VANCOUVER, BC, Feb. 3, 2026 /CNW/ - Goldsky Resources Corp (TSX-V: GSKR, FNSE: GSKR SDB, OTCQX: GSKRF, FRA: HEG0) ("Goldsky Resources" or the "Company") is pleased to announce the commencement of the 2026 winter drilling season at its 100% owned Rajapalot property in Northern Finland.

HIGHLIGHTS

- Four diamond drill-rigs have been mobilized to site over the past weeks and have begun a 10,000 meter drilling program at Rajapalot

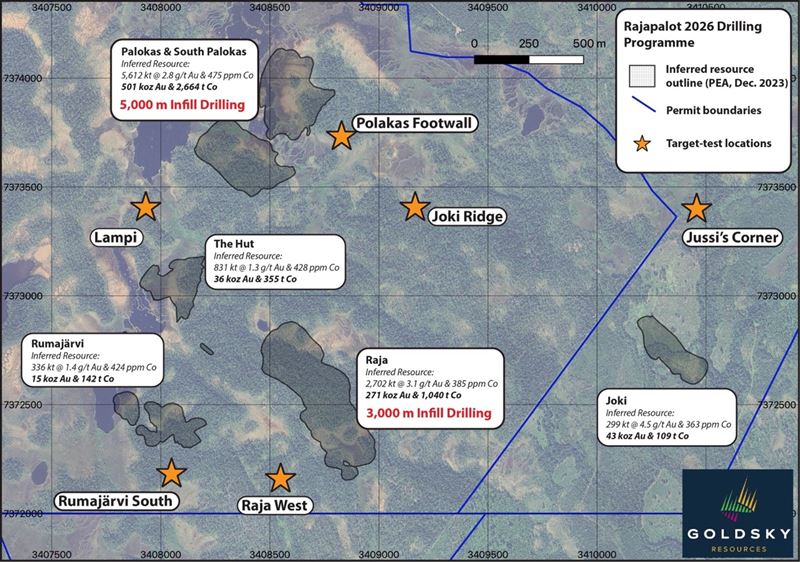

- Approximately 8,000 meters will focus on infill drilling at the Raja and Palokas deposits, aimed at increasing confidence in the existing Inferred Resources and supporting progression from exploration licenses to mining licenses under Finnish regulations (Figure 1)

- A 'target-test' drill program of approximately 2,000 meters is planned to drill-test several compelling high-priority exploration targets in the immediate vicinity to the current Rajapalot resource areas in order to support potential resource growth (refer to Figure 1)

Russell Bradford, CEO of Goldsky Resources, comments: "We are very excited to demonstrate our continued commitment to the Rajapalot Project under the new management of Goldsky by way of assigning a significant 10,000 meter drilling program that will support important long-term objectives for the project. Our commitment to upgrading some important areas of the currently defined mineral resource is a major step-forward for the project, which will enable us to forge ahead with our permitting advancement at Rajapalot. Similarly, further 'target-test' exploration drilling at the project, if successful, will only serve to strengthen the underlying fundamental of the project by way of increasing the gold-cobalt resource-base at Rajapalot. This is our first major exploration program under the new banner of Goldsky Resources Corporation, and an exciting first step in our new Nordic-focused gold development and exploration company."

THE RAJAPALOT DEPOSIT

At Rajapalot, mineralization is regarded as orogenic in nature. All examples of gold-cobalt mineralization are consistently located within highly-sheared and foliated wall-rocks adjacent to strongly hydrothermally altered, northwest to north dipping shear-zones. Mineralization is typically encountered as disseminated to semi-massive sulfide lenses (predominantly pyrrhotite and lesser pyrite and cobaltite), hosted within strongly deformed and altered, mafic volcanic and volcaniclasitic stratigraphy of the upper portions of the Paleoproterozoic-aged Kivalo Group of the Peräpohja Greenstone Belt. Prospects with high-grade gold and cobalt mineralization at Rajapalot occur across a 3 km (east-west) by 2 km (north-south) area within the larger Rajapalot project area measuring 4 km by 4 km with multiple mineralized boulders, base-of-till (BOT). Gold-Cobalt mineralization at Rajapalot has been drilled to over 640 meters below surface at both South Palokas and Raja prospects, and mineralization remains open at depth across the entire project.

