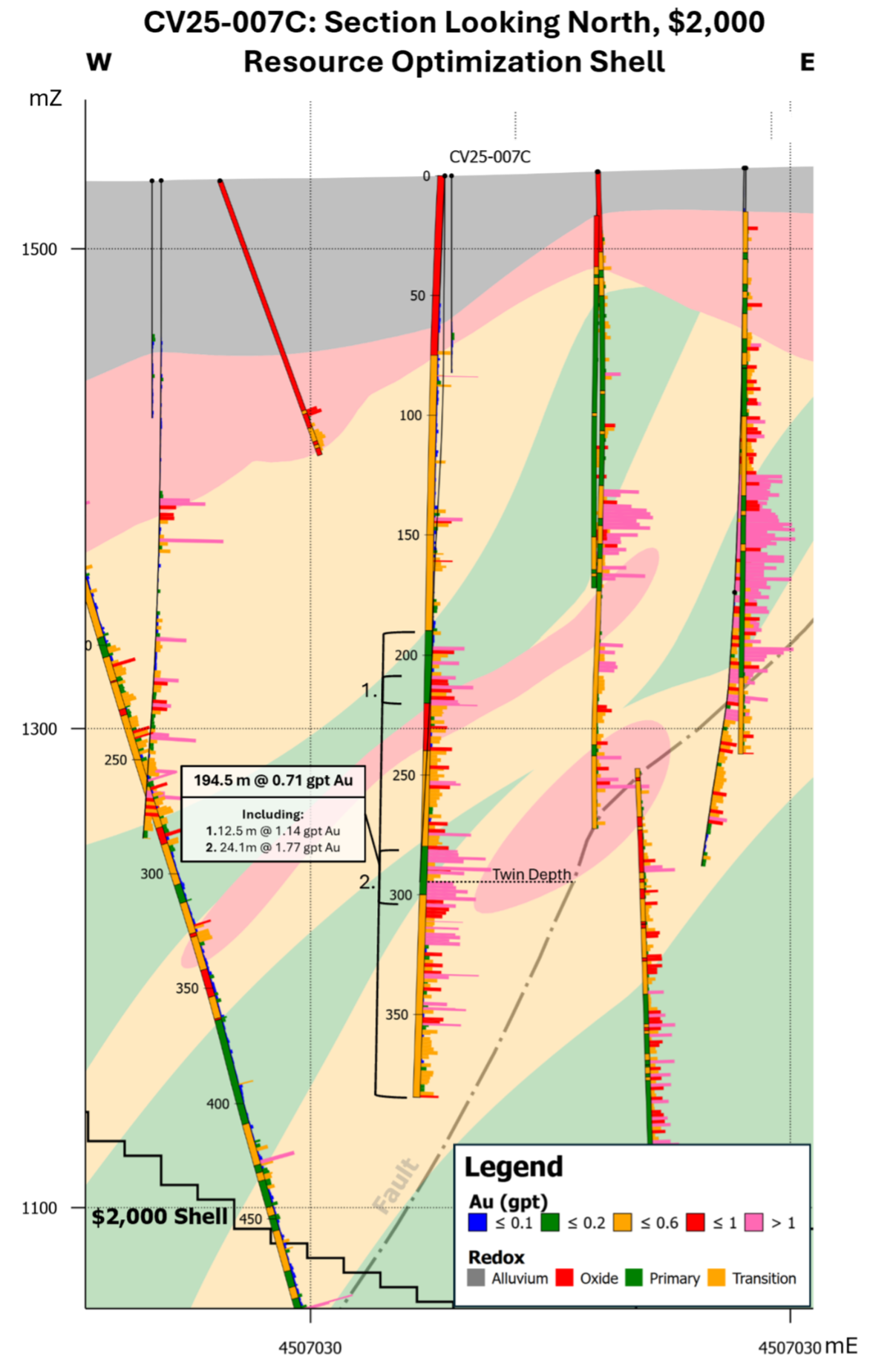

VANCOUVER, BC / ACCESS Newswire / January 20, 2026 / Roxmore Resources Inc. (formerly, Axcap Ventures Inc.) (CSE:RM)(OTCQX:GARLF) ("Roxmore" or the"Company") is pleased to report results from its ongoing drill campaign at its flagship Converse Gold Project ("Converse" or "the Project"), located on the Battle Mountain - Eureka Trend in Nevada, USA. Results include a significant intercept of 194.5m grading 0.71 g/t gold from 190.2m depth, including 12.5m grading 1.14 g/t Au from 208.5m, and 24.1m grading 1.77 g/t Au from 281m. The drill hole was completed as part of the Company's ongoing Preliminary Economic Assessment ("PEA") studies and continues to validate both the scale and continuity of gold mineralization at Converse.

