The profit from property management at record level

Profit from property management rose by 40 per cent in 2025 and is at the highest level to date for a single financial year, primarily attributable to two acquisitions in Poland during 2024. Profit from property management for the quarter also rose, the increase was 15 per cent year on year. The Board of Directors proposes an increased dividend to SEK 1.28 per share (1.20).

October-December 2025

- Rental income rose by 24 per cent, reaching EUR 15,429k (12,412k). In comparable portfolio, revenue increased by 2 per cent.

- Net operating income grew by 24 per cent, to EUR 14,322k (11,570k).

- Profit from property management rose by 15 per cent, to EUR 7,048k (6,155k).

- Unrealised changes in value amounted to EUR -1,646k (-3,263k), of which EUR -3,170k (-1,987k) was attributable to properties and EUR 1,524k (-1,276k) to derivatives. Realised changes in value totalled EUR -21k (49k).

- Profit for the period increased to EUR 4,404k (loss: -240k).

- Net lettings amounted to EUR 361k (183k).

- Adela Colakovic was appointed as the new CFO and will commence her tenure in June 2026.

- The lease agreement with Vinted for the Uptown Park property in Vilnius has been extended by seven years and expanded by approximately 3,000 sq.m., bringing the total lettable area to some 12,600 sq.m.

January-December 2025

- Rental income increased by 49 per cent, totalling EUR 61,723k (41,523k). In comparable portfolio, revenue increased by 4 per cent.

- Net operating income grew by 50 per cent, to EUR 57,644k (38,553k)

- Profit from property management rose by 40 per cent, reaching EUR 31,001k (22,193k), primarily due to two acquisitions in Poland in 2024.

- Unrealised changes in value totalled EUR 22,609k (-9,693k). Of these changes, EUR 21,108k (-4,260k) was attributable to real estate and EUR 1,501k (-5,433k) to derivatives. Realised changes in value totalled EUR -86k (93k).

- Profit for the year rose to EUR 41,739k (5,908k).

- Net lettings amounted to EUR -211k (581k).

Significant events after the end of the year

- The Board of Directors proposes an increased dividend to SEK 1.28 per share (1.20), payable on a quarterly basis at SEK 0.32 per share (0.30). The proposed dividend entails an increase of 7 per cent and corresponds to 41 per cent of profit from property management less current tax.

- In December 2025, the credit facility with Swedbank was extended to a five-year term and increased by EUR 12.7m to a total of EUR 75.5m. The increased facility was disbursed in January 2026.

CEO comment

The profit from property management at all-time high

In 2025, Eastnine's profit from property management increases to the highest level ever and operations remain stable despite significant global geopolitical turbulence. In the fourth quarter, profit from property management was marginally weaker than in the third, due to lower occupancy rate and currency effects. We are focusing on additional acquisitions in Warsaw and have replenished our cash reserves through increased financing of our existing properties.

Eastnine's earnings

Despite rising geopolitical tensions in 2025 and early 2026, Eastnine remained largely unaffected, with profit from property management reaching a record by increasing 40 per cent during the year. This growth was primarily driven by the full-year inclusion of two major acquisitions in Poland in 2024. Rental income in comparable portfolio has increased by 4 per cent during the year. The fourth quarter performed somewhat weaker than the third, primarily due to lower occupancy rate and increased financial expenses driven by currency effects. A slight decline in occupancy rate is a natural consequence of Eastnine's high occupancy level, which was 95.8 per cent at year-end. We are seeing sustained demand for office space, and net letting was positive during the fourth quarter. Vinted, one of Eastnine's largest tenants in Vilnius, chose to extend and expand its lease to the entire Uptown Park property, covering an area of 12,600 sq.m. Similarly, the lease agreement with Rockwool in Poznan was extended and expanded earlier in the year. The annual customer satisfaction survey provides a clear indication that tenants are satisfied with our premises. Exchange rate effects, which influence financial income and expenses among other items, are a consequence of Eastnine's operations in countries with non-Euro currencies, i.e. Poland and Sweden. We are pleased to note that 97 per cent of our revenues are now aligned (environmentally sustainable) with the EU Taxonomy.

Favourable credit market climate

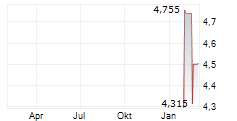

In late 2025, Eastnine refinanced bank loans ahead of schedule, benefitting from an unusually strong market with decreasing margins. In connection with the refinancing, loan agreements were expanded by EUR 27m. Approximately EUR 14m was disbursed in September, and a further EUR 13m in January 2026. The latter amount was not classified under "Interest-bearing liabilities" or "Cash and cash equivalents" at year-end, but combined with previous liquidity enhancements, it provides scope for future acquisitions. In 2026, only EUR 7m remains to be refinanced. The average borrowing rate continued its downward trend during the fourth quarter, decreasing from 4.4 to 4.3 per cent.

Organisation in Poland

In 2025, we began building our in-house organisation in Poland, focusing on property management, leasing and tenants, as well as finance. To date, six individuals have been recruited; three have commenced work on January 1, and the remaining three started in early February 2026. Consequently, Eastnine now has its own employees in all countries where it operates, which we believe is crucial for optimal tenant relations and, ultimately, for enhancing Eastnine's financial performance.

Eastnine's markets

Our markets are characterised by higher economic growth, relatively low office rent levels, and more attractive yields compared with other European markets. Financing conditions are comparable across these regions, resulting in robust cash flows and significant potential for long-term value appreciation. We are noticing a slight increase in competition in the transactions market, albeit from a low level. Yield requirements for fully let, high-quality office properties in central locations remained stable in 2025, standing at approximately 6.00 per cent in Warsaw, 6.50 in Vilnius, 6.75 in Riga, and 7.50 in Poznan.

Expectations for the future

We are entering the new year with a high occupancy rate and surplus ratio, alongside stable financing conditions. Our focus is to capitalise on these favourable market conditions and pursue additional acquisitions in Warsaw. Finally, I would like to thank our employees for a job well done over the past year, and others for their increased interest, which is being reflected in the increased trading of Eastnine shares.

Kestutis Sasnauskas, CEO

Report presentation

The report is presented on Thursday 5 February 2026 at 15.00 CET. Click here to see the webcast.

Eastnine AB (publ)

For more information contact:

Kestutis Sasnauskas, CEO, +46 8 505 97 700

Britt-Marie Nyman, CFO and Deputy CEO, +46 70 224 29 35

Visit www.eastnine.com

This information is information that Eastnine AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 14.00 CET on 5 February 2026.

Eastnine AB (publ) is a Swedish real estate company listed at Nasdaq Stockholm, Mid Cap, sector Real Estate. Eastnine strives to be a leading provider of offices in the fastest growing part of Europe.