KELLOGG, Idaho and VANCOUVER, British Columbia, Feb. 02, 2026 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corp. ("Bunker Hill" or the "Company") (TSX-V:BNKR |OTCQB:BHLL) is pleased to provide a corporate update to highlight that the mine restart for H1 2026 is on schedule and budget, improved project economics driven by silver and metal prices, and AI-enabled validation of high-priority exploration targets.

"Bunker Hill remains undervalued relative to other publicly traded silver companies, particularly when considering our advanced restart status, US jurisdiction, and growing silver exposure," said Sam Ash, President and CEO of Bunker Hill Mining. "That disconnect is not expected to persist. As we progress towards initial production, ramp up commercial production, and deliver meaningful exploration results over the coming year, we believe the market will increasingly recognize the asset's intrinsic value. We are executing on fundamentals, and the catalysts ahead are clear."

Mine Restart Advancing on Schedule and Budget

The restart of the Bunker Hill Mine in Idaho's Silver Valley continues to advance on schedule and within budget. Construction of the Process Plant is now 88% complete, with the Main Ball Mill turning, flotation motors being bump-tested, and the Process Plant formally in the commissioning phase. The previously delayed Tailings Filter Plant is progressing and is now close to 60% complete. The Tailings Filter Plant building is close to being structurally complete, with the last two weeks focused on installing the Filter Press with onsite Metso supervision. First production is targeted for H1 2026. Key milestones achieved this year are listed below and represent the ongoing safe and sustainable transition from construction/rehabilitation activity into final commissioning and readiness for operations.

- Continued Safety and Environmental Excellence. Bunker Hill has now recorded over 3 years without a Lost Time Incident and had a 2025 full-year Total Recordable Incident Rate of 1.23, roughly half of the national average. On December 3, 2025, MSHA recategorized the Bunker Hill Mine from 'Active: Non-Producing' to 'Active: Producing'. We received our Multi-Sector General Permit (Stormwater) on August 8, 2025, and our Air Permit on September 29, 2025. We have maintained 100% compliance with all environmental permits and reporting requirements.

- Underground Development and Preparation for mining: Infrastructure rehabilitation and lateral development are progressing as planned, with multiple high-priority mining areas now accessible and prepared for production sequencing. Ventilation, underground communications, and power links are fully established. This progress is supported by the phased influx of new CAT mechanized mining equipment, an expanded mine planning/engineering team, and further optimization of the mine plan. Approximately 20,000 tons of ore are stockpiled underground, ready to support plant commissioning through startup and into production.

- Surface Infrastructure: Completion and commissioning of key surface facilities in the Kellogg yard remain on track, with no delays. The commissioning of the 1,800 tpd Process Plant began on schedule and is accelerating, concurrent with the installation of the Tailings Filter Press within the steel superstructure, slightly ahead of schedule.

Figure 1: Tailings Filter Press installed within the steel superstructure, ahead of schedule

- Team Build-Out: In a competitive market, the Company is recruiting and onboarding experienced operations and technical teams with the relevant expertise in underground mining, asset management, and safety to support the mine restart and subsequent development. Since Q4 2025, particular focus has been on the technical team supporting underground mining operations. Since that point, the following roles have been recruited into the full-time Bunker Hill site team:

- Chief Geologist

- Senior Geologist

- Ore Control Geologist

- Mine Engineer

- Technical Services Manager

- Chief Geologist

An experienced recruiter has been brought in-house to support the ramp-up of recruiting, and the team continues to recruit high-quality miners from within the Silver Valley. Additional electricians and mechanics have also been recruited. On the processing side, the team is starting to recruit the first of three planned waves of operational teams to run the Process Plants and Tailings Filter Plants.

Silver Price Strength Enhances Project Economics

Recent strength in the silver price has materially improved the Company's projected revenue mix. Based on current pricing assumptions, silver and base metals are now expected to contribute approximately 50/50 to revenue, compared to prior forecasts that weighed more heavily toward base metals.

As a result, projected cash flow and operating margins are expected to exceed prior internal planning assumptions, providing increased financial flexibility and leverage to silver price upside. This adjustment to the metal revenue mix, combined with further ongoing optimization of the mine plan, positions Bunker Hill as a potential near-term US silver producer with meaningful base-metal credits.

