Highlights:

- Meridian announces Measured and Indicated ("M&I") resources for Cabaçal as part of initial workstream towards its definitive feasibility study;

- Cabaçal mine's Au-Cu-Ag open-pittable resource expanded;

- M&I: 70.1Mt @ 0.6g/t Au, 0.3% Cu, 1.3g/t Ag;

- Metal increases of 39.2% for Au, 14.2% for Cu and 19.3% for Ag;

- Mineralization remains open down dip;

- Cabaçal mine's Au-Cu-Ag open-pittable resource expanded;

- Meridian reports M&I resources for the Santa Helena Central deposit;

- Santa Helena Central's maiden open-pittable Au-Cu-Ag-Zn-Pb resource declared;

- M&I: 5.3Mt @ 0.6g/t Au, 0.4% Cu, 15.5g/t Ag, 1.9% Zn & 0.4% Pb;

- Resource remains open in all directions;

- Santa Helena Central's maiden open-pittable Au-Cu-Ag-Zn-Pb resource declared;

- The Cabaçal VMS Belt's M&I resources total 1.4Moz Au, 0.6Blbs Cu, 5.6Moz Ag, 217.4Mlbs Zn and 49.9Mlbs Pb; and

- Cabaçal DFS metallurgical studies have optimised recoveries of Au, Cu & Ag.

London, United Kingdom--(Newsfile Corp. - January 20, 2026) - Meridian Mining plc (TSX: MNO) (FSE: N2E0) (OTCQX: MRRDF) ("Meridian" or the "Company") is pleased to announce the results of separate Mineral Resource Estimates ("MRE") for the Cabaçal deposit and the Santa Helena Central deposit, concluded by its consultant, GE21 Consultoria Mineral. The Cabaçal Au-Cu-Ag project ("Cabaçal") is at an advanced permitting stage1 and is currently advancing to a Definitive Feasibility Study2 ("DFS"), expected in Q4 2026. The completion of the updated resource is one of the initial workstreams to be completed for the DFS, and the updated resource will be used for further studies in connection with the DFS. The Company has not applied any economic analysis to the updated resource beyond that required to state a resource estimate and does not consider the updated resource to be material to Cabaçal or the Company. It does not supersede the results of the Company's prefeasibility study ("PFS") dated March 31, 2025 and the Mineral Reserve Estimate set out in the PFS is considered to remain current3.

The Company is reporting an updated resource for Cabaçal. Cabaçal's M&I resource is reported at 70.1Mt grading 0.6g/t Au, 0.3% Cu, 1.3g/t Ag for 1.3Moz of Au, 0.5Blbs of Cu and 3.0Moz of Ag.

Meridian is also reporting the maiden open-pittable resource for the Santa Helena Central Au-Cu-Ag-Zn-Pb project ("Santa Helena Central"). Santa Helena Central's M&I resource is reported at 5.3Mt grading 0.6g/t Au, 0.4% Cu, 15.5g/t Ag, 1.9% Zn & 0.4% Pb for 95.8Koz of Au, 50.4Mlbs of Cu, 2.6Moz of Ag, 217.4Mlbs of Zn and 49.9Mlbs of Pb. The Company has not applied any economic analysis to the Santa Helena Central resource beyond that required to state a resource estimate and does not consider the resource to be material.

The Company is also reporting an increase in granted mineral rights across the Cabaçal, Jauru and Araputanga Greenstone Belts to Rio Cabaçal Mineraçao ("RCM"). This follows mineral applications being approved for exploration by the National Mining Agency - "Agência Nacional de Mineração" ("ANM"). The Company's granted exploration portfolio has now more than doubled with these titles. Subject to access agreements and licensing, Meridian will initiate exploration activities across the Jauru and Araputanga Belts during 2026, while continuing to expand multiple exploration programs along the Cabaçal Belt.

In this press release, Cabaçal's MRE is compared to that of March 20254. The September 2025 MRE is based on CIBC Analyst Consensus Commodity prices of November 2025: Au USD 3,103/oz, Ag USD 35.34/oz & Cu USD 4.39 /lb to determine cut-off grades (see Note 14 associated with Table 1) as compared to March 2025's MRE that used CIBC Analyst Consensus Commodity prices of November 2024: Au USD 2,119/oz, Ag USD 26.89/oz, Cu USD 4.16, refer to page 6, in the Company's March 31, 2025 MD&A.

Mr. Gilbert Clark, CEO, comments: "A tremendous start to 2026 with Cabaçal's resource update and Santa Helena Central's maiden resource estimate. This confirms the tremendous potential of the Cabaçal Belt that now hosts over one point three million ounces of gold, more than half a billion pounds of copper and over five million ounces of silver all within open pit depths. Santa Helena Central's resource is solely focused on the central part of an open and prospective system with its stand-alone PL application submitted. We can now look to further near-term growth from additional resource and exploration drilling knowing that we are already well on our way to developing these two resource hubs. The near-term development of a modern and sustainable mining operation in the state of Mato Grosso has been greatly advanced with Meridian's growing Au-Cu-Ag resources, the advancement of the DFS and its expanding exploration programs."

