VANCOUVER, British Columbia, Jan. 28, 2026 (GLOBE NEWSWIRE) -- Atico Mining Corporation (TSX.V: ATY | OTCID: ATCMF) ("Atico" or the "Company") is pleased to announce positive results from 21 drill holes completed in 2025 within an area of historical mining, successfully expanding the tonnage at the El Roble mine. The table below highlights some assay results in bold for drill core holes, which include 10.20m of 6.26% Cu, 8.50 g/t Au and 10.00m of 6.77% Cu, 3.39 g/t Au. Ore grade intercepts are reported over widths of 0.27 to 10.3 meters in areas with limited drilling with results highlighting the possibility of further extending the ore body with additional drill programs.

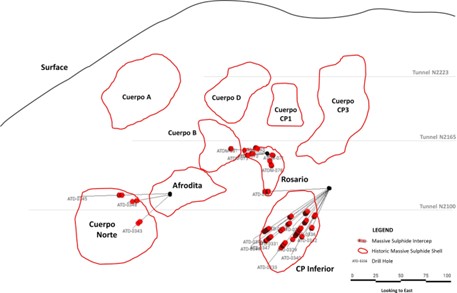

Holes ATD-0329 through ATD-0348 have discovered important new mineralization which are considerably beyond our expectations for the Cuerpo Principal Inferior CP ore body.

"Our ongoing drilling campaign at El Roble continues to deliver important results, intercepting new mineralization while successfully extending the boundaries of historical massive sulfide zones," said Fernando E. Ganoza, CEO. "These assay results reinforce our confidence that higher-grade copper and gold mineralization extends beyond the historical footprint. The deposit remains open both at depth and along strike, confirming significant potential within and outside the previously defined mineralized shell. The drill campaign is planned to continue throughout 2026."

Exploration Drilling Results with a 1% copper cutoff Include:

| Hole | From (m) | To (m) | Interval (m) | Cu % | Au g/t |

| ATD-0329 | 75.00 | 82.30 | 7.30 | 9.93 | 2.56 |

| ATD-0329 | 92.90 | 94.60 | 1.70 | 6.54 | 1.79 |

| ATD-0329 | 96.30 | 99.10 | 2.80 | 6.56 | 1.40 |

| ATD-0329 | 101.00 | 102.00 | 1.00 | 2.91 | 4.95 |

| ATD-0329 | 103.00 | 113.00 | 10.00 | 6.77 | 3.39 |

| ATD-0329 | 119.60 | 121.20 | 1.60 | 2.20 | 2.95 |

| ATD-0331 | 92.00 | 94.80 | 2.80 | 7.26 | 6.28 |

| ATD-0331 | 95.40 | 99.00 | 3.60 | 3.51 | 24.61 |

| ATD-0331 | 107.80 | 109.00 | 1.20 | 7.45 | 7.95 |

| ATD-0331 | 111.80 | 113.70 | 1.90 | 7.30 | 4.61 |

| ATD-0333 | 98.30 | 99.20 | 0.90 | 4.92 | 7.62 |

| ATD-0333 | 100.00 | 101.00 | 1.00 | 1.76 | 4.00 |

| ATD-0333 | 104.00 | 109.20 | 5.20 | 3.40 | 3.54 |

| ATD-0333 | 112.00 | 116.60 | 4.60 | 3.60 | 5.32 |

| ATD-0333 | 119.50 | 123.10 | 3.60 | 10.14 | 9.46 |

| ATD-0333 | 126.00 | 127.00 | 1.00 | 3.35 | 1.11 |

| ATD-0334 | 91.60 | 95.20 | 3.60 | 6.27 | 4.99 |

| ATD-0334 | 95.70 | 98.00 | 2.30 | 2.63 | 3.14 |

| ATD-0334 | 99.50 | 101.60 | 2.10 | 10.65 | 2.16 |

| ATD-0334 | 106.80 | 108.80 | 2.00 | 7.70 | 1.10 |

| ATD-0336 | 70.14 | 70.43 | 0.29 | 1.47 | 1.92 |

| ATD-0336 | 71.00 | 71.27 | 0.27 | 4.34 | 21.10 |

| ATD-0336 | 72.40 | 76.00 | 3.60 | 3.91 | 3.85 |

| ATD-0338 | 68.44 | 76.45 | 8.01 | 7.02 | 2.78 |

| ATD-0338 | 88.90 | 93.20 | 4.30 | 1.58 | .60 |

| ATD-0338 | 101.10 | 103.00 | 1.90 | 6.36 | 2.09 |

| ATD-0340 | 93.70 | 96.00 | 2.30 | 4.21 | 3.98 |

| ATD-0340 | 98.40 | 108.70 | 10.30 | 3.33 | 4.21 |

| ATD-0341 | 86.40 | 90.90 | 4.50 | 5.57 | .83 |

| ATD-0341 | 92.30 | 93.40 | 1.10 | 2.97 | 1.04 |

| ATD-0342 | 88.25 | 91.60 | 3.35 | 4.92 | 14.23 |

| ATD-0343 | 82.00 | 84.50 | 2.50 | 1.21 | 1.22 |

| ATD-0343 | 85.00 | 89.00 | 4.00 | 3.75 | 3.72 |

| ATD-0344 | 105.10 | 106.80 | 1.70 | 2.03 | 1.84 |

| ATD-0346 | 112.00 | 122.20 | 10.20 | 6.26 | 8.50 |

| ATD-0347 | 113.55 | 119.20 | 5.65 | 5.94 | 8.72 |

| ATD-0347 | 121.80 | 122.80 | 1.00 | 1.45 | 24.60 |

| ATD-0347 | 123.90 | 124.60 | 0.70 | 1.94 | 31.70 |

| ATD-0348 | 81.15 | 82.60 | 1.45 | 1.01 | 5.00 |

| ATD-0348 | 84.60 | 86.35 | 1.75 | 3.27 | 18.40 |

| ATDM-070 | 43.00 | 47.60 | 4.60 | 5.12 | 3.12 |

| ATDM-071 | 35.00 | 37.00 | 2.00 | 3.77 | 5.12 |

| ATDM-071 | 39.00 | 43.00 | 4.00 | 4.60 | 2.30 |

| ATDM-073 | 37.00 | 40.00 | 3.00 | 7.84 | 5.39 |

| ATDM-075 | 37.20 | 45.50 | 8.30 | 4.01 | 3.77 |

| ATDM-078 | 43.60 | 46.30 | 2.70 | 2.44 | 12.67 |

| ATDM-081 | 32.40 | 33.50 | 1.10 | 4.95 | 4.90 |

| ATDM-081 | 51.50 | 54.40 | 2.90 | 1.98 | 1.15 |

True widths are dependent on uncertainties in the local strike and dip of the mineralization and are estimated to be between 90% and 95% of the drill intercept.

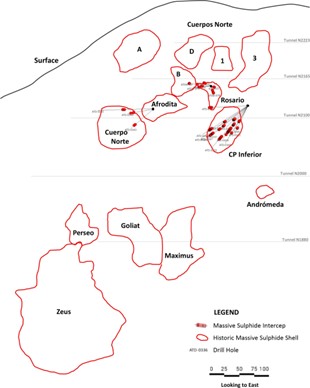

Image 1: Mineralized shells based on historical massive and new bodies at the El Roble Mine with intercepts from the current drill program

Image 2: Detailed view of mineralized shells based on historical massive and new bodies at the El Roble Mine with intercepts from the current drill program

Exploration Drilling Program

The goal of the 2025 underground drilling program at the El Roble mine is to define zones of mineralization within the extent of the main historic massive sulphide body that were not exploited by previous operators, to expand the historically identified resource and explore for new massive sulfide bodies. The Company began this drill infill program to test the main mineralized body and the immediately adjacent area during the first quarter of 2023 and has continued the program with over 5,000 meters of drilling during 2025.

