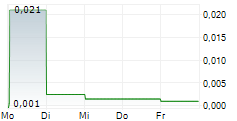

As of today, 30 January 2026, the Company's shares are trading under the new ticker symbol "36GRP." The name change to 36 Group AB reflects the Company's strategic direction as a group focused on scalable iGaming operations with recurring revenues, built around a combination of B2C activities and a B2B platform business.

Over the past year, the Company has undergone a significant transformation in its business mix, capital allocation, and operational focus. The transition to 36 Group marks the point at which this transformation becomes explicit and visible to the market.

- 36 Group is no longer a hardware-led, land-based casino story.

- 36 Group is now organised for scalable execution. Remaining land-based hardware assets will be retained within the group while a buyer is sought, and any hardware order opportunities that may arise during this period will be evaluated strategically.

- At the same time, capital, management attention, and execution capacity are clearly concentrated on iGaming operations with recurring revenue streams.

The group is structured around two complementary engines:

- B2C operations, serving as a cash-flow and data engine through owned casino brands

- B2B platform services, offering a scalable, recurring-revenue model to operators through technology, infrastructure, and managed services

This structure is designed to shorten feedback loops, improve capital efficiency, and build more predictable earnings over time.

5 prioritised focus areas in ongoing execution

As 36 Group enters its next phase, management is focused on the following prioritised areas:

- Reduce cost base and strengthen cash flow

- A focused cost programme is being executed with clear prioritisation: activities that do not contribute to operational stability, customer delivery, or revenue generation are reduced, paused, or renegotiated. The objective is a lower run-rate and greater endurance per invested krona.

- Scale B2C with strict capital discipline

- Meta Bliss Group's B2C crypto casino brands are being scaled progressively through controlled player acquisition following a test-learn-scale approach, where investments are increased only once defined profitability thresholds have been met.

- Bring a B2B customer live and establish recurring revenues

- Focus is on completing the go-live of a B2B customer on the platform and establishing processes for stable operations, SLAs, and ongoing performance follow-up. The objective is to demonstrate scalability and lay the foundation for a recurring revenue engine.

- Sharpen the offering and packaging under 36 Group

- The group logic is clarified: B2C as a cash-flow and data engine, and B2B as a scalable platform business with recurring revenues. At the same time, packaging and onboarding are being simplified to enable faster commercialisation of additional customers.

- Communicate progress through concrete milestones

- The Company will focus on clear, verifiable milestones, allowing the market to follow developments in the cost base, B2B go-live execution, and B2C performance. The Company remains committed to its previously communicated ambition of SEK 108-142 million in revenue by the end of 2026, subject to access to the resources required for execution.

Near-term focus on treasury execution

In parallel with operational execution, an important near-term milestone will be the implementation of the Company's Bitcoin treasury strategy. The recently announced financing agreement with Loft Capital enables 36 Group to initiate Bitcoin purchases, representing an important step in the Company's capital allocation framework.

CEO comment

"The move to 36 Group is about creating clarity-both internally and externally-around what we are building. Over the past year, we have evaluated several strategic paths aimed at accelerating value creation. While those processes did not ultimately proceed, they sharpened our focus and resulted in a structure that is now ready to scale.

We are running the Company with a clear bias toward discipline: cost control, capital efficiency, and growth only where it is proven. The priorities we have outlined are operational. Over the coming quarters, our job is to execute, reach milestones, and let results do the talking. That is how we intend to build long-term value in 36 Group."

For more information, please contact:

Chris Steele, CEO

Email: chris.steele@36.group

Tel: +46 70 978 1081

About 36 Group AB

36 Group AB is a Swedish iGaming group focused on scalable operations with recurring revenues. The group operates both B2C activities through owned casino brands and B2B activities by providing platform services and managed services to gaming operators. The Company's shares (36GRP) are traded on NGM Nordic SME. More information is available at www.36.group

Over the past year, the Company has undergone a significant transformation in its business mix, capital allocation, and operational focus. The transition to 36 Group marks the point at which this transformation becomes explicit and visible to the market.

- 36 Group is no longer a hardware-led, land-based casino story.

- 36 Group is now organised for scalable execution. Remaining land-based hardware assets will be retained within the group while a buyer is sought, and any hardware order opportunities that may arise during this period will be evaluated strategically.

- At the same time, capital, management attention, and execution capacity are clearly concentrated on iGaming operations with recurring revenue streams.

The group is structured around two complementary engines:

- B2C operations, serving as a cash-flow and data engine through owned casino brands

- B2B platform services, offering a scalable, recurring-revenue model to operators through technology, infrastructure, and managed services

This structure is designed to shorten feedback loops, improve capital efficiency, and build more predictable earnings over time.

5 prioritised focus areas in ongoing execution

As 36 Group enters its next phase, management is focused on the following prioritised areas:

- Reduce cost base and strengthen cash flow

- A focused cost programme is being executed with clear prioritisation: activities that do not contribute to operational stability, customer delivery, or revenue generation are reduced, paused, or renegotiated. The objective is a lower run-rate and greater endurance per invested krona.

- Scale B2C with strict capital discipline

- Meta Bliss Group's B2C crypto casino brands are being scaled progressively through controlled player acquisition following a test-learn-scale approach, where investments are increased only once defined profitability thresholds have been met.

- Bring a B2B customer live and establish recurring revenues

- Focus is on completing the go-live of a B2B customer on the platform and establishing processes for stable operations, SLAs, and ongoing performance follow-up. The objective is to demonstrate scalability and lay the foundation for a recurring revenue engine.

- Sharpen the offering and packaging under 36 Group

- The group logic is clarified: B2C as a cash-flow and data engine, and B2B as a scalable platform business with recurring revenues. At the same time, packaging and onboarding are being simplified to enable faster commercialisation of additional customers.

- Communicate progress through concrete milestones

- The Company will focus on clear, verifiable milestones, allowing the market to follow developments in the cost base, B2B go-live execution, and B2C performance. The Company remains committed to its previously communicated ambition of SEK 108-142 million in revenue by the end of 2026, subject to access to the resources required for execution.

Near-term focus on treasury execution

In parallel with operational execution, an important near-term milestone will be the implementation of the Company's Bitcoin treasury strategy. The recently announced financing agreement with Loft Capital enables 36 Group to initiate Bitcoin purchases, representing an important step in the Company's capital allocation framework.

CEO comment

"The move to 36 Group is about creating clarity-both internally and externally-around what we are building. Over the past year, we have evaluated several strategic paths aimed at accelerating value creation. While those processes did not ultimately proceed, they sharpened our focus and resulted in a structure that is now ready to scale.

We are running the Company with a clear bias toward discipline: cost control, capital efficiency, and growth only where it is proven. The priorities we have outlined are operational. Over the coming quarters, our job is to execute, reach milestones, and let results do the talking. That is how we intend to build long-term value in 36 Group."

For more information, please contact:

Chris Steele, CEO

Email: chris.steele@36.group

Tel: +46 70 978 1081

About 36 Group AB

36 Group AB is a Swedish iGaming group focused on scalable operations with recurring revenues. The group operates both B2C activities through owned casino brands and B2B activities by providing platform services and managed services to gaming operators. The Company's shares (36GRP) are traded on NGM Nordic SME. More information is available at www.36.group

© 2026 GlobeNewswire (Europe)