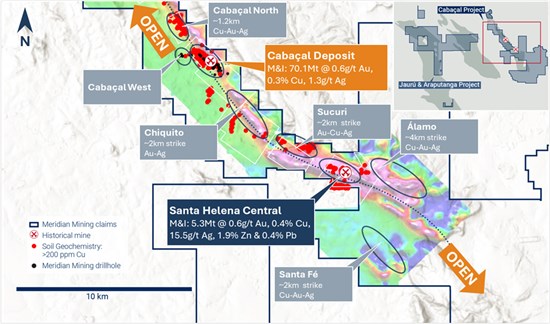

Figure 1: Cabaçal and Santa Helena Central resource locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/280861_e10f0e39b4763aca_002full.jpg

Resource Development Studies - Cabaçal

The mineral resource for Cabaçal (Table 1) was classified and prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014, as amended (the "CIM Standards"), and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019, as amended (the "CIM Guidelines") by Mr. Leonardo Moraes Soares, MAIG. Mr. Soares is an independent Qualified Person as such term is defined under NI 43-101. Mineral resource estimates defined within this 2025 MRE for Cabaçal will feed into the pending DFS, on track for filing in Q4 2026.

| Classification | Weathering | Average Value | Material Content | |||||

| Mass | Au | Ag | Cu | Au | Ag | Cu | ||

| Mt | g/t | g/t | % | koz | koz | kt | ||

| Measured | Saprolite | 0.33 | 0.44 | 0.69 | 0.12 | 4.56 | 7.22 | 0.38 |

| Transition | 1.83 | 0.55 | 0.63 | 0.21 | 32.60 | 37.25 | 3.81 | |

| Fresh Rock | 62.53 | 0.57 | 1.36 | 0.35 | 1,138.52 | 2,743.29 | 217.43 | |

| Total | 64.69 | 0.57 | 1.34 | 0.34 | 1,175.68 | 2,787.77 | 221.61 | |

| Indicated | Saprolite | 0.01 | 0.30 | 0.99 | 0.16 | 0.14 | 0.46 | 0.02 |

| Transition | 0.07 | 0.13 | 0.59 | 0.22 | 0.31 | 1.37 | 0.16 | |

| Fresh Rock | 5.32 | 0.49 | 1.00 | 0.22 | 83.09 | 170.77 | 11.69 | |

| Total | 5.41 | 0.48 | 0.99 | 0.22 | 83.54 | 172.59 | 11.87 | |

| Total | Saprolite | 0.34 | 0.43 | 0.70 | 0.12 | 4.70 | 7.68 | 0.40 |

| Transition | 1.90 | 0.54 | 0.63 | 0.21 | 32.91 | 38.62 | 3.96 | |

| Fresh Rock | 67.85 | 0.56 | 1.34 | 0.34 | 1,221.61 | 2,914.06 | 229.12 | |

| Total | 70.10 | 0.56 | 1.31 | 0.33 | 1,259.22 | 2,960.36 | 233.48 | |

Table 1: Cabaçal deposit mineral resource table.

Notes related to the Mineral Resource Estimate ("MRE"):

- Measured and Indicated Resource estimate reported inside open pit constraints. Inferred category was not classified inside open pit constraints.

- The Mineral Resource Estimates were prepared in accordance with the CIM Standards, and the CIM Guidelines, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit

- Mineral Resources are not Mineral Reserves and are not demonstrably economically recoverable.

- Grades reported using dry density.

- The effective date of the MRE was December 31, 2025.

- The QP responsible for the Mineral Resources is geologist Leonardo Soares (MAIG #5180).

- The MRE numbers provided have been rounded to the estimate relative precision. Values cannot be added due to rounding.

- The MRE is delimited by Mining tenement areas.

- The MRE was estimated using ordinary kriging in 5m x 5m x 2.5m blocks with sub-blocks of 2.5m x 1.25m x 0.625m.

- The MRE report table was produced in Leapfrog Edge software.

- The MRE was restricted by a pit shell defined using metal prices of USD 3,103/oz Au, USD 35.34/oz Ag, USD2 4.39/lb Cu, Mining cost of USD 9.11/t mined, processing cost of USD 7.82/t processed, metallurgical recovery calculated block by block based on metallurgical tests, G&A costs of USD 2.19/t processed, and USD 2.36/t processed logistics.

- Equivalent Gold grade ("AuEq") was calculated with the following general formula: AuEq = (Au_grade * %Au_Recovery) + (1.346*(Cu_grade * %Cu_Recovery)) + (0.013*(Ag _grade * %Ag_Recovery)).

- The QP is not aware of political, environmental, or other risks that could materially affect the potential development of the Mineral Resources other than those typical for mining projects at this stage of development.

- The resource cut-off grade applied for Measured and Indicated resources was 0.117 g/t AuEq.

- The underground mining void model has been used to deplete the resource.

The mineral exploration data was applied to define the 3D geological model and resource estimate. It was compiled into Leapfrog software for the audit and validation of the organization, integrity and security of the data. The database is considered suitable for the purposes of mineral resource estimation.

The Cabaçal deposit mineral resource database consists of 1,290 drillholes, 34 trenches, 83 channels, 25 auger drilling, 15 mixed drilling, 13 percussion drilling and 12 rotary percussion drilling (Meridian + historic drilling), totalling 139,956.78 metres. This database includes 96,900.22 metres of assayed intervals.

All historic data used for the MRE has been validated statistically to show no significant bias, either by twinned drillholes, extensive re-sampling and assaying of historic drill core, statistical comparison of historical data with Meridian drilling, and by field validation of collar locations.

The 3D geological model was prepared by the QP using Leapfrog Geo software, to define and interpolate geological domains.

The nominal sample length of 1 m was selected to be used in sample compositing based on the analysis of composite support for the Cabaçal deposit. The variograms prepared for each domain were used in Ordinary Kriging for Au (g/t), Cu (%) and Ag (g/t) estimates, using Leapfrog Edge software.

The block model for the Cabaçal Project was built using Leapfrog software. The dimensions of the blocks are 5m x 5m x 2.5m blocks with sub-blocks of 2.5m x 1.25m x 0.625m.