All intervals include only assays of greater than 1% Cu and higher-grade intervals within these sections do not occur.

QA/QC

Atico Mining adheres to strict Quality Assurance and Quality Control protocols. Blanks and certified reference standards are inserted in each sample batch of drill core that is sent to the lab for analyses. The ATD series of drill holes are HQ diameter and the ATDM series of drill holes are NQ diameter core. All drill core samples are split in half using a diamond saw with one half saved for reference and the other half shipped via secure transport to ALS sample preparation facility in Medellin, Colombia.

Analysis is carried out at ALS, Lima, Peru. Core samples are analyzed for copper, silver, zinc and lead utilizing 4-acid dissolution followed by ICP-AES, Code 8 OG62. Gold is analyzed by fire assay (50 g) with gravimetric finish (Code 1A3). Silver over 100 g is analyzed by fire assay with gravimetric finish (Code GRA22) using WST-SIM.

El Roble Mine

The El Roble mine is a higher grade, underground copper and gold mine with nominal processing plant capacity of 1,000 tonnes per day, located in the Department of Choco in Colombia. Its commercial product is a copper-gold concentrate.

Since obtaining control of the mine on November 22, 2013, Atico has upgraded the operation from a historical nominal capacity of 400 tonnes per day.

El Roble's reserves estimate, with an effective date of March 12, 2024, includes Proven and Probable mineral reserves of 828 thousand tonnes averaging 2.49% Cu, 2.20 g/t Au and a life of mine until Q1-2027. A full NI 43-101 technical report is available on SEDAR+. For more information on the reserves estimate refer to SEDAR+ and on the Company's website.

Mineralization is open at depth and along strike and the Company plans to further test the limits of the deposit. On the larger land package, the Company has identified a prospective stratigraphic contact between volcanic rocks and black and grey pelagic sediments and cherts that has been traced by Atico geologists for ten kilometers. This contact has been determined to be an important control on VMS mineralization on which Atico has identified numerous target areas prospective for VMS type mineralization occurrence, which is the focus of the current surface drill program at El Roble.

Qualified Person

Garth Graves, P. Geo.

Garth Graves, P. Geo., independent consultant geologist for Atico Mining Corporation and a qualified person in accordance with National Instrument 43-101 has reviewed and approved the technical information contained in this news release.

About Atico Mining Corporation

Atico is a growth-oriented Company, focused on exploring, developing and mining copper and gold projects in Latin America. The Company generates significant cash flow through the operation of the El Roble mine and is developing its high-grade La Plata VMS project in Ecuador. The Company is also pursuing additional acquisition of advanced stage opportunities. For more information, please visit www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. Ganoza

CEO

Atico Mining Corporation

Trading symbols: TSX.V: ATY | OTCID: ATCMF

Investor Relations

Igor Dutina

Tel: +1.604.633.9022

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the 'U.S. Securities Act'), or any state securities laws, and may not be offered or sold in the United States, or to, or for the account or benefit of, a "U.S. person" (as defined in Regulation S of the U.S. Securities Act) unless pursuant to an exemption therefrom. This press release is for information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward Looking Statements

This announcement includes certain "forward-looking statements" within the meaning of Canadian securities legislation. All statements, other than statements of historical fact, included herein, are forward-looking statements. Forward-looking statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs; the need to obtain additional financing to maintain its interest in and/or explore and develop the Company's mineral projects; uncertainty of meeting anticipated program milestones for the Company's mineral projects; and other risks and uncertainties disclosed under the heading "Risk Factors" in the AIF of the Company dated September 4, 2024 filed with the Canadian securities regulatory authorities on the SEDAR+ website at www.sedarplus.com.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8f3b2897-8d72-43ed-8eae-9776b0d34b93

https://www.globenewswire.com/NewsRoom/AttachmentNg/1584b156-c3ed-449f-8240-ca9d532f6948