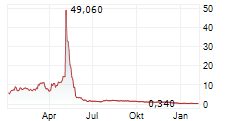

SINGAPORE and HONG KONG, Jan. 29, 2026 (GLOBE NEWSWIRE) -- NETCLASS TECHNOLOGY INC (Nasdaq: NTCL; the "Company" or "NetClass"), a leading B2B smart education IT solutions provider with offices in Shanghai, Hong Kong, Singapore and Tokyo, today announced that, on January 27, 2026, the Company received a letter from the Listing Qualifications Department of the Nasdaq Stock Market LLC ("Nasdaq") notifying the Company that based on the closing bid price of the Class A ordinary shares of the Company for the last 30 consecutive business days, the Company no longer meets the continued listing requirement of Nasdaq under Nasdaq Listing Rules 5550(a)(2), to maintain a minimum bid price of $1 per share.

The notification has no immediate effect on the listing or trading of the Company's Class A ordinary shares on Nasdaq, and the shares will continue to trade uninterrupted under the symbol "NTCL". Nasdaq has provided the Company with a 180 calendar-days compliance period, or until July 27, 2026, in which to regain compliance with Nasdaq continued listing requirement. In the event that the Company does not regain compliance in the compliance period, the Company may be eligible for additional time, should the Company meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the bid price requirement, and is able to provide written notice of its intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. However, if it appears that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible, Nasdaq will provide notice that the Company's securities will be subject to delisting.

The Company is currently evaluating options to regain compliance and intends to timely regain compliance with Nasdaq's continued listing requirement. Although the Company will use all reasonable efforts to achieve compliance with Rule 5550(a)(2), there can be no assurance that the Company will be able to regain compliance with that rule or will otherwise be in compliance with other Nasdaq continued listing requirements.

About NETCLASS TECHNOLOGY INC

NETCLASS TECHNOLOGY INC is a leading B2B smart education specialist with offices in Shanghai, Hong Kong, Singapore, and Tokyo, providing innovative IT solutions to schools, training institutions, corporations, public agencies, and other organizations. Our services include SaaS subscription services and application software development, with solutions spanning teaching and campus management, online teaching, examinations, epidemic prevention, data storage, EDC (Education Credit) blockchain systems, and lecturer evaluation services. Our mission is to deliver reliable, high-quality products that drive sustainable growth for our customers. For more information, please visit the Company's website: https://ir.netclasstech.com

Forward-Looking Statements

All statements other than statements of historical fact in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as "approximates," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may" or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company's registration statement and other filings with the U.S. Securities and Exchange Commission.

For investor and media inquiries, please contact:

NETCLASS TECHNOLOGY INC

Investor Relations

Email: ir@netclasstech.com

Jackson Lin

Lambert by LLYC

Phone: +1 (646) 717-4593

Email: jian.lin@llyc.global