Key Highlights

194.5m grading 0.71 g/t Au from 190.2m in CV25-007C, including:

12.5m grading 1.14 g/t Au from 208.5m; and

24.1m grading 1.77 g/t Au from 281m.

CV25-007C was designed to twin an historic reverse circulation ("RC") hole, with the results demonstrating an excellent comparison between core and RC drilling.

The historic RC hole ended in mineralization, with CV25-007C extending mineralization a further 89.6m downhole, highlighting the potential for future mineral resource expansion.

Gold Continuity and Robust Mineralization

A thick, continuous interval of gold mineralization was intersected in core hole CV25-007C, demonstrating the robust nature of mineralization at Converse.

High-grade, variable oxidized intersection (downhole thickness):

194.5m grading 0.71 g/t Au from 190.2 m, including:

12.5m grading 1.14 g/t Au from 208.5m; and

24.1m grading 1.77 g/t Au from 281m.

Nearby historic RC hole NK-087 intersected 118.3m at 0.63 g/t Au (74.3 g*m). Through its twinned interval, CV25-007C returned 104.6m at 0.73 g/t Au (76.3 g*m), demonstrating an excellent correlation between RC and core drilling results at Converse. As RC hole NK-087 ended in mineralization, CV25-007C was extended to depth, successfully extending gold mineralization an additional 89.6 m below the historic hole.

The true thickness of mineralization in CV25-007C is estimated to be approximately 150m, based upon modelled controlling sedimentary bedding dips and grade shell models. The highest individual gold assay returned 5.39 g/t Au, determined by fire assay with gravimetric finish.

The continuity and grade of mineralization intersected in CV25-007C support previous drilling results and strengthen confidence in the reliability of the existing database as the Project advances through economic studies. These results further demonstrate the potential for new mineralized zones within the current pit-shell constrained mineral resource.

John Dorward, Executive Chairman of Roxmore commented: "Drilling continues to reinforce the robust nature of the Converse deposit. Our geology team has undertaken a significant relogging and modelling exercise in recent months and it is very encouraging to see this work reflected in today's strong result. We continue to advance project studies and look forward to delivering what we believe will be a compelling PEA next quarter."

Geology and Mineralization

The Company believes the gold system at Converse has similarities to the giant Phoenix deposit currently being mined by Nevada Gold Mines, located a short distance to the east. The geology intersected in CV25-007C was predicted by Roxmore's updated geological model, including stratigraphy, faulting and alteration styles. This predictable three-dimensional model will further support the updated gold mineral resource estimate currently being completed by SLR Consulting as part of the PEA.

CV25-007C targeted skarn related gold mineralization in Converse's North Redline Zone. The drill hole intersected gold mineralization hosted within the well-defined portion of the gold skarn system that remains open for expansion. Mineralization is controlled by calcareous Havallah Formation sedimentary beds crosscut by high-angle deposit-scale fluid-feeding structures.

Alteration intensity increases toward these structures and is characterized by a transition from proximal garnet-pyroxene-dominated prograde skarn that grades outward to pyroxene-dominant prograde skarn, overprinted by epidote-chlorite-carbonate that grade outward into chlorite-carbonate dominant retrograde assemblages. Retrograde alteration is the dominant predictor of better gold grades within skarn related gold mineralization.

The oxidation state of the mineralized intercept is variable between oxidized, transitional and sulphide zones. Metallurgical testwork conducted at Converse indicates that gold is recoverable by cyanidation from all three oxidation states, to varying degrees.

Results from this drilling program will be incorporated into the updated geological model and ongoing PEA studies. Roxmore continues to advance the Converse Gold Project with a focus on scale, continuity, and technical rigor. Drilling at the Project is ongoing.