Density data was supplied by Meridian inside the drillhole database with selected intervals of 10-15 cm in length for weathered samples and 1 meter for fresh material. A total of 70,976 density test results are present in the database. The QP assumed a fixed value of 2.16 t/m³ by average density on Saprolite and 2.54 t/m³ for the Saprock horizon based on statistical analysis. Density on Fresh Rock Zone was estimated by inverse weighting distance using a minimum of 5 and a maximum of 15 density sample values.

The Ordinary Kriging (OK) estimation method was applied to estimate the Au (ppm), Cu (%) and Ag (ppm) grades for mineralized domains. The estimates were separated for each domain, respecting the composites of each of the mineralized horizons. Grades were estimated considering Soft Boundary domains.

The classification of mineral resources for the Cabaçal deposit was determined by the QP's using the definitions of the Resources established by the CIM. This process involved assessing data quality and quantity, and resource classification was also based on search pass numbers used in grade interpolation.

The Mineral Resource value was quantified inside a resource pit based on the current cost and assumed commodity price, represented for the Reasonable Prospect for Eventual Economic Extraction (RPEEE), considering as effective date December 31, 2025.

Mineral Resources were classified based on the estimation search radius, in conjunction with geological continuity, data spacing, and confidence in the grade estimates. Distances of up to 55 metres were assigned to Measured Mineral Resources, up to 80 metres to Indicated Mineral Resources.

There were no blocks classified as inferred within the open-pit shell.

The resource cut-off grade applied for low- and high-grade domains in Measured and Indicated resources was 0.117 g/t AuEq.

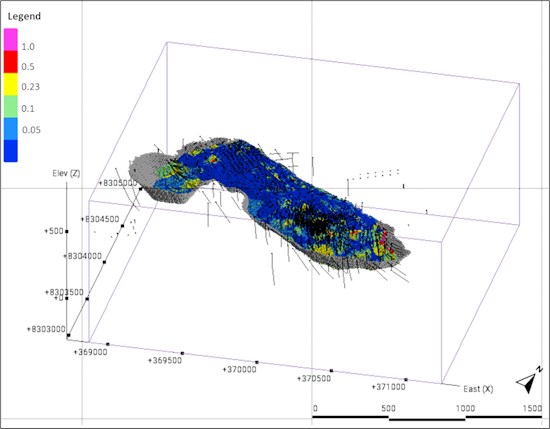

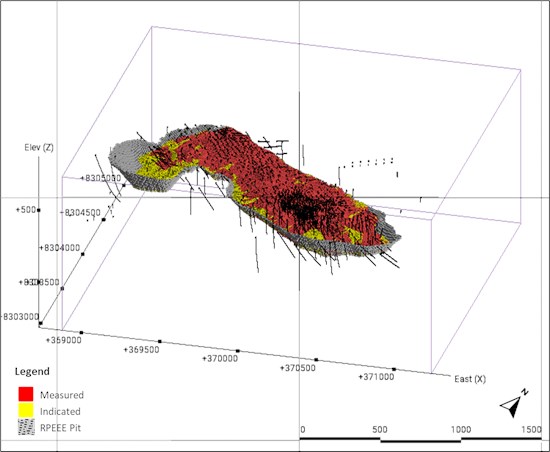

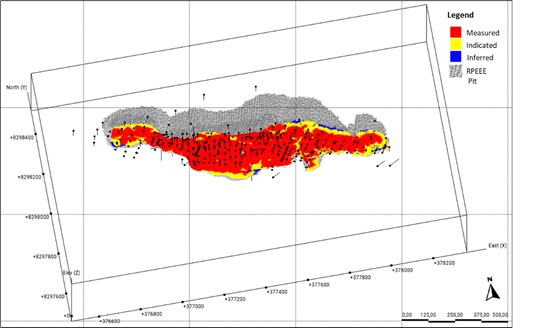

Figure 2 presents the equivalent gold grade within the block model and the RPEEE pit shell, while Figure 3 shows the mineral resource classification.

Figure 2: Gold Equivalent grade within the block model for Cabaçal and the pit optimized for Reasonable Prospects for Eventual Economic Extraction ("RPEEE").

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/280861_e10f0e39b4763aca_003full.jpg

Figure 3: Mineral Resource Classification for Cabaçal

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/280861_e10f0e39b4763aca_004full.jpg

Whilst the resource has grown, the Company notes that the Preliminary Licence for the development footprint of Cabaçal is approved for the volumes of material aligned with those established in the PEA5 and PFS. An increase in the volumes of mined material would require amending the Preliminary Licence, thus extending the Cabaçal development timeline. As a result, the Company will continue to base its Cabaçal DFS and initial development plans on the footprint defined by the Preliminary Licence pit and waste dump areas. Future possibilities may include an expansion of the open pit, implementing backfilling within the approved pit footprint, or potential underground exploitation. The Company will continue to assess near-mine exploration opportunities. The down-dip and down-plunge extensions of the Cabaçal mineral system remain lightly drilled. The Company's focus to date has been restricted to a small number of holes at Cabaçal West. It may be that local flexures or structural intersections, or periodicity in the original VMS architecture, create favourable positions for the copper-gold mineralization event, with scope to test for underground targets. The Company has recently drilled a number of holes to the south-east of Cabaçal with results pending and will progressively test for vectors to potential underground resource extension targets.

Geochemical and geophysical programs remain active in the mine corridor and the Company is purchasing drone-based geophysical sensors to add further to our in-house capabilities for better mapping the structure and stratigraphy for exploration targeting, with equipment expected to be delivered over the course of the first quarter.

