WASHINGTON, DC / ACCESS Newswire / January 22, 2026 / SETO Holdings, Inc. (OTCID:SETO), a publicly traded consumer products company, today announced its formal repositioning as a premium total beverage platform-focused on the intersection of spirits, functional beverages, wholesale distribution, experiential marketing, media, and emerging fintech innovation. Built on vertical integration and cultural relevance, SETO is creating a next-generation platform engineered for speed, scale, and long-term shareholder value.

Inspired by the Japanese word Seto (??)-meaning "strait" or "gateway"-the Company serves as a modern bridge between global production and consumer engagement, reimagining how premium beverage brands are developed, scaled, and monetized across an integrated ecosystem that spans brand ownership, global supply chain, marketing, distribution, and digital connectivity.

"We're not just building brands-we're building infrastructure," said Janon Costley, Chairman & CEO of SETO Holdings, Inc. "SETO was designed to solve the structural gaps that hold back great founders and high-potential categories. By owning the value chain, we can accelerate growth, control margin, and prepare each brand for scalable success."

Strategic Focus

SETO's closed-loop ecosystem is engineered to capture value across every stage of the brand lifecycle, integrating:

Brand Ownership & Global Sourcing

Production Partnerships (Domestic & International)

Sales, Distribution & Compliance Infrastructure

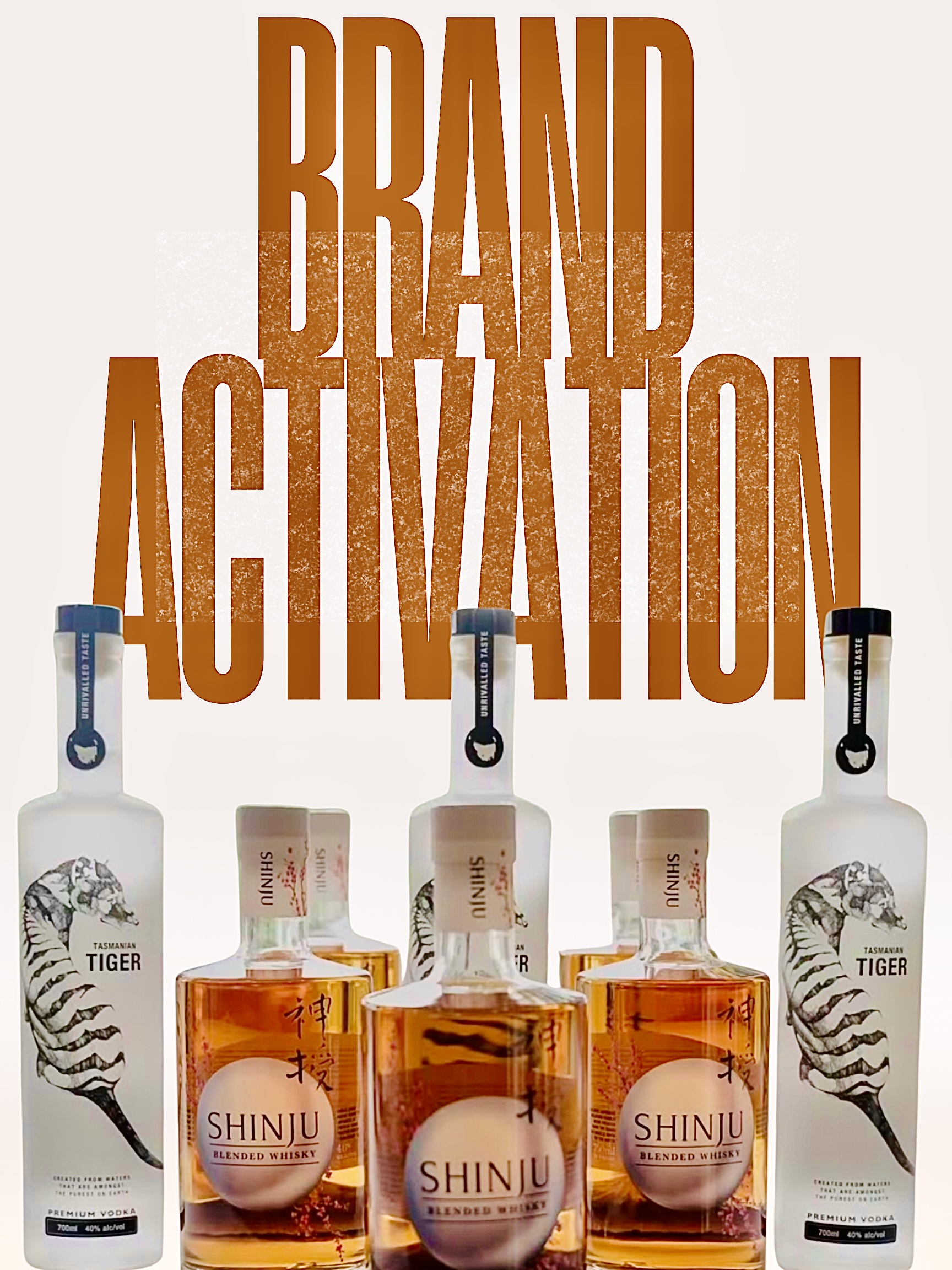

Retail Marketing & Experiential Activation

Social Fintech & Digital Loyalty Layers

As industry consolidation, premiumization, and consumer fragmentation reshape the $2.2T global beverage market, emerging brands face infrastructure bottlenecks, compliance hurdles, and margin compression. SETO's vertically integrated model intends to address these pain points-unlocking category ownership through speed, scale, and route-to-market efficiency.