Upcoming Catalysts

Q1 2026 - Further drill results from current drilling program

Q2 2026 - Release of the Converse PEA

About Roxmore Resources Inc.

Roxmore is focused on developing its flagship, Converse Gold Project, one of the largest undeveloped gold deposits not owned by a major mining company in Nevada, USA. The Converse Gold Project is located within the prolific Battle Mountain trend containing 5.57Moz Au of Measured and Indicated Mineral Resources and 0.42Moz Au Inferred Mineral Resources (238mt at 0.539g/t Au for 4.13Moz Measured Mineral Resources; 92mt at 0.487g/t Au for 1.44Moz Indicated, 25mt at 0.528g/t Au for 0.42Moz Inferred Mineral Resources). With decades of expertise in Nevada and globally, our Board and management are focused on unlocking the potential of this project. For further details please refer to our technical report entitled "Amended and Restated NI 43-101 Technical Report and Mineral Resource Update, Converse Property, Humboldt County, Nevada, USA" dated effective February 13, 2025 which is available on our website at www.roxmoreresources.com and on our SEDAR+ profile at www.sedarplus.ca.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Vance Spalding, CPG, Executive VP Exploration for Roxmore, who is a "qualified person" within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Quality Control & Assurance

Drill core is generally extracted from the core tube and split tubes by the drill contractor and placed in core boxes with appropriate depth markers noting recovery. Full core boxes are then sealed before being transported by Roxmore's personnel to a facility in Carlin, Nevada where it is processed, geologically and geotechnically logged by Roxmore geologists: checked for recovery, photographed, and marked for assays. The core is cut in half and placed in plastic bags, zip-tied and grouped in burlap sacks and sealed for transport to the Paragon Geochemical's laboratory in Sparks Nevada. Sample preparation is done according to Paragon codes PREP-PKGB [plate pulverize] and HOMO-ROL. The primary assay methods used are Paragon codes Au-FA30 and 33MA-OES. The gold overlimit methods are Au-GR023 and Au-SCR1k (overlimit triggers are 3 ppm and 10 ppm Au respectively). Paragon Geochemical is an independent, ISO-accredited laboratory with no affiliation to Roxmore Resources beyond its role as a third-party analytical service provider. The retained half-core is transported to the company's warehouse in Lovelock, Nevada.

QA/QC is performed as each certificate is imported into Roxmore's GeoSequel database. Performance charts are prepared for coarse blanks, certified reference materials and duplicates used. Roxmore uses OREAS standards for the Converse project. The insertion frequencies of blanks is 3.33%, of CRMs is 3.33%, and of full half-core duplicates is 3.33%. Coarse blank above 10x over the lower detection limit (LDL) of the Au-FA30 method are re-run. For certified reference materials, the certified mean is considered the target. The certified standard deviation is used to calculate the acceptable range. The acceptable range is defined as within 3 standard deviations from the certified mean.

For further information please contact:

John Dorward

Roxmore Resources Inc.

Contact@roxmoreresources.com

Tel: 905-961-4727

Cautionary Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward- looking statements") within the meaning of applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward- looking statements are often identified by terms such as "may", "should", "anticipate", "will", "estimates", "believes", "intends" "expects" and similar expressions which are intended to identify forward-looking statements. More particularly and without limitation, this news release contains forward-looking statements concerning the Converse Gold Project, the Preliminary Economic Assessment and the timing therefore, the results of exploration being indicative of further mineralization at the Converse Gold Project, the timing for the release of results from the remaining deep drill holes, and mineral resource estimates.

Forward-looking statements are inherently uncertain, and the actual performance may be affected by a number of material factors, assumptions and expectations, many of which are beyond the control of the Company, including expectations and assumptions concerning general economic and industry conditions, applicable laws and regulations, commodity prices, the use of proceeds, and the future business and operational needs of the Company. Readers are cautioned that assumptions used in the preparation of any forward-looking statements may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including, but not limited to, the impact of general economic conditions, industry conditions, volatility of commodity prices, currency fluctuations, dependency upon regulatory approvals, the uncertainty of obtaining additional financing and exploration risk. Readers are further cautioned not to place undue reliance on any forward-looking statements, as such information, although considered reasonable by the respective management of Roxmore at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

