CALGARY, AB / ACCESS Newswire / January 20, 2026 / CANEX Metals Inc. ("CANEX" or the "Company") (TSXV:CANX) issues the following response to Gold Basin Resources Corporation's ("Gold Basin") (TSX.V:GXX) news release dated January 19, 2026, where Gold Basin announced that it has granted security over a portion of its only material property, the Gold Basin Project in Mojave County, Arizona, to a related party. Despite this announcement, CANEX remains committed to its offer (the "Offer") to acquire all of the issued and outstanding common shares of Gold Basin and unlock value for Gold Basin and CANEX shareholders.

Highlights:

Gold Basin's January 19, 2026 news release has revealed their management's intention to transfer Gold Basin's only material property to a related party in a last-minute defensive tactic against the Offer

CANEX remains undeterred in our commitment to the Offer. We will not abandon our bid and will work hard to preserve value for Gold Basin's shareholders (the "Gold Basin Shareholders") and look out for their interests, which align with our own

CANEX encourages all Gold Basin Shareholders to tender to the Offer before Gold Basin's management can further impair the value of Gold Basin's only material property

CANEX is optimistic that we will achieve the 50% + 1 share minimum tenderrequirementshortly and take the steps needed to elect a highly qualified and experienced board of directors and pursue district consolidation and advancement

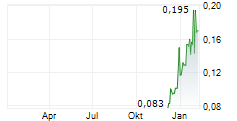

The Offer value equates to approximately $22,000,000 or roughly $0.163 per Gold Basin share based on CANEX's January 19, 2026 closing price. This value is far superior to the related party transactions put forward by Gold Basin's current management, and within three days of take-up, Gold Basin Shareholders could receive valuable and free trading shares of CANEX

Gold Basin's January 19, 2026 News Release

On January 19, 2026, Gold Basin issued a news release announcing the updated terms of an unsecured loan in the amount of USD $500,000 at an interest rate of 15% per annum, received from Charrua Capital LLC ("Charrua Capital") in 2024 (the "Loan"). Charrua Capital has agreed to forbear exercising its rights and remedies under the Loan agreement until March 31, 2026 and to reduce the interest rate on the Loan from 15% to 9% through the period January 1, 2026 until March 31, 2026. However, the Loan is no longer unsecured. A portion of the Gold Basin Project has been put up as security during the forbearance period, which will be removed when payments resume to the satisfaction of Charrua Capital. Gold Basin has announced no plan for repaying the stated amount of approximately C$856,730 (USD $617,652) owing on the Loan, which is due March 31, 2026. The intent is clear, with no ability or plan to repay the Loan, Gold Basin's management is attempting to transfer a portion of Gold Basin's only material property to a related party.

Michael Povey, the former Chief Executive Officer of Gold Basin, is known to be the owner of Charrua Capital. Mr. Povey's connection to Charrua Capital has been discussed in a September 26, 2025, news story reporting on an Australian court case in businessnews.com.au and Mr. Povey recently personally confirmed his ownership to CANEX's management.

Mr. Povey is the current Executive Chairman of Helix Resources Ltd. (ASX:HLX) ("Helix") and a close business associate of Charles Straw, the President, interim Chief Executive Officer and a director of Gold Basin. Charles Straw has been granted a right to become one of the largest shareholders in Helix via the sale of the White Hills Project (referenced in a November 2, 2022 press release of Gold Basin as containing 12 exploration targets of interest to Gold Basin) to Helix. On April 28, 2025, as an improper defensive tactic to an offer from Mayfair Acquisition Corp., Gold Basin announced that it had executed a binding farm-in agreement granting Helix the right to earn up to 40% of the Gold Basin Project and acquire a 1% net smelter royalty over the Gold Basin Project. Gold Basin Shareholders should question Gold Basin management's repeated assertion that the Loan was provided on an arm's-length basis and ask them to explain how this is not a direct attempt to transfer Gold Basin's assets to a related party. To CANEX's knowledge, neither the Loan nor the updated terms of the Loan announced yesterday, placing a direct lien on Gold Basin's only material property, have been approved by the TSX Venture Exchange.

Yesterday's announcement is a desperate attempt by Gold Basin's management to impair the value of the Gold Basin Project to the benefit of related parties and constitutes an improper defensive tactic against the Offer. CANEX will not abandon its Offer, and we will work hard to preserve value for Gold Basin Shareholders and look out for their interests, which align with our own.

It should now be very clear to even the most loyal of Gold Basin Shareholders that Gold Basin's management has no plan to address Gold Basin's liquidity and compliance issues and is only focused on transferring Gold Basin's assets to related parties to the detriment of Gold Basin Shareholders.

