DJ Genel Energy PLC: Trading and operations update

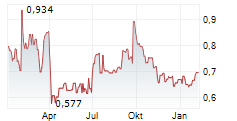

Genel Energy PLC (GENL)

Genel Energy PLC: Trading and operations update

27-Jan-2026 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

27 January 2026

Genel Energy plc

Trading and operations update

Genel Energy plc ('Genel' or 'the Company') issues the following trading and operations update in advance of the

Company's full-year 2025 results, which are scheduled for release on 18 March 2026. The information contained herein

has not been audited and may be subject to further review.

Paul Weir, Chief Executive of Genel, said:

"We are well positioned to progress on our strategy and deliver significant value to our shareholders. Notably, we have

a resilient core business, which covers its costs even when sales are restricted to discounted domestic market pricing

at just over USD30/bbl and a balance sheet that provides the funding required to deliver on our strategic objectives.

Geographical diversification of our cash generation remains the priority for the business. Our process remains active

with live opportunities under review, and we continue to pursue and bid on these opportunities. We will retain our

discipline and rigorous evaluation process to ensure every opportunity we choose to pursue is value accretive over the

long term for our shareholders and meets our priority criteria.

There is significant, currently unvalued, potential in our portfolio. On the Tawke PSC, the new drilling campaign is

underway targeting the maximisation of production from, and additions to, the existing material reserves base there. In

terms of accessing export pricing, the first stage of the new Kurdistan export arrangement has been reported by all

participants to be working. We congratulate those stakeholders involved in the significant effort and trust that has

resulted in export arrangements reaching this promising stage. We see sustained and consistent execution as a key

consideration as we keep export arrangements under review. On Block 54 in Oman, preliminary operational work has been

completed safely, ahead of time and under budget. Work is ongoing to assess the accumulated data to inform the focus of

our activity over the next two years, which will include drilling two wells. In Somaliland, we continue to work with

stakeholders to progress to a position where we can drill the potentially transformational Toosan-1 well there.

Each of these strategic objectives has the potential to deliver significant value. In combination they can transform

the business, transform our cash generation capacity, and further energise the business and the value proposition for

our shareholders."

KURDISTAN: TAWKE PSC (25% working interest)

-- Exceptional performance from the Operator has resulted in Q4 average production being close to the levels delivered

in the first half of the year

QUARTER FULL YEAR

Q4 2025 Q4 2024 FY2025 FY2024

Gross production 77,270 74,140 70,090 78,615

Working interest production 19,320 18,540 17,520 19,650

Realised price USD/bbl 32 34 32 35

-- The efficient and effective programme of workovers and well intervention continues to yield excellent results.

Average production for months not impacted by the drone attack was higher than last year despite no new wells being

drilled. Actual average production for the full year was 70,090 bopd compared to 78,615 bopd last year -- The process for mobilisation of rigs for a sustained drilling programme is well underway, with that programme

targeting additions to both production and reserves -- Our Genel20 scholarship programme continues to provide funding and support to talented, yet financially

disadvantaged high school graduates from the Kurdistan Region of Iraq. Since its launch, the programme has been

implemented in line with our long-term sustainability commitment, focusing on lasting educational and social impact

OMAN: BLOCK 54 (40% working interest)

-- Our preliminary activity, re-entry and workover of the legacy Batha West-1 (BW-1) discovery well was completed

ahead of time and under budget -- The BW-1 well operation was a low-cost preliminary activity to commence our work on the block representing the

first of a number of steps towards understanding the full potential of the license -- Work is now ongoing on analysing data collected and assessing its implications for the location of further activity

on the block, which includes the acquisition of 3D seismic data and drilling two exploration wells over the next 2

years. In line with our guidance, we will update on these plans in March

SOMALILAND: SL10B13 (51% working interest)

-- We continue to work towards drilling of the highly prospective Toosan-1 exploration well -- Genel continues to work closely with local communities and beneficiaries, with its social investments including a

broad range of initiatives in the space of mother/child health, education and the environment

FINANCIAL PERFORMANCE

-- Working interest average production of 17,520 bopd was lower than last year (2024: 19,650 bopd), with exit rate

production back to around 20,000 bopd. All production was sold into the domestic market at average USD32/bbl (2024:

USD35/bbl) -- Core business netback of USD11 million (2024: USD5 million) -- Free cash flow of USD4 million (2024: USD20 million) -- Balance sheet at 31 December 2025

- Cash of USD224 million (2024: USD196 million)

- Total debt of USD92 million (2024: USD66 million)

- Net cash of USD134 million (2024: USD131 million) -- Receivables

- USD88 million (under KBT pricing and excluding interest) remains overdue from the Kurdistan Regional Government

('KRG'), although this is offset by about USD40 million of payables

- We continue to work towards a plan for payment or settlement of amounts owed, and appropriate adjustment for

price and interest -- Genel Energy Miran Bina Bawi Limited appeal against the arbitration costs award of USD27 million will be heard in Q2

2026

ESG

-- Climate disclosure: maintained a CDP Climate rating of B for a fourth consecutive year

OUTLOOK

-- With Tawke domestic market sales expected to be consistent and production expected to benefit from new drilling in

FY2026, we expect core business free cash flow generation to more than cover its costs, which includes net interest

payable -- In addition to the core business, the Company expects to invest up to USD20 million on its pre-production assets:

- On Block 54 in Oman, in line with the 3-year work plan that we announced at the time of entering the licence

- SL10B13 in Somaliland, as we seek progress towards drilling the Toosan-1 prospect towards the end of 2027 -- The Company continues to progress towards building a business with a strong balance sheet that delivers resilient,

reliable, repeatable and diversified cash flows that supports a dividend programme. The Company objectives for the

year on the path to building that business include:

- acquisition of new assets to add reserves and diversify our cash generation

- restart of exports of Tawke oil to access international pricing

- recovery of net amounts owed by the KRG

- determination and execution of activity on Block 54

- further progress towards drilling Toosan-1

Genel will host a live presentation on the Investor Meet Company platform on Wednesday 28 January at 1000 GMT. The presentation is open to all existing and potential shareholders. Questions can be submitted at any time before or during the live presentation. Investors can sign up to Investor Meet Company for free and add to meet Genel Energy PLC via: https://www.investormeetcompany.com/genel-energy-plc/register-investor

-ends-

For further information, please contact:

Genel Energy: Luke Clements, CFO +44 20 7659 5100 Vigo Consulting: Patrick d'Ancona +44 20 7390 0230

Genel Energy is a socially responsible oil producer listed on the main market of the London Stock Exchange (LSE: GENL, LEI: 549300IVCJDWC3LR8F94). For further information, please refer to www.genelenergy.com

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside information in accordance with the Market Abuse Regulation (MAR), transmitted by EQS Group. The issuer is solely responsible for the content of this announcement.

View original content: EQS News -----------------------------------------------------------------------------------------------------------------------

ISIN: JE00B55Q3P39, NO0010894330 Category Code: TST TIDM: GENL LEI Code: 549300IVCJDWC3LR8F94 Sequence No.: 416200 EQS News ID: 2266244 End of Announcement EQS News Service =------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=2266244&application_name=news&site_id=dow_jones%7e%7e%7ebed8b539-0373-42bd-8d0e-f3efeec9bbed

(END) Dow Jones Newswires

January 27, 2026 02:00 ET (07:00 GMT)