The forward looking statements contained in this news release are made as of the date of this news release and are expressly qualified by the foregoing cautionary statement. Except as expressly required by securities law, Roxmore does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Table 1: Drill collar table

Hole ID | Coordinate System | Easting | Northing | Elevation | Azimuth | Dip | Depth (m) |

CV25-007C | NAD 83 UTM Zone 11N | 477456 | 4507033 | 1530 | 239 | -87 | 385 |

Table 2: Table of full assays

Hole ID | From (m) | To (m) | Length (m) | Au (gpt) | Hole ID | From (m) | To (m) | Length (m) | Au (gpt) |

CV25-007C | 190.2 | 191.7 | 1.5 | 0.28 | CV25-007C | 289.9 | 291.4 | 1.5 | 1.93 |

CV25-007C | 191.7 | 193.2 | 1.5 | 0.06 | CV25-007C | 291.4 | 292.9 | 1.5 | 0.47 |

CV25-007C | 193.2 | 194.8 | 1.5 | 0.06 | CV25-007C | 292.9 | 294.1 | 1.2 | 0.21 |

CV25-007C | 194.8 | 196.3 | 1.5 | 0.04 | CV25-007C | 294.1 | 294.7 | 0.6 | 1.22 |

CV25-007C | 196.3 | 197.8 | 1.5 | 1.57 | CV25-007C | 294.7 | 296.0 | 1.2 | 1.16 |

CV25-007C | 197.8 | 199.3 | 1.5 | 0.90 | CV25-007C | 296.0 | 297.5 | 1.5 | 1.34 |

CV25-007C | 199.3 | 200.9 | 1.5 | 0.59 | CV25-007C | 297.5 | 299.0 | 1.5 | 2.30 |

CV25-007C | 200.9 | 202.4 | 1.5 | 0.29 | CV25-007C | 299.0 | 300.5 | 1.5 | 1.35 |

CV25-007C | 202.4 | 203.9 | 1.5 | 1.22 | CV25-007C | 300.5 | 302.1 | 1.5 | 3.22 |

CV25-007C | 203.9 | 205.4 | 1.5 | 0.24 | CV25-007C | 302.1 | 303.6 | 1.5 | 0.64 |

CV25-007C | 205.4 | 207.0 | 1.5 | 0.07 | CV25-007C | 303.6 | 305.1 | 1.5 | 1.36 |

CV25-007C | 207.0 | 208.5 | 1.5 | 0.32 | CV25-007C | 305.1 | 306.6 | 1.5 | 0.95 |

CV25-007C | 208.5 | 210.0 | 1.5 | 1.02 | CV25-007C | 306.6 | 308.2 | 1.5 | 0.79 |

CV25-007C | 210.0 | 211.5 | 1.5 | 0.62 | CV25-007C | 308.2 | 309.7 | 1.5 | 0.61 |

CV25-007C | 211.5 | 212.4 | 0.9 | 0.65 | CV25-007C | 309.7 | 310.9 | 1.2 | 0.29 |

CV25-007C | 212.4 | 214.0 | 1.5 | 2.38 | CV25-007C | 310.9 | 311.2 | 0.3 | 1.97 |

CV25-007C | 214.0 | 215.5 | 1.5 | 0.81 | CV25-007C | 311.2 | 312.7 | 1.5 | 0.29 |

CV25-007C | 215.5 | 217.0 | 1.5 | 0.55 | CV25-007C | 312.7 | 313.3 | 0.6 | 0.24 |

CV25-007C | 217.0 | 218.5 | 1.5 | 0.98 | CV25-007C | 313.3 | 314.2 | 0.9 | 1.63 |

CV25-007C | 218.5 | 219.8 | 1.2 | 1.19 | CV25-007C | 314.2 | 315.8 | 1.5 | 0.30 |

CV25-007C | 219.8 | 220.4 | 0.6 | 1.29 | CV25-007C | 315.8 | 316.7 | 0.9 | 1.40 |