Resource Development Studies - Santa Helena Central

The maiden mineral resource for Santa Helena Central (Table 2) was classified and prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014, as amended (the "CIM Standards"), and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019, as amended (the "CIM Guidelines") by Mr. Leonardo Moraes Soares, MAIG. Mr. Soares is an independent Qualified Person as such term is defined under NI 43-101.

| Average Value | Material Content | |||||||||||

| Classification | Weathering | Mass Mt | Au | Ag | Cu | Zn | Pb | Au | Ag | Cu | Zn | Pb |

| g/t | g/t | % | % | % | koz | koz | kt | kt | Kt | |||

| Measured | Saprolite | 0.50 | 0.69 | 11.07 | 0.39 | 0.84 | 0.49 | 11.02 | 177.65 | 1.96 | 4.21 | 2.45 |

| Saprock | 0.55 | 0.53 | 13.47 | 0.57 | 1.27 | 0.34 | 9.38 | 238.45 | 3.17 | 7.00 | 1.87 | |

| Fresh_Rock | 3.70 | 0.58 | 17.07 | 0.45 | 2.20 | 0.45 | 69.03 | 2 027.86 | 16.50 | 81.14 | 16.75 | |

| Total | 4.75 | 0.59 | 16.02 | 0.46 | 1.95 | 0.44 | 89.43 | 2,443.96 | 21.63 | 92.36 | 21.07 | |

| Indicated | Saprolite | 0.08 | 0.43 | 11.10 | 0.21 | 0.78 | 0.29 | 1.06 | 27.60 | 0.16 | 0.60 | 0.23 |

| Saprock | 0.03 | 0.35 | 7.27 | 0.55 | 0.78 | 0.24 | 0.37 | 7.88 | 0.18 | 0.26 | 0.08 | |

| Fresh_Rock | 0.44 | 0.35 | 10.67 | 0.20 | 1.24 | 0.29 | 4.93 | 149.84 | 0.86 | 5.40 | 1.25 | |

| Total | 0.55 | 0.36 | 10.52 | 0.22 | 1.15 | 0.28 | 6.36 | 185.32 | 1.21 | 6.27 | 1.56 | |

| Meas + Ind | Saprolite | 0.58 | 0.65 | 11.07 | 0.37 | 0.83 | 0.46 | 12.08 | 205.25 | 2.12 | 4.81 | 2.67 |

| Saprock | 0.58 | 0.52 | 13.12 | 0.57 | 1.24 | 0.33 | 9.76 | 246.33 | 3.35 | 7.27 | 1.95 | |

| Fresh_Rock | 4.13 | 0.56 | 16.39 | 0.42 | 2.09 | 0.44 | 73.95 | 2,177.70 | 17.37 | 86.55 | 18.01 | |

| Total | 5.29 | 0.56 | 15.45 | 0.43 | 1.86 | 0.43 | 95.79 | 2,629.28 | 22.84 | 98.63 | 22.62 | |

| Inferred | Saprolite | 0.00 | 0.43 | 11.20 | 0.19 | 1.25 | 0.34 | 0.06 | 1.45 | 0.01 | 0.05 | 0.01 |

| Saprock | 0.00 | 0.20 | 6.78 | 0.49 | 0.66 | 0.25 | 0.01 | 0.32 | 0.01 | 0.01 | 0.00 | |

| Fresh_Rock | 0.03 | 0.31 | 11.67 | 0.18 | 1.50 | 0.30 | 0.29 | 11.11 | 0.05 | 0.45 | 0.09 | |

| Total | 0.04 | 0.32 | 11.41 | 0.19 | 1.44 | 0.30 | 0.36 | 12.88 | 0.07 | 0.51 | 0.11 | |

Table 2: Santa Helena Central deposit mineral resource table.

Notes related to the Mineral Resource Estimate:

- Measured and Indicated Resource estimate reported inside open pit constraints.

- The Mineral Resource Estimates were prepared in accordance with the CIM Standards, and the CIM Guidelines, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit

- Mineral Resources are not Mineral Reserves and are not demonstrably economically recoverable.

- Grades reported using dry density.

- The effective date of the MRE was December 31, 2025.

- The QP responsible for Mineral Resources is geologist Leonardo Soares (MAIG #5180).

- The MRE numbers provided have been rounded to the estimated relative precision. Values cannot be added due to rounding.

- The MRE is delimited by Mining tenement areas.

- The MRE was estimated using ordinary kriging in 5m x 5m x 2.5m blocks with sub-blocks of 1.25m x 1.25m x 1.25m.

- The MRE report table was produced in Leapfrog Geo software.

- The Mineral Resource Estimate (MRE) was constrained by an optimized pit shell generated using the following parameters: metal prices of USD3,103/oz gold, USD35.34/oz silver, USD4.39/lb copper, USD1.22/lb zinc, and USD0.92/lb lead; mining costs of USD2.98/t for oxidized ROM and waste material, USD10.44/t for transitional and fresh ROM material, and USD2.98/t for waste; a processing cost of USD7.82/t processed; general and administrative (G&A) costs of USD2.19/t processed; and logistics costs of USD2.36/t processed.

- Equivalent Gold grade ("AuEq") was calculated with the following formula:

- Fresh Rock Gold Equivalent: AuEq(g/t) = (Au_ppm * 57.0%Rec) + (0.970 * Cu_pct * 76.9%Rec) + (0.270 * Zn_pct * 90.6%Rec) + (0.203 * Pb_pct * 78.3%Rec.) + (0.011 * Ag _ppm * 83.7%Rec.).

- Transition Zone Gold Equivalent: AuEq(g/t) = (Au_ppm * 83.1%Rec) + (0.970 * Cu_pct * 75.3%Rec) + (0.270 * Zn_pct * 77.4%Rec) + (0.203 * Pb_pct * 51.4%Rec) + (0.011 * Ag _ppm * 80.1%Rec).

