Indicated Gold and Silver Ounces Increase by 11% and 7%, Respectively

Inferred Gold and Silver Ounces are Nearly Doubled

Tucson, Arizona--(Newsfile Corp. - January 22, 2026) - Alaska Silver Corp. (TSXV: WAM) (the "Company" or "Alaska Silver") is pleased to announce the release of an updated mineral resource estimate for the Illinois Creek gold-silver deposit at its 100% owned Illinois Creek project (the "Project") located on state land in Western Alaska. The Illinois Creek deposit represents one of the distal zones of the +7.5km long Illinois Creek Carbonate Replacement Deposit ("CRD") system and this updated mineral resource estimate was primarily undertaken to quantify the realities of the current price environment for gold and silver. The underlying block model is original to 2021 as reported in "NI 43-101 Technical Report, Illinois Creek Project, Western Alaska" issued on July 21, 2021.

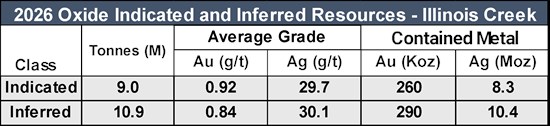

Highlights of the Updated Indicated and Inferred Mineral Resource Estimate at the Illinois Creek Deposit (Table 1):

Indicated Mineral Resources of 9.0Mt @ 0.92 g/t gold and 29.72 g/t silver containing 260,000 ounces of gold and 8.3 million ounces of silver.

Inferred Mineral Resources of 10.9Mt @ 0.84 g/t gold and 30.1 g/t silver containing 290,000 ounces of gold and 10.4 million ounces of silver.

The Indicated and Inferred Mineral Resources are based on an open-pit shell assuming metals prices of US$3,500/oz gold and US$45/oz silver.

The mineralization within the Illinois Creek deposit is oxide material which is amenable to heap leach extraction and processing.

Oxide mineralization remains open along strike and at depth.

Table 1. 2026 Illinois Creek Oxide Deposit Indicated and Inferred Mineral Resource Summary, reported using a US$24.00/t NSR cut-off

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7510/281238_680e72e10441687e_002full.jpg

The effective date of the mineral resource estimate is January 22, 2026. The Qualified Person ("QP") for the Mineral Resource is Dr. Bruce Davis, PhD, FAusIMM, an associate of Lions Gate Geological Consulting Inc. (LGGC).

The updated mineral resource estimate uses the 2021 block model as reported in "NI 43-101 Technical Report, Illinois Creek Project, Western Alaska" issued on July 21, 2021.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves.

In-Situ mineral resources are constrained within a pit shell developed using a metal price of US$3,500/oz Au and US$45/oz Ag, mining costs of US$4.00/t, processing costs of US$10.25/t, G&A cost of US$9.75/t, 92% metallurgical recovery Au, 65% metallurgical recovery Ag and an average pit slope of 45 degrees.

The cut-off grade for resources considered amenable to open pit extraction methods is based on a NSR of $24/t.

Mineral resources in the Inferred category have a lower level of confidence than that applied to Indicated mineral resources and, although there is sufficient evidence to imply geologic grade and continuity, these characteristics cannot be verified based on the current data. It is reasonably expected that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration. Blocks were classed into the Inferred mineral resources category if a drill hole was within 100 m of a block and into Indicated mineral resources category if drill hole spacing was nominally at a maximum of 30 m.

"For the last few years, our focus has been on the Waterpump Creek Deposit, which contains some of the highest silver grades in the world. However, the Illinois Creek deposit, which is part of the same extensive CRD system, is also a significant piece of the Project and, like Waterpump Creek, contains significant amounts of silver. All of the Illinois Creek resource is oxide materials which are amenable to low-cost heap or vat leaching operations to recover both the gold and the silver," said CEO Kit Marrs. "Going forward, the Company plans to invest more resources in expanding this deposit, which is open along strike and at depth, but also investigating the viability of Illinois Creek becoming a standalone mining operation that could produce Dore on-site."

Key Highlights at the Illinois Creek Project:

Historical mining and recovery of gold and silver at site was carried out at the site between 1997 and 2002, and therefore there is considerable permitting and engineering data including metallurgy on the oxide mineralization.

Historical leach pad and mined stacked material could be re-evaluated with modern recovery techniques offering optimization upside.

In addition to the in-pit resources described above, the nearby leach pad resource, which was completed in 2021, contains 1.3 million tonnes of Indicated mineral resources grading 0.44 grams/t Au and 44.3 g/t Ag containing 18,600 ounces of gold and 1.9 million ounces of silver. The leach pad also contains 152,000 tonnes of inferred mineral resources at a grade of 0.37 g/t gold and 42.6 g/t silver containing 1,800 ounces of gold and 200,000 ounces of silver1. Based on modern metallurgical testing this material is also amenable to potential vat leaching.

