TORONTO, Jan. 29, 2026 /PRNewswire/ - Hemlo Mining Corp. (TSXV: HMMC) (the "Company"), a new Canadian mid-tier gold producer, is pleased to provide an update on its 2026 exploration drilling program at the Hemlo Gold Mine ("Hemlo" or the "Mine"), located near Marathon, Ontario, Canada.

Highlights

- The Company has initiated an aggressive 130,000 metre exploration drilling program aimed at extending mine life, de-risking the near-term mine plan and identifying near-mine growth opportunities.

- The 2026 exploration drilling program is expected to serve as the foundation for an updated technical report, expected to be released in H2 2027.

Drilling Program Breakdown

- Resource Conversion Drilling (70,000 metres):

- Targeting conversion of Inferred mineral resources to Indicated mineral resource classification.

- Expected to support mineral reserve growth ahead of the updated technical study planned for H2-2027.

- High-Definition Drilling (30,000 metres):

- Focused on de-risking the short-term mine plan over the next two years.

- Expected to enhance geological confidence and operational predictability.

- Growth Drilling (30,000 metres):

- Testing new mineralized zones outside the current mineral resource footprint.

- Aimed at demonstrating the broader scale and long-term potential of the Hemlo gold deposit.

Jason Kosec, President and CEO of Hemlo Mining Corp., stated:

"This 130,000 metre drilling program represents a step-change in ambition for Hemlo. It is a disciplined investment focused on converting mineral resources, de-risking our near-term mine plan, and testing the broader scale potential of the Hemlo system. With a strong mineral reserve base, robust economics, and existing infrastructure, we believe this program positions us to extend mine life, grow reserves, and create long-term value in a supportive gold price environment."

Program Context

In late 2025 the Company released a technical report disclosing the results of a Pre-Feasibility Study (the "PFS") on the Mine, which demonstrated significant leverage to gold price assumptions (see table 1). As disclosed in the PFS, increases in the assumed gold price result in materially higher Net Present Value using a 5% discount rate ("NPV5%"), highlighting the strong economics of the Mine. The current gold price environment provides an attractive opportunity for the Company to invest in drilling and exploration that supports future technical studies, mine life extension, and long-term value creation at Hemlo.

Based on the PFS, the Mine hosts the following mineral resources and mineral reserves1:

- Probable mineral reserves of 2,321 koz of contained gold (41.2 million tonnes at grade of 1.75 g/t), including:

- Open-Pit: 781 koz (28.4 million tonnes at grade of 0.85 g/t)

- Underground: 1,540 koz (12.8 million tonnes at grade of 3.74 g/t).

- Measured and indicated mineral resources of 3,626 koz of contained gold (71.3 million tonnes at grade of 1.58 g/t), including:

- Underground: 624 koz of contained gold (4.3 million tonnes at grade of 4.47 g/t) in the measured mineral resource

- and 3,002 koz of contained gold (66.9 million tonnes at grade of 1.39 g/t) in the indicated mineral resource category:2

- Underground: 1,401 koz (10.1 million tonnes at grade of 4.33 g/t)

- Open-Pit: 1,601 koz (59.0 million tonnes at grade of 0.88 g/t)

- Inferred mineral resources of 624 koz of contained gold (9.8 million tonnes at grade of 1.97 g/t) including:

- Underground: 535 koz (3.3 million tonnes at grade of 5.02 g/t)

- Open-Pit: 88 koz (6.5 million tonnes at grade of 0.42 g/t)

The PFS reports an after-tax NPV5% of approximately US$1.1 billion based on a long-term consensus gold price of US$2,610/oz, with NPV increasing to approximately US$1.6 billion under higher gold price assumptions, as illustrated in the gold price sensitivity analysis presented in Table 1.

The 2026 resource conversion drilling program is designed to extend current mine life by targeting Inferred mineral resources and unclassified material, and upgrading it to the Indicated mineral resource category. Drilling will focus on multiple areas across the mine, with particular emphasis on the western portion of the operation, including the C-Zone and the newly-defined E-Zone, where significant volumes of Inferred mineral resources are already defined and remain open at depth. In these areas, the program is intended to improve geological confidence, test down-plunge continuity, and position additional mineralization for inclusion in future mine plans.

In addition, mineralization located in proximity to historic workings (Figure 2) represents an important conversion opportunity, as portions of this material were previously excluded from mineral resources due to limited drilling density or geological confidence rather than a lack of mineralization. Successful conversion drilling in these zones is expected to support future mineral reserve conversion, contributing to mine life extension, increased operational flexibility, planned production rate ramp-up, and improved overall mine economics.

_____________________________ |

1 As of December 31st, 2024. Totals may not sum, due to rounding. |

2 Mineral resources are inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

The high-definition drilling program refers to the tighter drill spacing routinely applied at Hemlo prior to mining and is focused on areas scheduled for extraction within the next 24 months. The objective of this drilling program is to de-risk local geology, enhance geological confidence, grade, tonnage, and improve operational predictability during the planned production ramp-up period.