- Oxide Zone Gold Equivalent: AuEq(g/t) = (Au_ppm * 78.1%Rec.) + (0.011 * Ag _ppm * 62.3%Rec.).

- The resource cut-off grade applied for Measured and Indicated resources was 0.125 g/t AuEq.

- The underground mining void model has been used to deplete the resource.

The mineral exploration data was applied to define the 3D geological model and resource estimate. It was compiled into Leapfrog software for the audit and validation of the organization, integrity and security of the data. The database is considered suitable for the purposes of mineral resource estimation.

The Santa Helena Central deposit's mineral resource database consists of 327 drillholes, 22 trenches, 104 channels and 47 auger drill holes, and 245 grade control holes (Meridian + historic drilling), with 27,533.96 metres (Table 3). This database includes 18,655.35 metres of assayed intervals.

| Type | Number | Meterage |

| Auger | 47 | 329.89 |

| Channel | 104 | 188.69 |

| Diamond | 327 | 25145.38 |

| Grade Control | 245 | 770.77 |

| Trench | 22 | 1099.23 |

| Total | 745 | 27533.96 |

Table 3: Santa Helena database drill types.

All historic data used for Santa Helena Central's MRE has been validated statistically to show no significant bias, either by twinned drillholes, extensive re-sampling and assaying of historic drill core, statistical comparison of historical data with Meridian's drilling, and by field validation of collar locations, to validate them. A change of support was performed to guarantee the use of historical data including channel, trench, grade control and auger drilling, by comparing values with the original diamond drill hole (DDH) data.

The 3D geological model was prepared by the QP using Leapfrog Geo software, to define and interpolate geological domains.

The nominal sample length of 1 m was selected to be used in sample compositing based on the analysis of composite support for the Santa Helena Central deposit. The variograms prepared for each domain were used in Ordinary Kriging for Au (g/t), Cu (%), Ag (g/t), Zn (%) and Pb (%) estimates, using Leapfrog Edge software.

The block model for Santa Helena Central was built using Leapfrog software. The dimensions of the blocks are 5m x 5m x 2.5m blocks with sub-blocks of 1.25m x 1.25m x 1.25m.

Density data was supplied by Meridian inside the drillhole database with selected intervals of 10-15 cm in length for weathered samples and 1 meter for fresh material. A total of 11,702 density test results are present in the database. The QP assumed a fixed value of 1.70 t/m³ by average density on Saprolite and 2.33 t/m³ for the Saprock horizon based on statistical analysis. Density on Fresh Rock Zone was estimated by inverse weighting distance using a minimum of 5 and a maximum of 15 density sample values.

The Ordinary Kriging (OK) estimation method was applied to estimate the Au (ppm), Cu (%), Ag (ppm) Zn (%) and Pb (%) grade for mineralized domains. The estimates were separated for each domain, respecting the composites of each of the mineralized horizons. Grades were estimated considering Soft Boundary domains.

The classification of mineral resources for the Santa Helena Central deposit was determined by the QP's using the definitions of the Resources established by the CIM. This process involved assessing data quality and quantity, and resource classification was also based on search pass numbers used in grade interpolation.

The Mineral Resource value was quantified inside a resource pit based on the current cost and assumed commodity price, represented for the Reasonable Prospect for Eventual Economic Extraction (RPEEE), considering as effective date December 31, 2025.

Mineral Resources were classified based on the estimation search radius, in conjunction with geological continuity, data spacing, and confidence in the grade estimates. Distances of up to 55 metres were assigned to Measured Mineral Resources, up to 80 metres to Indicated Mineral Resources, and up to 120 metres to Inferred Mineral Resources.

CIBC Analyst Consensus Commodity prices of November 2025 have been used for Santa Helena Central's Mineral Resource Estimates: Au USD 3,103/oz, Ag USD 35.34/oz, Cu USD 4.39 /lb, Zn USD 1.22/lb and Pb USD 0.92/lb.

The resource cut-off grade applied for low- and high-grade domains in Measured and Indicated resources was 0.125 g/t AuEq.

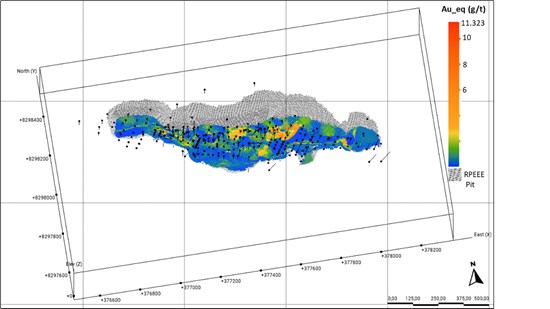

Figure 4 presents the equivalent gold grade within the block model and the RPEEE pit shell, while Figure 5 shows the mineral resource classification.

Figure 4: Gold Equivalent grade within the block model for Santa Helena Central and the pit optimized for Reasonable Prospects for Eventual Economic Extraction ("RPEEE").

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/280861_e10f0e39b4763aca_005full.jpg

Figure 5: Mineral Resource Classification for Santa Helena Central

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/280861_e10f0e39b4763aca_006full.jpg

The Santa Helena Central deposit remains open particularly to the west, where results have included CD-605's 75.6m @ 3.0g/t Au, 1.0% Cu, 30.2 g/t Ag & 2.5% Zn from 32.4m6. Meridian's drilling to the west has been limited to the reach of low-angled holes and the open mineralization trends towards the Sucuri VTEM conductor. This western extension is in a forest regrowth area where the Company is continuing to engage with agencies to assess options for permitting for low-impact activities. A limited amount of historical drilling had been undertaken by historical operators in this corridor, before changes in the environmental permitting system were implemented. Highlighted historical results from Sucuri, included a peak grade of 1.0 m at 140.0 g/t Au from 53.0 m in JUCHD-011.