"SETO is creating the platform I wish existed when I was first bringing brands to market," said Costley. "We're building a modern growth engine for beverage innovation-designed to empower diverse founders, increase speed-to-shelf, and deliver long-term value to investors."

Why It Matters Now

The beverage industry is at an inflection point: a few legacy conglomerates dominate the landscape, while consumer demand shifts toward craft, health-conscious, culturally relevant, and digitally connected brands. SETO's unified platform delivers the infrastructure, compliance, and consumer connection necessary to scale in this dynamic landscape-while unlocking investor access to high-margin, premium categories.

"The future of beverage isn't just about what's in the bottle," Costley added. "It's about how brands reach consumers, connect culturally, and scale globally. With SETO, we're positioning ourselves at the intersection of spirits, social fintech, and storytelling to unlock the next generation of beverage growth."

Market Opportunity

SETO is uniquely positioned at the convergence of multiple high-growth verticals:

$400B+ Global Spirits Market (IWSR)

$45B+ Global RTD Category (12% CAGR)

$19B+ Global Tequila Market (7.5% CAGR through 2030)

$10B+ Japanese Whisky Category (9.4% CAGR)

$70B+ Functional/Non-Alc Beverage Sector

$310B Global Fintech Market (16.5% CAGR by 2025)

$15B+ Global Loyalty & Rewards Tech (10% CAGR)

$4.5B Blockchain Loyalty & Tokenized Assets (30%+ CAGR)

Current Core Infrastructure & Portfolio

CapCity Beverage

Acquired in 2025, CapCity Beverage is SETO's fully licensed U.S. importer and wholesale distributor. It provides:

Bonded warehousing & TTB-compliant import operations

State-by-state compliance & registration

Active distributor relationships (SGWS, RNDC, PLCB, NC ABC)

DTC/e-commerce enablement (ReserveBar, BevStack, etc.)

CapCity's infrastructure gives SETO unmatched speed-to-market, regulatory fluency, and margin control.

Shinju Whisky

Award-winning and crafted in Japan, Shinju is currently distributed in 15+ U.S. markets (including CA, NY, FL, DC, and TX) and positioned as a super-premium yet approachable entry point into the Japanese whisky category. It's available in Total Wine & More, ReserveBar, and key on-/off-premise accounts, with expansion into the UK, EU, and Asia underway.

Brand Portfolio Highlights

Shinju Japanese Whisky - Flagship product with strong domestic performance and global expansion upside

Whiteout Tequila & RTD Cocktails - Clean-label tequila & RTD line aligned with modern taste and category growth

Tasmanian Tiger Vodka - Ultra-premium vodka with craft positioning and global brand story potential

Additional Brands, Products in Pipeline - Aged and specialty spirits (Tequila/Japanese Whisky), RTD's, functional beverages (Hemp/D-9), high-profile collabs/lifestyle brand extensions and additional spirit categories.

Platform Outlook & Vision

SETO's long-term strategy is to build a modern beverage ecosystem through strategic acquisitions that merges:

Premium alcoholic & functional beverage brands

Wholesale + DTC distribution infrastructure

Experiential marketing & omni-channel activation

IP development, brand licensing & strategic partnerships (sourcing/Production)

Social fintech + tokenized loyalty & first-party consumer data

Looking ahead, SETO is also actively exploring a digital asset strategy which may include blockchain-enabled consumer loyalty systems, tokenized incentives, and digital-native engagement tools-offering SETO brands future-proofed mechanisms to build brand equity, drive participation, leverage first party data and unlock new monetization channels.

Please continue to follow the company for further details on SETO's digital asset initiatives and other Company developments that will be shared in future communications.

About SETO Holdings, Inc.

A Gateway for Global Spirits, Innovation & Shareholder Value

SETO Holdings, Inc. is a publicly traded (OTCID:SETO), vertically integrated total beverage platform redefining the future of premium beverages through cultural relevance, vertical integration, and digital innovation. Guided by its mission to "Own the Spirit", SETO merges production, distribution, marketing, technology, and capital markets into a unified engine for scalable brand growth for under-valued companies and founders.

By aligning brand ownership, infrastructure, and go-to-market execution, SETO delivers a capital-efficient path to margin capture, consumer loyalty, long-term value creation and exit opportunities -for founders, shareholders, and strategic partners alike.

Media & Sales Inquiries:

Sales@capcitybeverage.com

www.capcitybeverage.com

Info@shinjuwhisky.com

www.shinjuwhisky.com

Investor Relations:

ir@seto-holdings.com

www.setoholdings.com

SOURCE: SETO Holdings, Inc.

Related Documents:

- IMG_1510

- 2f087451-c6a7-44ff-b311-fa67453e1928

- D80AC572-AC74-4756-A6DE-752548A35107

- IMG_1335

- IMG_2146

- IMG_1379

- 22d7052c-fbfc-452b-8cb3-9ca40c1a7cea

- 3e7dac97-fb75-45c9-9e27-d0066aff7ebc

- 8cf49014-1929-4c2a-845c-157534d061af

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/consumer-and-retail-products/seto-holdings-inc.-otcid-seto-launches-premium-total-beverage-platform-1129999