TORONTO, Feb. 05, 2026 (GLOBE NEWSWIRE) -- Consolidated Lithium Metals Inc. (TSXV: CLM | FRA: Z36 | OTCQB: JORFF) ("CLM" or the "Company") announces today that it has entered into an amendment effective February 4, 2026 (the "Amendment") to the previously announced definitive agreement dated November 17, 2025, between the Company and SOQUEM Inc. ("SOQUEM"), a wholly owned subsidiary of Investissement Québec, pursuant to which the Company has acquired an option to earn, subject to the satisfaction of certain conditions, an undivided interest of up to 80% in the Kwyjibo Rare Earth Project (the "Project"), located 125 km northeast of the city of Sept-Îles, in the Côte-Nord region of Québec (the "Transaction"). The purpose of the Amendment is to clarify certain provisions with respect to the mechanism of issuing common shares of the Company ("Common Shares") to SOQUEM as consideration pursuant to the Transaction (the "Consideration Shares"), further to the review of the Transaction by the TSX Venture Exchange ("TSXV").

Pursuant to the Amendment:

- the number of Consideration Shares issuable to SOQUEM as consideration to earn a 60% and an additional 20% undivided interest in the Project is limited to no more than an aggregate of 110,000,000 and 90,000,000 Common Shares, respectively;

- no Consideration Shares shall be issued to SOQUEM if, as a result of such issuance, SOQUEM's undiluted holding of CLM's common shares would represent 10% or more of the issued and outstanding Common Shares, or if SOQUEM would otherwise become an insider of CLM, in which case CLM shall have the right to pay the applicable milestone amount to SOQUEM in cash in lieu of issuing Consideration Shares;

- SOQUEM undertook not to acquire Common Shares without approval of the TSXV if, as a result of such acquisition, SOQUEM's undiluted holding of Common Shares would represent 10% or more of the issued and outstanding Common Shares; and

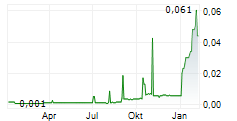

- no Consideration Shares shall be issued to SOQUEM if the applicable closing price of Common Shares on the TSXV is less than $0.05, in which case CLM will pay the applicable milestone amount to SOQUEM in cash in lieu of issuing Consideration Shares.

In addition, the Company notes that the Project remains subject to a 1.5% net smelter return royalty in favor of Iron Ore Company of Canada. For more information about the Transaction, please see the Company's press release dated November 18, 2025, which is available under the Company's SEDAR+ profile at www.sedarplus.ca.

Richard Quesnel, President and CEO of CLM, stated: "This amendment aligns the option structure with regulatory requirements, while maintaining our ability to advance the Project, and underscores our focus on responsible growth, capital discipline, and long-term value creation as we continue to advance the rare earth opportunity."

About Consolidated Lithium Metals Inc.

Consolidated Lithium Metals Inc. is a Canadian junior mining exploration company trading under the symbol "CLM" on the TSX Venture Exchange, "Z36" on the Frankfurt Stock Exchange, "JORFF" on the OTCQB Venture Market. The Company is focused on the exploration and development of critical mineral projects in stable jurisdictions. The Company is committed to supporting the energy transition through the responsible development of critical mineral supply chains.

For more information:

Rene Bharti, Vice President Corp. Dev.

Email | rene@consolidatedlithium.com

Phone: +1 (647) 965 2173

Website: www.consolidatedlithium.com

Cautionary Statements

This press release contains "forward-looking information" within the meaning of applicable Canadian securities laws. Forward-looking information includes, but is not limited to, statements with respect to the Transaction, including the exercise of the options, and other matters related thereto.

Generally, forward-looking information is identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially, including risks related to: the Company's ability to fund earn-in expenditures; regulatory approvals, including respecting permits and approval of the TSXV of the Transaction and the issuances of Consideration Shares to exercise one or both of the options; commodity prices and demand; exploration and development risks; environmental and social risks; community and Indigenous relations; general business, economic, competitive, political, social, and market conditions; accidents, labour disputes and shortages and other risks of the mining industry.

Although the Company has attempted to identify the important factors that could cause actual results to differ materially from those contained in the forward-looking information, and believes the expectations expressed in such forward-looking information are reasonable, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information or expectations will prove to be correct, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Forward-looking information is provided as of the date of this press release, and the Company does not undertake any obligation to update or revise such information except as required by law.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.