Induced polarization surveys and reconnaissance drilling also suggests that the VMS position is structurally repeated along chargeability corridors detected to the northeast of Santa Helena Central, which will be subject to further evaluation (Santa Helena North; Santa Helena Far North7).

There is also limited drilling at depth beneath the deposit and testing for the possibility of stacked lenses for underground resource potential will be an objective. VMS Camps such as La Ronde - Penna host mineralization stacked at different stratigraphic intervals. With the Cabaçal Belt being characterised by gentle dips, there is a significant footprint of unexplored stratigraphy between the sub-volcanic intrusive system and the known VMS deposit horizon. With potential for gold mineralization associated with the syn-volcanic event and subsequent introduction/remobilization in the subsequent deformational history, a range of conceivable targets exist.

The tonnage and grades of the Santa Helena Central's resource differ from historical exploration targets and resource estimates, being influenced by:

- Increased gold price, which in the metal equivalence formulas has the effect of subduing base metal grades;

- GE21's assessment that some of the historical grade control data analysed at the site laboratory required levelling impacting historical drill hole metal grades;

- Differing metallurgical properties between the historically mined higher-grade massive sulphide mineralization and the lower-grade stringer to disseminated mineralization;

- Mineralization extending out of open pit constraints; and

- Infill drilling resulted in a more defined geological model of the higher-grading massive sulphide zones.

Cabaçal Definitive Feasibility Study Update

The DFS's metallurgical test work phase is complete with new metallurgical recovery formulae calculated. Further increases in the already high recoveries for gold and silver have been achieved. This was also achieved for the Cabaçal's copper mineralization grading above 0.5% Cu.

For the DFS's metallurgical program, the samples supplied to SGS for testing were selected from the planned first five years of mill feed[8] to test the process flowsheet over the mine payback period and beyond. An updated process flowsheet was tested based on this program's metallurgical results. The main enhancements being a slightly finer primary grind of 150 micron compared to the PFS's 200 micron as well as a marginally increased dosage of collector in the copper cleaner stage.

New metal recovery formulae have been calculated for use in the pending DFS. The metal recovery formulae are provided in the Technical Notes. Based on the average metal grades of the DFS's resource estimate outlined in this release, the improvements in metal recoveries compared to the PFS can be seen in Table 4:

| Au g/t | Cu % | Ag g/t | |

| Cabaçal updated M&I resource grade | 0.56 | 0.33 | 1.31 |

| DFS metal recovery % | 88.35 | 90.97 | 72.51 |

| PFS metal recovery % | 85.52 | 90.97 | 51.97 |

| DFS metal recovery difference | 2.83% | * | 20.54% |

Table 4: Comparative DFS and PFS metal recoveries.

* As the DFS's metallurgical program used samples grading +0.5% Cu, for grades below 0.5% Cu the PFS's metal recoveries were applied. Therefore, with the Cabaçal resource update's average copper grade of 0.33% the average copper metal recoveries are the same for both the DFS and the PFS.

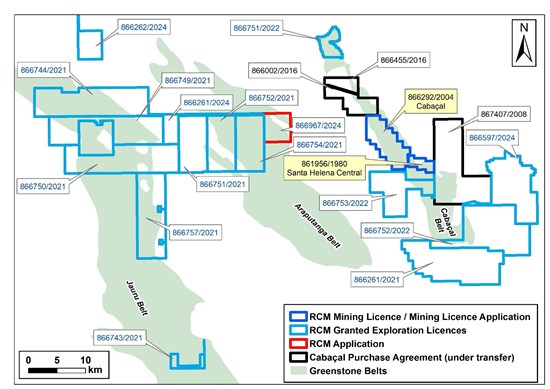

Landbank Developments - Mato Grosso

The Company is pleased to report that an additional ten of its exploration mineral title applications have been recently approved for exploration by the ANM (Figure 6) to RCM. The newly granted licences cover 64,490 ha. Combined with previous granted tenure and titles covered by the Cabaçal purchase agreement9, this brings the footprint of tenure available to exploration to a total 104,932 ha (granted exploration licences, combined with the Cabaçal mining title application, and Santa Helena mining licence). One licence remains under application spanning 2,336 ha.

The ten newly approved mineral titles expand the footprint of granted licences in each of the three greenstone belts.

Newly granted tenure in the Cabaçal Belt includes two licences:

Licence 866752/2022 (9,466 ha) and Licence 866597/2024 (7,561 ha) are located on the southern extension of the Cabaçal Belt, southeast and east of the Santa Fé target region. Regional geological maps show the belt projecting into this region, and magnetic data coupled with drilling in the Santa Fé area indicates that the greenstone projects under the younger Proterozoic Aguapei sedimentary formation (with this formation itself being prospective for gold)10.

Newly granted tenure in the Araputanga Belt includes two licences:

Within the Araputanga Belt, the newly granted licences 866752/2021 (4,911 ha) and 866754/2021 (4,917 ha) adjoin the previously granted licence 866751/2021. These two licences consolidate the Company's footprint over the BP Minerals ("BPM") "A1" target area, a position where BP Minerals ("BPM") previously conducted soil geochemistry and ground geophysical follow up of aerial INPUT anomalies. Two holes were drilled by BPM (but complete results are lost). The A1 soil geochemical results have been recently recovered through georeferencing of historical maps. BP applied an empirical but effective method of panning a set volume (5L) soil sample to derive gold counts. At a 10-count threshold, there are at least 12 anomalies varying from 150 to 850m in strike length. Copper values reach over 250ppm in the grid. A number of gold and base metal stream anomalies are present outside of the limits of the soil grid, along with INPUT geophysical targets, still leaving first principals exploration programs to be executed.