- As reported in "NI 43-101 Technical Report, Illinois Creek Project, Western Alaska" issued on July 21, 2021

Sensitivity Analysis

The 2021 Illinois Creek mineral resource estimate, effective January 15, 2021, was based on pit shell inputs using metal prices of US$1,600/oz gold and US$20/oz silver, US$2.50/t mining costs, US$S10.00 processing costs, US$4/t G&A costs, gold recovery of 92%, silver recovery of 65% and a pit slope of 45°. The cut-off grade for resources considered amenable to open pit extraction methods is 0.35 g/t AuEq where AuEq=Aug/t + (Ag g/t x 0.0125).

The updated 2026 mineral resource estimate uses the 2021 block model and restated economic inputs for the pit shells of US$3,500/oz gold and US$45/oz silver mining costs of US$4.00/t, processing costs of US$10.25/t, G&A costs of US$9.75, gold recovery of 92%, silver recovery of 65% and a pit slope of 45°.

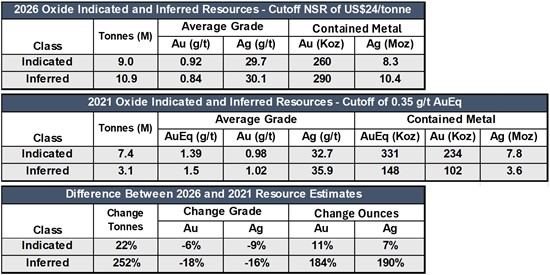

Tables 2 and 3 present the 2026 and 2021 resource estimates, respectively, while Table 4 summarizes the changes between the two estimates. No additional drilling was completed between the 2021 and 2026 estimates. Table 5 illustrates how the 2026 restated resource estimate varies under different gold and silver price assumptions.

Tables 2-4. Comparative Tables for the Illinois Creek Open Pit Oxide Resource Estimate

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7510/281238_alaskasilver2en.jpg

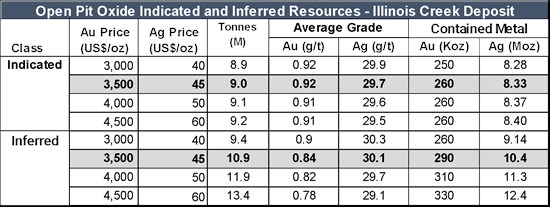

Table 5. Sensitivity table, at a NSR cutoff of US$24/tonne, showing 2026 Illinois Creek Open Pit Oxide Indicated and Inferred Mineral resources at various gold and silver prices.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7510/281238_680e72e10441687e_004full.jpg

Additional Illinois Creek Initial Resource Estimate Notes:

The QP for the mineral resource estimate is Dr. Bruce Davis, PhD, FAusIMM, an associate of Lions Gate Geological Consulting Inc. (LGGC).

The database comprises a total of 505 drill holes for 41,488 metres of drilling completed by various operators since 1981 including Alaska Silver, which drilled 3 core holes (365.8m) and 73 reverse circulation holes (646.2m) between 2019 and 2020.

Drilling on the Illinois Creek deposit was conducted between 1981 and 2006 with the majority of holes completed during campaigns run from 1990 through 1995. Drill holes penetrate the south-southeast dipping Illinois Creek deposit over a strike length of more than 2,500 m and to depths that exceed 200 m below surface.

The mineral resource estimate is based on three three-dimensional resource models, constructed in MinePlan software in July 2021 and reported in "NI 43-101 Technical Report, Illinois Creek Project, Western Alaska."

The block size used in the Illinois Creek oxide deposit resource estimate was 10 meters × 10 meters × 5 meters. The in-situ block model grades for gold silver and copper were estimated using ordinary kriging ("OK"). The results of the OK estimation were validated by visual and statistical methods. Drill hole data was composited to 1.5 m and grade was estimated within indicator shells, one with a threshold of 0.10 g/t Au and another of 10 g/t Ag. Anomalous gold, silver and copper grades were restricted using outlier limitation controls where top grades per metal were limited to a maximum distance of 20 m.

Specific gravity ("SG") values range from 2.29 to 2.67 and average 2.56. The mineralized core of the deposit tends to have lower SG values due to the intense oxidation that is present. SG was estimated in the block model using Inverse Distance Squared (ID2) method.

In-Situ Mineral Resources are constrained within a pit shell developed using a metal price of US$3,500/oz Au and US$45/oz Ag, mining costs of US$4.00/t, processing costs of US$10.25/t, G&A cost of US$9.75/t, 92% metallurgical recovery Au, 65% metallurgical recovery Ag and an average pit slope of 45 degrees. The cut-off grade for resources considered amenable to open pit extraction methods is based on a NSR of $24/t.

The full National Instrument 43-101 technical report will be filed within 45 days of the filing of this press release.

Qualified Persons

The updated mineral resource estimate was completed by Bruce Davis, PhD, FAusIMM, an associate of Lionsgate Geological Consulting Inc. Mr. Davis is an independent Qualified Person as defined by NI 43-101. The QP has reviewed and approved the technical contents of this news release.

Dr. Davis's review verified the technical data disclosed, including geology, sampling, analytical and QA/QC data underlying this news release, including reviewing the reports of ALS, methodologies, results, and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice.