Message to Gold Basin Shareholders

CANEX would like to thank Gold Basin Shareholders for the significant support for the Offer in the face of the challenges presented by Gold Basin's delinquent status. Despite having no transfer agent engaged to assist Gold Basin Shareholders to gather necessary documents, almost 50% of Gold Basin Shareholders have tendered to the Offer. Once the 50% + 1 share minimum tender requirement is reached, CANEX will be able to take up and pay for the Gold Basin shares deposited under the Offer and CANEX shares can be issued within three business days of take-up. CANEX intends to elect a highly qualified and experienced board of directors, clean up Gold Basin, settle debts and lawsuits, explore a merger of Gold Basin into CANEX, and aggressively expose and pursue any improper transactions relating to Gold Basin by its current management and directors.

The Offer value equates to approximately $22,000,000 or roughly $0.163 per Gold Basin share based on CANEX's January 19, 2026, closing price. This value is far superior to the related party transaction with Helix put forward by Gold Basin's current management.

There is no certainty that CANEX will be able to restore Gold Basin to compliant status or successfully conclude a Subsequent Acquisition Transaction (as defined in the Original Offer and Circular) and the Offer could be the last opportunity for Gold Basin Shareholders to exchange their cease-traded Gold Basin shares for valuable and liquid CANEX shares.

Gold Basin Shareholders with questions or who need assistance tendering their Gold Basin shares should contact Laurel Hill Advisory Group by calling 1-877-452-7184 (toll-free in Canada and the United States), or 1-416-304-0211 (collect call outside of Canada and the United States), by texting "INFO" to either number, or by email at assistance@laurelhill.com

Advisors

CANEX has retained Borden Ladner Gervais LLP as its legal advisor and Laurel Hill Advisory Group as its information agent.

About CANEX Metals

CANEX Metals (TSX.V:CANX) is a Canadian junior exploration company focused on advancing its 100% owned Gold Range Project in Northern Arizona. With several near surface bulk tonnage gold discoveries made to date across a 4 km gold mineralized trend, the Gold Range Project is a compelling early-stage opportunity for investors. CANEX is also advancing the Louise Copper-Gold Porphyry Project in British Columbia. Louise contains a large historic copper-gold resource that has seen very little deep or lateral exploration, offering investors copper and gold discovery potential. CANEX is led by an experienced management team which has made three notable porphyry and bulk tonnage discoveries in North America and is sponsored by Altius Minerals (TSX: ALS), a large shareholder of the Company.

Dr. Shane Ebert P.Geo., is the Qualified Person for CANEX and has verified the data disclosed in this news release against historical and current data sources and has approved the technical disclosure contained in this news release.

"Shane Ebert"

Shane Ebert, President/Director

For Further Information Contact:

Shane Ebert at 1.250.964.2699 or

Jean Pierre Jutras at 1.403.233.2636

Web: http://www.canexmetals.ca

Gold Basin Shareholders:

Laurel Hill Advisory Group

North American Toll Free: 1-877-452-7184

Outside North America: 1-416-304-0211

Email: assistance@laurelhill.com

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

U.S. Notice

The Offer is being made for the securities of a foreign company. The Offer is subject to disclosure requirements of a foreign country that are different from those of the United States. Financial statements included in the Offer materials, if any, have been prepared in accordance with foreign accounting standards that may not be comparable to the financial statements of United States companies. It may be difficult for you to enforce your rights and any claim you may have arising under the federal securities laws, since the issuer is located in a foreign country, and some or all of its officers and directors may be residents of a foreign country. You may not be able to sue a foreign company or its officers or directors in a foreign court for violations of the U.S. securities laws. It may be difficult to compel a foreign company and its affiliates to subject themselves to a U.S. court's judgment. You should be aware that the issuer may purchase securities otherwise than under the Offer, such as in open market or privately negotiated purchases, in accordance with applicable law. Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the Offer or passed upon the adequacy or accuracy of the Offer materials. Any representation to the contrary is a criminal offense.

Forward-Looking Statements

Except for the historical and present factual information contained herein, the matters set forth in this news release, including words such as "potential", "intends", "risks", "opportunities" and similar expressions, are forward-looking information that represents management of CANEX Metals Inc.'s internal projections, expectations or beliefs concerning, among other things: the Offer; the satisfaction of the conditions of the Offer; Gold Basin Shareholders' support for the Offer; the anticipated successful completion of the Offer; the anticipated effect of the Offer; CANEX's plans for Gold Basin if the Offer is successful; the expected benefits to Gold Basin Shareholders of tendering their Gold Basin Shares to the Offer; whether Gold Basin will regain regulatory compliance; and future operating results and various components thereof or the economic performance of CANEX. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause CANEX's actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, the risk that the transactions contemplated by the Offer will not be consummated; the risk that the conditions of the Offer will not be met or met or a timely basis; and those risks described in CANEX's filings with the Canadian securities authorities. Accordingly, holders of CANEX Shares and potential investors are cautioned that events or circumstances could cause results to differ materially from those predicted. CANEX disclaims any responsibility to update these forward-looking statements.

SOURCE: CANEX Metals Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/canex-metals-responds-to-gold-basin-resources-last-minute-attempt-to-transfer-mat-1129217