VANCOUVER, BC / ACCESS Newswire / January 28, 2026 / Golden Lake Exploration Inc. ("Golden Lake" or the "Company") (CSE:GLM)(OTCQB:GOLXF) and McEwen Inc. ("McEwen") (NYSE/TSX: MUX) are pleased to announce that they have entered into a Definitive Agreement (the "Agreement") on January 28th, 2026 in respect of a proposed transaction (the "Proposed Transaction"), whereby McEwen would acquire all of the issued and outstanding shares of Golden Lake by way of plan of arrangement. If the Proposed Transaction is completed, Golden Lake would become a wholly-owned subsidiary of McEwen.

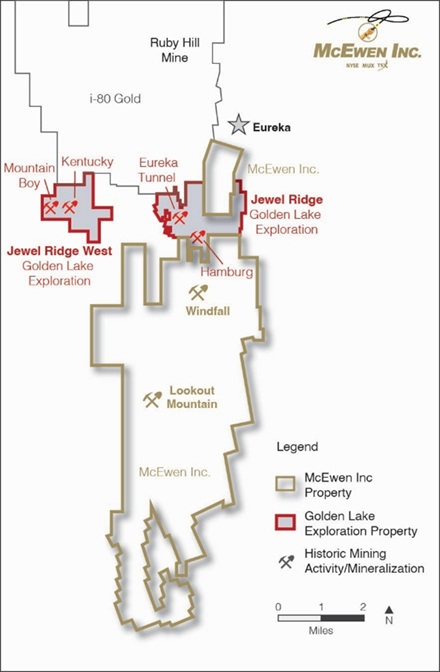

Golden Lake's principal asset is its 100%-owned Jewel Ridge and Jewel Ridge West projects located adjacent to McEwen's Windfall and Lookout Mountain discoveries, part of the Gold Bar Mine Complex, in the Eureka Mining District of Nevada. Historical drill highlights from Jewel Ridge project include 2.20 gpt gold over 28.96 meters, 1.24 gpt gold over 56.39 meters, 2.37 gpt gold over 67.57 meters. These holes are located north of McEwen's Windfall deposit where a recent drill hole returned 5.55 gpt gold over 44.2 meters. Incorporating Golden Lake's projects into the Gold Bar Mine Complex will help continue the mine's transformation into a long-life operation by investing in exploration and leveraging the current McEwen infrastructure.

The Proposed Transaction

Pursuant to the terms of the Proposed Transaction, each Golden Lake common share (a "Golden Lake Share") would entitle its holder to receive 0.003876 McEwen common shares (each, a "McEwen Share") as is equal to $0.12 divided by the volume-weighted average trading price of the McEwen Shares on the Toronto Stock Exchange (the "TSX") for the twenty (20) consecutive trading days ending on and including the trading day of January 26, 2026. (the "Exchange Ratio"). The Exchange Ratio represents an implied offer price of CDN $0.12 per Golden Lake Share, being a premium of 60% to the 20-day volume weighted average price ("VWAP") of the Golden Lake Shares as at market close on January 26, 2026. Following completion of the transaction, existing Golden Lake shareholders will own approximately 0.5% of the combined company resulting from the Proposed Transaction.

Benefits of the Transaction for Golden Lake Shareholders:

Ability to integrate Jewel Ridge and Jewel Ridge West into the Gold Bar Mine Complex, leveraging McEwen's ability to fund exploration and utilize existing infrastructure;

Access to McEwen's Nevada technical team with a track record in gold exploration, open pit mining, heap leaching, permitting and mine development;

Exposure to McEwen's diversified portfolio of commodities, producing operations, development projects and royalties; and

An attractive premium of approximately 60% to the 20-day VWAP of the Golden Lake Shares and the enhanced liquidity of McEwen Shares from dual listing on US and Canada stock exchanges.

Benefits of the Transaction for McEwen Shareholders:

Adds an adjacent property to McEwen's Gold Bar Mine Complex, with promising drill results.

Continued execution on the Gold Bar Mine Complex plan to develop a long-life operation with increasing production.

Details of the Proposed Transaction

The Proposed Transaction is expected to be completed by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia). Under the Plan of Arrangement, (i) all outstanding warrants of Golden Lake will be cashlessly exercised and cancelled in exchange for Golden Lake Shares having a value equal to their in-the-money amount, and (ii) all outstanding Golden Lake convertible notes will be converted into Golden Lake Shares based on principal and accrued interest in accordance with their terms. All issued and outstanding Golden Lake Shares (other than those held by McEwen or dissenting shareholders but including the Golden Lake Shares issued to warrant holders and noteholders) will be exchanged for McEwen Shares on the basis of the Exchange Ratio. Outstanding stock options of Golden Lake will be exchanged for replacement options of McEwen on an equivalent economic basis, with adjusted exercise prices.

To be effective, the Proposed Transaction will require the approval of 66 ?% of the votes cast by shareholders, warrant holders and noteholders of Golden Lake at a special meeting of Golden Lake shareholders, warrant holders and noteholders expected to take place in March (the "Golden Lake Meeting").

The Agreement includes provisions such as conditions to closing the Proposed Transaction, and representations and warranties and covenants customary for arrangement agreements. The Agreement also includes: (i) customary deal protection and non-solicitation provisions in favor of McEwen, including a break fee of approximately C$250,000 payable to McEwen in certain circumstances; and (ii) provisions allowing Golden Lake to consider and accept superior proposals, in compliance with its fiduciary duties.