The growth drilling program is designed to test expanded mineralized footprints identified through sporadic historical drilling and localized past mining areas, with the objective of identifying near-mine new mineralization outside the currently defined mineral resource estimate area. These target areas have returned encouraging historical results but have not been systematically tested. The program will focus on four priority target areas, selected based on geological interpretation, structural continuity, proximity to existing infrastructure, and a disciplined ranking strategy emphasizing mineability and long-term operational impact (see Figure 1 for target locations and Table 2 for selected historical intercepts).

Successful growth drilling is expected to support the addition of new Inferred Mineral Resources. Where results demonstrate continuity, grade, and geometry consistent with potential future development, the Company intends to follow up immediately with targeted infill drilling to rapidly advance such mineralization toward the Indicated mineral resource category. By prioritizing targets with clear pathways to development, the growth drilling program is designed to support mine life extension and reinforce the long-term scale potential of the Hemlo mineral system.

- B-Zone Footwall Mineralization ("BFW")

The BFW target comprises footwall-hosted mineralization within volcano-sedimentary units along the southern contact of the Moose Lake Porphyry, characterized by strongly silicified host rocks with pervasive feldspar replacement. Historically, exploration in the B-Zone has focused on the prolific northern (hanging wall) contact, although footwall mineralization has been recognized for decades and was locally mined in the upper portions of the Mine (figure 2). The deepest parts of the Golden Giant and David Bell mines are interpreted to lie within the BFW domain, and the majority of current B-Zone Lower East ("BLE") production is sourced from footwall mineralization. To date, drilling of the BFW has been largely limited to the eastern portion of the zone, while historical results support the potential for extensions beyond the currently defined footprint. - South Rim Mineralization

The South Rim target is located in the western portion of the Williams Mine, mostly south of the main C-Zone mineralization. Mineralization at South Rim exhibits a distinct style characterized by gold-quartz-carbonate veins with associated disseminated pyrite along the southern contact of the Moose Lake Porphyry and adjacent metasedimentary units. The 2026 drilling program will test the continuity, geometry, and potential relationship between the South Rim and BFW mineralization to determine whether they represent a single mineralized system or two distinct mineralized domains. - E-Zone and Horizon Zone

The newly-defined E-Zone is located approximately 300 m west of the C-Zone mineralization and exhibits strong geological similarities to the C-Zone in terms of vein style, host lithologies, and structural orientation (see the Company's January 26, 2026 press release for additional details). The E-Zone remains open at depth and to the west toward the Horizon area. The 2026 program will include drilling from both underground and surface platforms, as well as the development of an approximately 450 m exploration drift, to improve drill coverage and test down-plunge and western extensions toward the Horizon Zone. - Highway Zone

The Highway Zone is a shallow mineralized target located between the historic Golden Giant and David Bell shafts and represents the eastern extension of the B-Zone hanging wall system. The 2026 drilling program will focus on increasing data density. Positive outcomes could support the delineation of Indicated Mineral Resources accessible from existing underground development or a potential future decline.

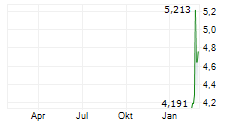

Table 1. PFS's After-Tax NPV analysis (using a 5% discount rate)

Gold price | NPV at 5% |

2,088 | 550 |

2,349 | 822 |

2,610 | 1,094 |

2,871 | 1,366 |

3,132 | 1,639 |

Table 2. Selected Historical Drill holes highlights 1, 2, 3,

DDH-ID | Target Areas | From | To | Length | Au Grade (g/t) | Azimuth | Dip |

6702503 | E-Zone | 534.0 | 539.0 | 5.0 | 15.8 | 285.7 | -10.1 |

including | 536.0 | 537.0 | 1.0 | 49.0 | |||

W24 | Highway | 42.0 | 46.0 | 4.0 | 20.8 | 166.6 | -41.7 |

52431102 | Highway | 58.0 | 66.2 | 8.2 | 14.4 | 14.1 | -34.8 |

including | 62.4 | 62.9 | 0.5 | 132.5 | |||

1501216 | B-Zone | 47.0 | 51.6 | 4.7 | 24.6 | 343.2 | 6.5 |

including | 51.0 | 51.3 | 0.2 | 435.0 | |||

1601514 | B-Zone | 244.0 | 249.0 | 5.0 | 12.0 | 178.0 | -46.3 |

including | 248.0 | 248.6 | 0.6 | 71.2 | |||

3100725 | B-Zone | 30.0 | 35.3 | 5.3 | 8.4 | 177.7 | -3.1 |

including | 34.0 | 34.8 | 0.8 | 44.4 | |||

4502113 | South Rim | 253.0 | 258.3 | 5.3 | 12.4 | 167.5 | -23.9 |

including | 255.0 | 256.0 | 1.0 | 55.7 | |||

6601805 | South Rim | 155.0 | 159.3 | 4.3 | 18.3 | 215 | -19.3 |

including | 158.0 | 159.3 | 1.3 | 57.3 | |||

6701835 | South Rim | 147.0 | 153.8 | 6.8 | 17.1 | 162.9 | 13.2 |

including | 152.7 | 153.8 | 1.1 | 94.4 |

Notes: | |

1. | Totals may not sum, due to rounding. |

2. | True thickness is estimated to vary between 40% to 70% of downhole length. |

3. | Drill intercepts are constrained to the interpreted vein envelope and include internal dilution, Uncap Assays. |

Qualified Person

The scientific and technical information contained in this news release, including sampling, analytical and test data underlying the information regarding the drill results, has been reviewed and approved by Raphael Dutaut, Ph.D. (P.Geo), the Company's Vice President, Exploration. Mr. Dutaut is a "qualified person" as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

To verify the information related to the historical drilling programs at the Hemlo property, Mr. Dutaut has visited the property; discussed logging, sampling, and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations.