Newly granted tenure in the Jauru Belt includes six licences:

Licence 866262/2024 (2,116 ha) lies to the north and covers the J9 exploration target, which again hosts a series of clustered gold, copper and polymetallic stream anomalies. A strong gold-in-soil anomaly is registered in this area, although the map is less well located and some field validation is required to confirm the east-west spatial positioning of the response. There are seven BPM INPUT geophysical anomalies present on this licence.

Licence 866757/2021 (7,400 ha) projects over a more southern extension of the belt and hosts the projection of the J7 target (a northern extension of the off-licence J6 target trend, held by River Gold Mineração Ltda under mining licence application). Gold in this region is associated with shearing close to the margin of the granite-greenstone contact. Licence 866757/2021 hosts four BP INPUT geophysical anomalies requiring further evaluation.

Licences 866744/2021 (9,767 ha) and 866749/2021 (7,544 ha) host the Jauru copper-in-stream target[11]. This target corridor is associated with an exhalative unit extending over a strike length of 9km, contained wholly within the Company's licence package. A strong copper-in-stream anomaly is evident over at least a 7km strike extent over this exhalative unit. Basaltic metavolcanics are developed in the footwall of the exhalative unit to the east, and a metasedimentary unit is present to the west in the hangingwall. The copper-in-stream response increases rapidly from background values over the metavolcanic-sedimentary package, to form a coherent strike-extensive anomaly over the exhalative unit, increasing to peak values of up to 240ppm Cu. For context, peak copper values for the stream anomaly that led to definition of the Cabaçal target were in the order of 34 - 56ppm Cu, and for Santa Helena, 20 - 36ppm Cu. Within licence 866744/2021, there are 19 BPM INPUT geophysical anomalies, some aligning with the stream anomaly and some detached associated with footwall lead-zinc anomalies or hangingwall positions requiring further evaluation.

Jauru licence 866750/2021 (8,917 ha) does not span a specifically defined BPM target position but is structurally along strike and down plunge from the copper-in- stream anomaly of licences 866744/2021 - 866749/2021. It hosts four INPUT geophysical anomalies from the BPM aerial survey, and various lead-zinc stream anomalies not surveyed in more detail with follow up soil programs. Such responses could be indicative of broader zoned systems and in time will be evaluated in more detail. Licence 866261/2024 (1,890) lies east of the Jauru copper-in-stream target, hosts some lead-in-stream anomalies, and provides continuity with the Araputanga licence package.

The Company's community relations and permitting teams are now focussed on securing expanded access agreements and environmental licensing to facilitate exploration programs and have commenced making contact with the farming community in this district. The Company has in total 104 written agreements and is building on a base of new contacts to expand our strong community relations. Environmental permitting for exploration also required landholders to have a registered "CAR" (Cadastro Ambiental Rural; land use document). Not all properties yet have this, which may limit access to some regions until they can be obtained. There is a program of work still in progress to vectorize the prospect-scale historical soil, geology and geophysical datasets which will continue whilst the land-access and permitting programs continue.

The Company will recommence full field activities in late January.

Figure 6: Mineral Title status map of the Cabaçal, Araputanga and Jauru Belts. Newly approved licences are 866752/2022, 866752/2021, 866262/2024, 866757/2021, 866744/2021, 866750/2021, 866597/2024, 866261/2024, 866754/2021, 866749/2021.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/280861_e10f0e39b4763aca_007full.jpg

Landbank Developments - Rondônia

With the increasing focus on copper-gold exploration in Mato Grosso, the Company has decided to relinquish certain non-core licences in Rondônia (within the Mirante da Serra and Ariquemes districts), whilst maintaining the Espigão d'Oeste licence package. The Company's objective is to continue to build a strong pipeline of copper-gold exploration and development opportunities.

Technical Notes

The CIBC Analyst Consensus Commodity prices (USD) of November 2025 have been used for the Mineral Resource Estimates: Gold USD 3,103/oz, Silver USD 35.34/oz, Copper USD 4.39 /lb, Zinc USD 1.22/lb and Lead USD 0.92/lb. Metallurgical recoveries have been based on testwork programs undertaken on drill core at SGS Lakefield in Canada, determining the following parameters:

Cabaçal Fresh Rock Gold Recovery:

- Recovery for grades less than 0.5g/t Au = 5.4022∗Ln(Grade)+88.66

- Recovery for grades equal to or higher than 0.5g/t Au = 5.807∗ (Grade)+85.11

- Recovery for grades higher than 1.65g/t Au is capped at 94.69%

Cabaçal Fresh Rock Copper Recovery:

- Recovery for grades less than 0.5% Cu = 3.9067∗Ln(Grade)+95.269

- Recovery for grades equal to or higher than 0.5% Cu = 1.3393 Ln(Grade)+97.83

- Recovery for grades higher than 1.03% Cu is capped at 98.1%

Cabaçal Fresh Rock Silver Recovery:

- Recovery for grades less than 0.5g/t Ag = 30.354∗Ln(Grade)+43.691

- Recovery for grades equal to or higher than 0.5g/t Ag = 3.8821∗ (Grade)+67.406

- Recovery for grades higher than 5.0g/t Ag is capped at 86.81%

Cabaçal (Saprock) Transition Zone:

- For all blocks that contain more than 0.1% sulphur, the fresh rock recovery formula would apply

- For all blocks containing less than 0.01% sulphur the oxide recovery would apply

- Between 0.01 and 0.1% sulphur, a pro rata of the fresh rock recovery formula was applied for copper

- Between 0.01 and 0.1% sulphur, a recovery of 77.3% was applied to gold, and a recovery of 40% was applied to silver

Cabaçal Saprolite (Oxide) Zone:

- Gold: 62.1% recovery

- Copper: 1.2% recovery

- Silver: 17.9% recovery

Cabaçal Metal Equivalent Formulas:

AuEq_ppm = (Au_ppm * %Rec.) + (0.970*Cu_pct * %Rec.) + (0.011*Ag _ppm * %Rec.)

