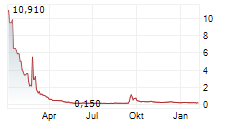

TAMPA, Fla., Jan. 27, 2026 (GLOBE NEWSWIRE) -- AtlasClear Holdings, Inc. (NYSE American: ATCH) ("AtlasClear" or the "Company"), a technology-enabled financial services platform modernizing trading, clearing, settlement, and banking, today reported on fiscal 2025 balance sheet transformation, improved operating momentum, and strategic priorities for 2026.

Fiscal 2025: Rebuilding the Foundation and Restoring Financial Flexibility

Fiscal 2025 represented a pivotal year for AtlasClear, marked by a comprehensive effort to stabilize the Company's financial position, resolve legacy structural constraints, and reposition the platform for sustainable, scalable growth.

As reported in our Quarterly Report for the quarter ended September 30th, 2025, AtlasClear executed a series of balance sheet actions that resulted in the conversion and extinguishment of more than $43 million of legacy de-SPAC liabilities, reducing those obligations by over 80% and restoring positive stockholders' equity. These actions materially strengthened the Company's capital structure, reduced financial overhang, and improved financial flexibility.

We look forward to filing our Quarterly Report for the quarter ended December 31, 2025 on or about February 13th, 2026.

"Our focus in 2025 was deliberate and uncompromising," said Executive Chairman of AtlasClear Holdings John Schaible. "Before pursuing growth, we needed to correct the structural issues that constrained our ability to execute. We simplified the balance sheet, addressed legacy liabilities, strengthened governance, and aligned leadership. As we prepare to report on the December quarter, we believe the progress achieved throughout 2025 meaningfully changes the trajectory of AtlasClear as we move forward."

Operating Progress and Revenue Expansion Across Core Businesses

AtlasClear's operating subsidiaries delivered improving performance throughout fiscal 2025, led by Wilson-Davis & Co., the Company's wholly owned broker-dealer. Wilson-Davis generated consistent profitability on a standalone basis during the year, supported by growth across correspondent clearing, underwriting activity, and stock loan operations. Net capital levels remained well in excess of regulatory requirements, providing capacity to onboard new correspondent relationships and expand service offerings.

October 2025 serves as a clear example of the operating improvements the Company has delivered following its fiscal 2025 restructuring efforts. For the month, Wilson-Davis reported revenue of $3.05 million, up 113% year-over-year, and net income of $0.94 million, up 169% year-over-year, reflecting the effectiveness of management's operational, technology, and business development initiatives.

AtlasClear also activated previously underutilized revenue lines, most notably within its stock loan business, following the deployment of new management, enhanced technology, and refined inventory management processes. Stock loan revenue accelerated during the second half of the year, contributing to improved operating leverage.

The Company expanded its fintech ecosystem through targeted partnerships, including the integration of LocBox technology to enhance stock loan inventory optimization and fully paid lending capabilities. These initiatives create additional opportunities to expand services across AtlasClear's growing client base and further embed the platform within client workflows.

"What we are seeing now is the result of sustained operational focus," said President of AtlasClear Holdings Craig Ridenhour. "Correspondent clearing remains the core of our platform, but we are increasingly seeing contributions from stock loan, margin lending, underwriting, and fintech-enabled services. These businesses are scaling together, improving diversification and supporting a more resilient revenue profile."

Capital Formation and Leadership Alignment

Throughout fiscal 2025, AtlasClear completed multiple financings totaling approximately $25 million, including a $20 million financing completed subsequent to the end of the first fiscal quarter of 2026. These included investments from institutional partners and members of the Board and executive leadership team, strengthening liquidity and aligning leadership with shareholders.

The Company also enhanced its leadership and governance framework with the appointment of Sandip Patel as Chief Financial Officer and General Counsel and the return of Steven Carlson as an independent director.

"Alignment matters, particularly in financial infrastructure businesses where trust and discipline are essential," Schaible added. "Our Board and leadership have demonstrated alignment through investments alongside shareholders, and we have assembled a team with deep experience across clearing, banking, regulation, and capital markets."

2026 Outlook: Disciplined Execution, Scale, and Platform Expansion

Entering 2026, AtlasClear is focused on disciplined execution and expanding the operating platform established over the past year. The Company is well positioned to pursue organic growth while remaining selective in evaluating opportunities that enhance its ecosystem.

Key priorities include:

- Continued onboarding of correspondent clearing clients, each contributing recurring revenue, scale, and operating leverage

- Expansion of stock loan and margin lending activity, with enhanced opportunities to serve existing and new clients

- Further deployment of fintech infrastructure to enhance automation, risk management, and client experience

- Advancing the Company's digital asset strategy, with a focus on regulated, institutional-grade trading, custody, clearing, and related infrastructure services

- Continued progress toward the planned acquisition of Commercial Bancorp of Wyoming, which would provide low-cost funding, a regulated banking charter, and the foundation for a vertically integrated brokerage and banking platform, subject to negotiation of mutually-agreeable definitive documents, regulatory approval and customary closing conditions

"AtlasClear approaches potential acquisitions with discipline, prioritizing opportunities that are accretive, strategically aligned, and complementary to our organic momentum," said Schaible. "We focus on transactions that expand our capabilities or client reach while reinforcing a client-first culture and long-term value creation."

"2026 is about execution," added Ridenhour. "We are focused on scaling the businesses that are working, maintaining regulatory and capital discipline, and continuing to build a durable financial infrastructure platform. AtlasClear today is fundamentally different than it was a year ago."

About AtlasClear Holdings, Inc.

AtlasClear Holdings, Inc- (NYSE American: ATCH) is building a cutting-edge, technology-enabled financial services platform designed to modernize trading, clearing, settlement, and banking for emerging financial institutions and fintechs. Through its subsidiary Wilson-Davis & Co., Inc., a full-service correspondent broker-dealer registered with the SEC and FINRA, and its pending acquisition of Commercial Bancorp of Wyoming, AtlasClear seeks to deliver a vertically integrated suite of brokerage, clearing, risk management, regulatory, and commercial banking solutions. For more information, visit www.atlasclear.com

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, that reflect AtlasClear Holdings' current views with respect to, among other things, its future operations and financial performance. Forward-looking statements in this communication may be identified by the use of words such as "anticipate," "assume," "believe," "continue," "could," "estimate," "expect," "foreseeable," "future," "intend," "may," "outlook," "plan," "potential," "proposed," "predict," "project," "seek," "should," "target," "trends," "will," "would" and similar terms and phrases. Forward-looking statements contained in this communication include, but are not limited to, statements as to (i) the Company's expectations regarding planned future growth and financial results, (ii) AtlasClear Holdings' expectations regarding future financings, (iii) AtlasClear Holdings' expectations as to future operational results, (v) AtlasClear Holdings' anticipated growth strategy, including its planned acquisition of Commercial Bancorp of Wyoming, and (v) the financial technology of AtlasClear Holdings. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, many of which are beyond the Company's control. Actual results may differ materially from those anticipated. For additional details regarding risks and uncertainties, please refer to AtlasClear Holdings' filings with the SEC, including its Form 10-Q for the quarter ended September 30, 2025, and its Annual Report on Form 10-K filed September 29, 2025. AtlasClear Holdings undertakes no obligation to update or revise forward-looking statements, except as required by law.

Company Contact:

AtlasClear Holdings, Inc.

Email: AtlasClearIR@atlasclear.com

Investor Relations Contact:

Jeff Ramson, CEO

PCG Advisory, Inc.

Email: jramson@pcgadvisory.com