High-Priority Exploration Targets Validated

The Company seeks to both expand the quantity of its resources and reserves and increase the relative quantity of silver mineralization within the mine plan. To that end, and in preparation for a 2026 exploration campaign, it has recently completed an advanced technical review using AI-assisted analysis of geological and historical data. This has affirmed the viability and upside potential of several key exploration targets within the expanded Bunker Hill land package, following the acquisition of the Ranger-Page properties.

These high-priority targets include:

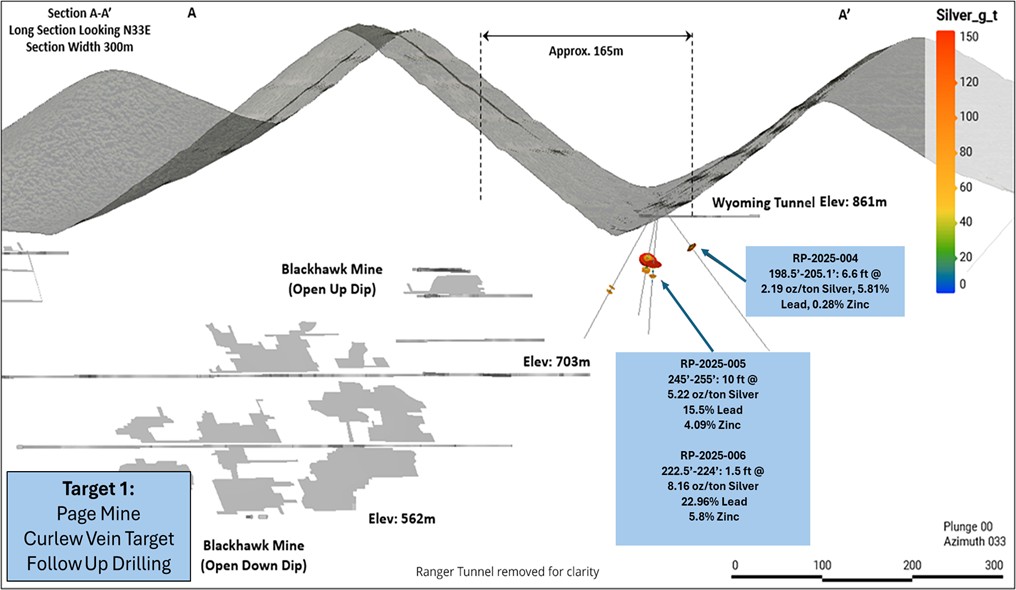

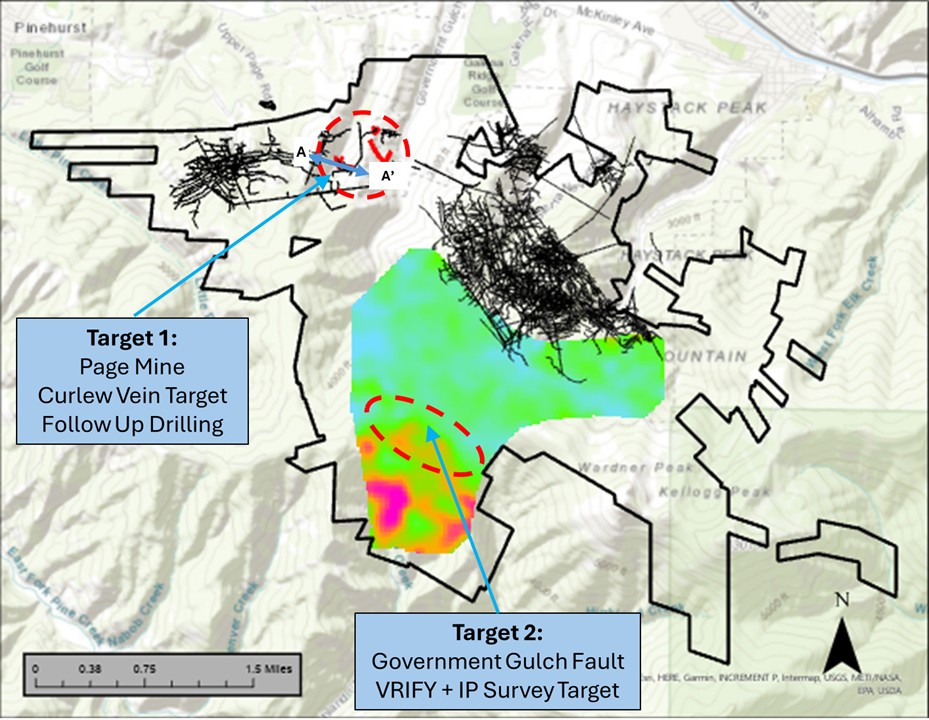

- Target 1: Page Mine-Curlew Vein. This target, located within the recently acquired Ranger-Page property, is based on data from a 2025 drilling campaign that discovered higher-grade silver, lead, and zinc mineralization in a splay of the previously mined Curlew Vein at relatively shallow depths and not explored by prior operators. See the October 27, 2025, release here.