Rajapalot Mineral Resource

An Inferred Mineral Resource ("MRE") has been calculated for the Rajapalot project (effective date August 26, 2021), and is based on an 'underground only' mining scenario containing 9.8 million tonnes @ 2.8 g/t gold ("Au") and 441 ppm Co, equating to 867 thousand ounces ("koz") gold and 4,311 tonnes of cobalt.

| Zone | Cut-off(AuEq¹) | Tonnes(kt) | Au(g/t) | Co(ppm) | Au(koz) | Co(tonnes) | |

| Palokas | 1.1 | 5,612 | 2.8 | 475 | 501 | 2,664 | |

| Raja | 1.1 | 2,702 | 3.1 | 385 | 271 | 1,040 | |

| East Joki | 1.1 | 299 | 4.5 | 363 | 43 | 109 | |

| Hut | 1.1 | 831 | 1.3 | 428 | 36 | 355 | |

| Rumajärvi | 1.1 | 336 | 1.4 | 424 | 15 | 142 | |

| Total Inferred Resources | 9,780 | 2.8 | 441 | 867 | 4,311 |

Rajapalot Inferred Mineral Resource Effective August 26, 2021

- The independent geologist and Qualified Person as defined in NI 43-101 for the mineral resource estimates is Mr. Ove Klavér (EurGeol). The effective date of the MRE remains unchanged to the Previous MRE (August 26, 2021, available on SEDAR as filed by the previous owner, Mawson), and will be restated in the PEA technical report when it is filed.

- The mineral estimate is reported for a potential underground only scenario. Inferred resources were reported at a cut-off grade of 1.1 g/t (AuEq1 Au g/t + Co ppm /1005) with a depth of 20 meters below the base of solid rock regarded as the near-surface limit of potential mining.

- Wireframe models were generated using gold and cobalt shells separately. Forty-eight separate gold and cobalt wireframes were constructed in Leapfrog Geo and grade distributions independently estimated using Ordinary Kriging in Leapfrog Edge. A gold top cut of 50 g/t Au was used for the gold domains. A cobalt top cut was not applied.

- A parent block size of 12 m x 12 m x 4 m (>20% of the drillhole spacing) was determined as suitable. Sub-blocking down to 4 m x 4 m x 0.5 m was used for geologic control on volumes, thinner and moderately dipping wireframes.

- Rounding of grades and tonnes may introduce apparent errors in averages and contained metals.

- Drilling results to 20 June 2021.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

QUALIFIED PERSON

The technical and scientific information in this news release was reviewed, verified and approved by Dr. Thomas Fromhold, an employee of Fromhold Geoconsult AB, and Member of The Australian Institute of Geosciences (MAIG, Membership No. 8838). Dr. Fromhold is a "qualified person" as defined under NI 43-101. Dr. Fromhold is not considered independent of the Company under NI 43-101 as he is a consultant of the Company.

ON BEHALF OF THE BOARD OF DIRECTORS

Russell Bradford,

CEO & Director

Follow Goldsky Resources:

