facilities across the entire rare earth supply chain over the past four decades, providing EM&T with the technical depth needed to scale complex, large commercial scale operations.

About Evolution Metals & Technologies Corp.

Evolution Metals & Technologies Corp. is a U.S. based critical materials and advanced manufacturing company formed through the Business Combination of Welsbach Technology Metals Acquisition Corp. and Evolution Metals LLC, together with a roll-up of operating companies in the Republic of South Korea. EM&T is focused on building a secure, non-China-dependent supply chain for rare earth permanent magnets, battery materials, and related critical technologies, leveraging proven commercial-scale operations, advanced processing technologies, and strategic partnerships.

Forward-Looking Statements

This document contains forward-looking statements as defined within Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding EM&T's plans, objectives, expectations, projections, strategies, anticipated production capacity, expansion plans, financing activities, and the expected timing of Nasdaq trading. All statements, other than statements of historical facts, included herein and public statements by our officers or representatives, that address activities, events or developments that our management expects or anticipates will or may occur in the future, are forward-looking statements, including but not limited to such things as future business strategy, plans and goals, competitive strengths and expansion and growth of our business. These forward-looking statements, along with terms such as "anticipate," "expect," "intend," "may," "will," "should," and other comparable terms, involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the future, and include risks related to changes in our operations; uncertainties concerning estimates; industry-related risks; the commercial success of, and risks related to, our development activities; uncertainties and risks related to our reliance on contractors and consultants. Those statements include statements regarding the intent, belief, or current expectations of EM&T and members of its management, as well as the assumptions on which such statements are based. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Although these forward-looking statements were based on assumptions that the Company believes are reasonable when made, you are cautioned that forward-looking statements are not guarantees of future performance and that actual results, performance or achievements may differ materially from those made in or suggested by the forward-looking statements contained in this news release. In addition, even if our results, performance, or achievements are consistent with the forward-looking statements contained in this news release, those results, performance or achievements may not be indicative of results, performance or achievements in later periods. Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statements made in this news release speak only as of the date of those statements, and we undertake no obligation to update those statements or to publicly announce the results of any revisions to any of those statements to reflect future events or developments. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied, including risks related to execution, financing, regulatory approvals, market conditions. Additional information concerning these and other factors that may impact EM&T's expectations and projections can be found in filings it makes with the SEC, including the definitive proxy statement/prospectus filed by WTMA and EM&T with the SEC on August 11, 2025, including those under "Risk Factors" therein, and other documents filed or to be filed with the SEC by EM&T. SEC filings are available on the SEC's website at www.sec.gov.

Media & Investor Contact

Evolution Metals & Technologies Corp.

Attn: Judith McGarry

Email: judith.mcgarry@evolution-metals.com

Phone: +1 (415) 971-2900