Allschwil, Switzerland, January 13, 2026

Basilea Pharmaceutica Ltd, Allschwil (SIX: BSLN), a commercial-stage biopharmaceutical company committed to meeting the needs of patients with severe bacterial and fungal infections, announced today a partnership with INCATE (INCubator for Antibacterial Therapies in Europe), an antimicrobial incubator supporting the advancement of early stage anti-infectives.

Basilea is joining INCATE as an industry partner, bringing extensive preclinical, clinical, and commercial expertise in anti-infectives and, for the first time, expanding INCATE's scope to include antifungals, hence addressing the critical need for novel antifungal therapies. Through this partnership, Basilea will help INCATE to identify and support the most promising early-stage innovations and strengthen the bridge between emerging ideas and real-world medical needs.

Dr. Laurenz Kellenberger, Chief Scientific Officer of Basilea, said: "Invasive fungal infections are a serious and growing health challenge, particularly for vulnerable patient populations, which continue to increase in number. Through this partnership with INCATE, we aim to share our expertise in anti-infective development and help advance promising early-stage antifungal approaches into therapies that deliver meaningful clinical impact."

"We are thrilled to welcome Basilea as an industry partner - this is an important milestone for INCATE and a testament to its growing impact and credibility in the field," said Prof. Dr. Primo Schär, Vice President for Research at the University of Basel and member of the INCATE board. "This partnership further solidifies Basel's unique position as a global hub for innovation in infectious disease therapies, where scientific excellence, industry leadership, and a spirit of collaboration converge in a thriving ecosystem. Basilea's deep expertise in antibacterial and antifungal development will be instrumental in accelerating the discovery and advancement of groundbreaking therapeutic solutions."

The partnership with INCATE will help transform preclinical antibacterial and antifungal concepts towards assets that can be later advanced through industry partnerships for further development, bridging the gap between academic innovation and life-saving medicines.

About INCATE

INCATE is a not-for-profit partnership which brings together translational and basic research, industry, experienced entrepreneurs, and investors from across Europe and beyond. The German Center for Infection Research.

About Basilea

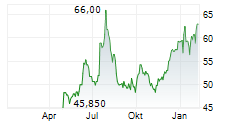

Basilea is a commercial-stage biopharmaceutical company founded in 2000 and headquartered in Switzerland. We are committed to discovering, developing and commercializing innovative drugs to meet the needs of patients with severe bacterial and fungal infections. We have successfully launched two hospital brands, Cresemba for the treatment of invasive fungal infections and Zevtera for the treatment of bacterial infections. In addition, we have preclinical and clinical anti-infective assets in our portfolio. Basilea is listed on the SIX Swiss Exchange.

Disclaimer

This communication expressly or implicitly contains certain forward-looking statements, such as "believe", "assume", "expect", "forecast", "project", "may", "could", "might", "will" or similar expressions concerning Basilea Pharmaceutica Ltd, Allschwil and its business, including with respect to the progress, timing and completion of research, development and clinical studies for product candidates. Such statements involve certain known and unknown risks, uncertainties and other factors, which could cause the actual results, financial condition, performance or achievements of Basilea Pharmaceutica Ltd, Allschwil to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Basilea Pharmaceutica Ltd, Allschwil is providing this communication as of this date and does not undertake to update any forward-looking statements contained herein as a result of new information, future events or otherwise.

For further information, please contact:

| Peer Nils Schröder, PhD Head of Corporate Communications & Investor Relations Basilea Pharmaceutica International Ltd, Allschwil Hegenheimermattweg 167b 4123 Allschwil Switzerland | |

| Phone | +41 61 606 1102 |

| media_relations@basilea.com (mailto:media_relations@basilea.com) investor_relations@basilea.com (mailto:investor_relations@basilea.com) | |

This press release can be downloaded from www.basilea.com.

Attachment

- Press release (PDF) (https://ml-eu.globenewswire.com/Resource/Download/780607dd-18ea-4f30-8e63-cae617dab413)