Twitter: https://x.com/goldskyir

Youtube: https://www.youtube.com/@goldskyir

LinkedIn: https://www.linkedin.com/company/goldskyir

Facebook: https://www.facebook.com/goldskyir

Instagram: https://www.instagram.com/goldskyir

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Statements

This news release contains forward-looking statements that reflect the Company's intentions, beliefs, or current expectations about and targets for the Company's and the group's future results of operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which the Company and the group operates and includes, statements with respect to (i) the NBU Acquisition, (ii) issuance of Shares thereunder, and (iii) receipt of TSXV approval of the NBU Acquisition. Forward-looking statements are statements that are not historical facts and may be identified by words such as "believe", "expect", "anticipate", "intend", "may", "plan", "estimate", "will", "should", "could", "aim" or "might", or, in each case, their negative, or similar expressions. The forward-looking statements in this news release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that they will materialize or that the assumptions on which it is based are correct. Because these statements are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcome could differ materially from those set out in the forward-looking statements as a result of many factors. Such risks, uncertainties, contingencies, and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. The Company does not guarantee that the assumptions underlying the forward-looking statements in this news release are free from errors and readers of this news release should not place undue reliance on the forward-looking statements in this news release. The information, opinions and forward-looking statements that are expressly or implicitly contained herein speak only as of the date of this news release and are subject to change without notice. Neither the Company nor anyone else undertake to review, update, confirm or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this news release, unless it is required by law or Nasdaq First North Growth Market Rulebook for Issuers of Shares.

APPENDIX

Figure 1. Map of the Rajapalot project illustrating areas of drilling focus in the upcoming 2026 winter drilling campaign. In total, 8,000 meters of infill drilling split across the Palokas (5,000 meters) and Raja (3,000 meters) Au-Co deposits, while approximately 2,000 meters will be allocated to 'target-test' priorities.

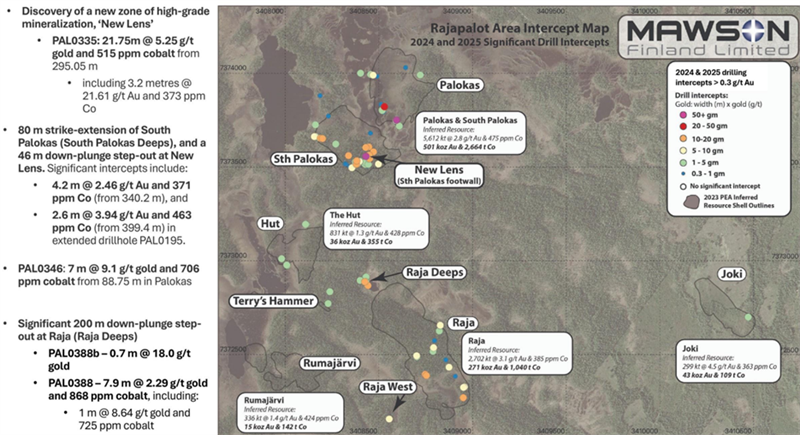

Figure 2. Map of the Rajapalot project illustrating significant Au-Co drilling intercepts from the previous 2024 and 2025 drilling programs by Mawson Finland Limited.

Figure 3. One of two Comadev Oy diamond drill-rigs now on-site at Rajapalot.

Goldsky Resources Corp 0203

For further information contact:

Investor Relations

Neil MacRae

SVP, Corporate Development

ir@goldskyresources.com

Tavistock PR (media contact)

Jos Simson/Saskia Sizen

goldskyresources@tavistock.co.uk

The Company's certified adviser on the Nasdaq First North Growth Market is Augment Partners AB, info@augment.se, +46 8-604 22 55.

ABOUT GOLDSKY RESOURCES

Goldsky Resources is a Canadian-based gold exploration company, consolidating assets in Sweden and Finland, with a vision to create Europe's next gold camp. The Company's flagship asset is the Barsele gold project in northern Sweden in which it has entered into an agreement with its partner, Agnico Eagle, to become the 100% owner. Immediately surrounding the Barsele project, the Company is 100%-owner of a district-scale license position comprised of two additional projects (Paubäcken, Storjuktan), which combined with Barsele, total approximately 80,000 hectares on the Gold Line greenstone belt. In Finland, the Company also holds a 100% interest in the Rajapalot Gold-Cobalt Project and a district-scale position covering the Oijärvi greenstone belt, including the Kylmäkangas Gold-Silver deposit. The Rajapalot Project represents approximately 5% of the larger 600-square kilometer-sized Rompas-Rajapalot Property, which is wholly owned by Goldsky and consists of 13 granted exploration permits for a total of 11,262 hectares. The Rompas-Rajapalot Property operations are carried out through the Company's fully owned subsidiary, Mawson Oy. Mawson maintains an active local presence of Finnish staff with close ties to the communities of Rajapalot.