Scientific and Technical Information

Scientific and technical information in this press release regarding PFS mineral resource and mineral reserve estimates at Hemlo are derived from the Company's technical report titled "NI 43-101 Technical Report Hemlo Mine, Ontario, Canada" with an effective date of December 31, 2024 and a signature date of October 27, 2025, and the Company's news release dated January 26, 2026, copies of which have been filed on the Company's SEDAR+ profile at www.sedarplus.ca.

About Hemlo Mining Corp.

Hemlo Mining Corp. (previously Carcetti Capital Corp.) recently closed the acquisition of the Hemlo Gold Mine from Barrick Mining Corp. for aggregate consideration of up to US$1.1 billion. The Hemlo Gold Mine is located 35 kilometers east of the town of Marathon, Ontario and has produced approximately 25 million ounces of gold from both underground and open pit operations since production began in 1985. The Company is looking to establish itself as a leading Canadian mid-tier growth-focused gold producer, with an immediate focus on maximizing the value of the Hemlo Gold Mine's existing infrastructure through a fit-for-purpose operating approach, while unlocking new opportunities through an aggressive brownfields exploration.

Neither the TSX Venture Exchange nor its Regulatory Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively, "forward-looking statements"). The use of words such as "expects", "anticipates", "plans", "will," "may", "should" and similar expressions are intended to identify forward-looking statements. Forward-looking statements contained in this press release include statements regarding: the Company's plans to launch a 130,000 m drilling campaign aimed at extendeding mine life, de-risking the near-term mine plan and indentifying near-mine growth opportunities; the Company's expectation that the 2026 exploration drilling program will serve as the foundation for an updated technical report, expected to be released in H2 2027; the Company's expectation that planned resource conversion drilling will support mineral reserve growth ahead of the updated techncial study planned for H2 2027; the Company's expectation that high-definition drilling will enhance geological confidence and operational predictability; the Company's belief that the program positions the Company to extend mine life, grow reserves, and create long-term value in a supportive gold price environment; the Company's expectation that successful growth drilling will suport the addition of new Inferred Mineral Resources and intention to follow up immediately with targetted infill drilling where results demonsstrate continuity, grade and geometry consistent with potential future development; and the Company's goals, plans, commitments, objectives and strategies.

These forward-looking statements are provided as of the date of this news release, or the effective date of the documents referred to in this news release, as applicable, and reflect predictions, expectations or beliefs regarding future events based on the Company's beliefs at the time the statements were made, as well as various assumptions made by and information currently available to them. In making the forward-looking statements included in this news release, the Company has applied several material assumptions, including, but not limited to: the successful integration of Hemlo; the future price of gold; anticipated costs and the Company's ability to fund its programs; the Company's ability to carry on exploration, development, and mining activities; currency exchange rates remaining as estimated; prices for energy inputs, labour, materials, supplies and services remaining as estimated; the timing and results of operational plans; mineral reserve and mineral resource estimates and the assumptions on which they are based; the timely receipt of required approvals and permits; the timing of cash flows; the costs of operations; the Company's ability to operate in a safe, efficient, and effective manner; the Company's ability to obtain financing as and when required and on reasonable terms; that the Company's activities will be in accordance with the Company's public statements and stated goals; and that there will be no material adverse change or disruptions affecting the Company or Hemlo. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

We caution readers not to place undue reliance on these forward-looking statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: uncertainty and variations in the estimation of mineral resources and mineral reserves; risks related to the Company's anticipated indebtedness and gold stream obligations; risks related to exploration, development, and operation activities; political risks, delays in obtaining or failure to obtain governmental permits, or non-compliance with permits; environmental and other regulatory requirements; uncertainties related to title to mineral properties; water rights; risks related to natural disasters, terrorist acts, health crises, and other disruptions and dislocations; financing risks and access to additional capital; risks related to guidance estimates and uncertainties inherent in the preparation of pre-feasibility studies; uncertainty in estimates of production, capital, and operating costs and potential production and cost overruns; the fluctuating price of gold; unknown liabilities in connection with the acquisition of Hemlo; global financial conditions; uninsured risks; climate change risks; competition from other companies and individuals; conflicts of interest; volatility in the market price of the Company's securities; the Company's limited operating history; litigation risks; the Company's ability to complete, and successfully integrate the acquisition of Hemlo; intervention by non-governmental organizations; outside contractor risks; risks related to historical data; risks related to the Company's accounting policies and internal controls; shareholder activism; and other risks associated with executing the Company's objectives and strategies.

Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

SOURCE Hemlo Mining Corp.