- AEON confirmed that earlier today it held its BPD Type 2a Meeting with the FDA, in line with prior guidance, and is now awaiting official meeting minutes -

- Separately, AEON shareholders today voted in favor of the proposals required to complete the transactions announced in November, including the consummation of the PIPE financing and the related Daewoong note exchange -

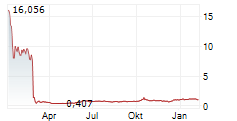

IRVINE, Calif., Jan. 21, 2026 (GLOBE NEWSWIRE) -- AEON Biopharma, Inc. ("AEON" or the "Company") (NYSE American: AEON), a biopharmaceutical company seeking accelerated and full-label U.S. market entry by developing ABP-450 (prabotulinumtoxinA) as a biosimilar to BOTOX (onabotulinumtoxinA), today reported on two separate positive events for the Company:

- AEON confirmed that earlier today it held its scheduled BPD Type 2a meeting with FDA, in line with prior guidance. The Company looks forward to commenting on the meeting's substance and outcome following receipt of the official meeting minutes from the U.S. Food and Drug Administration ("FDA").

- AEON also held today a special meeting at which shareholders voted to approve the completion of the transactions announced in November, including the remaining issuances related to the Company's private investment in public equity ("PIPE") financing and the related exchange of the Company's convertible notes held by Daewoong Pharmaceutical Co., Ltd. ("Daewoong"). As previously disclosed, the Daewoong note exchange, which closed today following shareholder approval, will substantially reduce the Company's outstanding debt and further simplify AEON's capital structure. AEON expects to proceed with the second closing of the PIPE financing on or around Tuesday, January 27, 2026, subject to customary closing conditions.

"We are encouraged by the continued progress we are making early in 2026. The completion of our BPD Type 2a meeting with FDA represents an important procedural milestone, and we now look forward to receiving the official meeting minutes within approximately 30 days, which we expect will help inform next steps for the development of ABP-450, our biosimilar to BOTOX," said Rob Bancroft, President & Chief Executive Officer of AEON. "Additionally, we are thankful to our shareholders for their support of the transactions we announced in November, which strengthen our balance sheet, simplify our capitalization structure and position the company to continue executing on our biosimilar program."

About the U.S. Biosimilar Pathway

The U.S. Food and Drug Administration ("FDA") regulates biosimilars under the Public Health Service Act's 351(k) pathway, which require developers to demonstrate that a proposed product is highly similar to an approved reference biologic with no clinically meaningful differences in safety, purity, or potency. Analytical similarity is the scientific foundation of this process, representing the most critical and data-intensive phase of development. Once analytical comparability across key quality attributes is established, subsequent FDA interactions focus on confirming whether any residual uncertainty requires limited clinical evaluation.

About AEON Biopharma

AEON Biopharma is a biopharmaceutical company seeking accelerated and full-label access to the U.S. therapeutic neurotoxin market via biosimilarity to BOTOX. The U.S. therapeutic neurotoxin market exceeds $3.0 billion annually, representing a major opportunity for biosimilar entry. The Company's lead asset is ABP-450 for debilitating medical conditions. ABP-450 is the same botulinum toxin complex currently approved and marketed for cosmetic indications by Evolus, Inc. under the name Jeuveau. ABP-450 is manufactured by Daewoong Pharmaceutical in compliance with current Good Manufacturing Practice, or cGMP, in a facility that has been approved by the U.S. Food and Drug Administration, Health Canada, and European Medicines Agency. The product is approved as a biosimilar in India, Mexico, and the Philippines. AEON has exclusive development and distribution rights for therapeutic indications of ABP-450 in the United States, Canada, the European Union, the United Kingdom, and certain other international territories. To learn more about AEON, visit www.aeonbiopharma.com.

Forward-Looking Statements

Certain statements in this press release may be considered forward-looking statements. Forward-looking statements generally relate to future events or AEON's future financial or operating performance and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied. These risks and uncertainties include, among others, the satisfaction of remaining closing conditions for the PIPE financing, regulatory developments, and other risks described in the Company's filings with the Securities and Exchange Commission.

Contacts

Investor Contact:

Laurence Watts

New Street Investor Relations

+1 619 916 7620

laurence@newstreetir.com

Source: AEON Biopharma