Notable vein intercepts include:

RP-2025-004: 6.6 ft starting at 198.5' @ 2.19 oz/ton silver, 5.81% lead, 0.28% zinc

RP-2025-005: 10 ft starting at 245' @ 5.22 oz/ton silver,15.5% lead, 4.09% Zinc

RP-2025-006: 1.5 ft starting at 222.5' @ 8.16 oz/ton Silver, 22.96% Lead, 5.8% Zinc

Figure 2: Page-Mine Curlew Vein higher-grade targets

Figure 3: Page-Mine Curlew Vein and Government Gulch target

- Target 2: VRIFY Prospectivity Score + IP Chargeability High. The target highlighted by VRIFY AI along the Government Gulch Fault is an overlap of IP chargeability highs collected during the 2022 geophysical surveys overlain with VRIFY Prospectivity Score correlation of Radiometric surveys (U, Th, REE), geologic lineaments, and silver zinc sample values, the same signature found over the Bunker Hill Mine workings. This target is significant in that it is in the hanging wall of a stacked series of major thrust faults, bottomed by the Cate Fault. The Cate Fault cut and offset major ore bodies within the Bunker Hill Mine, with >2,000 feet of up-dip displacement, with similar displacement along smaller faults in the target area. The footprint of the Government Gulch Fault Target is comparable in size to one of the largest individual ore bodies in the Bunker Hill Mine - the March Ore Body, which produced 4.7M tons grading 12% lead, 5.22 oz/ton silver and 2.25% zinc.

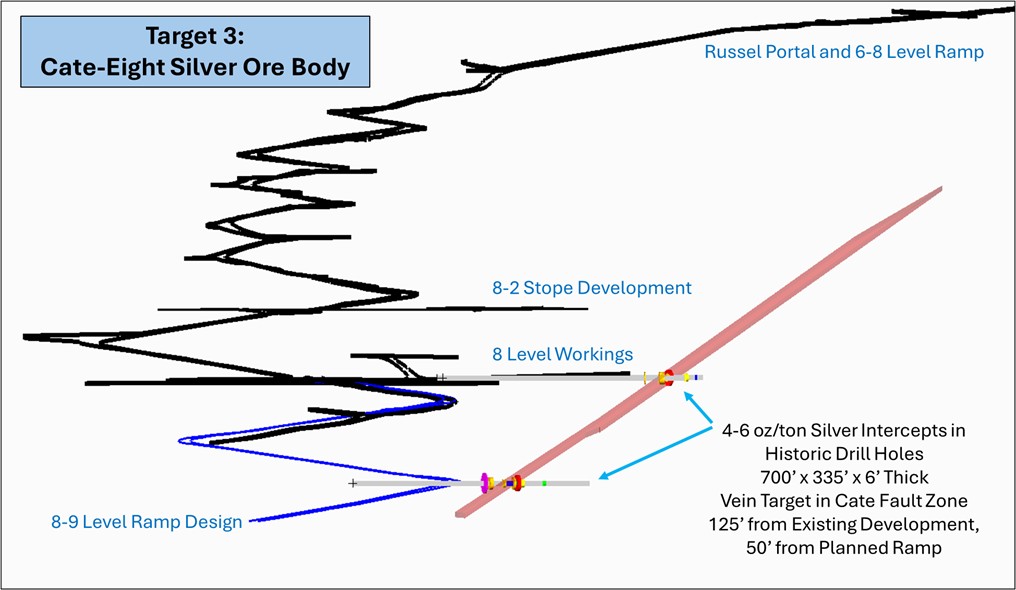

- Target 3: Cate Fault Zone Silver Mineralization in Historic Drilling. Drilling in the 1970s in the Bunker Hill Mine identified a zone of high-grade silver-lead mineralization within the Cate Fault zone, which was never exploited. This zone is in close proximity to current and planned mine development, with a predictable geometry following the Cate Fault. Drill intercepts are within 125 feet of the rehabilitated 8 Level, and within 60 feet of the planned 8-9 Level ramp, providing two access points within a distance amenable for efficient exploration by drifting.

