Toronto-based company has deployed IoT monitoring on 3,000+ projects in 20+ countries, with 150% year-over-year revenue growth

TORONTO, ON / ACCESS Newswire / January 20, 2026 / Brickeye, a Toronto-based construction technology company, today announced a $10 million Series B financing round to expand its IoT monitoring and risk mitigation services platform across North America and into international markets.

The round was led by GreenSky Ventures, Brightspark Ventures, Graphite Ventures, Export Development Canada (EDC), Beauchamp Construction, and one of the largest building materials suppliers in North America.

Construction remains one of the largest and least digitized industries in the world. When problems go undetected-a water line bursts overnight, concrete cures improperly-the costs are measured in millions of dollars and weeks of delays. Brickeye's risk mitigation services platform catches these issues before they escalate, and in many cases, intervenes automatically.

The company has deployed its technology on more than 3,000 construction projects across 20+ countries, reported 150% year-over-year revenue growth, and was recently named to Deloitte's 2025 Technology Fast 50 list of Canada's fastest-growing technology companies.

Avoiding Damage Before It Happens

On a 40-story condo tower project in Florida, Brickeye's sensors detected a temporary water line breach and automatically triggered a shut-off valve, avoiding an estimated 1,650 gallons of water from flooding the site.

"That would have cost us hundreds of thousands in damage and delays," said Blaik Ross, Executive Vice President at Beauchamp Construction. "The system caught it and stopped it before anyone even knew there was a problem."

This kind of automated intervention is core to Brickeye's approach. Rather than simply monitoring job sites and sending alerts, the platform integrates with building systems to take action - shutting off water, flagging concrete curing anomalies, and documenting everything for insurance purposes.

Data That Lowers Premiums

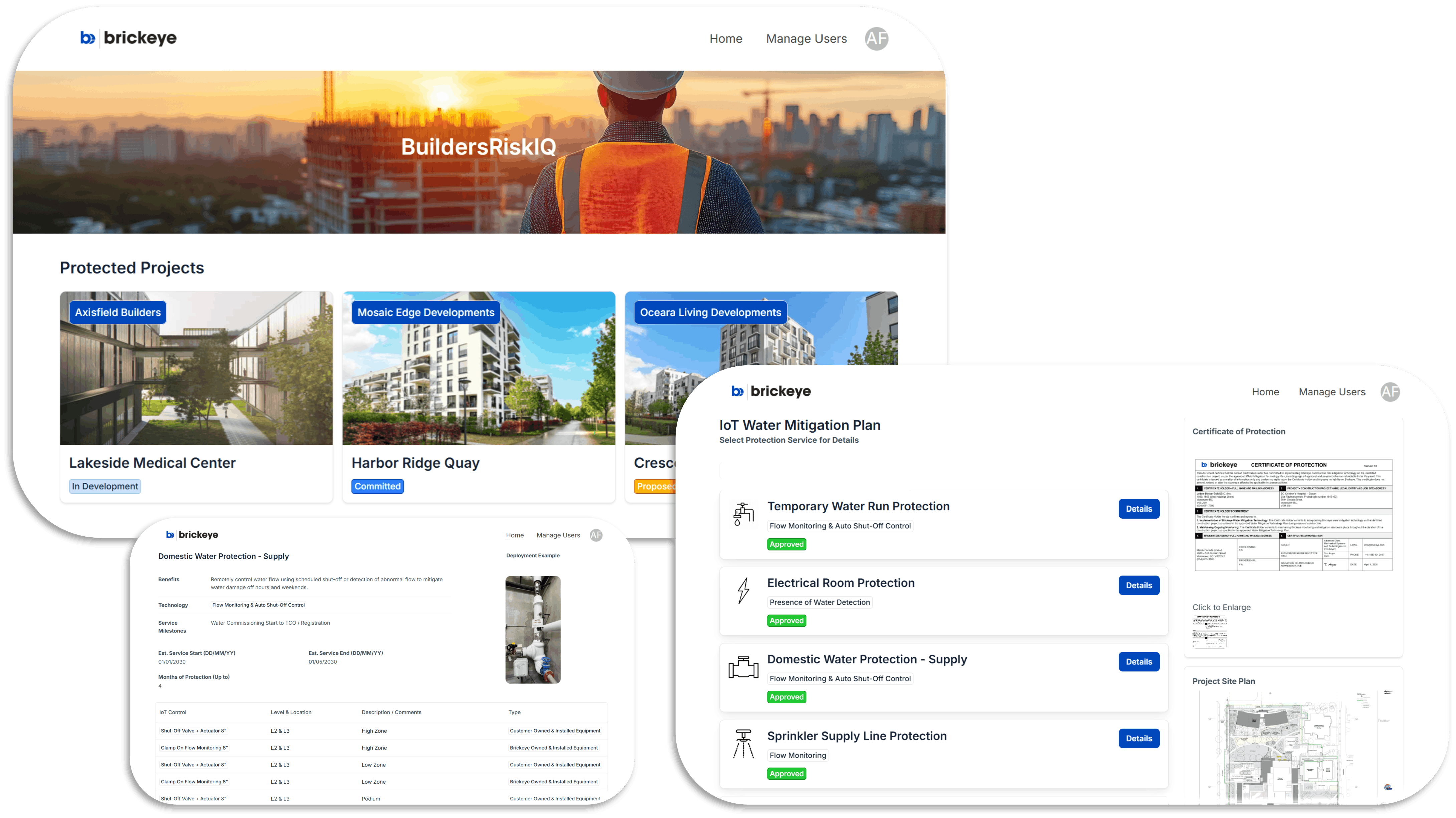

Earlier this year, Brickeye launched BuildersRiskIQ, a preconstruction dashboard that shows insurers exactly where IoT controls will be deployed on a project. Risk managers and brokers use the platform's project plans and Certificate of Protection as part of their insurance submissions, giving underwriters visibility into the scope of protection before ground is even broken.

The results are measurable: customers using the platform have reduced water loss deductibles and buy-downs by up to 50%.

"Brickeye demonstrates how IoT solutions, paired with innovations like BuildersRiskIQ, can meaningfully de-risk projects and mitigate losses," said Mike List, Founder and Managing Partner at GreenSky Ventures. "We're proud to support their next stage of growth."

What's Next

Brickeye will use the financing to accelerate product development in IoT-enabled software and AI services, expand its engineering and field operations teams, and grow sales across North America and international markets including the Middle East, South America, and Europe. The company is also expanding beyond high-rise and multi-family construction into healthcare and data center facilities.

"We're scaling a platform that delivers measurable results for contractors, developers, and insurers," said Tim Angus, CEO of Brickeye. "This investment accelerates our ability to help customers reduce risk and improve profitability across all stages of construction."

About Brickeye

Brickeye is a construction IoT and risk mitigation services company trusted by contractors, developers, owners, and insurers across 20+ countries. Its platform delivers real-time monitoring, automated risk controls, and actionable insights for construction stakeholders. Learn more at brickeye.com.

Media Contact

Justin Mauldin

Salient PR

737.234.0936

achievemore@salientpr.com

SOURCE: Brickeye

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/electronics-and-engineering/brickeye-raises-10m-series-b-to-scale-construction-risk-mitigation-tech-1129129