CV25-007C | 220.4 | 221.0 | 0.6 | 2.86 | CV25-007C | 316.7 | 318.2 | 1.5 | 1.76 |

CV25-007C | 221.0 | 222.5 | 1.5 | 0.60 | CV25-007C | 318.2 | 319.4 | 1.2 | 1.03 |

CV25-007C | 222.5 | 223.7 | 1.2 | 0.40 | CV25-007C | 319.4 | 321.0 | 1.5 | 1.77 |

CV25-007C | 223.7 | 224.3 | 0.6 | 0.45 | CV25-007C | 321.0 | 322.5 | 1.5 | 0.12 |

CV25-007C | 224.3 | 225.6 | 1.2 | 0.38 | CV25-007C | 322.5 | 324.0 | 1.5 | 0.06 |

CV25-007C | 225.6 | 227.1 | 1.5 | 0.10 | CV25-007C | 324.0 | 325.5 | 1.5 | 0.66 |

CV25-007C | 227.1 | 228.6 | 1.5 | 0.48 | CV25-007C | 325.5 | 327.1 | 1.5 | 0.16 |

CV25-007C | 228.6 | 229.5 | 0.9 | 0.12 | CV25-007C | 327.1 | 328.6 | 1.5 | 0.28 |

CV25-007C | 229.5 | 230.7 | 1.2 | 0.61 | CV25-007C | 328.6 | 330.1 | 1.5 | 0.70 |

CV25-007C | 230.7 | 232.3 | 1.5 | 0.55 | CV25-007C | 330.1 | 331.6 | 1.5 | 0.27 |

CV25-007C | 232.3 | 233.8 | 1.5 | 0.04 | CV25-007C | 331.6 | 332.8 | 1.2 | 0.65 |

CV25-007C | 233.8 | 235.3 | 1.5 | 0.36 | CV25-007C | 332.8 | 333.5 | 0.6 | 3.95 |

CV25-007C | 235.3 | 236.8 | 1.5 | 0.31 | CV25-007C | 333.5 | 335.0 | 1.5 | 1.07 |

CV25-007C | 236.8 | 238.4 | 1.5 | 0.06 | CV25-007C | 335.0 | 336.5 | 1.5 | 0.48 |

CV25-007C | 238.4 | 239.9 | 1.5 | 0.88 | CV25-007C | 336.5 | 336.8 | 0.3 | 0.12 |

CV25-007C | 239.9 | 241.4 | 1.5 | 0.60 | CV25-007C | 336.8 | 337.1 | 0.3 | 0.13 |

CV25-007C | 241.4 | 242.9 | 1.5 | 0.22 | CV25-007C | 337.1 | 338.6 | 1.5 | 0.21 |

CV25-007C | 242.9 | 244.5 | 1.5 | 0.36 | CV25-007C | 338.6 | 340.2 | 1.5 | 0.67 |

CV25-007C | 244.5 | 246.0 | 1.5 | 0.24 | CV25-007C | 340.2 | 341.7 | 1.5 | 0.11 |

CV25-007C | 246.0 | 247.5 | 1.5 | 0.74 | CV25-007C | 341.7 | 343.2 | 1.5 | 0.27 |

CV25-007C | 247.5 | 248.1 | 0.6 | 0.50 | CV25-007C | 343.2 | 344.7 | 1.5 | 0.02 |

CV25-007C | 248.1 | 249.6 | 1.5 | 0.25 | CV25-007C | 344.7 | 346.3 | 1.5 | 1.01 |

CV25-007C | 249.6 | 250.9 | 1.2 | 0.53 | CV25-007C | 346.3 | 346.9 | 0.6 | 0.16 |

CV25-007C | 250.9 | 252.4 | 1.5 | 0.30 | CV25-007C | 346.9 | 347.2 | 0.3 | 1.57 |

CV25-007C | 252.4 | 253.3 | 0.9 | 1.15 | CV25-007C | 347.2 | 348.1 | 0.9 | 2.52 |

CV25-007C | 253.3 | 254.2 | 0.9 | 1.47 | CV25-007C | 348.1 | 349.6 | 1.5 | 0.36 |

CV25-007C | 254.2 | 255.7 | 1.5 | 0.81 | CV25-007C | 349.6 | 351.1 | 1.5 | 0.05 |

CV25-007C | 255.7 | 257.3 | 1.5 | 0.34 | CV25-007C | 351.1 | 352.7 | 1.5 | 0.83 |

