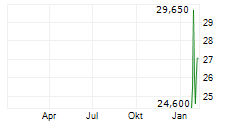

COLUMBIA, Mo., Jan. 23, 2026 (GLOBE NEWSWIRE) -- EquipmentShare.com Inc (Nasdaq: EQPT) ("EquipmentShare"), a leader in connected jobsite technology and one of the largest equipment rental providers in the United States, today announced that its Class A common stock has begun trading on the Nasdaq Global Select Market under the ticker symbol "EQPT." The listing follows a decade of growth for the Missouri-based company.

By integrating a large rental fleet with its proprietary T3 operating system, EquipmentShare has created a digital-first model built to provide contractors with real-time data and unified management. EquipmentShare's operating model combines a modern fleet and national scale with the innovation and vision of a technology leader, allowing EquipmentShare to deliver better outcomes for customers who demand safer, smarter, and more profitable jobsites.

"Our vision since we founded EquipmentShare more than 10 years ago was to transform the fragmented and underserved construction industry and fuel the engine that powers America's growth," said Jabbok Schlacks, co-founder and CEO of EquipmentShare. "The substantial investment in infrastructure, energy, and industrial projects over the next 10 years demands a new approach - one that is data-driven, connected, and built for scale. We believe that EquipmentShare is best positioned to connect the industry, and becoming a public company allows us to extend our impact for the customers and communities we serve."

"As contractors, we spent years on jobsites watching machines sit idle while projects fell behind schedule. It was a systemic failure of visibility," said Willy Schlacks, co-founder and president of EquipmentShare. "We have an incredible team building the future of construction through our T3 technology platform that connects assets, materials, and people - and we believe it will support our expansion into new verticals and new sectors within and beyond construction. Now, as a public company, we are staying true to our long-term vision of bringing visibility and control to the construction industry: combining physical distribution with the transition from analog processes to a digital reality to modernize how contractors manage every facet of their projects."

For more information about EquipmentShare, please visit www.equipmentshare.com/nextchapter-

About EquipmentShare

Founded in 2015 and headquartered in Columbia, Missouri, EquipmentShare is a nationwide construction technology and equipment solutions provider dedicated to transforming the construction industry through innovative tools, platforms and data-driven insights. By empowering contractors, builders and equipment owners with its proprietary technology, T3- , EquipmentShare aims to drive productivity, efficiency and collaboration across the construction sector. With a comprehensive suite of solutions that includes a fleet management platform, telematics devices and a best-in-class equipment rental marketplace, EquipmentShare continues to lead the industry in building the future of construction. For more information, visit www.equipmentshare.com

Forward-Looking Statements

This press release includes certain "forward-looking statements" for purposes of United States federal and state securities laws. Forward-looking statements are statements other than statements of historical fact and can be identified by words such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "our vision," "plan," "potential," "preliminary," "predict," "should," "will," or "would" or the negative thereof or other variations thereof or comparable terminology. These forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond EquipmentShare's control, including but not limited to, risks and uncertainties related to economic, market or business conditions, the T3 operating system, and the construction equipment rental industry. For a further list and description of such risks and uncertainties, please refer to EquipmentShare's filings with the Securities and Exchange Commission available at www.sec.gov. All forward-looking statements, expressed or implied, included in this press release are made as of the date of this press release and are expressly qualified in their entirety by this cautionary statement. Except as otherwise required by applicable law, EquipmentShare disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release.

Press Inquiries:

Amy N. Susán

press@equipmentshare.com

Investor Inquiries:

Rhett Butler

ir@equipmentshare.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/af05faf7-9f75-46f2-8ba3-4103d21465d8

-

-