Completion of the Proposed Transaction will be subject to customary closing conditions and receipt of necessary court and regulatory approvals, including approval of the TSX and the NYSE.

A copy of the Agreement will be filed on McEwen's and Golden Lake's SEDAR+ profiles at www.sedarplus.ca. The Proposed Transaction was approved by the Board of Directors of both McEwen and Golden Lake. No fairness opinion was obtained in connection with the Proposed Transaction. Further details with respect to the Proposed Transaction are included in the Agreement and in an information circular to be mailed to Golden Lake shareholders in connection with the Golden Lake Meeting. Once available, a copy of the Agreement will be filed on each of McEwen's and Golden Lake's SEDAR+ profiles at www.sedarplus.ca and a copy of the information circular will be filed on Golden Lake's SEDAR+ profile at www.sedarplus.ca.

About McEwen

McEwen shares trade on both the NYSE and TSX under the ticker MUX.

McEwen provides its shareholders with exposure to a growing base of gold and silver production in addition to a very large copper development project, all in the Americas. The gold and silver mines are in prolific mineral-rich regions of the world, the Cortez Trend in Nevada, USA, the Timmins district of Ontario, Flin Flon in Manitoba and the Deseado Massif in Santa Cruz province, Argentina. McEwen is also reactivating its gold-silver El Gallo Mine in Mexico.

About Golden Lake

Golden Lake Exploration is a junior public mining exploration company engaged in the business of mineral exploration and the acquisition of mineral property assets.

For Further Information, Please Contact:

Mike England

CEO & Director

Golden Lake Exploration Inc.

1-888-945-4770

Neither the NYSE, TSX or CSE have reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen and Golden Lake.

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

In this news release, forward-looking statements relate to, among other things, statements regarding: the Proposed Transaction; the Agreement; the receipt of necessary shareholder, court and regulatory approvals for the Proposed Transaction; the anticipated timeline for completing the Proposed Transaction; the terms and conditions pursuant to which the Proposed Transaction will be completed, if at all; the anticipated benefits of the Proposed Transaction including, but not limited to McEwen having an 100% interest in Jewel Ridge; the combined company; the future financial and operational performance of the combined company; the combined company's exploration and development programs; and potential future revenue and cost synergies resulting from the Proposed Transaction. These forward-looking statements are not guarantees of future results and involve risks and uncertainties that may cause actual results to differ materially from the potential results discussed in the forward-looking statements.

In respect of the forward-looking statements concerning the Proposed Transaction, including the entering into the Agreement, and the anticipated timing for completion of the Proposed Transaction including, but not limited to the expectation of McEwen having a 100% interest in Jewel Ridge, McEwen and Golden Lake have relied on certain assumptions that they believe are reasonable at this time, including assumptions as to the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary regulatory, court, shareholder, stock exchange and other third party approvals and the ability of the parties to satisfy, in a timely manner, the other conditions to the completion of the Proposed Transaction. This timeline may change for a number of reasons, including unforeseen delays in preparing meeting materials; inability to secure necessary regulatory, court, shareholder, stock exchange or other third-party approvals in the time assumed or the need for additional time to satisfy the other conditions to the completion of the Proposed Transaction. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these times.

Risks and uncertainties that may cause such differences include but are not limited to: the risk that the Proposed Transaction may not be completed on a timely basis, if at all; the conditions to the consummation of the Proposed Transaction may not be satisfied; the risk that the Proposed Transaction may involve unexpected costs, liabilities or delays; the possibility that legal proceedings may be instituted against the McEwen, Golden Lake and/or others relating to the Proposed Transaction and the outcome of such proceedings; the possible occurrence of an event, change or other circumstance that could result in termination of the Proposed Transaction; risks relating to the failure to obtain necessary shareholder and court approval; other risks inherent in the mining industry. Failure to obtain the requisite approvals, or the failure of the parties to otherwise satisfy the conditions to or complete the Proposed Transaction, may result in the Proposed Transaction not being completed on the proposed terms, or at all. In addition, if the Proposed Transaction is not completed, the announcement of the Proposed Transaction and the dedication of substantial resources of McEwen and Golden Lake to the completion of the Proposed Transaction could have a material adverse impact on each of McEwen's and Golden Lake's share price, its current business relationships and on the current and future operations, financial condition, and prospects of each McEwen and Golden Lake.

McEwen and Golden Lake expressly disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

Qualified Person

Technical information pertaining to the Gold Bar Complex exploration contained in this press release has been prepared under the supervision of Robert Kastelic, MSc, CPG, Exploration Manager for McEwen Inc. in Nevada, and Luke Willis, P.Geo, Director of Resource Modelling for McEwen Inc., who are Qualified Persons (QPs) as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects. Technical information disclosed in this news release pertaining to the historic Jewel Ridge drilling was reviewed and approved by Don Hoy, P. Geo., who serves as a Qualified Person as defined under National Instrument 43-101 for Golden Lake Exploration Inc.

Historical References for Exploration Drilling at Jewel Ridge

Golden Lake press release of March 23, 2022

Golden Lake corporate website

SOURCE: Golden Lake Exploration

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/mcewen-inc.-to-acquire-golden-lake-exploration-inc.-1131544