Qualified Person

Patrick Donnelly P.Geo, Executive Vice President of Alaska Silver, a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this news release.

About Alaska Silver

Alaska Silver controls one of North America's major high-grade silver and critical minerals districts at the Illinois Creek (IC) Project in western Alaska. The project is anchored by high-grade silver mineralization at the Waterpump Creek zone, which hosts an Inferred Mineral Resource of 75 Moz AgEq at a grade of 279 g/t silver, 11.28 % zinc and 9.87% lead ¹, ² and remains open to the north and south, as well as by the Illinois Creek mine. The previously operating mine contains Indicated Mineral Resources of 260,000 oz gold at 0.92 g/t Au and 8.3 Moz silver at 29.72 g/t Ag, along with Inferred Mineral Resources of 290,000 oz gold at 0.84 g/t Au and 10.4 Moz silver at 30.11 g/t Ag³, 4. Alaska Silver's 100%-owned carbonate replacement deposit demonstrates significant exploration potential along an 8-kilometre strike length. The IC Project is located approximately 38 kilometres from the Yukon River, the region's primary marine transportation corridor, and comprises a contiguous, 100%-owned land package totaling 80,895 acres (126.36 square miles or 32,337 hectares). Headquartered in Alaska and Arizona, Alaska Silver is led by a team with a proven track record of large-scale mine discoveries.

1 For Waterpump Creek, the formulas for AgEq are AgEq (g/t)= Ag (g/t) + 28.56 x Pb(%) + 37.12 x Zn(%) and assume metal prices of US$24/oz Ag, US$1.30/lb Zn, and US$ 1.00/lb Pb.2

2 Please refer to the NI 43-101 Technical Report titled "Illinois Creek Project Update" dated September 22, 2023 (effective date of May 22, 2023).

3 For Illinois Creek, AuEq values are based only on gold and silver values using metal prices of US$3,500/oz Au and US$45/oz Ag.

"Kit Marrs"

Kit Marrs

President & CEO

kit@alaskasilver.com

Phone: 1-520-200-1667

For further information, please contact:

Patrick Donnelly

Executive Vice President

pat@alaskasilver.com

Or visit our website at: www.alaskasilver.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Information

Certain statements made, and information contained herein may constitute, "forward looking information" and "forward looking statements" within the meaning of applicable Canadian and United States securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management's expectations. Forward-looking statements and information may be identified by such terms as "anticipates", "believes", "targets", "estimates", "plans", "expects", "budget", "scheduled", "forecasts", "intends", "may", "will", "could" or "would" or the negative connotation thereof. This forward looking information relates to, among other things, the estimated Inferred and Indicated mineral resources at the Illinois Creek project; ongoing and anticipated exploration work at the Illinois Creek Project; the implementation of the objectives, goals and future plans of the Company including the proposed advancement of the Illinois Creek Project as currently contemplated; the proposed filing of a full NI 43-101 technical report; the proposed investment of resources to expand the Illinois Creek deposit; the potential viability of Illinois Creek becoming a standalone mining operation that could produce Dore on-site; the expectation that exploration activities (including drill results) will accurately predict mineralization; the potential for modern recovery techniques to offer optimization upside; the expectation that the Company will implement its drilling, geoscience and metallurgical work on its properties and work plans generally; the effective targeting activities proposed by the Company; and the anticipated benefits of the Company's approach to exploration.

Such forward-looking information is based on numerous assumptions, including among others, that exploration work at the Illinois Creek Project will occur as anticipated; assay results will be received when anticipated; the Company will be able to implement its objectives, goals and future plans, including the proposed advancement of the Illinois Creek Project as currently contemplated; exploration activities (including drill results) will accurately predict mineralization; the Company will be able to implement its drilling, geoscience and metallurgical work on its properties and work plans generally; the targeting activities proposed by the Company will be effective; and the Company's approach to exploration will result in the expected benefits. Although the assumptions made by the Company in providing forward-looking information is considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate and actual results and future events could differ materially from those anticipated in such information.

Important factors that could cause actual results to differ materially from the Company's plans or expectations include: the risk that exploration work at the Illinois Creek Project will not occur as anticipated; the risk that assay results will not be received when anticipated; the risk that the CRD property will not exhibit the anticipated continuity; the risk that the Company will not be able to implement its objectives, goals and future plans, including the proposed advancement of the Illinois Creek Project as currently contemplated; the risk that exploration activities (including drill results) will not accurately predict mineralization; the risk that Company will not be able to implement its drilling, geoscience and metallurgical work on its properties and work plans generally; the risk that the targeting activities proposed by the Company will not be effective; the risk that the Company's approach to exploration will not result in the expected benefits; risks related to market conditions and metal prices; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; the other risks involved in the mineral exploration and development industry; and those risks set out in the Company's public disclosure record on SEDAR+ (www.sedarplus.com) under the Company's issuer profile. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information or financial outlook that are incorporated by reference herein, except in accordance with applicable securities laws. Any forward-looking information contained in this news release is expressly qualified in their entirety by this cautionary statement. We seek safe harbor.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281238

Source: Alaska Silver Corp.