December same-store sales increased 4.5% year-over-year

The average price paid for the top 500 items in December increased 2.3% year-over-year

NEWARK, N.J., Jan. 09, 2026 (GLOBE NEWSWIRE) -- NRSInsights, a provider of sales data and analytics drawn from retail transactions processed through the National Retail Solutions (NRS) point-of-sale (POS) platform, today announced comparative retail same-store sales results for December 2025.

As of December 31, 2025, the NRS retail network comprised approximately 38,700 active terminals nationwide, scanning purchases at approximately 33,200 independent retailers, including convenience stores, bodegas, liquor stores, grocers, and tobacco and sundries sellers, predominantly serving urban consumers.

December Highlights

(Same-store sales, unit sales, transactions, and average price data refer to December 2025 and are compared to December 2024 unless otherwise noted. All comparisons are provided on a "per calendar day" basis to remove from consideration variability in the number of days per month or three-month period.)

- SALES

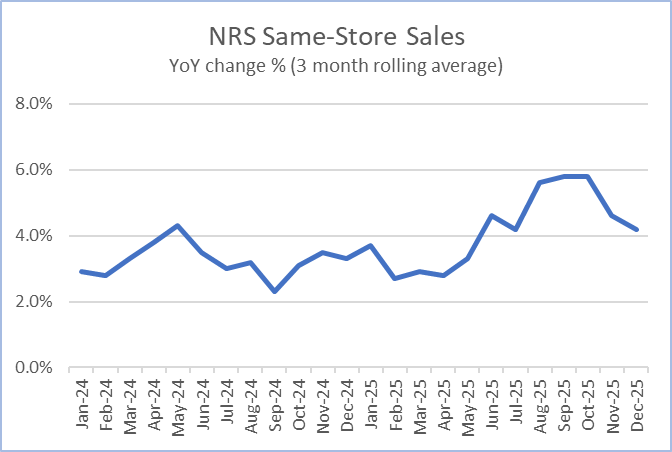

- Same-store sales increased 4.5% year-over-year. In the previous month (November 2025), same-store sales increased 3.8% year-over-year.

- Same-store sales increased 4.5% year-over-year. In the previous month (November 2025), same-store sales increased 3.8% year-over-year.

-

- Same-store sales increased 1.2% compared to the previous month (November 2025). Same-store sales in November 2025 decreased 0.7% compared to the previous month (October 2025).

- For the three months ended December 31, 2025, same-store sales increased 4.2% compared to the corresponding three months a year ago.

- UNITS SOLD

- Units sold increased 1.7% year-over-year. In the previous month (November 2025), units sold increased 0.9% year-over-year.

- Units sold decreased 0.4% compared to the previous month (November 2025). Units sold in November 2025 decreased 0.9% compared to the previous month (October 2025).

- BASKETS (TRANSACTIONS) PER STORE

- Baskets decreased 0.5% year-over-year. In the previous month (November 2025), baskets decreased 0.9% year-over-year.

- Baskets decreased 3.0% compared to the previous month (November 2025). Baskets in November 2025 decreased 3.7% compared to the previous month (October 2025).

- AVERAGE PRICES

- A dollar-weighted average of prices for the top 500 items purchased in December increased 2.3% year-over-year, a slight increase from the 3.1% year-over-year increase in November 2025.

- A dollar-weighted average of prices for the top 500 items purchased in December increased 2.3% year-over-year, a slight increase from the 3.1% year-over-year increase in November 2025.

Retail Trade Comparative Data

As a result of the recent government shutdown, U.S. Commerce Department's Advance Monthly Retail Trade comparative same-store sales data excluding food service has not been released.

Commentary from Brandon Thurber (VP, Data Sales & Client Success at NRS)

"December capped off the year with solid same-store dollar growth. Sales increased 4.5% year over year, supported by a 1.7% rise in units sold, while inflationary pressure eased.

"Larger basket sizes and strong category performance helped drive the sales increase overcoming a slight dip in transactions.

"Cigarettes, prepared cocktails, smokeless tobacco, energy drinks, and rolling papers led the month's increase, reflecting continued demand for convenience and adult-use categories."

NRSInsights Reports

The NRSInsights monthly Retail Same-Store Sales Reports are intended to provide timely topline data reflective of sales at NRS' network of independent, predominantly urban, retail stores.

Same-store data comparisons of December 2025 with December 2024 are derived from approximately 217 million transactions processed through the approximately 24,300 stores on the NRS network that scanned transactions in both months. Same-store data comparisons of December 2025 with November 2025 are derived from approximately 266 million transactions processed through approximately 32,200 stores.

Same-store data comparisons for the three months ended December 31, 2025 with the year-ago three months are derived from approximately 644 million transactions processed through those stores that scanned transactions in both three-month periods.

NRS POS Platform

The NRS platform predominantly serves small-format, independent, retail stores nationwide including convenience stores, bodegas, liquor stores, grocers, and tobacco and sundries sellers. These independent retailers operate in all 50 states and the District of Colombia, including 205 of the 210 designated market areas (DMAs) in the United States, and in Canada. During December 2025, NRS' POS terminals processed $2.2 billion in sales (+15% year-over-year) across 136 million transactions.

About National Retail Solutions (NRS):

National Retail Solutions operates a leading point-of-sale (POS) terminal-based platform and digital payment processing service for independent retailers nationwide. Retailers utilize NRS offerings to process transactions and effectively manage their businesses. Consumer packaged goods (CPG) suppliers, brokers, analytics firms, and advertisers access the terminal's digital display network to reach these retailers' predominantly urban, multi-cultural shopper base, and to harness transaction data-based learnings to identify growth opportunities and measure execution and returns on marketing investment. NRS is a subsidiary of IDT Corporation (NYSE: IDT).

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words "believe," "anticipate," "expect," "plan," "intend," "estimate," "target" and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

NRSInsights Contact:

Brandon Thurber

VP, Data Sales & Client Success at NRS

National Retail Solutions

Brandon.Thurber@nrsplus.com

IDT Corporation Contact:

Bill Ulrey

william.ulrey@idt.net

# # #