Significant drill intercepts include:

DH 1698: 7.5' @ 4.6 oz/ton silver, 16.2% lead, 4.7% zinc

DH 1764: 6' @ 4.2 oz/ton silver, 13% lead and 1% zinc

DH 1768: 4' @ 6 oz/ton silver, 5.2% lead and 0.8% zinc

Figure 4: Cate-Eight Silver Ore Body

These targets represent near potential silver opportunities, leveraging existing underground access, historical production data, and modern geological interpretation. Exploration activities will be focused, disciplined, and designed to deliver near-term value creation alongside production ramp-up.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Sam Bourque P.Geo., Chief Geologist of the Company, who is a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Bunker Hill Mining Corp.

Bunker Hill Mining Corp. is a US-based mineral exploration and development company advancing the restart of the historic Bunker Hill Mine, a past-producing zinc, lead, and silver asset located in northern Idaho's prolific Coeur d'Alene Mining District. One of the most storied base and precious metals areas in North America, the Silver Valley has a long history of production and established infrastructure.

The Company is focused on unlocking the remaining value of this high-quality brownfield asset through modern exploration, disciplined project development, and responsible mining practices. With a singular strategic focus on Bunker Hill, the Company is positioned to maximize shareholder value while revitalizing a cornerstone asset in a premier American mining jurisdiction.

Additional information about Bunker Hill Mining Corp. is available at www.bunkerhillmining.com or through the Company's filings on SEDAR+ and EDGAR.

On behalf of Bunker Hill Mining Corp.

Sam Ash

President and Chief Executive Officer

For additional information, please contact:

Brenda Dayton

Vice President, Investor Relations

T: 604.417.7952

E: brenda.dayton@bunkerhillmining.com

Cautionary Statements

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase 'forward-looking information' in the Canadian Securities Administrators' National Instrument 51-102 - Continuous Disclosure Obligations (collectively, "forward-looking statements"). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", "plan" or variations of such words and phrases.

Forward-looking statements in this news release include, but are not limited to, statements regarding the Company's objectives, goals, priorities or future plans, including the timing of the restart and development of the Bunker Hill Mine; the achievement of future short-term, medium-term and long-term operational strategies; degree and extent of progress towards realizing the Company's objectives, goals, priorities or future plans; the Company's ability to recruit employees; use and the expected benefits derived from the historical geological database obtained in the acquisition, including potential extension of operational life at Bunker Hill, efficiencies derived from economies of scale and availability of local synergies; whether indicated grade and other qualities of certain minerals remain open at depth and along strike; any benefits derived from the Ranger-Page Project's existing underground workings and surface access points, including relating to future mine planning, ventilation and exploration access to deeper levels of the Bunker Hill Mine system; timing of operations at the Bunker Hill Mine; potential for future production at the Bunker Hill Mine; any enhancements to upside optionality for future resource expansion and mill feed sources; the nature and anticipated benefits of the Company's collaboration with VRIFY; anticipated recovery rates; the nature and anticipated benefits of the Company's programs; the availability and adequacy of the Company's existing financing; and benefits to the local community including job creation and stimulation of procurement from regional suppliers.

Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks and uncertainties identified in public filings made by Bunker Hill with the SEC and with applicable Canadian securities regulatory authorities, and the following: the Company's ability to raise additional capital for project activities on acceptable terms or at all; Bunker Hill's ability to operate as a going concern and its history of losses; failure to obtain TSX-V approval; the fluctuating price of commodities; capital market conditions; restrictions on labor and its effects on international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company's ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such statements or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as to the actual size or terms of those financing initiatives. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that could affect the Company's operations or financial results are included in the Company's annual information form or annual report and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through EDGAR on the SEC website (www.sec.gov), respectively.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/840f6491-a321-474f-876e-65f80a5be072

https://www.globenewswire.com/NewsRoom/AttachmentNg/771022df-e29f-4e8b-9cd5-b944b7930360

https://www.globenewswire.com/NewsRoom/AttachmentNg/4b986b02-ab68-4423-9138-10e0d64ab47b

https://www.globenewswire.com/NewsRoom/AttachmentNg/eab72da1-00d2-454c-81ac-e49c94a9dd47