CV25-007C | 257.3 | 258.8 | 1.5 | 0.45 | CV25-007C | 352.7 | 353.6 | 0.9 | 0.66 |

CV25-007C | 258.8 | 260.3 | 1.5 | 0.34 | CV25-007C | 353.6 | 354.5 | 0.9 | 2.08 |

CV25-007C | 260.3 | 261.8 | 1.5 | 0.24 | CV25-007C | 354.5 | 355.1 | 0.6 | 0.20 |

CV25-007C | 261.8 | 263.3 | 1.5 | 0.27 | CV25-007C | 355.1 | 356.3 | 1.2 | 0.11 |

CV25-007C | 263.3 | 264.9 | 1.5 | 0.12 | CV25-007C | 356.3 | 357.8 | 1.5 | 0.56 |

CV25-007C | 264.9 | 266.4 | 1.5 | 0.11 | CV25-007C | 357.8 | 358.4 | 0.6 | 0.27 |

CV25-007C | 266.4 | 267.9 | 1.5 | 0.43 | CV25-007C | 358.4 | 359.4 | 0.9 | 0.05 |

CV25-007C | 267.9 | 268.5 | 0.6 | 0.08 | CV25-007C | 359.4 | 360.6 | 1.2 | 0.27 |

CV25-007C | 268.5 | 269.4 | 0.9 | 0.06 | CV25-007C | 360.6 | 362.1 | 1.5 | 0.32 |

CV25-007C | 269.4 | 271.0 | 1.5 | 0.73 | CV25-007C | 362.1 | 363.6 | 1.5 | 0.32 |

CV25-007C | 271.0 | 272.5 | 1.5 | 0.20 | CV25-007C | 363.6 | 365.2 | 1.5 | 0.42 |

CV25-007C | 272.5 | 274.0 | 1.5 | 0.62 | CV25-007C | 365.2 | 366.7 | 1.5 | 0.60 |

CV25-007C | 274.0 | 275.2 | 1.2 | 2.47 | CV25-007C | 366.7 | 367.6 | 0.9 | 0.23 |

CV25-007C | 275.2 | 276.5 | 1.2 | 0.38 | CV25-007C | 367.6 | 368.5 | 0.9 | 0.24 |

CV25-007C | 276.5 | 278.0 | 1.5 | 0.36 | CV25-007C | 368.5 | 369.1 | 0.6 | 0.02 |

CV25-007C | 278.0 | 278.9 | 0.9 | 0.50 | CV25-007C | 369.1 | 370.3 | 1.2 | 0.08 |

CV25-007C | 278.9 | 279.5 | 0.6 | 0.30 | CV25-007C | 370.3 | 371.9 | 1.5 | 0.33 |

CV25-007C | 279.5 | 281.0 | 1.5 | 0.82 | CV25-007C | 371.9 | 373.4 | 1.5 | 0.17 |

CV25-007C | 281.0 | 282.2 | 1.2 | 1.38 | CV25-007C | 373.4 | 374.9 | 1.5 | 0.44 |

CV25-007C | 282.2 | 283.8 | 1.5 | 1.43 | CV25-007C | 374.9 | 375.8 | 0.9 | 0.41 |

CV25-007C | 283.8 | 285.0 | 1.2 | 4.42 | CV25-007C | 375.8 | 377.0 | 1.2 | 0.31 |

CV25-007C | 285.0 | 286.5 | 1.5 | 1.84 | CV25-007C | 377.0 | 378.6 | 1.5 | 0.28 |

CV25-007C | 286.5 | 288.0 | 1.5 | 0.24 | CV25-007C | 378.6 | 379.2 | 0.6 | 0.23 |

CV25-007C | 288.0 | 289.6 | 1.5 | 5.39 | CV25-007C | 379.2 | 380.7 | 1.5 | 0.12 |

CV25-007C | 289.6 | 289.9 | 0.3 | 0.97 | CV25-007C | 380.7 | 382.2 | 1.5 | 0.12 |

|

|

|

|

| CV25-007C | 382.2 | 383.7 | 1.5 | 0.48 |

|

|

|

|

| CV25-007C | 383.7 | 384.7 | 0.9 | 0.71 |

|

|

|

|

|

|

|

|

|

|

SOURCE: Roxmore Resources Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/roxmore-resources-reports-drill-results-from-drill-program-at-the-converse-projec-1129254