For Santa Helena Central, fixed recoveries were used from the initial metallurgical testwork program:

Santa Helena Central Fresh Rock Recovery:

- Zinc 90.6%, Copper 76.9%, Lead 78.3%, Gold 57.0% and Silver 83.7%

Santa Helena Central Saprock (Transition) Zone Recovery:

- Zinc 77.4%, Copper 75.3%, Lead 51.4%, Gold 83.1% and Silver 80.1%

Santa Helena Central Saprolite (Oxide) Zone Recovery:

- Gold 78.1% and Silver 62.3%

Santa Helena Metal Central Equivalent Formulas:

Fresh Rock:

AuEq_ppm = (0.57*Au_ppm) + (0.746*Cu_pct) + (0.244*Zn_pct) + (0.159*Pb_pct) + (0.010*Ag _ppm)

Saprock (Transition) Zone:

AuEq_ppm = (0. 831*Au_ppm.) + (0.731*Cu_pct) + (0.209*Zn_pct) + (0.104*Pb_pct) + (0.009*Ag _ppm)

Saprolite (Oxide) Zone:

AuEq_ppm = (0.781*Au_ppm.) + (0.007*Ag _ppm)

Qualified Person Statement

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, verified and approved the technical information in this news release.

Dr. Norman Lotter, P.Eng., C.Eng., FIMMM, FSAIMM and Consulting Engineer of Flowsheets Metallurgical Consulting Inc., is a Qualified Person as defined by National Instrument 43-101, and has reviewed, verified and approved the metallurgical information in this news release.

Leonardo Soares (Bsc Geo, MAIG), Senior Geological Consultant of GE21 Consultoria Mineral, is responsible for the geological setting, deposit type, exploration, drilling, sample preparation and Mineral Resource estimation, is a Qualified Person as defined by National Instrument 43-101 and has reviewed, verified and approved the mineral resource information in this news release.

About Meridian

Meridian Mining plc is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold-copper project;

- Expanding the initial resource inventory at in the Santa Helena area through extension of Santa Helena Central, and new discoveries;

- Regional scale exploration of the Cabaçal VMS Belt to expand the Cabaçal Hub strategy; and

- Exploration in the Jauru & Araputanga Greenstone Belts (the above all located in the State of Mato Grosso, Brazil).

The Pre-feasibility Study technical report (the "PFS Technical Report") dated March 31, 2025, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study" outlines a base case after-tax NPV5 of USD 984 million and 61.2% IRR from a pre-production capital cost of USD 248 million, leading to capital repayment in 17 months (assuming metals price scenario of USD 2,119 per ounces of gold, USD 4.16 per pound of copper, and USD 26.89 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 742 per ounce gold equivalent & production profile of 141,000-ounce gold equivalent life of mine, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.3:1, and the low operating cost environment of Brazil.

The Cabaçal Mineral Reserve estimate consists of Proven and Probable reserves of 41.7 million tonnes at 0.63g/t gold, 0.44% copper and 1.64g/t silver (at a 0.25 g/t gold equivalent cut-off grade).

Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report may be found under the Company's profile on SEDAR+ at www.sedarplus.ca and on the Company's website at www.meridianmining.co

The PFS Technical Report was prepared for the Company by Tommaso Roberto Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering Canada ULC; Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering Canada ULC; John Anthony McCartney, C.Geol., Ausenco Chile Ltda.; Porfirio Cabaleiro Rodriguez (Engineer Geologist FAIG), of GE21 Consultoria Mineral; Leonardo Soares (Bsc Geo, MAIG), Senior Geological Consultant of GE21 Consultoria Mineral; Norman Lotter (Mineral Processing Engineer; P.Eng.), of Flowsheets Metallurgical Consulting Inc.; and, Juliano Felix de Lima (Engineer Geologist MAIG), of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining plc

Mr. Gilbert Clark - CEO and Director

Meridian Mining plc

8th Floor, 4 More London Riverside

London SE1 2AU

United Kingdom

Email: info@meridianmining.co

Ph: +44 (0) 203 930 3145 (GMT)

Media Enquiries:

Gareth Tredway / Ruairi Millar

Tel: +44 (0) 207 920 3150

Email: meridianmining@tavistock.co.uk

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on X: https://X.com/MeridianMining

Further information can be found at: www.meridianmining.co

Cautionary Statement on Forward-Looking Information

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

1 Meridian Mining news release of November 03, 2025

2 Meridian Mining news release of May 08, 2025

3 Meridian Mining news release of March10,2025

4 Meridian Mining news releases of March 10, 2025

5 Meridian Mining news releases of March 06, 2023

6 Meridian Mining news releases of November 20, 2024

7 Meridian Mining news releases of July 9, 2025 and September 9, 2025

8 See Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study" - 10th March 2025

9 Meridian Mining news release of November 9, 2020

10 Meridian Mining news release of September 9, 2025

11 Meridian Mining News release of May 14, 2024

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280861

Source: Meridian Mining Plc