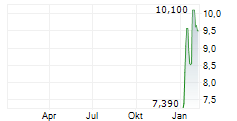

DALLAS, Jan. 07, 2026 (GLOBE NEWSWIRE) -- Buda Juice, Inc., pioneer of the new UltraFresh juice category for the supermarket fresh produce department with its cold-crafted, UltraFresh citrus juices, today announced the pricing of its initial public offering (the "Offering") of 2,666,667 shares of its common stock at the public offering price of $7.50 per share for a total of $20,000,000 of gross proceeds to the Company, before deducting underwriting discounts and offering expenses (the "Offering").

In addition, the Company has granted a 45-day option to the underwriter to purchase up to 400,000 additional shares, representing 15% of the shares sold in the Offering, solely to cover over-allotments, if any, at the initial public offering price, less underwriting discounts and commissions. All of the shares are being offered by the Company.

Buda Juice expects shares to begin trading on the NYSE American exchange on January 8, 2026, under the ticker symbol "BUDA". The offering is expected to close on January 9, 2026, subject to customary closing conditions.

Buda Juice intends to use the net proceeds from the offering to develop and build production plants in South Carolina and Arizona/Nevada, expand capacity in its Dallas production plant, support in-store marketing and provide working capital for its expansion.

Horatio Lonsdale-Hands, CEO and Co-Founder of Buda Juice, commented:

"Today marks an important milestone for our company and the growth of the UltraFresh juice category. Thanks to the support of our loyal Buda Juice consumers, retail and club store customers, and our IPO investors, we can further our mission to make UltraFresh juices the new standard in grocery stores across the U.S., without compromise on safety, taste or nutrients."

MDB Capital acted as the underwriter of the offering.

A registration statement on Form S-1 (File No. 333-289874) (the "Registration Statement") relating to these securities was filed with the Securities and Exchange Commission (the "SEC") and was declared effective on January 7, 2026. The Offering was made only by means of a prospectus, forming part of the effective registration statement. A copy of the final prospectus related to and describing the terms of the Offering may be obtained from MDB Capital, 14135 Midway Road, Suite G-150, Addison, TX 75001, or via email at community@mdb.com or telephone at (945) 262-9010. In addition, the final prospectus relating to the Offering may be obtained via the SEC's website at www.sec.gov.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under securities laws of any such state or jurisdiction.

About Buda Juice, Inc

Buda Juice is pioneering the UltraFresh juice category through an end-to-end cold chain platform that delivers always-cold, freshly crafted juices, lemonades, and wellness shots to grocery retailers. We provide a turnkey alternative to shelf-stable beverages and in-store juicing, enabling retailers to offer truly fresh juices without added infrastructure or operational complexity. Our continuous 35°F cold chain from fruit to shelf delivers clean-label products with an 8 to 12-day shelf life that preserves authentic taste and nutrient quality while enabling efficient retail distribution.

Buda Juice is expanding its branded portfolio, entering new geographic markets and scaling a growing white-label platform that delivers meaningful cost savings and fresh category differentiation for retail customers.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements are not historical facts and include statements regarding the company's plans, objectives, expectations and intentions. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those discussed in the forward-looking statements. Many such risks and uncertainties are beyond the control of the company, including those discussed in the Risk Factors section of the company's registration statement for the initial public offering, which is available on the SEC's website, www.sec.gov. The company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

Media and Investor Relations Contact:

Brian S. Siegel, IRC®, M.B.A.

Senior Managing Director

Hayden IR - Chicago

(346) 396-8696

brian@haydenir.com

www.haydenir.com